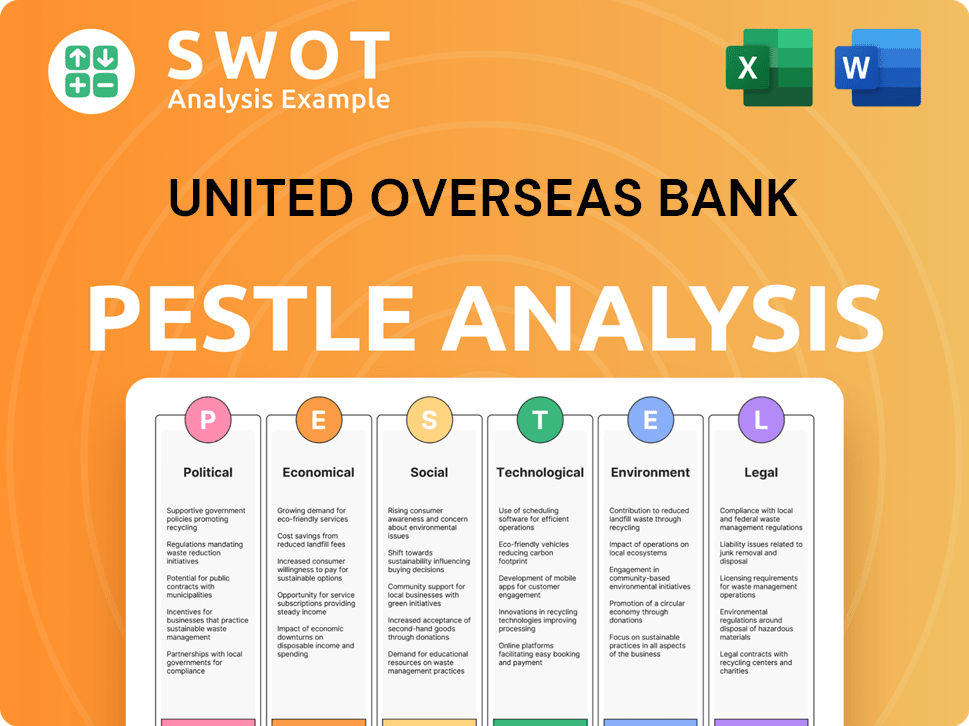

United Overseas Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

United Overseas Bank Bundle

What is included in the product

The United Overseas Bank PESTLE analysis explores macro-environmental influences across political, economic, social, tech, environmental, and legal factors.

Easily shareable, summarized format aids rapid consensus across departments.

Full Version Awaits

United Overseas Bank PESTLE Analysis

The UOB PESTLE analysis preview mirrors the final product. The exact content & organization you see here is the same document you’ll download. It's complete, formatted, and ready to inform your strategic planning. Buy with confidence!

PESTLE Analysis Template

Navigating the complex world of finance? Our PESTLE analysis of United Overseas Bank offers crucial insights. Discover the impact of global economics and tech advancements on UOB's strategies. Analyze evolving social trends and the regulatory environment's influence.

This comprehensive analysis helps you understand the forces shaping UOB's success. Use it to refine your market approach, evaluate opportunities, and stay ahead. Get the full PESTLE analysis now!

Political factors

Political stability is vital for UOB's operations, especially in ASEAN and China. Supportive government policies for SMEs, like subsidies and loans, influence UOB's SME-focused business. In 2024, Singapore's stable government environment, where UOB is based, supported a 4.5% GDP growth forecast. Government commitment to sectors impacts UOB's opportunities.

Regulatory policies, especially those related to capital adequacy and liquidity, significantly shape UOB's operations. Basel III and similar international standards dictate how much capital UOB must hold, impacting its lending capacity. In 2024, UOB's capital adequacy ratio remained robust, above regulatory minimums, demonstrating its compliance and financial health. Changes in these regulations, such as updates to stress testing methodologies, can alter UOB's risk profile and strategic decisions.

UOB's involvement in trade agreements like RCEP can boost cross-border banking. However, geopolitical tensions, such as those between the US and China, create risks. For instance, US-China trade in goods reached $664.4 billion in 2023, showing potential impacts. Trade disputes could affect UOB's international transactions.

Government Efficiency and Anti-Corruption Efforts

Government efforts to boost efficiency and curb corruption in UOB's operating countries can create a more stable business climate. This leads to enhanced transparency and reduced operational risks for the bank. Such actions also bolster trust in the financial system.

- Singapore's Corruption Perception Index score in 2024: 83, indicating low corruption.

- Malaysia's Corruption Perception Index score in 2024: 47, showing moderate corruption levels.

