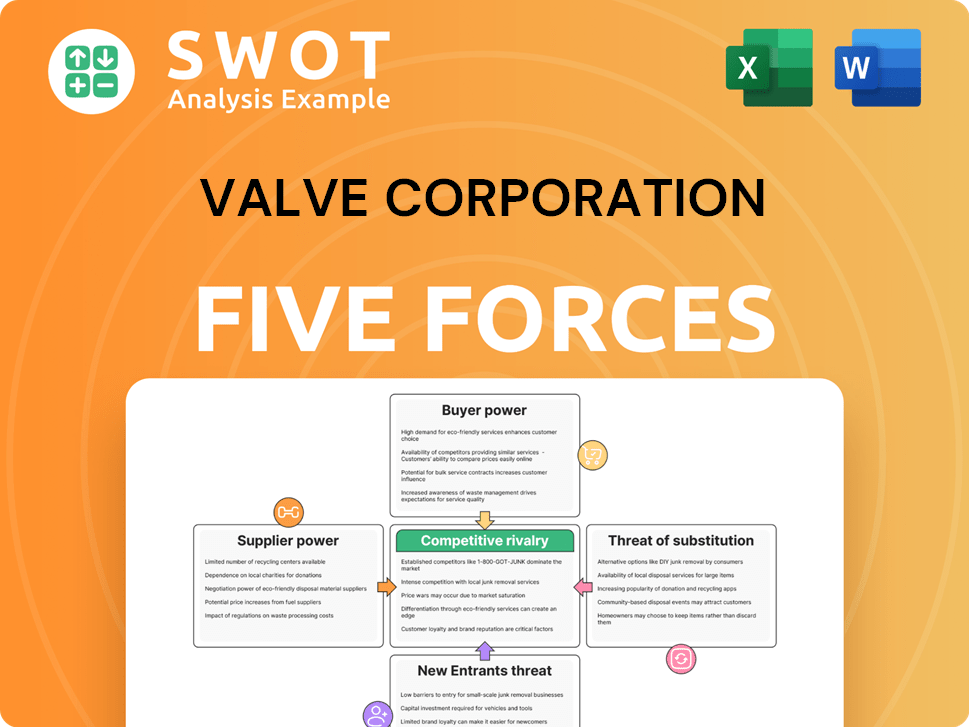

Valve Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Valve Corporation Bundle

What is included in the product

Identifies disruptive forces, emerging threats, and substitutes that challenge market share.

Instantly highlight potential threats and opportunities, saving you time on crucial strategic assessments.

Full Version Awaits

Valve Corporation Porter's Five Forces Analysis

You’re viewing the complete Valve Corporation Porter's Five Forces analysis. This preview reveals the final version, which you'll instantly receive after purchase. It comprehensively examines industry rivalry, supplier power, and buyer power. The analysis also considers the threats of new entrants and substitutes. This ready-to-use document is yours immediately upon buying.

Porter's Five Forces Analysis Template

Valve Corporation's success is shaped by complex market forces. Intense competition, especially from Epic Games Store, challenges its dominance. Buyer power, driven by consumer choice, also significantly impacts the company. Threats of new entrants and substitutes constantly reshape the gaming landscape. Supplier leverage, though present, is less of a direct threat. Understanding these forces is critical to navigating Valve's future.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Valve Corporation’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Valve's bargaining power of suppliers is generally limited. Steam, their primary platform, is digital, reducing dependence on physical component suppliers. They also own game IP, decreasing reliance on external content creators. However, Valve relies on hardware manufacturers for devices like the Steam Deck. In 2024, the digital games market reached $150 billion, highlighting Steam's strong position.

Game development heavily relies on software, with many developers using standardized engines like Unity and Unreal. This reduces the power of any single engine provider, as developers can switch easily. In 2024, Unity's market share was about 48%, and Unreal's was around 25%. Valve's Source engine also provides them control.

Valve faces strong supplier power regarding talent acquisition. The gaming industry's reliance on skilled developers fuels intense competition. Startups, backed by venture capital, offer enticing compensation packages. The average software developer salary in the US was around $120,000 in 2024. This impacts Valve's ability to secure talent.

