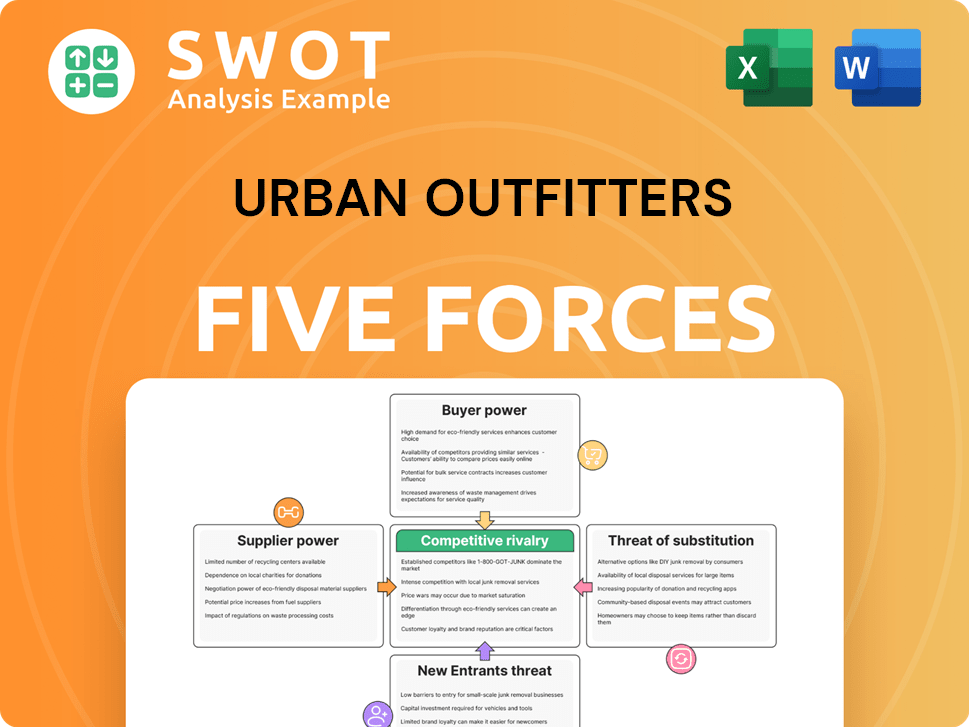

Urban Outfitters Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Urban Outfitters Bundle

What is included in the product

Analyzes Urban Outfitters' competitive position, considering suppliers, buyers, and new market entrants.

Customize pressure levels based on new data, helping you swiftly adapt to Urban Outfitters' changing landscape.

What You See Is What You Get

Urban Outfitters Porter's Five Forces Analysis

You're looking at the complete Urban Outfitters Porter's Five Forces analysis. This in-depth document assesses competitive forces within the retail industry.

It examines factors like rivalry, supplier power, and threat of new entrants, providing a comprehensive overview.

The analysis delves into the specifics impacting Urban Outfitters' market position and strategies. This is the full report.

No editing or waiting is needed; what you see is what you'll instantly download and receive.

This professionally written Porter's Five Forces analysis is ready for immediate use after purchase.

Porter's Five Forces Analysis Template

Urban Outfitters faces moderate competition. Buyer power is substantial, fueled by numerous apparel choices. Supplier bargaining power varies, depending on the item category. The threat of new entrants is moderate due to existing brand loyalty. Substitute products, like online retailers, pose a threat.

Ready to move beyond the basics? Get a full strategic breakdown of Urban Outfitters’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of suppliers for Urban Outfitters is moderately concentrated. The company relies on about 674 vendors globally, as of 2023. The top 10 suppliers account for 36% of all merchandise purchases. This concentration gives some leverage to larger suppliers.

Urban Outfitters' reliance on global suppliers, especially in Asia, significantly impacts its operations. In 2023, Asian vendors comprised 62% of the company's distribution network. To manage risks, the retailer diversifies its sourcing across multiple countries. Key manufacturing locations include Vietnam (28%), China (22%), Cambodia (15%), and Bangladesh (12%).

