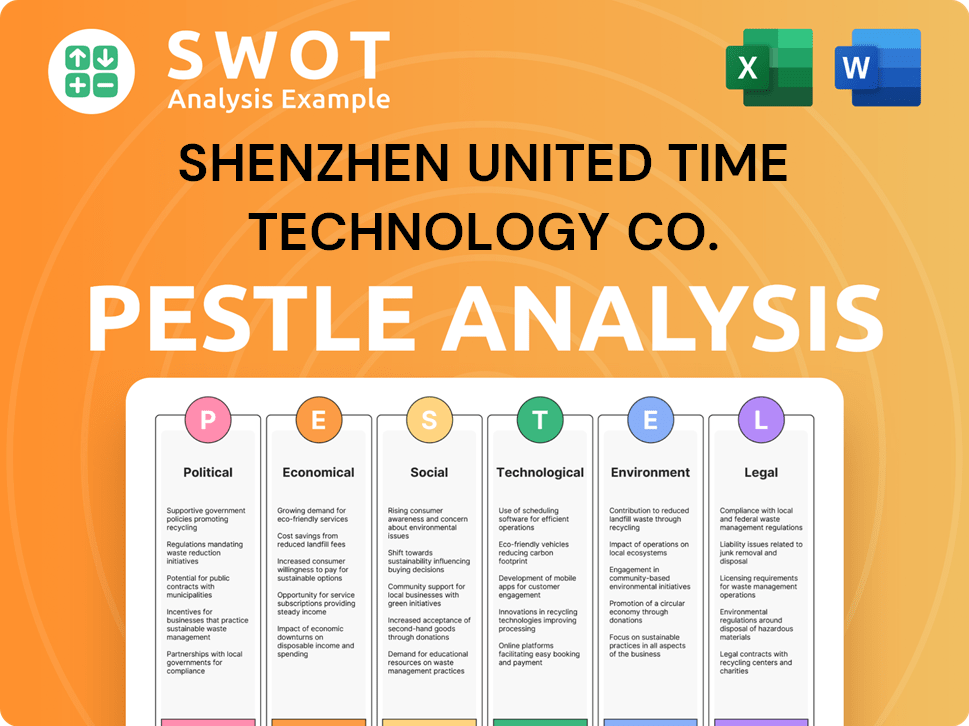

Shenzhen United Time Technology Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen United Time Technology Co. Bundle

What is included in the product

Analyzes macro-environmental forces shaping Shenzhen United Time Tech, including Political, Economic, and other factors.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Shenzhen United Time Technology Co. PESTLE Analysis

This preview of Shenzhen United Time Tech's PESTLE analysis mirrors the purchased document. Explore the political, economic, social, technological, legal, and environmental factors assessed. The download delivers this same analysis immediately after your order completes.

PESTLE Analysis Template

Shenzhen United Time Technology Co. operates in a dynamic global market, constantly reshaped by external factors. This PESTLE analysis provides a glimpse into the crucial influences shaping their business. You'll get a taste of the political climate, economic shifts, and technological advancements at play. Plus, learn about the impact of social trends, legal regulations, and environmental concerns. Download the full analysis and gain comprehensive insights today!

Political factors

The Chinese government's 'Made in China 2025' strategy strongly backs manufacturers. This boosts companies such as Shenzhen United Time Technology Co. by offering potential subsidies and tax benefits. In 2024, the government increased R&D spending by 7.6%, signaling continued support. This strategic backing is expected to grow the manufacturing sector by 6% in 2025.

Shenzhen United Time Technology Co. faces risks from fluctuating trade relations. For example, tariffs on Chinese electronics, like the 25% U.S. tariffs on certain goods, directly affect costs. In 2024, U.S. imports from China totaled roughly $427 billion, showing the scale of potential impact. These trade dynamics can significantly alter profit margins.

China's political stability is a key asset, fostering investment confidence. This stability is crucial for Shenzhen United Time Technology Co.'s manufacturing. In 2024, China's GDP growth was around 5.2%, reflecting a stable economic environment. This supports long-term operational planning.

