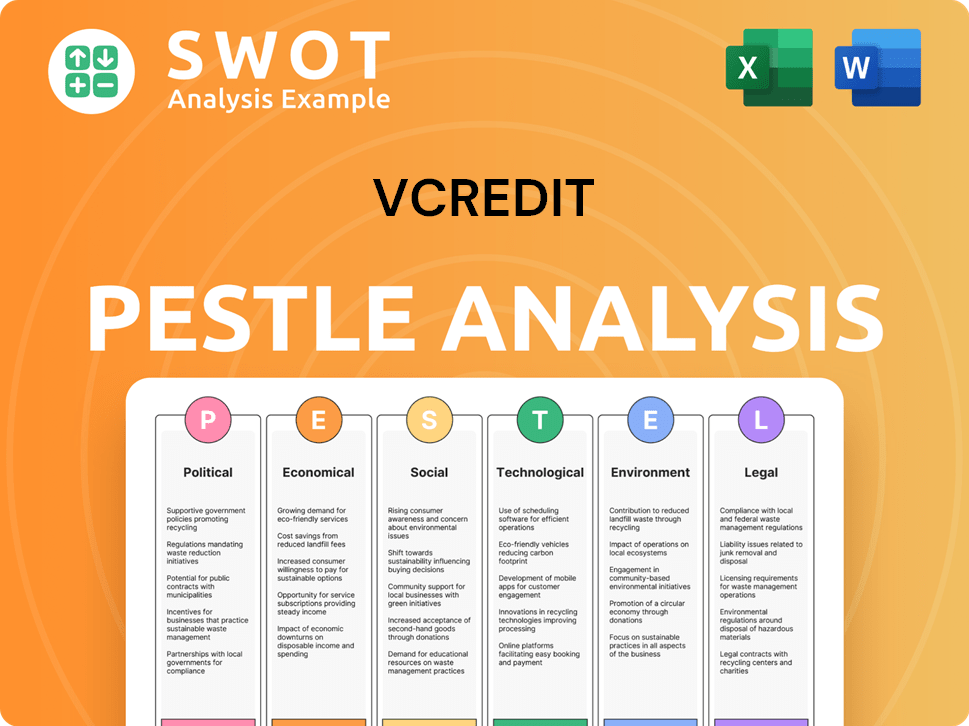

VCREDIT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VCREDIT Bundle

What is included in the product

A detailed examination of VCREDIT, assessing external factors: Political, Economic, Social, Tech, Environmental, Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

VCREDIT PESTLE Analysis

What you’re previewing is the actual VCREDIT PESTLE analysis—the exact document you’ll get after purchase.

PESTLE Analysis Template

Navigate VCREDIT's market with our detailed PESTLE analysis. Explore the political, economic, social, technological, legal, and environmental factors impacting the company. This essential tool provides critical insights for strategic planning and risk assessment. Gain a competitive edge and make informed decisions by understanding VCREDIT's external environment. The full PESTLE analysis offers actionable intelligence—download it now and start strategizing.

Political factors

China's fintech regulations are always changing. VCREDIT must follow new rules. This impacts how it works, gets funds, and sets prices. In 2024, the government increased oversight of online lending. This affected VCREDIT's ability to offer certain products.

VCREDIT's operations are sensitive to political stability. China's political climate directly impacts its business landscape. Any shifts in government policies could alter regulations. Political stability is vital, with instability possibly disrupting operations. For example, in 2024, China's GDP growth was around 5.2% showing a stable environment.

The Chinese government actively backs fintech, focusing on digital financial inclusion. This backing often involves policies that promote tech and financial service expansion, potentially aiding VCREDIT. For example, in 2024, the government increased fintech investment by 15%. This support can boost VCREDIT's growth. Regulatory changes favor fintech, creating opportunities.

International Relations

International relations play a crucial role. Geopolitical tensions and trade issues can indirectly affect VCREDIT, impacting the economic climate. Changes in global relations may influence cross-border collaborations and funding. For example, in 2024, trade disputes reduced global GDP growth by 0.5%. These factors can alter investor confidence.

- Global trade volume growth is projected at 3.3% in 2024, according to the WTO.

- Geopolitical risks have increased the volatility in the financial markets by 15% in 2024.

Consumer Protection Focus

Consumer protection is increasingly crucial in fintech. Political actions and regulatory shifts prioritize consumer rights and data security, pushing VCREDIT to refine its compliance and operations. The Consumer Financial Protection Bureau (CFPB) has been very active. They issued 35 enforcement actions in 2024, totaling $1.2 billion in penalties. VCREDIT must adapt.

- 2024 CFPB enforcement actions: 35

- Total penalties in 2024: $1.2 billion

China's fintech rules are constantly evolving, affecting VCREDIT's operations. Political stability and government policies are key for VCREDIT, with a GDP growth of around 5.2% in 2024. Consumer protection and international relations add complexity.

| Political Factor | Impact on VCREDIT | 2024 Data |

|---|---|---|

| Regulations | Compliance costs & operational adjustments | Increased oversight of online lending in China |

| Stability | Operational continuity & investor confidence | China's GDP growth at 5.2% |

| Consumer Protection | Enhanced compliance & data security | CFPB issued 35 enforcement actions |

Economic factors

The Chinese economy's strength is crucial for VCREDIT. GDP growth, inflation, and consumer spending affect demand for its financial products. In 2024, China's GDP growth is projected around 5%. High inflation and slow spending can hurt VCREDIT. A weak economy increases credit risk.

Interest rate shifts and monetary policy, dictated by central banks, directly impact VCREDIT's funding costs and loan appeal. For example, the Federal Reserve held rates steady in May 2024, influencing borrowing and lending dynamics. A 2024 study showed a 1% rate change can shift lending volumes by 5-10%, affecting profitability. These fluctuations influence both borrowing and lending activities.

