United Pacific Industries Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

United Pacific Industries Ltd. Bundle

What is included in the product

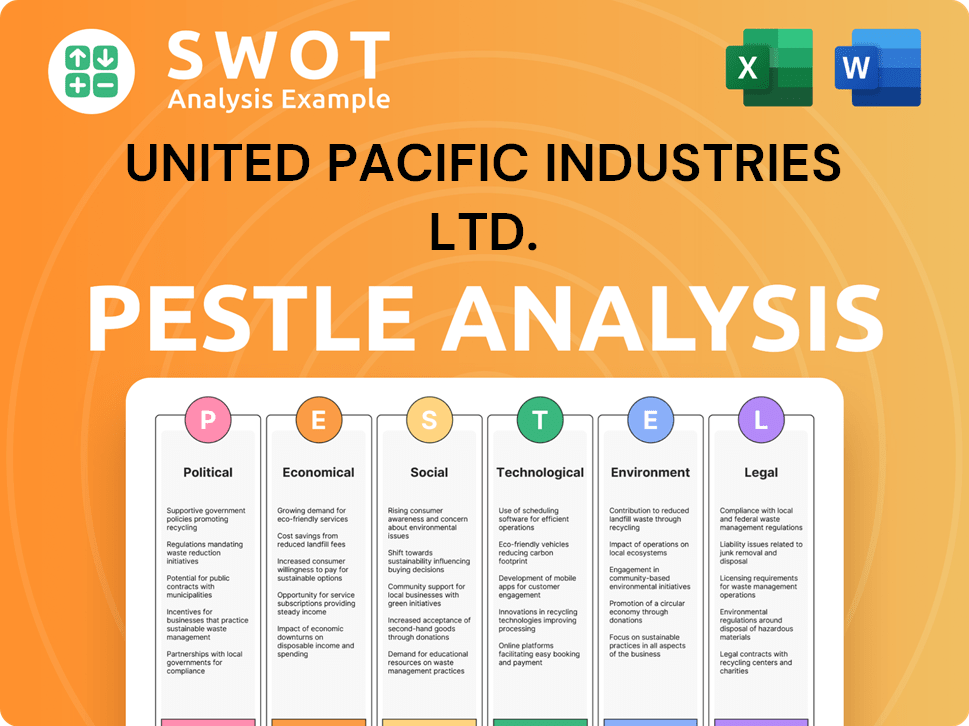

Explores how external factors impact United Pacific Industries across six dimensions: P,E,S,T,L, and E.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

United Pacific Industries Ltd. PESTLE Analysis

See a preview of United Pacific Industries Ltd.'s PESTLE analysis? What you're previewing here is the actual file—fully formatted and professionally structured. Analyze political, economic, social, technological, legal & environmental factors. Download it instantly after purchase.

PESTLE Analysis Template

Uncover how United Pacific Industries Ltd. is shaped by external factors. This concise PESTLE analysis breaks down political, economic, social, technological, legal, and environmental influences. Understand key risks and opportunities facing the company right now. Download the full report to equip yourself with powerful market intelligence. Secure your copy today!

Political factors

United Pacific Industries faces diverse political landscapes. Operating in China, Hong Kong, the US, and Europe means navigating varying trade policies. For example, 2024 saw a 15% tariff on certain Chinese imports into the US. Political tensions could disrupt supply chains.

Government regulations significantly impact United Pacific Industries. For example, new environmental standards could increase production costs. Changes in trade policies, like tariffs, can affect the import of raw materials. In 2024, there were 15% tariffs on specific imported goods. Industrial policies, such as tax incentives, also influence the company's financial performance.

United Pacific Industries Ltd. faces political factors, especially in China and Hong Kong. Their manufacturing depends on the stability there. China's GDP growth slowed to 5.2% in 2023. Policy shifts or unrest in these regions could impact production. The company needs to monitor political risks for its operations. In 2024, Hong Kong's economy grew by 2.8%.