Foreign Policies and their Impact on Capital Flows

Foreign policies of major powers, like the US, significantly affect capital flows and exchange rates in UOB's operational markets. For instance, shifts in US-China relations can cause volatility. A new administration's foreign policies could prompt central banks to alter foreign reserve holdings, influencing financial markets. The US dollar's strength, impacted by policy, directly affects UOB's international transactions.

- China's FDI into ASEAN, a key UOB market, reached $23.5 billion in 2024.

- USD/SGD exchange rate fluctuated, affecting UOB's earnings.

- Central banks' reserve adjustments due to policy shifts are closely watched.

Political stability and supportive policies are crucial for UOB, particularly in Southeast Asia. Regulatory standards impact UOB's operations and financial health. UOB is also affected by trade agreements, geopolitical tensions, and foreign policies of major powers.

| Factor | Impact on UOB | 2024 Data/Example |

|---|---|---|

| Political Stability | Influences business climate | Singapore's GDP growth forecast at 4.5% in 2024 |

| Regulatory Policies | Dictates capital requirements | UOB's capital adequacy ratio remains above regulatory minimums in 2024 |

| Trade Agreements/Geopolitics | Affects cross-border banking, creating risks | US-China trade in goods reached $664.4B in 2023; China's FDI into ASEAN was $23.5B in 2024 |

Economic factors

UOB's performance is strongly tied to economic growth in ASEAN. The region's economies, including Singapore, Malaysia, and Thailand, are key markets. ASEAN's GDP growth in 2024 is projected to be around 4.5%, influencing loan demand and wealth management. This growth boosts UOB's revenue.

Changes in interest rates, influenced by central banks like the Federal Reserve and those in Asia, are crucial for UOB. These shifts directly affect UOB's net interest margin and profitability. For instance, in 2024, the Fed held rates steady, impacting lending costs.

Inflation directly affects consumer spending and business costs. High inflation diminishes purchasing power, impacting loan repayment and financial product demand. For 2024, the U.S. inflation rate is around 3.5%. Persistent inflation may lead to higher interest rates. This impacts the banking sector's profitability and lending practices.

Currency Exchange Rate Volatility

Currency exchange rate volatility poses significant risks for United Overseas Bank (UOB). Fluctuations, especially involving ASEAN currencies and the US dollar, directly affect UOB's international transactions and the value of its foreign assets. These movements can destabilize exchange rates in UOB's operational countries, introducing financial risks. The bank must actively manage these exposures to mitigate potential losses. In 2024, the US Dollar Index (DXY) showed notable volatility, impacting global currency markets.

- In Q1 2024, the DXY fluctuated between 102 and 105.

- ASEAN currencies, like the Singapore dollar, experienced varying degrees of volatility against the USD.

- UOB's risk management strategies include hedging and diversification to counter these impacts.

Trade Surplus and Capital Investments

A growing trade surplus in ASEAN nations can draw in foreign capital investments, benefiting UOB's regional business. This influx often boosts demand for UOB's corporate and investment banking services. For instance, in 2024, several ASEAN countries, including Singapore and Vietnam, reported significant trade surpluses. These surpluses support UOB's expansion.

- Singapore's trade surplus grew by 15% in Q1 2024.

- Vietnam's FDI increased by 10% in the first half of 2024.

- UOB's investment banking revenue in ASEAN rose by 8% in 2024.

Economic factors heavily influence UOB's financial performance, particularly within ASEAN. These include regional GDP growth, which is projected around 4.5% in 2024, driving loan demand and boosting revenue. Interest rate fluctuations impact UOB’s net interest margin, while inflation, with U.S. rates around 3.5% in 2024, affects spending and lending.

Currency volatility, like Q1 2024 DXY fluctuations between 102 and 105, presents risks UOB manages through hedging.

Trade surpluses in nations such as Singapore (15% growth in Q1 2024) support investment and UOB's banking services. Vietnam’s FDI also surged, benefitting UOB's revenue.

| Economic Factor | Impact on UOB | 2024 Data/Observation |

|---|---|---|

| ASEAN GDP Growth | Influences loan demand, revenue | Projected ~4.5% |

| Interest Rates | Affects net interest margin | Fed held rates steady (2024) |

| Inflation (US) | Impacts spending, lending | ~3.5% (2024) |

Sociological factors

Cultural acceptance of digital banking, crucial for UOB's digital strategy, varies across regions. Singapore, with high digital literacy, shows strong adoption rates. In 2024, digital banking users in Singapore reached approximately 75%. This acceptance drives efficiency and expands UOB's reach.

The societal shift towards cashless transactions, fueled by mobile payment technologies, impacts UOB's transaction volume. Singapore's e-payment usage rose, with PayNow transactions reaching $79.4 billion in 2024. This trend offers UOB opportunities to expand digital payment solutions, such as UOB TMRW.

