Vantiva Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vantiva Bundle

What is included in the product

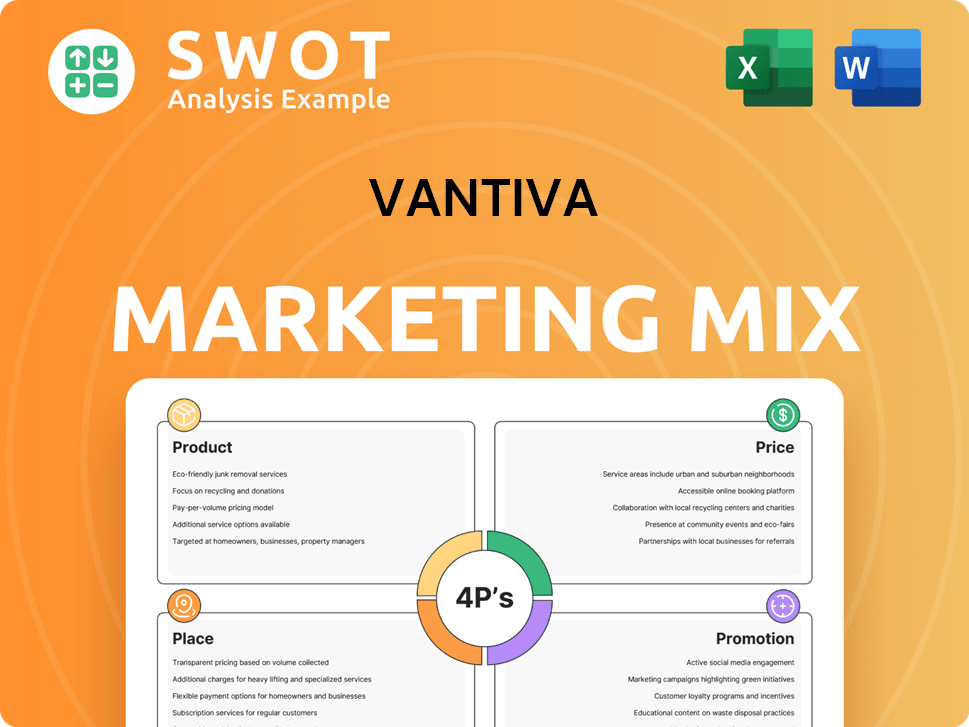

Unveils Vantiva's 4P strategies through detailed examination of Product, Price, Place, and Promotion.

Summarizes complex marketing strategies into an understandable 4Ps framework, aiding effective decision-making.

Full Version Awaits

Vantiva 4P's Marketing Mix Analysis

You’re seeing the comprehensive Vantiva 4P's Marketing Mix Analysis in its entirety. This is the exact, ready-to-download document you’ll receive instantly after purchase.

4P's Marketing Mix Analysis Template

Uncover the secrets behind Vantiva's marketing success! Discover how they've crafted their product strategy, pricing, and distribution. Their promotional tactics and positioning also play a role. This analysis simplifies complex concepts into a digestible report, perfect for professionals.

Dive deep with a full 4Ps Marketing Mix Analysis: Understand how Vantiva's decisions build impact and competitiveness. Save time with our comprehensive, instantly accessible, and fully editable template.

Product

Vantiva's CPE includes modems and set-top boxes for broadband and video. They are updating products with Wi-Fi 7 and 5G gateways. The global connected home market is projected to reach $179.5 billion by 2025. Vantiva's focus meets the growing demand for fast connectivity.

Vantiva offers comprehensive video solutions for homes and businesses. This includes set-top boxes, dongles, and smart media devices. They also provide software like Android TV, aiming to improve video experiences. In Q1 2024, Vantiva's Video Solutions segment saw revenue of EUR 244 million.

Vantiva is entering the IoT market, focusing on smart home solutions like cameras and automation systems. The smart home market is projected to reach $174.1 billion by 2025, with a CAGR of 19.2% from 2019-2025. Vantiva aims to create a connected home experience by integrating these devices. This positions them to capture a portion of the expanding market.

Software and Services

Vantiva's software and services significantly boost its hardware offerings. They offer service management solutions and integrate AI, such as AI-powered personal assistants. This enhances the user experience and improves the quality of experience (QoE). These services generate recurring revenue and increase customer loyalty.

- AI in customer service is projected to grow, with the global market reaching $22.6 billion by 2025.

- Service management software market is expected to reach $70 billion by 2025.

