UpHealth Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UpHealth Bundle

What is included in the product

Analyzes UpHealth's competitive position, assessing threats, power dynamics, and market entry barriers.

Customize pressure levels based on new data or evolving market trends.

Preview Before You Purchase

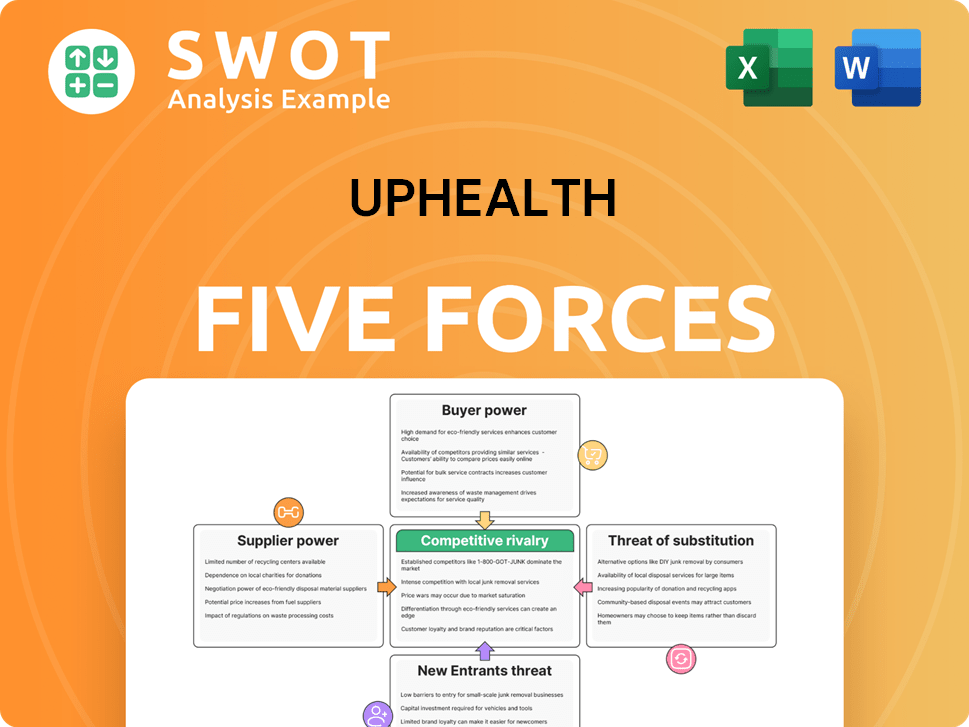

UpHealth Porter's Five Forces Analysis

This preview showcases the complete UpHealth Porter's Five Forces analysis. The document you see here is exactly what you'll receive immediately after purchase.

Porter's Five Forces Analysis Template

UpHealth's competitive landscape is shaped by forces like buyer power from healthcare providers and insurers. Supplier influence, particularly from technology and pharmaceutical companies, is also significant. The threat of new entrants, including digital health startups, adds further pressure. Competitive rivalry within the telehealth market remains intense. Substitute services, like in-person care, present an ongoing challenge.

Ready to move beyond the basics? Get a full strategic breakdown of UpHealth’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

UpHealth's reliance on specialized technology for digital health solutions elevates supplier power. Limited tech alternatives can let suppliers dictate prices, influencing UpHealth's costs. This dependence could affect UpHealth's cost structure and innovation capabilities. In 2024, companies with unique tech saw price increases of up to 15%.

Data security compliance significantly impacts UpHealth's supplier power dynamics. Suppliers offering data security and privacy solutions hold considerable power, particularly due to the rise in regulations. UpHealth must meet rigorous data protection standards, increasing its reliance on compliant suppliers. In 2024, the global cybersecurity market is projected to reach $269.4 billion, highlighting the substantial costs associated with data protection. This dependence can elevate costs and limit supplier choices because non-compliance can be costly.

The complexity of integrating digital health components significantly influences supplier bargaining power. Suppliers offering seamless integration gain leverage, as UpHealth requires cohesive systems. This increases their value, potentially diminishing UpHealth's negotiating strength. High switching costs further amplify supplier power; for example, in 2024, the average cost to switch EHR systems was approximately $34,000 per physician.