Urban Outfitters, with $5.551 billion in revenue by January 31, 2025, holds significant negotiation power. Their substantial purchasing volume secures bulk discounts. This also allows for flexible payment terms. Moreover, they can arrange customized manufacturing.

Raw Material Cost Volatility

Urban Outfitters deals with raw material cost volatility, significantly impacting its profitability. In 2023, the company experienced notable increases in key materials. Cotton prices went up by 14.3%, polyester by 9.7%, and wool by 11.2%. These increases highlight the suppliers' power to influence costs.

- 2023 saw substantial raw material cost increases.

- Cotton prices rose by 14.3%.

- Polyester prices increased by 9.7%.

- Wool prices went up by 11.2%.

Impact of Ethical Sourcing

Ethical sourcing significantly impacts Urban Outfitters' supplier relationships. Growing consumer awareness of ethical and sustainable practices drives this influence. Urban Outfitters is focusing on reducing its environmental impact and mapping its carbon footprint. This may lead to selecting suppliers meeting specific sustainability standards, which could limit options and raise costs.

- Urban Outfitters aims to decrease its environmental impact.

- The company is mapping its carbon footprint.

- Sustainability standards may limit supplier choices.

- Meeting these standards could increase costs.

Urban Outfitters' supplier bargaining power is moderate, with 674 global vendors in 2023. The top 10 suppliers make up 36% of purchases, affecting leverage. Raw material costs, like cotton (up 14.3% in 2023), also affect profitability and supplier influence.

| Factor | Impact | Data |

|---|---|---|

| Vendor Concentration | Moderate | Top 10 vendors: 36% of purchases (2023) |

| Raw Material Costs | Significant | Cotton price increase: 14.3% (2023) |

| Geographic Reliance | High | Asian Vendors: 62% of distribution (2023) |

Customers Bargaining Power

Urban Outfitters faces price-sensitive customers, primarily young adults aged 18-34. This demographic's price consciousness is significant; for example, in 2023, 67% of Gen Z and Millennial consumers were highly price-conscious. This high sensitivity necessitates competitive pricing and promotional strategies to attract and retain customers. This factor significantly impacts the company's profitability and market positioning.

Urban Outfitters faces strong customer bargaining power. Shoppers have many choices thanks to online platforms. In 2023, global e-commerce sales hit $5.8 trillion. Fashion comprised 29.5% of online retail. This ease of switching brands boosts buyer power.

Social media heavily shapes customer choices. Online reviews impact sales; good ones boost them, bad ones hurt. Urban Outfitters uses Instagram to attract customers. In 2024, social media marketing spend hit ~$225 billion globally.

Trend-Driven Demand

Urban Outfitters' success hinges on anticipating fashion trends. If they misjudge trends, sales decline, and markdowns rise, impacting profitability. Staying attuned to consumer preferences is crucial for competitiveness. In 2023, Urban Outfitters reported a 2.3% decrease in comparable sales.

- Trend Forecasting: Accurately predicting fashion shifts is critical.

- Inventory Management: Misjudging trends leads to excess inventory and markdowns.

- Consumer Preferences: Understanding and adapting to customer tastes is essential.

- Financial Impact: Poor trend predictions directly affect sales and profit margins.

Loyalty Programs and Personalization

Urban Outfitters focuses on customer loyalty through enhanced omnichannel experiences and personalization. Retailers are investing heavily in these strategies to boost sales and customer retention. Personalized recommendations, tailored communications, and seamless shopping experiences are key.

These efforts aim to increase customer loyalty and drive sales. According to recent reports, personalized marketing can significantly improve conversion rates. For example, studies show that personalized product recommendations can lift sales by 10-15%.

- Enhanced omnichannel experiences are a priority for retailers.

- Personalized marketing boosts conversion rates.

- Product recommendations lift sales by 10-15%.

- Seamless shopping journeys enhance customer loyalty.

