Hunan Valin Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunan Valin Steel Bundle

What is included in the product

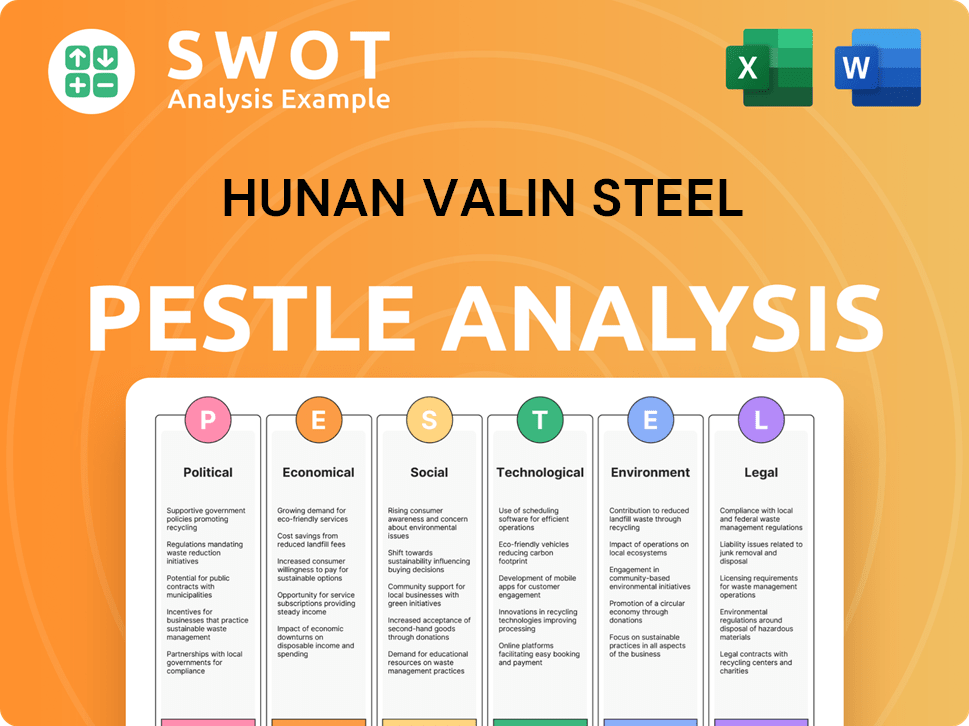

Provides a comprehensive evaluation of Hunan Valin Steel, examining macro-environmental influences through PESTLE framework.

Allows users to modify or add notes specific to their own context, region, or business line.

Full Version Awaits

Hunan Valin Steel PESTLE Analysis

The preview shows the full Hunan Valin Steel PESTLE analysis.

You'll receive this complete, professionally structured document upon purchase.

No alterations or substitutions—it's ready for immediate use.

The exact content, format, and details are all available now.

Enjoy your thorough, ready-to-go analysis!

PESTLE Analysis Template

Uncover the external factors influencing Hunan Valin Steel's performance with our PESTLE Analysis. Explore the political landscape's impact on regulations. Analyze economic trends affecting market stability. Understand technological advancements transforming operations. Identify social factors impacting consumer behavior. Examine environmental concerns. Discover the legal challenges & opportunities. Download the full PESTLE analysis for actionable intelligence.

Political factors

Hunan Valin Steel, a state-owned enterprise, benefits from Chinese government backing. This includes favorable policies and resource access. Government support helps cushion against market volatility, impacting operations. In 2024, state-owned enterprises in China saw increased investment. This support influences Hunan Valin's strategic decisions.

China's steel industry faces strict regulations. The government focuses on capacity limits and environmental protection. These rules affect Hunan Valin Steel's output and tech investments. In 2024, China's steel production was about 1.0 billion metric tons. Industrial upgrades are also a key government goal.

Global trade policies significantly impact Hunan Valin Steel. Tariffs and quotas from other nations can hinder exports, affecting sales. China's domestic trade policies offer market protection. In 2024, China's steel exports were around 77 million tons. Protectionist measures can either boost or limit market access.

Geopolitical Stability and International Relations

Geopolitical stability significantly affects Hunan Valin Steel, a key player in international trade. Tensions can disrupt supply chains, as seen with recent trade disputes. These disruptions can lead to increased costs and reduced market access. For instance, steel prices have fluctuated due to geopolitical events.

- China's steel exports in 2024 reached 76.5 million tons.

- Global steel demand is projected to grow, but unevenly.

Political Influence on Corporate Governance

Hunan Valin Steel's state ownership means political factors significantly shape its governance. This can influence strategic direction, potentially prioritizing national interests over pure profit. Management appointments might also be affected, impacting operational efficiency and responsiveness to market changes. For instance, in 2024, state-owned enterprises in China saw increased scrutiny on compliance and political alignment.