Supplier Power 4

Cloud service providers wield moderate power over UpHealth. UpHealth's dependency on cloud services like AWS or Azure gives providers leverage. Switching cloud providers is complex and costly. This allows providers to influence pricing, impacting UpHealth's operational costs.

- AWS controls about 32% of the cloud infrastructure market in 2024.

- Microsoft Azure holds around 25% of the market share in 2024.

- The global cloud computing market is projected to reach $1.6 trillion by 2025.

Supplier Power 5

The bargaining power of suppliers for UpHealth is significantly influenced by talent acquisition firms specializing in healthcare IT. The demand for skilled IT professionals in healthcare is rising, thus strengthening these firms' position. UpHealth needs specialized expertise to maintain its digital health platform, making it reliant on these suppliers. Consequently, these firms can charge higher fees and influence hiring terms, affecting UpHealth's costs and recruitment strategies.

- The global healthcare IT market was valued at $67.2 billion in 2023.

- The market is projected to reach $103.7 billion by 2028.

- IT salaries in healthcare can range from $70,000 to $150,000 annually.

- Recruiting costs can add 20-30% to the base salary.

UpHealth faces supplier power challenges from tech, data security, and integration demands.

Specialized tech suppliers, data protection providers, and integration experts can control pricing, raising costs.

Cloud providers and talent acquisition firms further influence costs and operations, affecting profitability.

| Supplier Type | Impact | 2024 Data |

|---|---|---|

| Tech Suppliers | Price Control | Price increase up to 15% |

| Data Security | Compliance Costs | Cybersecurity market: $269.4B |

| Talent Acquisition | Recruiting Costs | Healthcare IT market: $67.2B (2023) |

Customers Bargaining Power

Large healthcare providers wield considerable buyer power. Major hospital networks and integrated systems leverage their patient volume for advantageous terms. UpHealth might face pressure to offer discounts or tailored services to secure contracts. This can impact profit margins and necessitate customized service approaches. In 2024, such providers control a significant portion of healthcare spending.

Individual patients' price sensitivity is increasing, making them more cost-conscious. In 2024, healthcare spending per capita rose, highlighting this trend. UpHealth's cost-effective solutions are key to attracting patients. This sensitivity can limit premium pricing in competitive markets. UpHealth must offer value to retain customers.

Government and insurance payers significantly influence UpHealth's buyer power. Medicare and Medicaid, along with major insurers, hold substantial bargaining power, dictating reimbursement rates. In 2024, Medicare spending reached approximately $976 billion. UpHealth must meet payer demands to secure coverage. This impacts revenue streams.

Buyer Power 4

Buyer power in telehealth is high due to low switching costs; customers can easily change providers. UpHealth faces pressure to offer competitive pricing and high-quality services. In 2024, the telehealth market saw a 15% churn rate, highlighting customer mobility. UpHealth needs to build strong customer relationships to combat this.

- Low switching costs amplify customer bargaining power.

- Competitive pricing and quality are essential for customer retention.

- Telehealth churn rates were approximately 15% in 2024.

- UpHealth must prioritize customer satisfaction and innovation.

Buyer Power 5

Buyer power is heightened by data privacy concerns. Patients are increasingly worried about the security of their health information. UpHealth must prove its dedication to data protection to keep customer trust and dodge issues. Failure to protect data can cause customers to leave and hurt the company's image.

- In 2024, healthcare data breaches affected millions, raising buyer concerns.

- Data breaches can lead to significant financial penalties and legal issues.

- Customers now demand transparency and control over their data.

- UpHealth must invest in robust cybersecurity measures.

UpHealth encounters significant buyer power from various sources. Large healthcare providers and payers, like Medicare and major insurers, dictate terms and reimbursement rates. The telehealth market's 15% churn rate in 2024 shows how easy it is for customers to switch. Data privacy concerns also bolster buyer power, demanding robust cybersecurity.

| Buyer Group | Bargaining Power Impact | 2024 Data |

|---|---|---|

| Large Providers | High; Pressure on pricing | Control significant spending share |

| Individual Patients | Increasing price sensitivity | Per capita healthcare spending rose |

| Payers (Gov/Insurers) | High; Dictate reimbursements | Medicare spending ≈ $976B |

Rivalry Among Competitors

The telehealth market is highly competitive. Many companies provide telehealth services, driving price wars and service differences. UpHealth competes with giants like Teladoc and Amwell, plus new startups. In 2024, Teladoc's revenue was about $2.6 billion, showing the scale of competition.