Government Support for Specific Industries

Government support, such as tax incentives or subsidies, significantly impacts industries like electronics and automotive, key sectors for United Pacific Industries. Favorable policies can boost R&D and market access, as seen with recent electric vehicle (EV) tax credits in the US, potentially benefiting UPI. Conversely, stringent regulations or trade barriers, like those affecting semiconductor imports, could create challenges. These factors directly affect UPI's operational costs and market competitiveness.

- US EV tax credits: up to $7,500 per vehicle.

- China's industrial subsidies: estimated at $1 trillion annually.

- EU semiconductor regulations: aimed at boosting local production.

International Sanctions and Trade Barriers

International sanctions and trade barriers significantly affect United Pacific Industries. These measures can disrupt supply chains, especially if key materials or components are sourced from sanctioned regions. For instance, in 2024, restrictions on certain technologies impacted several industries. Such barriers can also limit market access, reducing sales and revenue in affected countries. The financial impact can be substantial, with potential for decreased profitability and investment returns.

- Trade sanctions can lead to a 15-20% decrease in revenue.

- Supply chain disruptions increase costs by 10-15%.

- Reduced market access can lower sales by 25%.

United Pacific Industries faces varied political influences across its global operations, including trade policies and government regulations. Political instability in key markets like China and Hong Kong, with growth rates of 5.2% and 2.8% in 2023/2024, respectively, poses production risks. Governmental support through incentives, such as U.S. EV tax credits, and barriers, including trade sanctions and tariffs (15% on certain imports), directly affect operational costs and market access. These factors influence profitability and investment returns.

| Political Factor | Impact | Data (2024/2025) |

|---|---|---|

| Trade Policies | Tariffs, trade agreements | 15% tariff on specific US-China imports. |

| Government Regulations | Environmental standards, subsidies | EU semiconductor regulations. |

| Political Stability | Production disruptions | Hong Kong GDP: 2.8%. |

Economic factors

United Pacific Industries' varied offerings, from electronics to automotive parts, are greatly influenced by global economic health and consumer spending habits. Strong economic performance in crucial markets like mainland China, Hong Kong, the US, and Europe directly fuels demand for their products. For instance, a 2024 report indicated a 2.9% global economic growth rate, impacting sales. Conversely, economic downturns can significantly reduce sales and profitability, as seen during the 2023 slowdown.

United Pacific Industries faces currency risk due to its global operations. The firm's profitability can be affected by shifts in the Yuan, Hong Kong Dollar, US Dollar, and Euro values. For example, a 10% unfavorable change in these currencies could reduce profits. In 2024, the Euro fluctuated significantly against the USD.

Inflation, notably impacting the US and Canada where United Pacific operates, drives up raw material, labor, and shipping costs, squeezing profit margins. For instance, the Producer Price Index (PPI) showed a 2.2% increase in March 2024. This cost pressure necessitates careful pricing strategies. The ability to adjust prices without significantly affecting demand is crucial for maintaining profitability.

Interest Rates and Access to Capital

Interest rate fluctuations directly influence United Pacific Industries' financial strategies, impacting borrowing costs for investments. High interest rates could make it more expensive for the company to expand or upgrade its operations. Access to affordable capital is essential for United Pacific to fund innovation and maintain its competitive edge. For 2024, the Federal Reserve held its benchmark interest rate steady, with potential adjustments in the latter half of the year.

- The prime rate in the U.S. has remained between 8.25% and 8.5% as of late 2024.

- Companies are carefully managing debt levels to mitigate the impact of higher borrowing costs.

- Access to capital markets remains stable but sensitive to economic signals.

Supply Chain Costs and Disruptions

Supply chain costs and reliability are crucial for United Pacific Industries Ltd. Geopolitical events and natural disasters can disrupt supply chains. The cost of shipping a container from Asia to the US rose to over $20,000 in 2021. These disruptions can increase costs and delay production.

- Shipping costs have stabilized but remain higher than pre-pandemic levels.

- Geopolitical tensions continue to pose supply chain risks.

