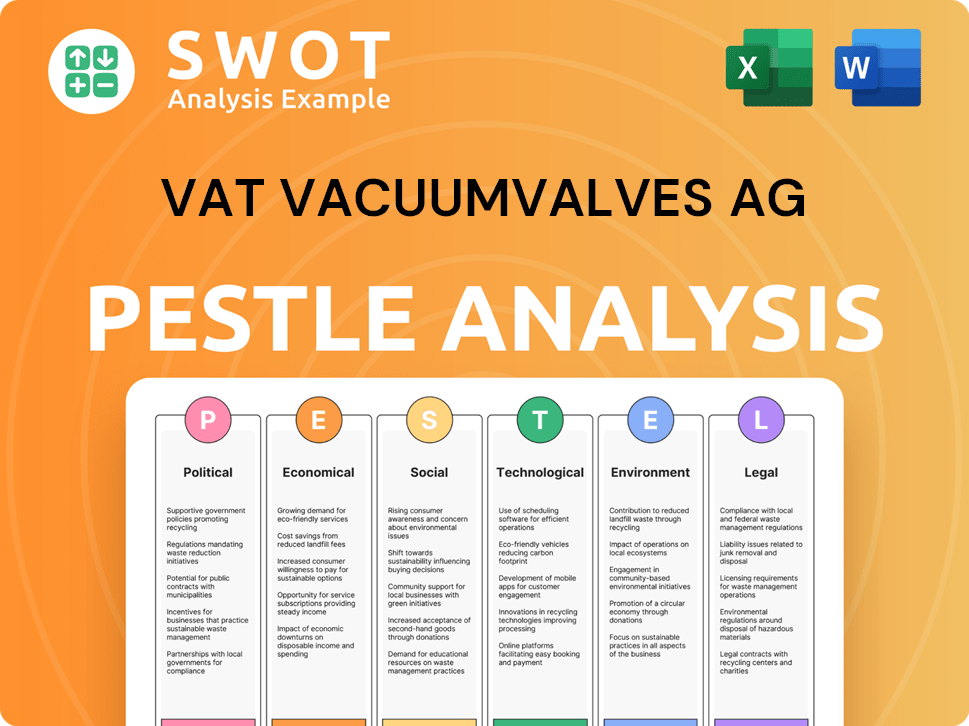

VAT Vacuumvalves AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VAT Vacuumvalves AG Bundle

What is included in the product

Unpacks how external factors impact VAT Vacuumvalves AG, covering Political, Economic, Social, etc.

Easily shareable for quick alignment across teams.

Same Document Delivered

VAT Vacuumvalves AG PESTLE Analysis

The preview provides an authentic look at the VAT Vacuumvalves AG PESTLE Analysis. This comprehensive document's layout and insights are exactly what you’ll receive. You'll find the same analysis, professionally structured, once purchased. No content variations will exist after payment. The file is instantly downloadable after you buy.

PESTLE Analysis Template

Unlock strategic advantage with our VAT Vacuumvalves AG PESTLE Analysis. Explore the complex external factors impacting their operations. Understand market shifts, regulatory pressures, and tech advancements. Gain critical insights for informed decision-making. Buy the full PESTLE analysis to elevate your strategic planning instantly!

Political factors

Geopolitical factors are crucial for VAT Vacuumvalves AG. Global tensions and trade policies, like tech transfer restrictions, affect the semiconductor market. Export controls and tariffs can impact demand for vacuum valves. For example, the U.S.-China trade war has influenced chip manufacturing. In 2024, global semiconductor sales reached $526.8 billion.

Government incentives boost domestic semiconductor manufacturing. The U.S. CHIPS Act, for example, allocated $52.7 billion. This spurs fab construction and upgrades. Increased fabs mean higher demand for VAT's vacuum valves. Expect continued growth due to these political drivers.