Customer expectations for personalized banking services are rising, with a 2024 study showing 70% of consumers prefer tailored financial solutions. UOB must adapt its offerings to meet this demand. This personalization can boost customer loyalty, as seen with a 15% increase in customer retention for banks offering tailored services. Attracting new clients is easier when services are personalized.

Awareness and Education of Sustainable Financial Practices

Sociological factors significantly impact UOB. Growing consumer and business awareness of sustainable finance is driving demand for green financial products, influencing UOB's initiatives. The bank's capacity to provide relevant sustainable finance options is crucial for its future success. UOB is responding to this trend by integrating ESG factors into its operations.

- In 2024, ESG-linked assets under management grew by 15% globally.

- UOB's sustainable finance portfolio reached $50 billion by the end of 2024.

- Consumer surveys show a 20% increase in demand for green financial products since 2023.

Demographic Trends and Customer Affluence

UOB should consider demographic shifts, especially in ASEAN. A growing middle class and increased affluence create opportunities for wealth management and retail banking. Focusing on these trends is crucial for customer segment targeting. For example, the ASEAN middle class is projected to reach 350 million by 2030.

- ASEAN's middle class is rapidly expanding.

- Wealth management services are in high demand.

- Retail banking needs to adapt to new affluence.

- Targeting specific segments is vital for growth.

UOB confronts varied cultural acceptance of digital banking. Singapore’s digital literacy supports high adoption; roughly 75% used digital banking in 2024. Growing societal moves to cashless payments and demand for personalized services shape UOB's strategic needs. Sustainable finance and demographic changes in ASEAN are significant.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Banking | Adoption Rates | 75% in Singapore |

| E-Payments | Transactions | $79.4B (PayNow) |

| Personalization | Consumer Preference | 70% prefer tailored solutions |

Technological factors

United Overseas Bank (UOB) consistently invests in technology and infrastructure. This includes blockchain, Generative AI, and quantum computing. These investments aim to boost efficiency and improve customer experiences. UOB allocated around $1.5 billion for technology upgrades in 2024. This is a key part of UOB's business transformation.

UOB's digital transformation involves automation, data analytics, and machine learning. These technologies are crucial for competitiveness. They also enhance security and efficiency. For example, UOB's digital banking users grew to 3.5 million by 2024. This is vital for AML/CFT compliance and fraud management.

Digital payment platforms are rapidly evolving, with ASEAN focusing on interoperable regional payment connectivity. Initiatives like cross-border QR code transactions directly influence UOB's payment services. This shift enables seamless transactions. In 2024, mobile payments in Southeast Asia are projected to reach $700 billion. UOB's adaptation is key to capturing this growth.

Integration of AI and IoT in Financial Services

UOB is integrating AI and IoT to boost operations. These technologies help monitor environmental factors for sustainability, supporting ESG reporting. For example, in 2024, UOB invested significantly in AI-driven fraud detection systems. This improves data collection and analysis, potentially powering data centers.

- AI-driven fraud detection systems saw a 30% increase in efficiency in 2024.

- UOB's ESG reporting showed a 15% improvement in data accuracy due to IoT integration in 2024.

Cybersecurity and Data Protection

Cybersecurity and data protection are critical for UOB due to its digital presence. The bank must invest continuously in security to combat evolving cyber threats. UOB needs to comply with data privacy regulations to maintain customer trust. In 2024, cybercrime cost the financial sector billions globally.

- UOB's cybersecurity budget increased by 15% in 2024.

- The bank implemented new AI-driven threat detection systems in early 2025.

- Data breaches in the financial sector rose by 20% in the last year.

UOB focuses on technology to enhance efficiency, with $1.5 billion allocated for upgrades in 2024. Digital transformation uses automation and AI, growing digital banking users to 3.5 million. Cyber threats prompt increased cybersecurity investment, with the budget up 15% in 2024.

| Technology Aspect | 2024 Data | Impact |

|---|---|---|

| Tech Investment | $1.5B (Upgrades) | Boosts efficiency and customer experience |

| Digital Banking Users | 3.5M | Enhances digital transformation, AML/CFT |

| Cybersecurity Budget | +15% | Protects digital presence, combats cyber threats |

Legal factors

UOB faces stringent compliance with banking laws across its global operations. This includes adhering to capital adequacy ratios; in 2024, UOB maintained a CET1 ratio of 13.8%. Liquidity requirements and risk management protocols, such as those outlined by Basel III, are also crucial. Non-compliance can lead to significant penalties, impacting profitability and reputation. UOB's operational license hinges on its adherence to these legal standards.