- Increased government oversight of SOEs in 2024.

- Potential for delayed decision-making due to political reviews.

- Risk of strategic shifts based on policy rather than market demands.

Political influences on Hunan Valin Steel are substantial due to its state-owned status. Government policies significantly shape its operational environment. Increased scrutiny of SOEs like Hunan Valin affects compliance. Strategic shifts may prioritize national interests over market demands.

| Factor | Impact | 2024 Data |

|---|---|---|

| State Ownership | Strategic Direction, Compliance | Increased SOE oversight |

| Policy Influence | Decision-making, Market Alignment | 76.5M tons Steel Export |

| Geopolitical Events | Supply Chain | Fluctuating Steel Prices |

Economic factors

Hunan Valin Steel's financial success hinges on steel market supply and demand. Demand is driven by construction, auto, and infrastructure projects. The industry's production capacity impacts pricing and supply. In 2024, China's steel output reached 1,019 million tons, reflecting global demand. Supply chain issues and economic shifts continue to influence these dynamics.

Hunan Valin Steel heavily relies on iron ore and coking coal, making it sensitive to global commodity price swings. In 2024, iron ore prices ranged from $100-$150/tonne, impacting production expenses. Coking coal prices also fluctuated, affecting profitability.

Hunan Valin Steel's performance is closely tied to China's and the global economy's health. Strong economic growth boosts construction, manufacturing, and infrastructure, increasing steel demand. In 2024, China's GDP growth is projected at around 5%, impacting steel consumption.

Currency Exchange Rates

Hunan Valin Steel's profitability is sensitive to currency exchange rates due to its global operations. A stronger RMB can make exports less competitive, impacting revenue from international sales. Conversely, a weaker RMB can increase the cost of imported iron ore and other raw materials. These fluctuations directly influence the company's financial performance and strategic decisions.

- In 2024, the RMB experienced volatility against major currencies.

- Changes in exchange rates can lead to significant gains or losses on foreign transactions.

- Hedging strategies are crucial to mitigate these currency risks.

- The company closely monitors global currency trends.

Access to Financing and Investment

Hunan Valin Steel's financial health heavily relies on its access to financing for critical projects. This encompasses upgrades, expansion, and environmental compliance initiatives. Economic stability and market liquidity dictate financing availability and costs, impacting project viability. In 2024, interest rates and credit conditions in China will significantly affect Hunan Valin's investment decisions. The company must navigate these financial landscapes carefully.

- China's 2024 steel demand is projected to be around 950 million tons.

- Hunan Valin's 2023 revenue was approximately $15 billion.

- The company's debt-to-equity ratio is a critical factor.

- Government policies on infrastructure projects influence financing.

Hunan Valin Steel faces economic influences like market demand and global commodity prices. Demand for steel is linked to China's GDP growth, projected at around 5% in 2024. Fluctuations in currency exchange rates, particularly the RMB, affect profitability through exports and raw material costs.

| Economic Factor | Impact | 2024/2025 Data |

|---|---|---|

| Steel Demand | Construction, auto, infra | China's steel output (2024): 1,019M tons, projected demand ~950M tons |

| Commodity Prices | Iron ore, coking coal costs | Iron ore: $100-$150/tonne (2024). |

| Currency Exchange | RMB impact on exports/imports | RMB volatility vs major currencies in 2024. |

Sociological factors

Hunan Valin Steel must navigate workforce dynamics. The availability of skilled labor and labor costs significantly affect production. In 2024, the steel industry saw labor costs rise by 5-7%. Positive labor relations are crucial for efficiency. A stable, skilled workforce ensures productivity and safety.

Hunan Valin Steel's operations affect local communities through jobs and infrastructure. Social responsibility initiatives are crucial for its reputation. In 2024, the company invested in community projects. These efforts aim to improve its standing, which impacts its operational "license" and public perception.

Ongoing urbanization and infrastructure development in China, a major market for Hunan Valin Steel, fuels steel demand. China's urban population reached 65.2% in 2024, continuing to grow. This trend directly boosts construction, increasing steel consumption. Infrastructure projects, like railways and bridges, further drive demand, shaping the company's business.

Public Perception and Brand Image

Public perception heavily influences Hunan Valin Steel's brand. Concerns about environmental impact and safety within the steel industry can tarnish its image. A positive public view boosts customer loyalty and attracts skilled workers. For example, in 2024, the steel industry faced increased scrutiny regarding carbon emissions, impacting brand reputation.

- Environmental concerns significantly affect brand perception.

- Positive perception enhances customer and talent attraction.

- Industry-wide scrutiny impacts individual company reputations.

- 2024 saw increased focus on sustainable practices.

Changing Consumer Preferences

Hunan Valin Steel, though B2B, faces impacts from consumer trends. Automotive and appliance industries drive steel demand. Consumers now want lighter, stronger, and eco-friendly materials. This affects the types of steel needed and company innovation. For example, demand for high-strength steel in automotive is growing.