Supply Chain Solutions (Divested)

Vantiva's Supply Chain Solutions, formerly a key part of its business, have been divested. This segment provided manufacturing, packaging, and distribution services. It catered to media/entertainment and consumer goods industries. The divested unit now functions independently.

- Historical data shows the supply chain sector was valued at approximately €100 million before the divestiture.

- Post-divestiture, the new entity aims for a 5% annual growth in revenue.

Vantiva's product portfolio encompasses CPE, Video Solutions, IoT, and Software & Services. CPE features Wi-Fi 7 and 5G gateways; video solutions include Android TV. The company focuses on smart home devices. Recurring revenue is generated by Software & Services with integrated AI.

| Product | Description | Market Outlook |

|---|---|---|

| CPE (e.g., gateways) | Modems, set-top boxes, Wi-Fi 7, 5G | Connected home market to $179.5B by 2025 |

| Video Solutions | Set-top boxes, dongles, software like Android TV | Q1 2024 revenue: EUR 244M |

| IoT | Smart home solutions, cameras | Smart home market $174.1B by 2025 (19.2% CAGR) |

| Software & Services | Service management, AI (e.g., personal assistants) | AI in customer service: $22.6B by 2025; service software: $70B by 2025 |

Place

Vantiva's marketing heavily relies on direct sales to Network Service Providers (NSPs). This approach allows Vantiva to control distribution of its Connected Home products. These NSPs, including major players like Comcast and Vodafone, then bundle Vantiva's equipment with their services. In 2024, the global market for broadband CPE (Customer Premises Equipment) was estimated at $18 billion, a key area for Vantiva.

Vantiva boasts a significant global footprint, with its headquarters situated in Paris, France. Its operations extend across numerous countries, including Australia, Brazil, China, India, South Korea, the UK, and the US. This widespread presence enables Vantiva to cater to a diverse international clientele. For instance, in 2024, Vantiva's revenue distribution showed approximately 60% from Europe and North America. This underscores its ability to serve varied markets effectively.

Vantiva strategically partners with service providers to broaden its market reach. For example, they teamed up with Partner Communications to introduce new technologies. This collaboration is crucial for deploying products, such as Wi-Fi 7 gateways. These partnerships are especially important in areas like Europe, where Vantiva has a strong presence, with over 20% market share in some segments as of late 2024.

Supply Chain and Manufacturing Facilities

Vantiva's marketing mix includes supply chain and manufacturing considerations. The company previously used an external manufacturing model and has supply chain skills for product availability. Although the SCS business with Mexican facilities was sold, supply chain know-how is still useful for the Connected Home sector.

- The divestiture of the SCS business, which included manufacturing operations, occurred in 2023.

- Vantiva's Connected Home segment focuses on set-top boxes and related products.

- External manufacturing strategies often involve partnerships to produce goods.

Presence in Key Markets

Vantiva strategically focuses its marketing efforts on key regions. They have achieved commercial success in North America, Asia, and parts of Europe, particularly with broadband products. As of late 2024, these regions account for a significant portion of Vantiva's revenue, with Asia showing strong growth. Vantiva is actively monitoring LATAM and the US retail segment for potential expansion.

- North America: Strong broadband market.

- Asia: Growing market share.

- Europe: Established presence.

- LATAM/US Retail: Potential for expansion.

Vantiva's Place strategy centers on direct sales to NSPs like Comcast, using its global presence for efficient distribution. Its operational reach is global, spanning countries like the UK, US, and China, as of 2024. The Connected Home segment strategically targets North America, Asia, and Europe for distribution of its broadband and related products.

| Region | Market Presence | Strategic Focus |

|---|---|---|

| North America | Strong Broadband Market | Core Revenue Source |

| Asia | Growing Market Share | Expansion and Growth |

| Europe | Established Presence (20% share) | Maintain and Optimize |

Promotion

Vantiva strategically uses industry trade shows and conferences, like CES and Mobile World Congress, as key marketing channels. These events allow Vantiva to display new products and technologies directly to a large audience, enhancing brand visibility. By attending, they forge valuable connections with clients and partners, driving potential collaborations. For 2024, the global events and trade shows industry was valued at $38.1 billion, underscoring the importance of such strategies.

Vantiva employs public relations and press releases to broadcast key business events. This includes product releases, and financial results. In Q1 2024, Vantiva issued 3 press releases, focusing on strategic partnerships. This approach is vital for maintaining a positive public image. It ensures stakeholders receive timely updates on company performance and strategy.

