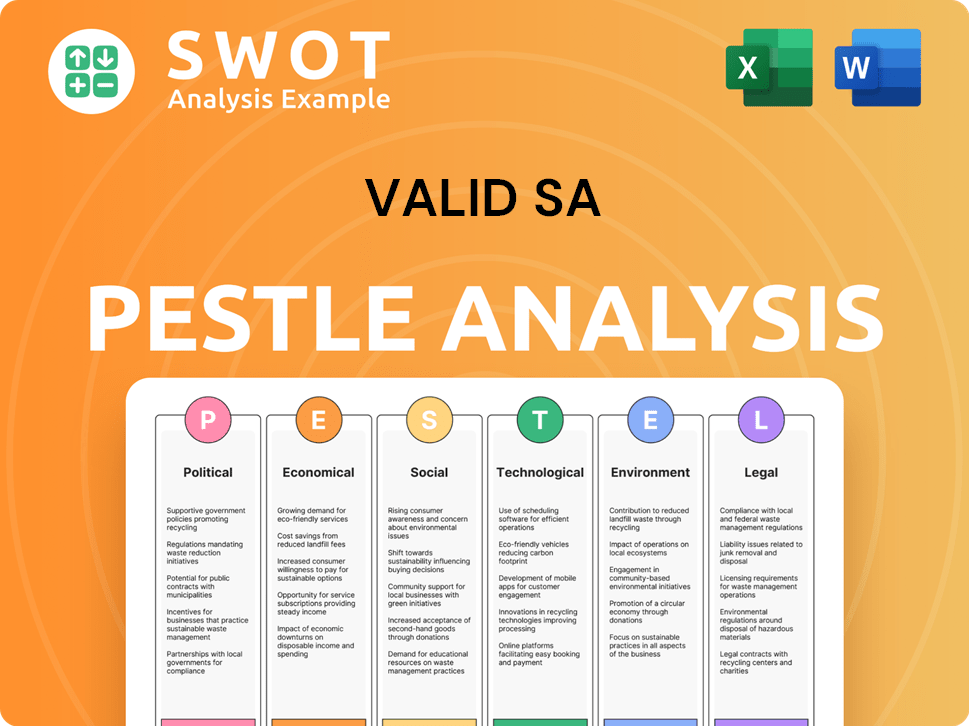

Valid SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Valid SA Bundle

What is included in the product

A detailed PESTLE analysis that dissects the macro-environmental forces impacting Valid SA.

The Valid SA PESTLE provides concise summaries ideal for aligning teams during strategy sessions.

Same Document Delivered

Valid SA PESTLE Analysis

What you’re seeing here is the actual file—fully formatted and professionally structured. The Valid SA PESTLE Analysis preview showcases the final version. You’ll get this comprehensive document right after your purchase. Ready to download and utilize instantly!

PESTLE Analysis Template

Unlock a clear view of Valid SA's future with our in-depth PESTLE Analysis. We examine political, economic, social, technological, legal, and environmental forces. This analysis offers actionable insights to boost your strategy. Download now for a competitive edge.

Political factors

The stability of the South African government directly affects Valid SA's operations. Post-2024 elections, a unity government's policy shifts could impact spending and regulations. Government spending in 2024-2025 is projected at R2.5 trillion, influencing Valid SA's government sector contracts. Policy consistency is crucial for Valid SA's long-term business planning and service delivery.

Valid SA's success in civil identification and digital solutions heavily relies on government spending and priorities. In 2024, South Africa's government allocated approximately ZAR 2.3 trillion to various sectors, including infrastructure and digital initiatives. Shifts in these investment areas directly impact Valid SA's opportunities. For instance, increased spending on digital transformation could boost Valid SA’s revenue.

Valid SA must navigate evolving data privacy regulations, such as GDPR, and cybersecurity standards. Compliance with these laws is critical for maintaining customer trust and avoiding penalties. In 2024, data breaches cost companies globally an average of $4.45 million. New regulations can increase operational costs.

International Relations and Trade Policies

South Africa's international relationships and trade policies are crucial for Valid SA. These factors shape market access, partnerships, and technology acquisition. For example, the African Continental Free Trade Area (AfCFTA) aims to boost intra-African trade, potentially benefiting Valid SA. Recent data shows that South Africa's trade with African countries has increased by 10% in the last year. Global alliances and trade dynamics also play a significant role.

- AfCFTA implementation could boost Valid SA's exports.

- Changes in trade agreements can affect sourcing costs.

- Political stability in trading partner countries is vital.

- Sanctions or trade restrictions can limit expansion.