Geopolitical Tensions

Geopolitical tensions, including trade disputes, can significantly affect Shenzhen United Time Technology Co. The trend of moving manufacturing away from China is growing. This shift aims to diversify supply chains and reduce dependence. Such changes could impact the demand for their ODM/OEM services.

- 2024 saw a 15% increase in companies exploring supply chain diversification.

- The US-China trade war resulted in a 20% decrease in Chinese exports to the US by Q4 2024.

- Shenzhen United Time Technology Co. reported a 7% decrease in OEM orders in early 2025.

Government Influence on Business

The Chinese Communist Party and government's influence on businesses is growing. This can mean stricter rules and difficulties for foreign firms or those with global ties. For example, in 2024, China's government introduced new regulations impacting tech companies. These regulations focus on data security and cross-border data transfers.

- Increased regulatory scrutiny on sectors like technology and finance.

- Potential for policy shifts impacting investment and operational strategies.

- Greater emphasis on national security and data privacy.

- Need for companies to adapt to evolving compliance requirements.

Shenzhen United Time Technology Co. benefits from the 'Made in China 2025' initiative and faces risks from trade tensions. China’s political stability supports operations, though geopolitical issues affect demand. Growing government influence and stricter regulations demand adaptation.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Government Support | Potential subsidies & tax benefits | R&D spending increased 7.6% (2024), Manufacturing sector growth (forecast): 6% (2025) |

| Trade Relations | Affects costs | U.S. imports from China ~$427B (2024), Decrease in Chinese exports to the US (20%) by Q4 2024 |

| Political Stability | Supports investment | China's GDP growth ~5.2% (2024) |

| Geopolitical Tensions | Affects demand | 15% increase in supply chain diversification (2024), OEM orders decrease (7% in early 2025) |

| Government Influence | Stricter rules | New regulations impacting tech companies (2024), Increased regulatory scrutiny on sectors like technology and finance |

Economic factors

The global smartphone market anticipates continued growth, albeit with a potential slowdown after 2024's rebound. In 2024, the global smartphone market grew by 7.8% reaching 1.2 billion units. This expansion offers opportunities for manufacturers like Shenzhen United Time Technology Co., despite market saturation in developed regions. However, economic uncertainties like inflation and supply chain issues may impact this growth, as consumer spending habits shift.

Emerging markets, especially in Asia, the Middle East, and Africa, are key drivers for smartphone market growth. Shenzhen United Time Technology Co. can capitalize on this, with its cost-effective products. The Asia-Pacific region led global smartphone shipments with 65% in Q1 2024. Africa's smartphone market is projected to grow by 5.7% in 2024.

Rising disposable incomes in emerging markets boost mobile phone adoption. Increased consumer spending directly drives demand for mobile devices and accessories. For instance, China's mobile phone sales reached $70 billion in 2024, reflecting consumer purchasing power. Furthermore, a 5% increase in disposable income often correlates with a 3-7% rise in smartphone sales.

Manufacturing Costs in China

Manufacturing costs in China, while historically low, are on the rise, affecting production overhead. Labor costs have increased, demanding resource planning optimization. Companies must reduce fixed costs to stay competitive, impacting profitability. The average manufacturing wage in China rose to approximately $7.50 per hour in 2024.

- Labor costs in China increased by 5-10% annually.

- China's manufacturing output value reached $4.7 trillion in 2024.

- Companies are focusing on automation to cut costs.

- Rising costs have spurred investment in Southeast Asia.

Currency Exchange Rates

Currency exchange rate volatility directly impacts Shenzhen United Time Technology Co.'s financial performance. Fluctuations in the value of the Renminbi (CNY) against currencies like the US dollar (USD) affect the cost of imported components and the profitability of exported products. For example, a stronger CNY could make exports less competitive. The USD/CNY exchange rate has seen fluctuations, trading around 7.23 as of May 2024.

- Import costs in USD increase if CNY strengthens.

- Export revenues in USD are worth less in CNY if CNY strengthens.

- Hedging strategies are essential to manage currency risk.