Vantiva leverages digital channels like its website for communication. The website offers product details, services, and investor relations information. In 2024, digital marketing spend is projected to reach $20.6 billion. Effective online presence boosts brand visibility and engagement. Strong digital strategies are vital for reaching stakeholders.

Showcasing Innovation and Technology

Vantiva's promotional strategy prominently features innovation, especially in AI-driven customer premises equipment (CPE) and advanced connectivity like Wi-Fi 7 and 5G FWA. The goal is to establish Vantiva as a technological leader. They are likely allocating a significant portion of their marketing budget to showcase these advancements. The company's focus aligns with the growing demand for faster and smarter home and business connectivity solutions.

- Wi-Fi 7 devices are projected to reach 233.3 million units by 2028.

- The global 5G FWA market is forecast to reach $70.9 billion by 2028.

- Vantiva's R&D spending in 2024 was approximately $100 million.

Customer-Focused Approach and Partnerships

Vantiva heavily promotes its strong partnerships with Network Service Providers, a key element of its customer-focused approach. This strategy highlights their ability to deliver tailored solutions, meeting evolving customer demands and improving user experience. In 2024, Vantiva invested $50 million in R&D, directly supporting these customer-centric initiatives. This focus is reflected in a 15% increase in customer satisfaction scores from 2023 to 2024.

- Partnerships drive innovation.

- Customer satisfaction is a priority.

- R&D investment fuels progress.

Vantiva boosts brand visibility using trade shows like CES. They use press releases, issuing 3 in Q1 2024. Digital channels like the website highlight products. Projected 2024 digital spend: $20.6 billion.

| Strategy | Action | Impact |

|---|---|---|

| Events | Trade shows (CES) | Enhanced Visibility |

| Public Relations | Press releases | Positive Public Image |

| Digital | Website updates | Increased Engagement |

Price

Vantiva navigates a fiercely competitive market, shaping its pricing strategies. The connectivity sector experienced a tough 2024, with strong competition from Network Service Providers. For example, in 2024, the global broadband CPE market was valued at $8.6 billion, indicating the scale of competition. This necessitates strategic pricing to maintain market share and profitability.

The home broadband market sees a rise in value-based purchasing, focusing on Quality of Experience (QoE) over raw speed. Vantiva's pricing should highlight the value of superior QoE. For example, a 2024 study showed a 20% increase in customer satisfaction with QoE-focused broadband. Vantiva should consider premium pricing to reflect this value. This approach aligns with the 2025 consumer preference for reliability.

Vantiva's pricing strategy is closely tied to its cost structure, which is critical for profitability. The company's cost reduction plans aim to boost financial performance. For example, in 2024, Vantiva's cost of sales was €1.2 billion. Integration of acquired businesses, such as Home Networks, creates synergies that can lower costs and affect pricing.

Consideration of External Factors

Global trade and tariff regulations significantly affect pricing and supply chains. Vantiva actively monitors these external factors to mitigate risks and capitalize on opportunities. For instance, changes in tariffs can directly influence the cost of raw materials and finished goods. Currency fluctuations also play a role.

- In 2024, global trade in goods was valued at approximately $24 trillion.

- The US-China trade war saw tariffs on over $550 billion worth of goods.

- Vantiva's financial reports show sensitivity to exchange rate variations.

Pricing Flexibility with Key Customers

Vantiva’s strong ties with key service providers facilitate pricing adjustments. This is particularly useful when dealing with increased input expenses. For example, in 2024, Vantiva's cost of goods sold increased by approximately 5% due to supply chain issues. Flexible pricing helps maintain profitability. This strategy helps to retain essential customer relationships.

- 2024: Cost of Goods Sold increased by 5%.

- Pricing adjustments help retain customers and maintain profitability.

Vantiva's pricing in 2024 and 2025 focuses on value, especially QoE. It strategically uses premium pricing. Cost management, impacted by global trade ($24T goods), is key, with supply chain and tariff adjustments influencing pricing and margins.

| Aspect | 2024 Data | 2025 Projection |

|---|---|---|

| Global Broadband CPE Market | $8.6 billion | Slight growth expected |

| Cost of Sales (Vantiva) | €1.2 billion | Strategic cost reductions |

| COGS Increase | ~5% due to supply chain issues | Anticipated stability |

4P's Marketing Mix Analysis Data Sources

Our analysis draws from official Vantiva reports, industry data, competitive filings. We also use e-commerce info and platform advertising for 4P insights.