Political stability significantly impacts VAT Vacuumvalves AG's operations. Countries like Switzerland, Germany, and the US, where VAT has facilities, offer relative stability. Political instability could disrupt supply chains, increasing operational costs. For instance, a 2024 report noted a 5% rise in logistics costs due to geopolitical tensions.

International Trade Agreements and Regulations

International trade agreements and regulations significantly impact VAT Vacuumvalves AG's operations. Changes in tariffs and trade barriers directly affect import costs and export revenues. Maintaining compliance with evolving international trade laws is crucial for efficient global logistics. Specifically, the EU-Vietnam Free Trade Agreement, effective since 2020, has already reduced tariffs, potentially benefiting VAT's supply chain.

- Tariff reductions can boost profitability on exported goods.

- Trade barriers can disrupt supply chains and increase costs.

- Compliance with regulations is vital to avoid penalties.

Political Focus on Renewable Energy

Government policies are significantly impacting VAT's prospects. Renewable energy initiatives, particularly in solar power, are crucial. Increased solar deployment targets drive demand for VAT's vacuum valves. For instance, the global solar PV capacity is projected to reach 600 GW by the end of 2024, and 1 TW by the end of 2025, creating opportunities.

- Solar PV capacity is expected to grow significantly.

- Incentives for renewable energy boost VAT's market.

- Demand for vacuum valves rises with solar expansion.

Political factors strongly influence VAT Vacuumvalves AG. Government incentives like the U.S. CHIPS Act support domestic manufacturing, which boosts demand. Trade agreements, such as the EU-Vietnam FTA, and tariffs significantly impact supply chains and profitability. Renewable energy policies also drive the company's growth.

| Factor | Impact | Data |

|---|---|---|

| Trade Policies | Affects import/export costs | Semiconductor sales: $526.8B (2024) |

| Government Incentives | Boosts market growth | US CHIPS Act: $52.7B allocated |

| Renewable Energy Policies | Increases valve demand | 600 GW Solar PV (end 2024) |

Economic factors

Global economic growth and industrial investment are crucial for VAT Vacuumvalves AG. Semiconductor manufacturing, a key sector, drives demand for VAT's products. In 2024, global GDP growth was around 3.1%, influencing capital expenditure. Any economic slowdown could decrease customer spending. Specifically, the semiconductor industry saw a 13.7% revenue increase in 2024.

As VAT Vacuumvalves AG operates globally, currency exchange rate shifts, especially the Swiss franc's value versus the USD, significantly impact financial outcomes. For instance, a stronger Swiss franc can increase the cost of exports. In 2024, the USD/CHF exchange rate has fluctuated, affecting reported revenues. Understanding these currency dynamics is crucial for financial planning and risk management.

Rising inflation presents challenges for VAT Vacuumvalves AG, potentially increasing operational expenses like raw materials and labor costs. For instance, the Eurozone's inflation rate was at 2.6% in March 2024. Changes in interest rates significantly impact investment decisions for both VAT's customers and the company's financing costs. The European Central Bank (ECB) held its main refinancing operations rate at 4.50% as of April 2024.

Supply Chain Costs and Disruptions

Fluctuations in raw material costs and supply chain disruptions can significantly impact VAT's production costs and delivery timelines. The Baltic Dry Index, a key indicator of shipping costs, showed volatility in 2024, reflecting ongoing supply chain pressures. VAT can use best-cost country sourcing to mitigate these risks. This approach involves strategically procuring materials from regions offering the most favorable cost structures.

- The Baltic Dry Index saw fluctuations in 2024, indicating supply chain volatility.

- Best-cost country sourcing can help reduce production costs.

Investment Cycles in Key End Markets

VAT Vacuumvalves AG's performance is significantly influenced by investment cycles in the semiconductor, display, and solar sectors. These industries' capital expenditures directly impact demand for VAT's vacuum valves. A downturn in these markets can lead to reduced orders, while expansions fuel growth. For example, the semiconductor industry is projected to grow, with global semiconductor sales reaching $611 billion in 2024 and potentially $692 billion in 2025.