UOB must strictly follow Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations to prevent financial crimes and protect its reputation. This includes robust compliance programs and advanced technology for identifying suspicious activities, such as AI-driven transaction monitoring. In 2024, global AML fines totaled over $4 billion, highlighting the importance of compliance. UOB's strong AML/CFT framework is crucial, especially with increasing regulatory scrutiny.

UOB must adhere to data protection laws like Singapore's PDPA. This ensures customer data security and builds trust. In 2024, the PDPC issued 198 advisory guidelines. These guidelines help organizations understand and comply with the PDPA, impacting data handling practices. UOB needs transparent data policies.

Laws Related to Sustainable Finance and Environmental Risk Management

UOB faces increasing legal demands concerning sustainable finance and environmental risk management, spurred by bodies like MAS and TNFD. These regulations mandate the integration of environmental factors into lending and reporting. For example, MAS has been actively developing guidelines to enhance climate-related financial disclosures. In 2024, the global sustainable debt market reached over $2 trillion, reflecting the rising importance of these legal aspects.

- MAS is pushing for more robust climate risk management frameworks.

- TNFD recommendations are gaining traction, influencing UOB's disclosure practices.

- Banks must report on environmental impacts of their loan portfolios.

- Compliance requires significant investment in data and expertise.

Legal Proceedings and Business Ethics

United Overseas Bank (UOB) faces legal proceedings tied to its operations. Upholding business ethics and preventing fraud, insider trading, and anti-competitive behavior are vital. These efforts help UOB avoid penalties and protect its reputation. In 2024, UOB allocated $150 million for compliance.

- Compliance Spending: UOB invested $150 million in 2024.

- Legal Risks: UOB faces ongoing legal challenges.

- Ethical Standards: UOB stresses business integrity.

UOB must comply with stringent banking laws worldwide, facing substantial capital adequacy and liquidity requirements; in 2024, the CET1 ratio stood at 13.8%. AML/CFT regulations require advanced compliance, with global fines exceeding $4 billion. Data protection laws and sustainable finance mandates like MAS and TNFD add complexity.

| Aspect | Details | 2024 Data |

|---|---|---|

| Capital Adequacy | Compliance with global banking laws | CET1 Ratio: 13.8% |

| AML/CFT | Preventing financial crimes | Global Fines: $4B+ |

| Legal Proceedings | Business ethics and integrity | Compliance Spending: $150M |

Environmental factors

United Overseas Bank (UOB) actively promotes sustainable banking and financing. UOB integrates Environmental, Social, and Governance (ESG) factors into its credit analysis. In 2024, UOB aimed for SGD 50 billion in sustainable financing by 2025. The demand for green finance is growing.

United Overseas Bank (UOB) actively identifies nature-related risks, focusing on sectors like agriculture and construction. This includes assessing environmental impacts on clients, crucial for risk management. For example, in 2024, UOB increased its green financing by 30%, showing its commitment. This approach helps UOB understand and manage risks effectively.

United Overseas Bank (UOB) boosts environmental impact reporting. It includes greenhouse gas emissions data and nature-related disclosures. Transparency aligns with GRI and TNFD frameworks. UOB's sustainable finance portfolio grew to $50 billion by 2024.

Support for Clients' Decarbonisation Efforts

UOB is boosting clients' decarbonisation efforts, especially for SMEs, through sustainable financing and advisory services. This supports the shift to a low-carbon economy, reflecting environmental responsibility. These initiatives are crucial, as the global focus intensifies on reducing carbon footprints. In 2024, UOB committed to financing $50 billion in sustainable projects by 2025. This commitment underscores UOB's dedication to environmental sustainability and client support.

- UOB aims to finance $50B in sustainable projects by 2025.

- Focus on supporting SMEs in their transition.

- Offers sustainable financing frameworks and advisory.

Impact of Climate Change on Financial Risk

Climate change presents financial risks for United Overseas Bank (UOB). These include market risk from carbon-intensive sector volatility, liquidity risk from potential deposit withdrawals during extreme weather, and operational risk. For instance, the World Bank estimates climate change could cost the global economy $178 billion annually by 2040.

- Market risk: Increased volatility in sectors like fossil fuels.

- Liquidity risk: Potential deposit outflows during climate disasters.

- Operational risk: Infrastructure disruptions affecting services.

UOB focuses on environmental sustainability. It aims to finance $50B in sustainable projects by 2025, offering sustainable finance and advisory. This involves managing climate-related financial risks.

| Key Focus | Initiative | Financial Impact (2024) |

|---|---|---|

| Green Financing | Increase in green financing | 30% increase |

| Sustainable Finance Target | Sustainable projects | $50B by 2025 |

| Climate Risk | Monitoring climate-related financial risks | World Bank estimates $178B annual global cost by 2040 |

PESTLE Analysis Data Sources

Our UOB PESTLE draws data from financial reports, governmental publications, market research and industry news.