The integrated care solutions market is becoming increasingly competitive. Growing demand attracts new entrants, intensifying rivalry. UpHealth faces pressure to offer seamless, comprehensive care. This necessitates robust tech and strong provider partnerships. In 2024, the market for integrated care is estimated at $300 billion.

Digital health platforms are in constant flux, intensifying competitive rivalry. Technological advancements necessitate continuous adaptation and innovation, which UpHealth must embrace. Research and development investments are crucial for staying ahead of competitors and satisfying customer needs. Failure to innovate can result in obsolescence and market share decline. In 2024, the digital health market was valued at over $200 billion, with a projected annual growth rate of 20%.

Competitive Rivalry 4

Competitive rivalry in the digital health sector is intensifying. Consolidation, through mergers and acquisitions, is creating larger players. This reshapes the competitive landscape, with companies like Teladoc and Amwell leading. UpHealth faces pressure to form partnerships or be acquired. This can lead to more intense competition and pricing pressures.

- Teladoc's revenue in 2024 is projected to be around $2.6 billion.

- Amwell's 2024 revenue is estimated to be approximately $300 million.

- The digital health market is expected to reach $660 billion by 2025.

- Over 200 digital health M&A deals were recorded in 2023.

Competitive Rivalry 5

UpHealth's geographic expansion intensifies competitive rivalry. Expanding globally means facing new competitors in various regions. This competitive overlap demands a strong grasp of local market dynamics. Such growth requires substantial investment and adapting services to diverse healthcare systems.

- UpHealth's revenue in 2024 is projected to be around $150 million.

- The global telehealth market is expected to reach $250 billion by 2027.

- Competitive intensity is high, with numerous telehealth providers vying for market share.

- UpHealth must strategically allocate its resources to remain competitive.

UpHealth operates within a fiercely competitive environment. Key players like Teladoc and Amwell dominate the telehealth landscape, each with substantial market share. Intense rivalry demands continuous innovation and strategic partnerships for survival. Mergers and acquisitions are common, further reshaping the competitive arena.

| Metric | 2024 Data | Notes |

|---|---|---|

| Teladoc Revenue | $2.6 billion | Projected |

| Amwell Revenue | $300 million | Estimated |

| UpHealth Revenue | $150 million | Projected |

| Digital Health Market | $660 billion by 2025 | Projected value |

SSubstitutes Threaten

Traditional in-person healthcare poses a significant threat as a substitute for UpHealth's services. Many patients still favor face-to-face consultations with healthcare providers, as shown by the 2024 data indicating that 60% of patients prefer in-person visits. UpHealth needs to highlight the value and ease of its digital health solutions to counter this preference. Building trust is key, and demonstrating clear advantages in cost, access, and outcomes is essential for success. For instance, a 2024 study revealed that telehealth can reduce healthcare costs by up to 20%.

Mobile health apps pose a significant threat to UpHealth by offering point solutions for specific health needs. Many apps provide specialized services like fitness tracking or medication reminders, potentially substituting UpHealth's broader platform. To compete, UpHealth must integrate these functionalities or provide superior value. The global mHealth market was valued at USD 61.3 billion in 2024 and is projected to reach USD 135.1 billion by 2028. This necessitates a focus on user experience and seamless feature integration.

Employer-sponsored wellness programs pose a significant threat to UpHealth. These programs, increasingly common, include telehealth services, offering direct alternatives to individual subscriptions. To compete, UpHealth must form partnerships with employers. This strategy demands tailored solutions and a compelling value proposition. In 2024, 78% of U.S. employers offered wellness programs, highlighting the competition.

Threat of Substitution 4

The threat of substitutes is increasing as DIY health monitoring becomes more popular. Wearable devices and at-home diagnostics allow individuals to manage their health independently, potentially reducing the need for UpHealth's services. This shift is evident; in 2024, the global market for wearable health devices reached $30.8 billion. UpHealth must integrate data from these devices or offer advanced analytics to stay competitive.

- Market growth: The wearable health device market is expected to reach $81.8 billion by 2029.

- Data integration: UpHealth must enhance data analytics capabilities.

- Competitive edge: Focus on providing unique, data-driven insights.