- Semiconductor sales grew by 13.7% in 2023, with further growth expected in 2024 and 2025.

- Display market growth is driven by consumer electronics, with demand varying based on product cycles.

- Solar industry investments are influenced by government incentives and renewable energy trends.

Economic conditions substantially influence VAT. Global GDP growth around 3.1% in 2024 impacts spending and investments. Currency exchange rates, such as USD/CHF fluctuations, also affect revenues. Semiconductor industry sales hit $611B in 2024, rising to $692B in 2025.

| Economic Factor | Impact on VAT | 2024 Data | 2025 Forecast |

|---|---|---|---|

| GDP Growth | Affects investment | ~3.1% Global Growth | Ongoing Growth |

| Exchange Rates | Impacts Revenues | USD/CHF Fluctuations | Uncertain |

| Semiconductor Sales | Drives Demand | $611B | $692B |

Sociological factors

VAT Vacuumvalves AG relies heavily on skilled labor for manufacturing and services. Demographic shifts and educational attainment in key regions impact the talent pool. In Switzerland, where VAT has significant operations, the unemployment rate was around 2.4% in early 2024, indicating a tight labor market. Investment in vocational training programs will be crucial for VAT to maintain a competitive edge in attracting and retaining skilled workers in 2025 and beyond.

Positive labor relations and high employee engagement are critical for VAT Vacuumvalves AG's productivity. Employee satisfaction, workplace safety, and fair labor practices directly affect operational efficiency. In 2024, companies with highly engaged employees showed 21% greater profitability. A focus on these factors can lead to reduced turnover and enhanced innovation. Data from 2024 shows that companies with strong labor relations experience 15% fewer workplace accidents.

Customer preferences are shifting, with increased demand for advanced vacuum valves. Industry standards emphasize improved performance and durability. VAT must adapt its designs to meet evolving needs. Market research in 2024 showed a 15% rise in demand for high-precision valves.

Public Perception and Corporate Social Responsibility

Public perception is critical; corporate social responsibility (CSR) is under scrutiny. VAT's reputation hinges on ethical conduct and community engagement. A 2024 study found 77% of consumers favor brands with strong CSR. VAT's stakeholders, from employees to customers, prioritize ethical practices. Failure to meet these expectations could damage VAT's brand and market position.

- Increased consumer demand for ethical products.

- Employee expectations for fair labor practices.

- Community pressure for environmental sustainability.

- Investor interest in ESG (Environmental, Social, and Governance) performance.

Demand for Consumer Electronics and Digitalization

The rising global demand for consumer electronics, significantly influenced by digitalization, the Internet of Things (IoT), and artificial intelligence (AI), directly stimulates the need for semiconductors and displays. This, in turn, escalates the demand for VAT's products. The consumer electronics market is projected to reach $2.4 trillion by 2025, with a growth rate of 5.5% annually. This growth is fueled by increased adoption of smart devices and the expansion of digital infrastructure globally.

- Global consumer electronics market expected to reach $2.4T by 2025.

- Annual growth rate of 5.5% drives demand.

VAT faces demographic impacts in key regions. Switzerland’s tight labor market, with about 2.4% unemployment in early 2024, stresses talent needs. Customer preferences shift, with a 15% rise in 2024 demand for high-precision valves.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Employee Engagement | Greater profitability | 21% higher for engaged companies |

| Labor Relations | Fewer workplace accidents | 15% reduction in companies with strong relations |

| Consumer Electronics Market | Demand Driver | Projected to reach $2.4T by 2025, 5.5% annual growth |

Technological factors

Advancements in semiconductor manufacturing, like smaller node sizes, demand sophisticated vacuum valve tech. VAT must innovate to stay competitive. The semiconductor market is projected to reach $1 trillion by 2030. VAT's revenue in 2024 was CHF 1.07 billion, showing its market relevance.