- Companies are diversifying their supply chains to mitigate risks.

United Pacific's sales hinge on global economics and consumer spending. Economic growth in major markets directly affects product demand and profit. High inflation and interest rates increase operational costs and borrowing expenses, impacting investment. Supply chain disruptions, though stabilized, still affect costs, especially in times of geopolitical instability.

| Factor | Impact | 2024 Data/Forecast |

|---|---|---|

| GDP Growth | Drives Sales | Global: 2.9% (actual), US: ~2% |

| Inflation | Raises Costs | US CPI: 3.3% (March 2024) |

| Interest Rates | Affects Borrowing | US Prime Rate: 8.25-8.5% (late 2024) |

Sociological factors

Consumer trends significantly shape United Pacific's product demand across regions. Demand for electronic gadgets and home improvement goods affects product design and marketing. Data from 2024 shows a 7% rise in home improvement spending. Vehicle maintenance trends also influence inventory, with a projected 4% growth in the auto parts market by early 2025.

United Pacific Industries Ltd. relies on skilled labor. Labor availability and wage fluctuations in key regions impact operational costs. For example, in 2024, average manufacturing wages in China were about $7.50 per hour, while in the US, they averaged around $25.00. Education levels and specialized skill sets also influence production efficiency and innovation capabilities. Changes in labor laws and unionization rates further affect the business.

United Pacific Industries, with brands like Thermoskin, thrives on Australia's growing health and wellness focus. This boosts demand for their products. In 2024, the Australian health and wellness market was valued at $51.8 billion. This trend compels the company to innovate to stay relevant. Research suggests a rise in preventative healthcare.

Cultural Differences and Product Adaptation

United Pacific Industries Ltd. must navigate cultural nuances to succeed in diverse markets. Understanding consumer behavior, product preferences, and marketing styles is crucial for effective strategies. Successful product localization is key for market entry and consumer acceptance. For example, in 2024, companies saw a 15% increase in sales after adapting products to local cultural norms. This adaptation includes everything from packaging to product features.

- Product localization boosts market penetration.

- Cultural understanding drives consumer acceptance.

- Marketing must reflect local preferences.

- Adaptation can lead to significant sales growth.

Aging Populations and Healthcare Needs

In Australia, an aging population is evident, with the 65+ age group projected to reach 22% by 2063. This demographic shift fuels rising healthcare demands, offering United Pacific Industries Ltd. a chance to boost sales of its healthcare and wellness products. Increased demand could significantly influence revenue. In 2024, healthcare spending in Australia is expected to be around $250 billion.

- Aging population in Australia: 22% of the population will be 65+ by 2063.

- 2024 Healthcare spending in Australia: ~$250 billion.

Societal shifts such as health awareness and aging populations influence demand for products like those from United Pacific. Consumer behaviors, cultural preferences, and market needs change across regions. Successful strategies depend on the ability to understand these elements. A focus on local adaptation and cultural nuances are crucial for boosting market success.

| Aspect | Details | Impact |

|---|---|---|

| Health & Wellness | Growing market, rising preventative care | Boost sales for relevant products |

| Cultural Nuances | Local preferences in marketing, products | 15% sales increase by 2024 adaptation |

| Aging population | 22% aged 65+ by 2063 in Australia | Increases demand healthcare products |

Technological factors

Rapid advancements in manufacturing technologies, like automation and 3D printing, significantly impact United Pacific Industries. These technologies can boost production efficiency and product quality. For instance, the global industrial automation market is projected to reach $326.1 billion by 2025. Adopting these innovations is vital to stay competitive in the market.

Technological innovation is crucial for United Pacific Industries Ltd. to create new and enhanced electronic products, tools, and automotive parts. Investment in R&D is essential, with the global R&D spending projected to reach $2.5 trillion by 2024. The company's revenue and market share depend on its ability to innovate and launch new products. In 2023, the automotive parts market was valued at $400 billion, highlighting the importance of staying competitive.