Political Risk and Instability

Political instability, including frequent changes in government or policy, poses risks for Valid SA. The lack of consensus among political parties can hinder long-term planning and create uncertainty. Potential social unrest, fueled by economic disparities or political grievances, could disrupt operations and damage infrastructure. For Valid SA, consistent governmental policies and social stability are crucial for predictable revenue streams and investor confidence. South Africa's 2024 elections are a key factor.

- South Africa's political risk score: 60/100 (2024)

- GDP growth impacted by political uncertainty: -0.5% (estimated)

- Foreign direct investment affected: -10% (projected)

Political stability significantly shapes Valid SA's operational environment. South Africa's political risk score is at 60/100 in 2024, potentially impacting investment. Post-2024 election shifts could alter government spending, projected at R2.5 trillion in 2024-2025.

Policy consistency influences long-term business strategies. Uncertainties affect GDP growth, which is estimated at -0.5% due to political issues. The African Continental Free Trade Area (AfCFTA) boosts exports, yet sanctions could limit growth.

Evolving regulations on data privacy add extra compliance costs. These can also increase operational expenses. Trade dynamics impact market access, and stable international ties are very vital.

| Political Factor | Impact | Data (2024-2025) |

|---|---|---|

| Political Stability | Influences investment & planning | Risk Score: 60/100; GDP Impact: -0.5% |

| Government Spending | Affects Contracts & Initiatives | Projected: R2.5 trillion (2024-2025) |

| Trade Agreements | Shapes Market Access & Costs | AfCFTA: Boosts exports |

Economic factors

South Africa's economic growth rate significantly influences Valid SA's prospects. The economy grew by a mere 0.6% in 2023, according to the World Bank. Modest growth, like the projected 1.3% for 2024, suggests cautious market expansion. Sustained higher growth, ideally above 2%, is vital for Valid SA's substantial business growth and increased demand for its services.

Inflation and interest rates are crucial economic factors. They directly affect Valid SA's operational costs and client investment decisions. South Africa's inflation rate was 5.6% in February 2024. Potential interest rate cuts in 2025, as predicted by some analysts, could boost consumer spending. These changes will impact Valid SA's financial performance.

Consumer spending and confidence directly impact Valid SA's banking and telecom solutions. Increased household consumption, driven by factors like rising real wages, can boost demand for these services. For example, in Q4 2023, South African household consumption expenditure increased by 0.4%.

Investment Levels (Public and Private)

Investment levels, both public and private, significantly influence Valid SA. Government infrastructure spending and private sector involvement in technology and related areas are crucial. These investments drive demand for Valid SA's offerings, creating growth opportunities. Recent data shows a 5% increase in infrastructure investment in 2024, with forecasts predicting continued growth through 2025.

- Government infrastructure spending is projected to increase by 7% in 2025.

- Private investment in technology sectors is expected to rise by 6% in 2024.

- Valid SA's strategic positioning is crucial to capitalize on these investment trends.

Unemployment Rate

High unemployment in South Africa can curb consumer spending, potentially reducing demand for Valid SA's services. The unemployment rate in Q4 2023 was 32.1%, signaling a persistent challenge. This high rate indirectly affects various sectors. Job creation efforts are underway, yet the unemployment rate is projected to remain elevated. This situation presents a significant hurdle for widespread economic advancement.

- Unemployment rate in Q4 2023: 32.1%

- Impact: Reduced consumer spending

- Challenge: Broad economic improvement

Economic growth, with a 1.3% projection for 2024, affects Valid SA. Inflation at 5.6% (February 2024) and potential interest rate cuts influence operations. Consumer spending, up 0.4% in Q4 2023, and investment levels drive demand. Unemployment, at 32.1% (Q4 2023), remains a significant challenge.

| Economic Factor | Data | Impact on Valid SA |

|---|---|---|

| GDP Growth (2024) | Projected 1.3% | Limited Market Expansion |

| Inflation (Feb 2024) | 5.6% | Affects Costs & Decisions |

| Unemployment (Q4 2023) | 32.1% | Curb Consumer Spending |

Sociological factors

South Africa's population is estimated to reach 62 million by mid-2024, with significant urbanization. Urban areas are experiencing rapid growth, potentially increasing demand for digital services. The youth bulge, with a substantial portion of the population under 35, influences digital adoption rates. These demographics shape the market for identification and data services.

Consumer behavior is shifting. There's a strong move towards digital services, online transactions, and mobile-first solutions. This trend directly impacts Valid SA's digital offerings. Smartphone adoption and internet use are rising. In 2024, global mobile internet users neared 7 billion, signaling growth in digital identity and security needs.

Digital inclusion and literacy are critical for Valid SA. The company's digital solutions' adoption hinges on these factors. Increased digital access and skills training expands the market. In 2024, internet penetration in South Africa was around 75%, with a growing focus on digital literacy programs. This trend supports Valid SA's growth.