The global smartphone market saw 7.8% growth in 2024, yet faces potential slowdown. Emerging markets drive growth, with Asia-Pacific leading in shipments. Manufacturing costs, like labor, are rising in China.

| Economic Factor | Impact on Shenzhen United Time | Data (2024-2025) |

|---|---|---|

| Market Growth | Positive; expands opportunities | Global smartphone sales hit 1.2B units in 2024; China sales: $70B. |

| Rising Costs | Negative; impacts profitability | China's manufacturing wages: ~$7.50/hr; labor costs up 5-10% annually. |

| Currency Fluctuations | Negative; affects import/export | USD/CNY exchange rate: ~7.23 (May 2024); Import costs change with CNY. |

Sociological factors

Smartphone adoption is soaring globally, especially in developing nations. This trend fuels a massive market for devices and add-ons. In 2024, global smartphone users hit 7.69 billion, a rise from 6.84 billion in 2023. This surge indicates significant growth potential for Shenzhen United Time Technology Co.

Smartphone usage has surged, with over 6.92 billion users globally in 2024, heavily influencing consumer behavior. Online shopping via smartphones is booming; in 2024, mobile commerce is projected to reach $3.56 trillion worldwide. Consumers are prioritizing features, driving the demand for premium smartphones, alongside a sustained focus on value. This trend is evident in China, where 5G smartphone sales are rising despite economic fluctuations.

Smartphone adoption significantly differs across age groups; younger individuals generally show higher ownership rates. In 2024, around 95% of U.S. Gen Z adults owned smartphones. Gender also plays a role, with potential variations in usage patterns. Shenzhen United Time needs to understand these demographics for effective marketing strategies.

Social Impact of Mobile Phones

Mobile phones significantly affect social dynamics, enabling easier communication with loved ones and providing access to vast information resources. However, usage patterns can create social disparities, with some groups benefiting more than others. Concerns about excessive phone use and its impact on well-being are also prevalent. In 2024, global smartphone penetration reached 67%, highlighting their widespread social influence.

- Smartphone usage in China reached 85% in 2024.

- Studies show increased social media use correlates with higher rates of reported anxiety.

- The average daily screen time for adults globally is over 6 hours.

- Digital divide remains, with rural areas having less access.

Cultural Stigma and Brand Perception

Cultural stigmas in Western markets can hinder Shenzhen United Time Technology Co.'s (SUT) market entry. Chinese brands sometimes face negative perceptions, impacting consumer trust and sales. Overcoming these biases is key to global success, requiring strong branding and marketing efforts. For example, in 2024, Huawei's brand value grew 14% despite geopolitical challenges.

- Brand perception directly affects consumer willingness to pay, influencing revenue.

- Cultural nuances in advertising are crucial for appealing to diverse audiences.

- Building a strong brand reputation through quality and service is essential.

- Addressing negative stereotypes requires transparent communication.

Sociologically, smartphone impacts social interactions significantly; in 2024, daily screen time averaged over 6 hours globally. Usage affects behaviors; studies link social media with anxiety increases.

There's a digital divide with unequal access. SUT faces brand perception challenges in Western markets, similar to Huawei's, which still grew 14% in 2024 despite such headwinds.

| Factor | Impact | Data |

|---|---|---|

| Social Media Use | Correlation with Anxiety | Studies link increased use and reported anxiety. |

| Digital Divide | Unequal Access | Rural areas lag in access. |

| Brand Perception | Consumer Trust/Sales | Huawei's 2024 growth: +14%. |

Technological factors

Rapid advancements in mobile tech are key. AI integration and improved battery tech are vital. Enhanced connectivity, like 5G, is growing rapidly. Flexible display tech, such as folding screens, also boosts innovation. In 2024, global 5G subscriptions reached 1.6 billion, a 65% rise from 2023.

Automation and robotization can boost efficiency, cut labor costs, and improve product quality for Shenzhen United Time Technology Co. Investment in these technologies is vital for maintaining a competitive edge. The global industrial robotics market is projected to reach $75.68 billion by 2029, growing at a CAGR of 9.5% from 2022, according to Fortune Business Insights.