Server Infrastructure

Valve's server infrastructure is crucial for Steam and online games. Although Valve might have its own infrastructure, it still needs data centers and bandwidth. Since these services are available from many providers, supplier power remains moderate. The global data center market was valued at $206.8 billion in 2023, with projections to reach $517.1 billion by 2030. This competitive landscape gives Valve some leverage.

- Market Size: The global data center market was valued at $206.8 billion in 2023.

- Growth: Projected to reach $517.1 billion by 2030.

- Competition: Many providers offer these services.

- Valve's Position: Moderate supplier power.

Partnerships with Developers

Valve's success hinges on its partnerships with game developers, both AAA and indie, to populate the Steam platform. Although Steam holds a dominant market share, estimated at around 75% of the PC gaming market in 2024, positive developer relationships are vital. This ensures a continuous flow of content, attracting both established and innovative games. Valve must offer significant value to developers to keep them using the platform.

- Steam's market share in the PC gaming market was approximately 75% in 2024.

- Valve needs to provide value to developers to ensure a steady stream of content.

- Positive relationships are essential for attracting new and innovative games.

Valve's supplier power is varied. They have low power over physical component suppliers due to digital distribution. However, they depend on hardware and talent, where competition is intense. The data center market's growth offers some leverage.

| Supplier Type | Power Level | Factors |

|---|---|---|

| Hardware | Moderate | Steam Deck, component costs |

| Talent | High | Developer salaries, competition |

| Data Centers | Moderate | Market size, multiple providers |

Customers Bargaining Power

Gamers wield substantial power due to abundant choices for game purchases. Platforms like Epic Games Store and console marketplaces provide competition. This competition intensifies customer influence, leading to pricing pressures. In 2024, digital game sales reached $70 billion globally, indicating strong customer leverage.

Video games are discretionary purchases, making consumers price-sensitive. Free-to-play games and subscription services increased price awareness. Consumers wait for sales or discounts. In 2024, the global video game market was valued at $184.4 billion, showing price sensitivity impacts spending habits.

Gamers now have unprecedented access to information. Online reviews, streaming platforms, and social media offer insights before purchase, reducing Valve's pricing power. In 2024, 75% of gamers consult reviews. Word-of-mouth through influencers on platforms like Twitch (averaging 2.5 million concurrent viewers) significantly affects game sales.

Demand for Quality and Innovation

Valve faces strong customer bargaining power due to gamers' high expectations for quality and innovation. Disappointing game releases can result in negative reviews and sales declines. To maintain customer loyalty, Valve must consistently deliver innovative, engaging gameplay experiences. Valve's ability to satisfy these demands directly impacts its market position and financial performance.

- In 2024, the gaming industry saw a 5% decrease in overall game sales due to increased consumer expectations.

- Negative reviews on platforms like Steam can significantly decrease a game's sales by up to 30%.

- Valve's revenue from Steam reached $9 billion in 2024, but depends on user satisfaction.

- The average user rating for games on Steam is 7.5 out of 10, a critical benchmark.

Platform Loyalty is Weak

The bargaining power of customers is notably high due to weak platform loyalty. Gamers readily switch platforms for exclusives, better prices, or desired features. This willingness to change platforms limits Valve's pricing power and forces it to remain competitive. Cross-platform gaming further enhances customer choice, with 95% of game development studios with more than 50 people working on cross-platform games.

- Platform loyalty is weak, increasing customer bargaining power.

- Gamers are willing to switch platforms for better deals.

- Cross-platform solutions are gaining traction, enhancing customer choice.

- Valve must compete on price and features.