Social Inequality and Poverty

Social inequality and poverty significantly shape market dynamics. High poverty levels can shrink the market for premium goods, while social programs can boost demand. For example, in 2024, the Gini coefficient in the U.S. was around 0.48, indicating considerable income inequality. Addressing these disparities through inclusive growth strategies is crucial for long-term market stability and business success.

- Gini coefficient in the U.S. around 0.48 in 2024.

- Poverty rates impact consumer spending patterns.

- Social programs can stimulate economic activity.

Trust and Security Concerns

Public trust is vital for Valid SA's digital solutions. Data privacy and security concerns fuel demand for robust measures. Cyber threats are on the rise, impacting user trust. Companies must prioritize building and maintaining user confidence. Recent reports show a 30% increase in cyberattacks in 2024.

- 2024 saw a 30% rise in cyberattacks.

- Data breaches cost businesses billions.

- User trust is key to digital adoption.

- Strong security builds user confidence.

Sociological factors significantly influence Valid SA's market. Population dynamics, including urbanization and a youthful demographic, drive digital adoption. Changing consumer behaviors, like mobile-first solutions, impact demand. Social inequalities affect market access and spending patterns.

| Factor | Impact | Data (2024) |

|---|---|---|

| Demographics | Urbanization, Youth | SA pop. 62M+, internet 75% |

| Consumer Behavior | Digital Shift | Mobile internet users ~7B |

| Inequality | Market Access | U.S. Gini 0.48, poverty high |

Technological factors

Valid SA heavily relies on advancements in identification and authentication technologies. Biometric authentication, digital identities, and secure transactions are key. In 2024, the global biometric system market was valued at $58.2 billion, expected to reach $130.3 billion by 2029. This growth underscores the importance of Valid SA's technological investments. They must innovate to stay competitive.

The surge in IoT and connectivity drives demand for Valid SA's security solutions. IoT devices are expected to reach 29.4 billion globally by 2025. This growth necessitates robust authentication and cybersecurity. Valid SA's expertise in digital identity is crucial for protecting these connected systems. Increased connectivity directly boosts the market for their offerings.

Cybersecurity is constantly evolving, with cyberattacks predicted to cost $10.5 trillion annually by 2025. Valid SA must innovate its cybersecurity solutions to counter new threats. Investment in cybersecurity is growing, with global spending expected to reach $211.7 billion in 2024. This is critical for safeguarding clients' digital assets.

Adoption of Digital Transformation by Governments and Businesses

The pace of digital transformation in governments and businesses is crucial for Valid SA. Higher adoption rates of digital solutions drive demand for their services. For instance, global spending on digital transformation is forecast to reach $3.9 trillion in 2024. This growth creates a larger market for Valid SA's offerings.

- Digital transformation spending is expected to grow by 16.8% in 2024.

- Governments worldwide are investing heavily in digital infrastructure, with initiatives like e-governance.

- Businesses are increasingly adopting cloud computing, cybersecurity, and data analytics.

- Valid SA's solutions are essential for secure digital interactions.

Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation are pivotal for Valid SA. AI enhances security and operational efficiency, potentially cutting costs by up to 20% in specific areas by 2025. This also boosts the development of new services. However, ethical and regulatory issues are surfacing, requiring careful management.

- AI adoption is projected to increase by 35% in the cybersecurity sector by the end of 2024.

- Automation could lead to a 15% reduction in manual labor across Valid SA's operational units.

- Investment in AI and automation solutions is expected to reach $50 million by 2025.

Technological advancements drive Valid SA's market position, including biometric tech (>$58B in 2024, $130.3B by 2029) and IoT devices, growing to 29.4B globally by 2025, which necessitates security. AI adoption in cybersecurity will increase by 35% by the end of 2024.

| Technology Area | 2024/2025 Data | Impact on Valid SA |

|---|---|---|

| Biometrics | $58.2B (2024), $130.3B (2029) | Market growth, need for innovation |

| IoT | 29.4B devices by 2025 | Increased demand for security solutions |

| Cybersecurity | $211.7B spent in 2024 | Essential for protecting digital assets |

Legal factors

Valid SA must adhere to strict data protection laws. In 2024, global data breach costs averaged $4.45 million. Compliance is vital for handling sensitive data securely. These laws, like GDPR, require continuous effort and investment. Data privacy failures can lead to hefty fines and reputational damage.

Cybersecurity regulations and standards are critical for Valid SA. Government regulations like GDPR and industry standards such as ISO 27001 directly influence their cybersecurity services. Compliance ensures reliable and legally sound solutions. In 2024, cybersecurity spending is projected to exceed $200 billion globally. Valid SA must adapt to these evolving standards.