Customer bargaining power significantly influences Urban Outfitters due to price sensitivity and diverse shopping options. The rise of e-commerce, with fashion sales hitting 29.5% in 2023, gives consumers ample choice. Social media's impact on customer decisions further amplifies this power.

| Aspect | Impact | Data (2023-2024) |

|---|---|---|

| Price Sensitivity | High | 67% of Gen Z/Millennials are price-conscious |

| E-commerce Influence | Strong | Fashion's online sales: 29.5% |

| Social Media Impact | Significant | Global social media marketing spend: ~$225B (2024 est.) |

Rivalry Among Competitors

Urban Outfitters faces fierce competition in its specialty retail and wholesale sectors, both at home and abroad. The company battles against numerous rivals, including small, independent shops, department stores, and large national chains. In 2024, the retail industry saw significant shifts, with online sales continuing to grow. Urban Outfitters reported a net sales decrease of 1.7% for the three months ended October 31, 2024, compared to the same period last year. This highlights the ongoing pressure from competitors.

Urban Outfitters faces intense competition, including Abercrombie & Fitch and American Eagle Outfitters. These rivals possess larger marketing budgets. In 2023, Abercrombie & Fitch's revenue was $4.3 billion, showing their financial strength.

Urban Outfitters' namesake brand faced challenges, contrasting with Anthropologie and Free People's sales growth. In Q3 FY2025, Anthropologie and Free People saw gains. Urban Outfitters experienced a decline, revealing mixed brand performance. This highlights the impact of varying consumer preferences. The competitive landscape is influenced by these divergent trends.

Omnichannel Competition

Urban Outfitters encounters robust competition in its omnichannel strategy. This includes fierce rivalry in its direct-to-consumer channel, particularly from online retailers. Success hinges on efficient merchandise delivery, robust website and mobile app functionality, and effective customer list management. Competitors, some like Amazon, may boast significantly higher web traffic and superior online marketing capabilities. In 2024, e-commerce sales accounted for approximately 35% of Urban Outfitters' total revenue, highlighting the channel's significance.

- Direct-to-consumer channel competition is intense.

- Key factors include delivery, web/app features, and customer lists.

- Competitors may have stronger online marketing.

- E-commerce sales were about 35% of total revenue in 2024.

Strategic Initiatives

Urban Outfitters is focusing on its FP Movement and Nuuly brands to boost growth. This strategy taps into the activewear and sustainable fashion markets, which are currently experiencing high demand. Expanding these brands helps Urban Outfitters grow within the market. In 2024, FP Movement's sales increased, showcasing the effectiveness of this initiative.

- FP Movement's sales growth in 2024.

- Nuuly's expansion contributes to market growth.

- Focus on activewear and sustainable fashion.

- Strategic brand enhancement for growth.

Urban Outfitters competes fiercely with various retailers. These competitors possess significant financial and marketing advantages, impacting its market share. In 2024, the company's namesake brand faced challenges. This suggests the need for strategies to strengthen its competitive position.

| Aspect | Details | 2024 Data |

|---|---|---|

| Net Sales | Overall sales trend | -1.7% (Q3) |

| E-commerce | Sales contribution | ~35% of revenue |

| Abercrombie & Fitch Revenue | Competitor's Financial Strength | $4.3 billion (2023) |

SSubstitutes Threaten

Online shopping platforms present a substantial threat to Urban Outfitters. In 2023, global e-commerce sales hit $5.8 trillion, showing strong growth. Fashion comprised 29.5% of online retail revenue, highlighting its importance. Amazon Fashion alone made $31.4 billion, showcasing the competition's scale.

The threat of substitutes for Urban Outfitters is increasing due to rental and thrift services. Nuuly, a rental service, is a direct competitor, offering an alternative to buying new clothes. Nuuly saw a 56% year-over-year increase in average subscribers. In fiscal year 2024, segmental revenues rose by 69.1%.

Consumers can readily swap to fast-fashion brands with comparable styles and prices. SHEIN, Fashion Nova, H&M, and Forever 21 offer alternatives, increasing substitution threats. In 2024, SHEIN's revenue reached $32 billion, showing significant market influence. This competitive landscape pressures Urban Outfitters to stay agile.

Sustainable Fashion

The threat of substitutes for Urban Outfitters is notably driven by the rise of sustainable fashion. Consumers are increasingly drawn to alternatives like secondhand clothing and eco-conscious brands. Urban Outfitters strategically responds to this trend through initiatives such as Urban Renewal and Reclectic, which provide recycled and upcycled products. This approach aims to mitigate the impact of substitute products.