Innovations in display technology, such as LCD, LED, and OLED, directly affect the vacuum valves market. For example, the global OLED market is projected to reach $64.3 billion by 2025, driving demand for specialized manufacturing equipment. In 2024, the LCD market was valued at around $130 billion, also requiring vacuum valves. The continuous advancement in display technologies necessitates high-precision vacuum valves.

Technological advancements in solar cell manufacturing, like the move towards perovskite cells, directly influence vacuum technology needs. Efficiency gains and cost reductions in solar panel production, such as those seen with advanced deposition techniques, drive investment. The global solar PV market, valued at $187.49 billion in 2024, is projected to reach $338.79 billion by 2029. These changes can significantly affect demand for vacuum equipment. The growth rate is 12.66% (2024-2029).

Automation and Digitalization in Manufacturing

Automation and digitalization are transforming manufacturing. VAT and its customers are increasingly adopting these technologies. This shift impacts production efficiency and quality control. It also boosts the demand for smart vacuum solutions. The global industrial automation market is projected to reach $370.3 billion by 2029, growing at a CAGR of 8.4% from 2022.

- Increased automation can reduce labor costs by up to 30%.

- Digitalization enhances real-time data analysis, optimizing processes.

- Smart vacuum solutions are essential for advanced manufacturing.

- The adoption rate of automation is accelerating across industries.

Research and Development Capabilities

VAT Vacuumvalves AG's R&D is critical for innovation. Their investment fuels new vacuum valve tech, catering to the high-tech sector's needs. In 2024, VAT's R&D spending was approximately CHF 75 million, reflecting a commitment to stay at the forefront. This investment helps them maintain a competitive edge in the market.

- R&D spending in 2024: approximately CHF 75 million.

- Focus: developing new and improved vacuum valve technologies.

Technological shifts, like automation, drive demand for advanced vacuum solutions, crucial for efficiency. VAT's R&D, with ~CHF 75M in 2024, is key. Semiconductor, display, and solar markets' growth fuels valve needs.

| Market | 2024 Value | Projected Growth by 2029 |

|---|---|---|

| Semiconductor | N/A | $1T by 2030 |

| OLED | N/A | $64.3B by 2025 |

| Solar PV | $187.49B | $338.79B, CAGR 12.66% (2024-2029) |

Legal factors

VAT faces intricate international trade regulations. These include export controls, sanctions, and customs laws. Such rules vary by country, impacting global operations. For example, in 2024, the EU updated its sanctions, affecting trade with Russia. Non-compliance can lead to hefty fines and operational disruptions.

VAT Vacuumvalves AG must comply with stringent product safety and quality standards. Failure to comply can result in product recalls and legal liabilities. In 2024, the semiconductor industry faced $1.2 billion in recall-related costs. Maintaining high standards protects the company's reputation.

VAT Vacuumvalves AG must adhere to environmental regulations. These cover manufacturing, waste, and emissions. Compliance impacts production and costs. In 2024, environmental fines for non-compliance in similar industries averaged $50,000-$200,000. Stricter EU regulations, effective January 2025, mandate specific emission controls, potentially increasing operational expenses by 10-15%.

Labor Laws and Employment Regulations

VAT Vacuumvalves AG must navigate complex labor laws and employment regulations. This includes adhering to local rules on working hours, ensuring fair wages, and respecting employee rights. For example, the European Union's Working Time Directive sets out maximum weekly working hours. Non-compliance can lead to hefty fines and legal challenges.

- EU Working Time Directive: Sets maximum weekly working hours.

- Wage compliance: Ensuring fair wages and benefits.

- Employee rights: Respecting employee rights in all operations.

Intellectual Property Protection

VAT Vacuumvalves AG must aggressively protect its intellectual property. This involves securing patents and utilizing other legal tools to safeguard its innovative vacuum valve technologies. Effective IP protection is vital for sustaining VAT's market leadership and competitive edge. In 2024, the company invested approximately CHF 40 million in research and development, a key area for generating intellectual property.