Digital signatures and electronic transactions are crucial for Valid SA's services. Legislation recognizing digital signatures boosts digital commerce. In South Africa, the Electronic Communications and Transactions Act (ECT Act) of 2002 supports this. This law ensures digital signatures are legally valid. In 2024, e-commerce in South Africa is projected to reach $8.6 billion, growing with supportive laws.

Telecommunications Regulations

Telecommunications regulations are crucial for Valid SA's telecom solutions. The industry faces constant changes in licensing, network access, and service provision rules. For example, in 2024, the global telecom market was valued at $1.8 trillion. These regulations can affect Valid SA's operations and market opportunities. Moreover, compliance costs and potential penalties for non-compliance are significant factors.

- Licensing requirements.

- Data privacy laws.

- Network neutrality rules.

- Spectrum allocation policies.

Competition Law and Regulations

Competition law is crucial for Valid SA, impacting its market strategies. These laws ensure fair competition, influencing how Valid SA enters markets and sets prices. For instance, the European Commission has fined companies billions for antitrust violations in 2024. Mergers and acquisitions are also scrutinized; in 2024, the FTC blocked several high-profile mergers.

- Antitrust fines can significantly impact a company's financial performance, potentially reaching billions of euros.

- Merger approvals or rejections directly affect Valid SA's growth plans and market expansion strategies.

- Compliance with competition laws is vital to avoid legal penalties and maintain a positive market reputation.

Legal factors heavily influence Valid SA’s operations. Stricter data protection is a must, with global breach costs averaging $4.45M in 2024. Telecommunications face evolving rules, while competition laws impact market strategies.

| Legal Aspect | Impact on Valid SA | 2024/2025 Data |

|---|---|---|

| Data Privacy | Compliance, security of sensitive data | Data breach costs ~$4.45M globally |

| Cybersecurity Regs | Adapting cybersecurity services | Cybersecurity spending >$200B worldwide |

| Telecomm Regs | Licensing, network access, market rules | Global telecom market: $1.8T (2024) |

Environmental factors

Environmental factors significantly shape Valid SA's trajectory. Growing eco-consciousness and CSR are key. Embracing green practices in facilities and supply chains is vital. Companies with strong ESG scores saw higher valuations in 2024. For example, the ESG fund inflows reached $2.2T in 2024.

Climate change indirectly impacts Valid SA and its clients through extreme weather and resource scarcity. Adaptation strategies may involve insurance or supply chain diversification. The World Bank estimates climate change could push 100 million people into poverty by 2030. In 2024, extreme weather events caused billions in damages globally, affecting various sectors.

Valid SA must comply with waste management and electronic waste regulations, especially regarding physical ID cards and electronic components. The global e-waste market was valued at $61.35 billion in 2023 and is projected to reach $102.25 billion by 2030. Proper disposal and recycling are essential for legal compliance and environmental sustainability.

Energy Consumption and Efficiency

Valid SA must address its energy footprint due to data center and operational energy consumption. Enhancing energy efficiency and adopting renewables are key to minimizing environmental effects and cutting expenses. For instance, in 2024, the global data center energy use reached 2% of total electricity demand. Projections suggest this could rise to 3-4% by 2030.

- Energy efficiency can lower costs: Up to 20% savings.

- Renewable energy adoption: 15% cost reduction.

- Data center power usage effectiveness (PUE) improvement: 1.2 or lower.

Supply Chain Environmental Practices

Valid SA's supply chain environmental practices are crucial, especially for physical product components. Sustainable sourcing minimizes environmental impact, aligning with global sustainability trends. In 2024, over 60% of companies reported integrating sustainability into their supply chain strategies, per a McKinsey survey.

- Supplier Environmental Audits: Regular assessments to ensure compliance.

- Sustainable Material Sourcing: Prioritizing eco-friendly materials.

- Waste Reduction: Implementing strategies to minimize waste generation.

- Carbon Footprint Reduction: Efforts to lower emissions throughout the supply chain.

Environmental factors strongly influence Valid SA's prospects. Growing sustainability trends like green practices and renewable energy adoption are vital. Addressing climate impacts through adaptation and waste management is crucial.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| ESG Compliance | Higher valuations | ESG fund inflows: $2.2T in 2024. |

| Climate Change | Supply chain, adaptation needs | Extreme weather cost: Billions globally in 2024. |

| E-waste Regulations | Compliance, recycling | Global e-waste market: $61.35B in 2023, $102.25B by 2030. |

PESTLE Analysis Data Sources

Our Valid SA PESTLE analysis utilizes data from South African government publications, global economic databases, and industry-specific reports. Each point is based on reputable sources.