- Consumer shift: Individuals are increasingly adopting self-monitoring tools.

Threat of Substitution 5

The threat of substitutes in UpHealth's market includes alternative therapies and wellness practices. These alternatives, like yoga, meditation, and acupuncture, can be viable substitutes for traditional healthcare for some individuals. To mitigate this, UpHealth needs to differentiate its services through evidence-based solutions and integration with conventional medical practices. This strategic approach requires a strong emphasis on clinical validation and seamless integration with existing healthcare systems.

- In 2024, the global wellness market was valued at over $7 trillion, highlighting the significant presence of substitutes.

- Digital therapeutics, a subset of these substitutes, is projected to reach $11.8 billion by 2025.

- UpHealth's ability to integrate with established healthcare systems is crucial, with telehealth adoption rates increasing by 38x in 2024.

The threat of substitutes includes alternatives like in-person healthcare, mobile health apps, and employer wellness programs. DIY health monitoring and wearable devices also pose a threat. UpHealth must compete by integrating features and offering superior value.

| Substitute Type | 2024 Market Data | UpHealth's Strategy |

|---|---|---|

| In-Person Healthcare | 60% patient preference | Highlight digital health value, cost savings |

| Mobile Health Apps | $61.3B mHealth market | Integrate features, improve user experience |

| Wellness Programs | 78% of U.S. employers | Partner with employers, offer tailored solutions |

| DIY Health Monitoring | $30.8B wearables market | Integrate device data, offer advanced analytics |

Entrants Threaten

The threat of new entrants in the telehealth market is moderate, especially in basic services. Developing and launching simple telehealth platforms is relatively easy. UpHealth faces this threat by differentiating through specialized services and strong branding.

The threat of new entrants, particularly tech giants, looms large. Amazon, with its acquisition of One Medical in 2023, shows its commitment. Apple and Google also have the resources to enter the telehealth market. UpHealth needs to innovate to stay competitive, as the telehealth market was valued at $62.4 billion in 2023.

Venture capital significantly fuels the growth of startups, and in the digital health sector, this is especially true. In 2024, digital health companies secured over $11.7 billion in funding, indicating a robust environment for new entrants. UpHealth faces increased competition from these well-funded startups. Therefore, UpHealth must maintain a strong financial footing and attract investment to compete.

Threat of New Entrants 4

New entrants pose a threat, especially with changing regulations in healthcare. Regulatory shifts can significantly lower the barriers to market entry. UpHealth needs to closely monitor regulatory developments. Adapting to these changes demands a strong understanding of the complex healthcare rules. In 2024, healthcare spending is projected to reach $4.8 trillion, highlighting the market's attractiveness to newcomers.

- 2024 healthcare spending is projected to reach $4.8 trillion.

- Regulatory changes can make it easier for new companies to enter the market.

- UpHealth must stay informed about regulatory developments.

- Adapting to regulatory changes demands a strong understanding of healthcare rules.

Threat of New Entrants 5

New entrants pose a significant threat, especially in the rapidly evolving digital health market. Partnerships are a key factor, as new companies can quickly enter the market by teaming up with established healthcare providers or tech firms. UpHealth needs to prioritize building strong relationships and strategic alliances to stay competitive.

- Digital health funding saw a significant drop in Q1 2024, hitting a five-year low.

- Market access is a crucial factor for success in the digital health sector.

- Collaboration and resource sharing are essential for maintaining a competitive edge.

The threat from new telehealth entrants is substantial, fueled by venture capital and partnerships. Digital health funding, though experiencing a dip in Q1 2024, remains significant. UpHealth competes with well-funded startups, and must adapt to evolving regulations.

| Aspect | Details | Impact on UpHealth |

|---|---|---|

| Market Growth | Telehealth market valued at $62.4 billion in 2023. | Attracts new entrants. |

| Funding | Digital health companies secured over $11.7B in funding in 2024. | Increased competition. |

| Regulation | Healthcare spending projected at $4.8T in 2024. | Requires adaptation. |

| Partnerships | Collaboration is key for quick market entry. | UpHealth needs strong alliances. |

Porter's Five Forces Analysis Data Sources

UpHealth's analysis leverages company filings, industry reports, and market analysis from expert research firms. This comprehensive approach helps identify strategic threats.