- China's EV sales grew 36.7% YoY in 2024, impacting steel demand.

- Globally, sustainable materials are a $400B market and rising.

- Automotive steel demand is projected to reach $250B by 2025.

Labor relations and skilled workforce availability directly impact productivity for Hunan Valin Steel. The company's investments in local communities influence its reputation. Steel demand is fueled by Chinese urbanization and infrastructure growth, reflecting broader social changes.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Labor Costs | Influence on Production | Labor costs rose 5-7% in the steel industry (2024). |

| Community Impact | Shapes "license" to operate | Community investment projects increased by 8% (2024). |

| Urbanization | Steel Demand | China's urban population reached 65.2% (2024), rising further. |

Technological factors

Technological advancements, like AI and automated systems, are key for Hunan Valin Steel. These innovations boost productivity, cut costs, and boost product quality. In 2024, the global steel industry saw a 5% increase in tech adoption, with AI-driven quality control systems becoming standard. Investing in these technologies is critical for staying competitive.

Innovation in material science drives the creation of new steel types with improved characteristics. Hunan Valin Steel's capacity to produce these advanced materials can unlock new markets and applications. The company's focus on high-strength steel is crucial, given the rising demand in construction and automotive industries. In 2024, the global market for high-strength steel reached $50 billion, with a projected 7% annual growth through 2025.

Hunan Valin Steel can boost efficiency by adopting digitalization, big data, and smart manufacturing. These technologies can optimize production and quality control. This can lead to better predictive maintenance, reducing downtime. In 2024, the global smart manufacturing market was valued at $310 billion, expected to reach $630 billion by 2028.

Environmental Technologies

Hunan Valin Steel faces significant technological factors related to environmental technologies. The steel industry must adopt advanced emissions control, waste management, and energy efficiency solutions to comply with stringent environmental regulations. Recent data indicates that the steel industry globally invests heavily in these technologies, with investments projected to reach billions by 2025. Hunan Valin must invest in these areas to remain competitive and reduce its environmental impact. This strategic move is crucial for long-term sustainability and operational efficiency.

- Projected global investment in green steel technologies by 2025: $50 billion.

- Average reduction in carbon emissions through advanced steelmaking technologies: 15-20%.

- Hunan Valin's 2024 expenditure on environmental upgrades: $150 million.

Automation and Robotics

Automation and robotics are transforming steel production at Hunan Valin Steel. This shift enhances safety and cuts labor costs, streamlining operations. Precision and consistency are boosted in manufacturing processes, improving product quality. The global industrial robotics market is projected to reach $81.7 billion by 2025.

- Hunan Valin Steel has been investing in automated systems for quality control.

- Labor cost reduction is a key driver for automation adoption.

- Robotics improve the consistency of steel products.

Technological factors greatly influence Hunan Valin Steel's operations. AI, automation, and new materials drive efficiency and product quality. Investment in smart manufacturing and green technologies is vital for competitiveness and environmental compliance.

| Technology Area | Impact | Data Point (2024-2025) |

|---|---|---|

| AI & Automation | Boost Productivity & Reduce Costs | Global Robotics Market: $81.7B by 2025 |

| Material Science | Unlock New Markets | High-Strength Steel Market Growth: 7% annually |

| Digitalization | Optimize Production | Smart Manufacturing Market: $630B by 2028 |

Legal factors

Hunan Valin Steel faces stringent environmental regulations concerning emissions, water, and waste. Compliance necessitates substantial investments in pollution control. Stricter rules may boost operational costs. In 2024, environmental fines for steel companies averaged $2.5 million.

Hunan Valin Steel must adhere to China's labor laws. These laws dictate employment terms, worker safety, and labor relations, impacting HR and costs. Proper compliance is crucial to avoid legal issues. China's minimum wage increased in 2024, affecting operational expenses. Worker safety regulations necessitate investment in protective equipment and training.

Hunan Valin Steel's products, vital in sectors like automotive and construction, must strictly adhere to quality and safety standards. These standards are non-negotiable for customer trust and regulatory compliance. In 2024, the company invested heavily in quality control, allocating $50 million to ensure product integrity. This focus is essential for retaining market access and minimizing legal liabilities. By 2025, they aim for zero product recalls, which is an ambitious goal.

Trade Laws and Anti-dumping Measures

Hunan Valin Steel faces legal hurdles from international trade laws, particularly anti-dumping and countervailing duties. These measures can restrict its exports and lead to hefty financial penalties. For instance, in 2024, the EU imposed anti-dumping duties on certain steel imports. Such actions can significantly impact profitability and market access. Understanding these regulations is crucial for Valin's global strategy.

- Anti-dumping duties can range from 10% to over 50% depending on the product and country.