- Secondhand clothing sales are projected to reach $77 billion by 2026.

- Urban Outfitters' Urban Renewal line features vintage and reworked items, reflecting the demand for sustainable options.

- Eco-friendly brands are gaining market share, with consumers prioritizing ethical sourcing and production.

- Urban Outfitters' investments in sustainable practices are aimed at retaining customer loyalty and competitiveness.

'No Buy' Movement

The "No Buy 2025" movement, gaining traction among Gen Z, presents a notable threat to Urban Outfitters. This trend, fueled by social media, encourages reduced consumption of new goods. Such behavior directly impacts demand, potentially shrinking Urban Outfitters' customer base.

- The movement's focus on buying less directly affects the retailer's sales volume.

- Increased awareness of sustainable fashion could push consumers towards second-hand options.

- Urban Outfitters' financial health in 2024 will be tested by this shift in consumer behavior.

Urban Outfitters faces increasing threats from substitutes like online platforms and rental services. Fast-fashion brands such as SHEIN also offer competitive alternatives, influencing consumer choices. These challenges are amplified by sustainable fashion trends and the "No Buy 2025" movement.

| Substitute Type | Example | Impact |

|---|---|---|

| Online Retail | Amazon Fashion | Increased competition, price pressure |

| Rental Services | Nuuly | Offers alternatives to buying |

| Fast Fashion | SHEIN | Competitive pricing & styles |

Entrants Threaten

The online retail sector presents low entry barriers, allowing new competitors to enter easily. New entrants can quickly establish an online presence and reach a broad customer base. The cost to launch an e-commerce site is significantly lower than opening physical stores. In 2024, the average cost for a basic e-commerce site setup was around $5,000-$10,000.

Urban Outfitters enjoys strong brand loyalty, making it tough for new competitors. This loyalty, built over time, gives them a real edge. They have strong brand recognition, helping them keep customers. In 2024, Urban Outfitters' brand strength helped them maintain a steady market share, showing its importance.

Urban Outfitters faces a moderate threat from new entrants due to high capital requirements. Entering the retail market demands substantial investment in inventory, prime store locations, and marketing campaigns. These significant upfront costs act as a barrier, discouraging smaller, less-capitalized businesses from competing directly. In 2024, average retail store lease costs in major cities ranged from $50 to $150 per square foot annually, highlighting the financial commitment needed.

E-commerce Expertise

The rise of e-commerce significantly impacts the retail landscape. Success now hinges on robust online platforms and digital marketing. New entrants face the challenge of building these capabilities from scratch. Urban Outfitters, in 2024, saw 40% of its sales from digital channels, highlighting e-commerce's importance.

- Website Development: New entrants need substantial investment.

- Digital Marketing: Crucial for visibility and customer acquisition.

- Supply Chain: Efficient management is key for timely deliveries.

- Competitive Pressure: Existing players have established advantages.

Competitive Saturation

The apparel retail market is intensely competitive, making it hard for new businesses to succeed [1]. Established companies, such as Urban Outfitters, have strong supply chains and distribution networks, creating a significant barrier for new entrants [1]. This saturation means newcomers face an uphill battle to capture market share and gain consumer recognition [1, 2]. New entrants must differentiate themselves significantly to compete effectively [1, 3].

- Market saturation limits growth opportunities for new businesses.

- Established brands have robust infrastructure, posing a challenge.

- Differentiation is crucial for survival in this competitive landscape.

- Urban Outfitters' strong position reflects the challenges.

New competitors face a moderate threat due to high initial capital needs. The retail market requires significant investments in inventory and marketing. Established companies like Urban Outfitters have strong supply chains.

| Factor | Impact | 2024 Data |

|---|---|---|

| E-commerce Setup | Lowers Entry Barriers | Avg. Cost: $5K-$10K |

| Brand Loyalty | Protects Market Share | UO: Steady Share |

| Capital Needs | Acts as a Barrier | Lease Cost: $50-$150/sq ft |

Porter's Five Forces Analysis Data Sources

This Urban Outfitters analysis utilizes financial reports, market analysis, and competitor data. It incorporates SEC filings and industry research for a comprehensive view.