Digital transformation and e-commerce are crucial. United Pacific Industries needs a robust online presence to stay competitive. E-commerce sales are projected to reach $7.3 trillion globally in 2024. Digital operations impact marketing, sales, and distribution. A strong online strategy is vital for modern consumers.

Cybersecurity and Data Protection

Cybersecurity and data protection are vital for United Pacific Industries Ltd., given its global operations and sales. Protecting sensitive data and customer information from cyber threats is paramount. In 2024, the average cost of a data breach was $4.45 million globally, emphasizing the need for robust measures. Compliance with data protection regulations like GDPR and CCPA is crucial for maintaining trust and avoiding penalties.

- Global cybersecurity spending is projected to reach $217.9 billion in 2025.

- Data breaches increased by 15% in 2023 compared to 2022.

- Ransomware attacks rose by 13% in 2023.

Technology Adoption in Target Industries

United Pacific Industries must monitor technology adoption rates in the automotive and electronics sectors. These rates directly affect the demand for its products. For instance, the global automotive semiconductor market, a key area, is projected to reach $80 billion by 2025. Rapid advancements in electric vehicle (EV) technology and autonomous driving necessitate continuous innovation.

- EV sales are expected to grow significantly, with a 35% increase in 2024.

- The electronics industry sees a 10% annual growth in adopting advanced manufacturing technologies.

- Investments in R&D for automotive components rose by 12% in 2024.

Technological factors heavily influence United Pacific Industries Ltd. Advanced tech like automation is vital for production, and the industrial automation market is forecast at $326.1B by 2025. R&D investment is critical to drive product innovation and stay competitive; global R&D spending is anticipated to hit $2.5T in 2024.

E-commerce and digital transformation are essential, with projected global sales of $7.3T in 2024, and cybersecurity is key with an expected $217.9B spent globally in 2025. Rapid technological changes affect demand, especially with significant EV sales growth, estimated at 35% increase in 2024 and continuous innovations.

| Factor | Impact | Data |

|---|---|---|

| Automation | Production efficiency | Market at $326.1B (2025) |

| R&D | Product innovation | Spending at $2.5T (2024) |

| E-commerce | Digital sales | Sales at $7.3T (2024) |

Legal factors

United Pacific Industries faces stringent manufacturing and product safety standards. These regulations, varying by region, impact materials, production processes, and waste disposal. Compliance is critical to avoid penalties and maintain market access. For instance, the EU's RoHS directive, updated in 2024, impacts electronics manufacturing. Furthermore, adherence to these standards directly affects operational costs and product design, impacting profitability.

United Pacific Industries Ltd. must adhere to import/export regulations, including customs duties and trade restrictions. In 2024, the World Trade Organization (WTO) reported global trade growth of 2.6%, indicating the importance of navigating these rules. This involves obtaining necessary licenses and understanding tariffs, which can significantly impact profitability. For example, in 2024, average tariffs on industrial goods in developed countries were around 3%.

United Pacific Industries Ltd. must adhere to varied labor laws across China, Hong Kong, the US, and Europe. These regulations influence HR, wages, and working conditions. In 2024, China's minimum wage ranged from ¥1,400 to ¥2,690 monthly. The US saw federal minimum wage at $7.25, while some states set higher rates.

Intellectual Property Protection

United Pacific Industries must secure its intellectual property (IP) through patents, trademarks, and designs to maintain its competitive edge. IP protection laws differ across regions, so understanding these variations is crucial. In 2024, the global market for IP services was estimated at $25 billion, with projections of reaching $35 billion by 2028.

- Patent filings in China increased by 10% in 2024.

- Trademark applications in the EU saw a 5% rise.

- US design patent grants grew by 3% last year.

Environmental Regulations and Compliance

United Pacific Industries Ltd. must comply with environmental regulations for manufacturing, waste, and emissions. Stricter rules may require investing in new technologies and practices. The global environmental services market is projected to reach $4.1 trillion by 2025. Non-compliance risks penalties and reputational damage. Environmental, social, and governance (ESG) factors influence investor decisions.