- Countervailing duties target subsidies, potentially increasing import costs.

- Compliance costs, including legal and administrative fees, can be substantial.

Corporate Governance Regulations

Hunan Valin Steel faces stringent corporate governance rules due to its public listing. These rules cover financial reporting, ensuring transparency, and protecting shareholder rights. Adherence to these regulations is crucial for maintaining investor trust and legal compliance. The company must navigate evolving standards to stay compliant. Recent data indicates a growing emphasis on ESG factors in corporate governance, influencing investor decisions.

- China's CSRC has increased scrutiny on financial reporting accuracy.

- Investor activism is on the rise, pushing for better governance.

- ESG compliance is becoming a key performance indicator.

- Failure to comply can result in penalties and loss of investor confidence.

Hunan Valin Steel must navigate China's complex legal landscape, including environmental regulations and labor laws, increasing operational costs. Strict quality and safety standards for steel products are crucial to maintain market access. International trade laws and corporate governance regulations present additional legal hurdles.

| Regulation Area | Impact on Hunan Valin | Financial Implication (2024/2025) |

|---|---|---|

| Environmental Compliance | Emission controls, waste management | Average fines of $2.5 million; investments in pollution control. |

| Labor Laws | Minimum wage, worker safety | Increased labor costs by 5%; Investments in protective equipment. |

| Product Standards | Quality control, safety checks | $50 million investment in quality control to achieve zero recall. |

| Trade Laws | Anti-dumping duties, import regulations | Anti-dumping duties ranging from 10% to 50% on exports. |

| Corporate Governance | Financial reporting, shareholder rights | Increased scrutiny from CSRC, push for ESG compliance. |

Environmental factors

The steel industry is a major carbon emitter, facing increasing pressure for decarbonization. Global and national climate policies are tightening, influencing operational strategies. Hunan Valin Steel must navigate these challenges, focusing on emission reduction. In 2024, China's steel sector accounted for roughly 15% of the country's total carbon emissions.

Steel production at Hunan Valin generates air pollutants and wastewater. They must control emissions to meet regulations, minimizing environmental impact. In 2024, China's steel industry aimed for significant emissions reductions, with specific targets for major producers like Hunan Valin. This included investments in advanced pollution control technologies to comply with stricter standards.

Hunan Valin Steel faces environmental scrutiny regarding raw material sourcing. Iron ore and coking coal availability and sustainability are key. The company must address the environmental impact of its sourcing practices. In 2024, global iron ore prices fluctuated, reflecting supply chain and environmental concerns. Recycling initiatives and resource efficiency are becoming increasingly important for steelmakers.

Waste Management and Recycling

Steel production at Hunan Valin Steel inevitably creates waste. Efficient waste management, encompassing recycling and responsible disposal, is crucial for environmental compliance. This approach helps conserve resources and minimizes pollution. Recent data from the China Iron and Steel Association shows a focus on reducing waste.

- China's steel industry aims for a 10% reduction in waste by 2025.

- Hunan Valin Steel invested $50 million in waste recycling facilities in 2024.

- Recycling steel scrap reduces energy consumption by 75%.

Energy Consumption and Efficiency

The steel industry's energy consumption is significant, with Hunan Valin Steel facing pressure to enhance energy efficiency. This is driven by both cost-saving and environmental goals. The company's operational costs and environmental footprint are directly affected by these factors. In 2024, China's steel sector aimed to reduce energy intensity by 2% annually. Hunan Valin Steel must adapt.

- China's steel production accounts for about 15% of the country's total energy consumption.

- Global steel industry accounts for approximately 7-9% of the world's CO2 emissions.

Environmental factors significantly influence Hunan Valin Steel, impacting its operational costs and strategies.

The company must address emissions and pollution to comply with regulations.

Sustainability in sourcing, waste management, and energy efficiency are key areas of focus for Hunan Valin Steel.

In 2024, the steel industry invested heavily in green technologies and aims to cut waste by 10% by 2025.

| Environmental Aspect | Impact on Hunan Valin Steel | 2024/2025 Data/Targets |

|---|---|---|

| Carbon Emissions | Compliance costs, reputation | China's steel sector: aiming for substantial emission cuts; Hunan Valin: focused on reduction targets |

| Pollution | Regulatory compliance, operational impact | Investments in advanced technologies, stricter environmental standards |

| Resource Management | Sourcing costs, sustainability | Fluctuating iron ore prices; focus on recycling and resource efficiency. $50M invested in 2024 on waste recycling facilities. |

| Energy Consumption | Operational costs, environmental footprint | Aiming to cut energy intensity by 2% annually. |

PESTLE Analysis Data Sources

The analysis uses data from China's National Bureau of Statistics, the Ministry of Ecology and Environment, and Hunan provincial government publications. It also incorporates industry reports from consulting firms.