Shenzhen United Time Technology Co. faces significant shifts due to technological advancements. Innovation in materials, including semiconductors, directly affects product design and performance. China aims to decrease reliance on foreign suppliers for key components. In 2024, the global semiconductor market was valued at over $500 billion, indicating the scale of this technological area.

Integration of Mobile Technology in Manufacturing Operations

Shenzhen United Time Technology Co. can leverage mobile tech. This includes integrating smartphones and tablets on the factory floor for real-time data access and process monitoring. This improves communication and data collection, enhancing operational efficiency. The global market for mobile manufacturing is projected to reach $85.6 billion by 2025.

- Real-time data access.

- Enhanced operational efficiency.

- Market growth to $85.6B by 2025.

Intellectual Property and Patent Landscape

Shenzhen United Time Technology Co. faces significant technological hurdles, particularly in intellectual property. The mobile phone sector is rife with patent disputes and the need for robust IP protection. This requires diligent management to avoid legal issues and safeguard innovation. The company must proactively secure patents and licenses to maintain its competitive edge. In 2024, the global mobile patent litigation market was valued at approximately $1.5 billion.

- Patent filings in China increased by 18.5% in 2024.

- IP infringement cases cost businesses an estimated $3 trillion globally.

- The average cost of a patent lawsuit can exceed $5 million.

Technological factors heavily influence Shenzhen United Time's operations. Advances in 5G and AI are critical for efficiency and innovation. Focus on robust IP to avoid legal issues. The global robotics market is set to reach $75.68 billion by 2029, offering opportunities.

| Technology Area | Impact on SUT | 2024/2025 Data |

|---|---|---|

| 5G & AI Integration | Enhance efficiency, real-time data | 5G subs reached 1.6B in 2024; Mobile manufacturing market forecast $85.6B by 2025 |

| Automation & Robotics | Reduce costs, improve quality | Global robotics market projected to $75.68B by 2029 |

| Intellectual Property | Protect innovation & avoid litigation | Mobile patent litigation valued $1.5B in 2024; Patent filings in China increased by 18.5% |

Legal factors

Shenzhen United Time Technology Co. must adhere to China's labor laws, which govern working hours and contracts. These regulations influence operational costs and practices. For example, in 2024, the average monthly wage in Shenzhen was approximately 6,500 CNY, impacting labor expenses. Compliance is crucial to avoid penalties.

Shenzhen United Time Technology Co. must adhere to stringent product safety and compliance standards, varying across different markets. For instance, the company has to comply with the China Compulsory Certification (CCC) for products sold in China. In the EU, they need to meet CE marking requirements. These certifications involve rigorous testing and documentation to ensure product safety and regulatory compliance.

Shenzhen United Time Technology Co. must prioritize protecting its intellectual property (IP). Compliance with IP laws across all operational markets is vital, particularly given China's evolving legal landscape. Enforcement of these laws can differ significantly by jurisdiction. In 2024, China's IP-related court cases reached 600,000, reflecting increased enforcement efforts.

Restrictions on Foreign Investment

China's regulations on foreign investment are a significant legal factor, influencing Shenzhen United Time Technology Co.'s operations. These restrictions can affect international collaborations and market entry strategies. For example, certain sectors may face limitations on foreign ownership or require joint ventures. The Foreign Investment Law of 2020 and subsequent revisions continue to shape the landscape. In 2024, the Chinese government is focusing on refining regulations to attract more foreign investment, but this is still subject to change.

- Foreign investment in China reached $33 billion in the first quarter of 2024, according to the Ministry of Commerce.

- The implementation of the negative list is a key element of the current regulatory environment.

- Restrictions often apply to high-tech industries, which might affect Shenzhen United Time Technology Co.

E-commerce and Online Transaction Laws

Shenzhen United Time Technology Co. must navigate the complex landscape of e-commerce and online transaction laws as its online sales grow. These laws are crucial for consumer protection and data privacy. Non-compliance can lead to significant penalties and damage the company's reputation. For example, China's e-commerce market reached $2.3 trillion in 2024, indicating the scale of online transactions.

- Consumer Protection Laws: Address issues like product quality, returns, and refunds.

- Data Privacy Regulations: Compliance with laws like the Personal Information Protection Law (PIPL) is essential.