- Investments in green technologies can boost operational efficiency.

- Failure to adhere to environmental standards can lead to significant fines.

- Companies with strong ESG profiles often attract more investment.

- Environmental regulations vary by region, impacting compliance costs.

Legal factors significantly impact United Pacific Industries. They must adhere to various manufacturing and product safety standards that affect their operational costs. Furthermore, compliance with import/export regulations and labor laws in diverse regions is essential.

The protection of intellectual property through patents, trademarks, and designs is vital for maintaining its competitive edge. In 2024, the global market for IP services reached $25 billion. Environmental regulations and ESG factors also influence their strategies.

Non-compliance risks penalties. It’s important to understand how to stay compliant across various regions, because this influences both financial performance and reputational health. Investments in green technologies can also boost operational efficiency.

| Factor | Details | Impact |

|---|---|---|

| Manufacturing & Safety | EU RoHS, other regional standards | Compliance costs, market access |

| Import/Export | Customs, trade restrictions (WTO) | Tariffs, profitability |

| Labor Laws | Minimum wage, HR standards (China, US, EU) | Operational costs |

Environmental factors

United Pacific Industries Ltd. relies on resources like metals and plastics. Environmental regulations and resource management policies affect their costs. For example, prices of key materials, like aluminum, fluctuated in 2024 due to supply chain issues. These costs directly influence production expenses and profit margins. In 2024, raw material costs increased by approximately 7%.

Stricter environmental regulations are emerging globally, focusing on emissions, waste, and resource use. United Pacific Industries' commitment to environmental responsibility is crucial for compliance and brand image. Investments in sustainable practices are vital; for example, the global green building materials market is projected to reach $475.6 billion by 2028. These initiatives can reduce operational costs and enhance market access.

Climate change presents significant challenges. Extreme weather events, like the 2024 floods in Southeast Asia, can disrupt United Pacific Industries' supply chains. These events can damage infrastructure and limit access to essential resources. For example, the World Bank estimates climate-related disasters cost the global economy over $200 billion annually.

Consumer Demand for Sustainable Products

Consumer demand for sustainable products is on the rise, influencing business strategies. United Pacific Industries must consider how eco-friendly options impact product design and sourcing. Companies offering sustainable products gain a competitive edge. The global green technology and sustainability market is expected to reach \$74.6 billion by 2025.

- 77% of consumers are concerned about the environmental impact of products.

- Demand for sustainable packaging has increased by 30% in the last year.

- Companies with strong ESG performance see a 10-15% increase in valuation.

Waste Management and Recycling

Waste management and recycling regulations significantly affect United Pacific Industries Ltd.'s operations. Varying infrastructure across regions influence disposal costs and the potential for recycled material use. For instance, the global waste management market was valued at $2.24 trillion in 2023, with projected growth. Companies must comply with local recycling laws, impacting their operational expenses.

- Global waste management market valued at $2.24 trillion in 2023.

- Compliance with local recycling laws impacts operational costs.

- Recycled materials offer cost-saving and sustainability opportunities.

Environmental factors profoundly shape United Pacific Industries Ltd., with resource costs influenced by fluctuating material prices, which rose 7% in 2024.

Growing global regulations emphasizing emissions and waste drive investments in sustainability, as the green building market nears \$475.6 billion by 2028, crucial for compliance.

Climate events like 2024's floods disrupt supply chains, and rising consumer demand for sustainable products demands eco-friendly changes; green technology hits \$74.6 billion by 2025.

| Factor | Impact | Data |

|---|---|---|

| Raw Material Costs | Influences Production Costs | 7% Increase in 2024 |

| Sustainability Market | Enhances Brand & Reduces Costs | \$475.6B by 2028 (Green Building) |

| Sustainable Demand | Shifts Business Strategies | \$74.6B by 2025 (Green Tech) |

PESTLE Analysis Data Sources

This PESTLE analysis sources data from industry reports, economic forecasts, and government publications for accuracy.