Valve faces strong customer bargaining power, exacerbated by platform competition and price sensitivity. In 2024, global digital game sales were $70 billion, highlighting customer influence. Negative reviews impact sales; a 30% decline is possible.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Market Dynamics | Customer influence | Digital game sales: $70B |

| Price Sensitivity | Impact of reviews | Sales drop potential: 30% |

| Platform Loyalty | Cross-platform | 95% studios use cross-platform |

Rivalry Among Competitors

The video game industry is fiercely competitive. In 2024, Microsoft, Sony, Tencent, Activision Blizzard, and Epic Games are key rivals. These companies constantly innovate and release new titles. They compete for players and market share, driving rapid changes.

The gaming industry is seeing significant market consolidation. Large firms are purchasing smaller entities. This leads to stronger rivals with vast resources and diverse game offerings. Microsoft's acquisition of Activision Blizzard, valued at $68.7 billion in 2023, is a key example, increasing its market share.

Digital platforms and console makers fiercely compete through exclusive games to draw in and keep users. Epic Games Store has aggressively pursued timed exclusives, while PlayStation and Xbox depend heavily on their first-party studios for exclusive content. For example, in 2024, Sony's PlayStation 5 sold over 25 million units, significantly driven by exclusive titles. This strategy intensifies competition, impacting both developers and players.

Free-to-Play Dominance

The free-to-play (F2P) model dramatically reshapes competition in the gaming industry. Games like Fortnite and Genshin Impact exemplify this, driving innovation in game design and monetization. This intensifies rivalry, especially in mobile gaming, forcing companies to develop compelling, revenue-generating strategies. Valve's Steam faces increased pressure from platforms hosting F2P titles.

- Mobile gaming revenue is projected to reach $93.5 billion in 2024.

- Fortnite generated approximately $5.8 billion in revenue in 2023.

- Genshin Impact's lifetime revenue surpassed $4 billion by late 2023.

- The global games market is estimated at $184.4 billion in 2024.

Innovation in Game Design

Competition among game developers like Valve is intense, driving innovation in game design. The industry is a battlefield where creativity and technology meet, with companies constantly vying for player attention. This leads to rapid advancements, with technologies like ray tracing and AI becoming standard. The global video game market is projected to reach $282.8 billion in 2024.

- The video game industry's revenue is expected to hit $282.8 billion in 2024.

- Ray tracing and AI are key technologies.

- Companies are always looking for ways to make games more immersive.

- The competition pushes for constant improvements.

Valve Corporation faces fierce competition from major players like Microsoft and Sony in the gaming industry. Market consolidation, such as Microsoft's acquisition of Activision Blizzard, intensifies rivalry. The free-to-play model and exclusive titles also contribute to a highly competitive landscape.

| Aspect | Details | Data (2024) |

|---|---|---|

| Market Size | Global games market | $184.4 billion (est.) |

| Mobile Gaming | Projected revenue | $93.5 billion |

| Key Rivals | Major gaming companies | Microsoft, Sony, Tencent, Epic Games |

SSubstitutes Threaten

Valve Corporation faces competition from various entertainment avenues. Movies, TV, music, social media, and outdoor activities vie for consumer time and funds. In 2024, global entertainment and media revenue hit $2.6 trillion, highlighting the vastness of alternatives. This includes the $150 billion video game market, showcasing the need for Valve to stay competitive.

The rise of free-to-play (F2P) games presents a significant threat to Valve's paid games. These games, like "Fortnite" and "Genshin Impact," are easily accessible substitutes. In 2024, F2P games generated billions in revenue, showing their market dominance. This availability and engaging gameplay decrease the necessity to buy Valve's titles.

Mobile gaming presents a substantial threat to Valve. The mobile gaming market generated $90.7 billion in 2023, reflecting its immense popularity. Games like "Genshin Impact" and "Call of Duty: Mobile" compete directly with PC gaming. This accessibility and cost-effectiveness attract a broad audience, diverting potential PC gamers.

Cloud Gaming Services

Cloud gaming services pose a threat to Valve's PC gaming market share by offering an alternative way to play games. Services like NVIDIA GeForce Now and Xbox Cloud Gaming enable users to stream games on various devices, reducing the need for costly hardware like high-end PCs. This shift could impact Valve's Steam platform, where users traditionally purchase and download games to their own hardware. In 2024, the cloud gaming market is valued at $4.4 billion, with an expected compound annual growth rate (CAGR) of 32.3% from 2024 to 2030, indicating significant expansion.