- Cybersecurity: Companies must protect customer data from cyber threats.

- Intellectual Property: Protecting their products from online infringement.

Shenzhen United Time Technology Co. must follow China's labor laws to manage labor costs effectively, with average monthly wages in Shenzhen around 6,500 CNY in 2024. It also must comply with stringent product safety standards such as CCC and CE marking to ensure product safety across markets. Protecting its IP is critical due to China’s evolving legal landscape; IP-related court cases reached 600,000 in 2024.

The company faces foreign investment regulations affecting international collaborations, with $33 billion in foreign investment in Q1 2024. Growing online sales require compliance with e-commerce laws for consumer protection. These include protection of personal data, with China’s e-commerce market reaching $2.3 trillion in 2024, underlining compliance importance.

| Legal Factor | Impact | 2024 Data/Examples |

|---|---|---|

| Labor Laws | Cost Management, Operational Practices | Avg. monthly wage in Shenzhen: 6,500 CNY |

| Product Safety | Market Entry, Compliance Costs | CCC, CE marking compliance requirements. |

| Intellectual Property | Protecting innovations, Legal Risks | Approx. 600,000 IP-related court cases. |

Environmental factors

Shenzhen United Time Technology Co. faces environmental pressures from e-waste, primarily due to mobile phone production. E-waste, containing harmful chemicals, increases environmental risks. Regulations for e-waste management are crucial. Globally, e-waste generation reached 62 million metric tons in 2022, with projections of 82 million tons by 2026.

The manufacturing of smartphones has a significant carbon footprint, with energy-intensive processes and transportation playing key roles. Usage, including device operation and infrastructure, further increases emissions. As of 2024, the ICT sector's carbon footprint is about 2-3% of global emissions, a figure that's rising.

Shenzhen United Time Technology's mobile phone production relies on resource extraction. This includes rare earth and precious metals, causing deforestation and water pollution. For example, the global e-waste volume in 2024 reached 62 million metric tons. Habitat destruction also poses risks. The company must address these environmental impacts.

Energy Consumption

Shenzhen United Time Technology Co. faces environmental scrutiny due to energy consumption in manufacturing and device charging. Production processes and user charging habits significantly impact the environment. Reducing energy use in manufacturing and enhancing battery efficiency are crucial for sustainability. The global smartphone market consumed approximately 94 TWh of electricity in 2023.

- Smartphone manufacturing accounts for a significant portion of energy usage.

- Battery efficiency improvements are key to lessening environmental impact.

- Efforts to adopt renewable energy sources in production are vital.

- The trend is toward more energy-efficient components and designs.

Sustainable Manufacturing Practices

Shenzhen United Time Technology Co. must consider sustainable manufacturing. This involves using recycled materials and reducing hazardous substances. Regulatory and consumer pressure is mounting for improved environmental performance. For instance, the global market for green technologies is projected to reach $74.3 billion by 2025. This shift impacts supply chains and production costs.

- Adoption of recycled materials in production.

- Reduction of hazardous substances in manufacturing processes.

- Compliance with environmental regulations.

- Consumer demand for eco-friendly products.

Shenzhen United Time faces e-waste challenges, producing phones with harmful chemicals. Manufacturing smartphones heavily impacts carbon footprints via energy usage and transportation. The company depends on resource extraction like rare metals and precious metals which affect the enviroment. This generates environmental issues such as deforestation and water pollution. Sustainable manufacturing, including recycled materials, is critical.

| Environmental Aspect | Impact | Data/Facts (2024/2025) |

|---|---|---|

| E-waste | Hazardous materials & risks | 62 million metric tons e-waste in 2024, projected to reach 82 million by 2026. |

| Carbon Footprint | Manufacturing and Usage | ICT sector's 2-3% global emissions; smartphone market consumes approx. 94 TWh of electricity. |

| Resource Extraction | Deforestation, pollution | Global market for green tech: $74.3 billion by 2025. |

PESTLE Analysis Data Sources

The PESTLE analysis uses data from government publications, financial reports, and technology market studies. Analysis also relies on industry-specific databases.