- Patents filed: VAT has a portfolio of over 2,000 patents worldwide.

- R&D investment: CHF 40 million in 2024.

- Legal costs: Significant ongoing costs for IP enforcement.

VAT must manage trade regulations, facing sanctions and customs laws which vary globally. Stringent product safety and quality standards are essential, with the semiconductor industry seeing significant recall costs. Environmental compliance is crucial, including emission controls with potentially increased operational costs in 2025.

Labor laws, employment regulations like working hours and fair wages, are critical for compliance, with potential for hefty fines. VAT aggressively protects its intellectual property through patents, investing in R&D and incurring legal costs to maintain a competitive advantage. VAT has over 2,000 patents filed, investing CHF 40 million in R&D in 2024.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Trade Regulations | Export controls, sanctions | EU sanctions updates, impacting trade |

| Product Safety | Product recalls, liabilities | Semiconductor recall costs of $1.2 billion |

| Environmental | Manufacturing, emissions | EU regulations, affecting operational costs, average fines of $50,000-$200,000 |

Environmental factors

Manufacturing vacuum valves demands significant energy. VAT could face rising energy costs and must consider energy efficiency. In 2024, the industrial sector accounted for roughly 33% of global energy consumption. Improving efficiency is crucial for operational costs. Energy-efficient product demand is growing.

VAT Vacuumvalves AG must prioritize responsible waste management. In 2024, the global waste management market was valued at $2.1 trillion. Recycling initiatives can reduce waste and operational costs. The adoption of sustainable practices enhances brand reputation.

Growing global emphasis on curbing carbon emissions and combating climate change is driving stricter environmental regulations. VAT Vacuumvalves AG, like many companies, faces increasing pressure to adopt sustainable practices. In 2023, global CO2 emissions reached approximately 37.4 billion metric tons. VAT has established targets to decrease greenhouse gas emissions, aligning with industry trends toward eco-friendly manufacturing.

Resource Scarcity and Raw Material Sourcing

Resource scarcity and raw material sourcing are environmental concerns for VAT Vacuumvalves AG. The availability of materials like specialty alloys and rare earth elements used in valve production is crucial. The environmental impact of sourcing these materials, including pollution and deforestation, can disrupt supply chains. These challenges can affect production costs and potentially limit VAT's growth. In 2024, the price of rare earth elements increased by 15% due to environmental regulations and geopolitical tensions.

- Supply chain disruptions can raise production costs.

- Environmental regulations affect material sourcing.

- Geopolitical factors influence material availability.

- Price volatility of raw materials is a key risk.

Customer Demand for Sustainable Products

Customer demand for sustainable products is rising, impacting VAT's product development and manufacturing. Consumers increasingly favor eco-friendly options, influencing purchasing decisions. VAT must adapt to meet these preferences to stay competitive. Addressing sustainability can enhance brand image and attract environmentally conscious customers.

- The global green technology and sustainability market is projected to reach $74.6 billion by 2024.

- 60% of consumers are willing to pay more for sustainable products.

- Companies with strong ESG performance often experience higher valuations.

VAT must manage energy use due to rising costs. The industrial sector consumed 33% of global energy in 2024. Recycling can reduce waste, supporting sustainability. The waste management market was valued at $2.1T.

| Environmental Factor | Impact on VAT Vacuumvalves AG | Data & Insights (2024/2025) |

|---|---|---|

| Energy Consumption | Increased costs, need for efficiency | Industrial sector's energy use: ~33% of global total. Demand for energy-efficient products grows. |

| Waste Management | Operational costs, brand reputation | Global waste management market: $2.1T. Recycling initiatives improve cost savings. |

| Environmental Regulations | Compliance, emission targets, costs | CO2 emissions in 2023: ~37.4 billion metric tons. Increasing adoption of sustainable practices is essential. |

PESTLE Analysis Data Sources

The VAT Vacuumvalves AG PESTLE draws from industry reports, financial databases, government regulations, and technological advancements for accurate assessments.