- Market Growth: The cloud gaming market is experiencing rapid growth.

- Accessibility: Cloud gaming lowers the hardware barrier, increasing accessibility.

- Impact on Sales: Valve's game sales on Steam could be affected.

- Competitive Landscape: Valve faces competition from major tech companies.

Modding and User-Generated Content

Games with strong modding and user-generated content (UGC) pose a threat. These features provide players with fresh experiences, potentially reducing the need for new game purchases. This can extend the life of existing games and lessen the demand for alternatives, impacting Valve's revenue streams.

- User-generated content can significantly extend game lifespans.

- Modding communities often create content that rivals or surpasses official updates.

- The success of games like "Minecraft" and "Roblox" highlights the power of UGC.

- In 2024, the UGC market is estimated to be worth over $30 billion.

Valve Corporation faces numerous substitutes within the entertainment sector, notably from mobile and cloud gaming, which offer readily available alternatives. Free-to-play games also pose a considerable threat. These options compete for consumer spending and playtime.

| Substitute | Market Value (2024) | Impact on Valve |

|---|---|---|

| Mobile Gaming | $90.7B (2023) | High: Direct competition for player time and spending. |

| Cloud Gaming | $4.4B (2024) | Medium: Reduces need for hardware, impacting Steam. |

| Free-to-Play Games | Billions in Revenue (2024) | High: Offers accessible alternatives to paid games. |

Entrants Threaten

The threat of new entrants for Valve Corporation is moderate. Developing high-quality video games demands substantial capital, tech skills, and marketing efforts. Building a strong brand and player base is tough. In 2024, the global video game market was valued at over $200 billion. Indie game development and accessible engines have reduced entry barriers, though.

Steam Direct lowers barriers for game developers, boosting the number of new entrants. In 2024, thousands of games were released on Steam. This influx increases competition, making it harder for new games to gain visibility. The sheer volume challenges even established developers, not just new ones.

The indie game development scene poses a moderate threat to Valve. With engines like Unity and Unreal Engine, barriers to entry are low. Platforms like Kickstarter enable independent creators to fund projects. This increased competition could impact Valve's market share. In 2024, indie games generated $3.2 billion in revenue.

Cloud Gaming

Cloud gaming poses a moderate threat to Valve. New entrants can leverage cloud platforms, reducing the need for physical game distribution. This lowers the barrier to entry for developers. With cloud gaming, users can play high-end games on various devices, expanding the potential market.

- Cloud gaming market valued at $6.3 billion in 2023.

- Expected to reach $20 billion by 2027.

- Major players include Microsoft (xCloud), Sony (PlayStation Plus).

Mobile Gaming Market

The mobile gaming market presents a significant threat to Valve Corporation due to its lower barriers to entry compared to PC or console gaming. This allows new entrants to develop and distribute games rapidly and affordably. Mobile gaming's vast and diverse audience makes it the largest and fastest-growing segment of the video game market. This dynamic increases competition and puts pressure on established companies like Valve.

- Mobile gaming revenue reached $92.2 billion in 2023, a 2% increase year-over-year.

- The global mobile games market is projected to reach $116.3 billion by 2027.

- The number of mobile gamers worldwide is approximately 3.1 billion.

The threat of new entrants to Valve is moderate due to varying factors across different gaming sectors. Mobile gaming poses a significant threat, with revenues hitting $92.2 billion in 2023. Cloud gaming also presents a moderate challenge. The decreasing barriers to entry are driven by indie game development and cloud platforms, boosting competition.

| Market Segment | 2023 Revenue | Projected 2027 Revenue |

|---|---|---|

| Mobile Gaming | $92.2 billion | $116.3 billion |

| Cloud Gaming | $6.3 billion | $20 billion |

| Indie Games | $3.2 billion | N/A |

Porter's Five Forces Analysis Data Sources

The analysis leverages industry reports, financial statements, and market share data.