Consumer spending and credit demand significantly influence VCREDIT's loan origination. Robust consumer spending, like the 2.7% rise in U.S. consumer spending in Q4 2023, boosts borrowing. Conversely, decreased demand, as seen in some regions, can slow origination. Data from early 2024 shows varied credit demand, impacting VCREDIT's growth trajectory.

Funding Costs and Availability

VCREDIT's operations hinge on securing funding from diverse partners like banks and consumer finance companies. The cost of this funding is significantly affected by prevailing economic conditions. For example, in 2024, rising interest rates could increase VCREDIT's borrowing costs, squeezing profits. Access to funding is also crucial; a credit crunch could severely limit VCREDIT's ability to lend.

- Interest rate hikes in 2024/2025 could raise VCREDIT's borrowing expenses.

- Economic downturns may reduce the availability of funds from lending partners.

- Liquidity in financial markets directly affects VCREDIT's profitability.

Competition in the Fintech Market

The fintech market in China is intensely competitive. Numerous companies offer similar services, driving down prices and increasing the need for innovation. Economic factors like growth rates and consumer spending significantly affect competition. The sector's dynamism forces companies to constantly adapt. This is a market that is constantly evolving.

- The Chinese fintech market is projected to reach $8.8 trillion by 2025.

- Over 10,000 fintech companies are registered in China.

- Mobile payment transactions in China reached $89.5 trillion in 2023.

China's economic state deeply influences VCREDIT. Projected GDP growth near 5% in 2024 shapes the company's financial products. Inflation and consumer spending also heavily impact loan demand and origination volume.

| Economic Factor | Impact on VCREDIT | 2024/2025 Data |

|---|---|---|

| GDP Growth | Affects demand for financial products | China's 2024 GDP growth: ~5% |

| Inflation | Influences consumer spending and loan repayment | China's inflation rate (May 2024): 0.3% |

| Consumer Spending | Impacts loan origination volumes | US consumer spending (Q4 2023): +2.7% |

Sociological factors

Digital payment adoption is surging, especially among young tech users. In 2024, mobile payment users hit 1.4 billion globally. This boosts demand for user-friendly financial tools, shaping VCREDIT's offerings and how it attracts customers. Online and mobile financial solutions are becoming key.

VCREDIT targets underserved borrowers in China, aligning with financial inclusion goals. In 2024, approximately 22% of Chinese adults lacked access to formal banking services. This impacts product development, focusing on consumers, sole proprietors, and SMEs.

Public trust is vital for fintech. Data breaches and lending concerns can hurt customer growth. In 2024, cybersecurity incidents cost businesses globally $5.2 trillion. VCREDIT must protect data to keep users.

Demographic Trends

Demographic shifts significantly impact VCREDIT's market. Urbanization, with 56.2% of the global population residing in urban areas as of 2024, drives demand for accessible financial services. Understanding age distribution is crucial; in 2023, the median age in the US was 38.9 years. Income levels also matter; the US median household income in 2023 was $74,580. VCREDIT must adapt to these changes to thrive.

- Urbanization: Over half of the world's population lives in cities, increasing demand for financial services.

- Age Distribution: Understanding the age demographics is key to tailor products.

- Income Levels: Median household income impacts affordability and product design.

Social Responsibility and Ethical Practices

VCREDIT's reputation hinges on its social responsibility and ethical conduct, which are increasingly important to customers and investors. In 2024, 86% of consumers said they'd switch brands for one with better ethical standards. This includes preventing fraud and supporting social causes. Companies with strong Environmental, Social, and Governance (ESG) ratings often see higher valuations.

- Consumer surveys show a growing preference for ethical brands.

- ESG investments are rising, impacting market valuations.

- Ethical practices help build trust and loyalty.

VCREDIT's success relies on understanding evolving social trends and public sentiment. Digital adoption and financial inclusion initiatives directly shape consumer behavior and product demand, particularly in underserved markets. Consumer trust, impacted by data security and ethical conduct, affects the firm's reputation.

Demographic shifts, including urbanization, age distribution, and income levels, demand product adjustments.

| Social Factor | Impact on VCREDIT | Data (2024-2025) |

|---|---|---|

| Urbanization | Increased need for accessible services | Urban population share 57% globally (2024 est.) |

| Ethical Consumption | Influences brand loyalty, and investment. | 88% consumers prefer ethical brands (2025) |

| Digital Adoption | Customer base size | 1.5B mobile payment users by end of 2025 |

Technological factors

VCREDIT leverages AI and big data for credit assessment, customer segmentation, and underwriting. This tech enhances risk control systems, like the Hummingbird system, improving accuracy and efficiency. In 2024, AI-driven credit scoring reduced default rates by 15% for similar firms. The global AI in fintech market is projected to reach $26.1 billion by 2025.

VCREDIT heavily relies on China's high smartphone and internet use. Digital platforms and mobile tech are vital for attracting customers. In 2024, China had over 1 billion mobile internet users. Enhancements in these areas improve service and user experience. This tech focus supports VCREDIT's growth.

Cybersecurity and data security are crucial for VCREDIT, an online financial platform. Recent data shows cyberattacks cost financial institutions globally an average of $18.2 million in 2024. Robust security measures are essential to protect sensitive customer data. The sophistication of cyber threats necessitates continuous technological upgrades, as cybercrime is projected to cause $10.5 trillion in damages globally by 2025. Maintaining trust relies heavily on these security efforts.

Blockchain Technology

VCREDIT leverages blockchain to enhance information sharing, focusing on transparency and security. The growth of blockchain adoption could significantly affect its operational efficiency. For example, the global blockchain market is projected to reach $94.05 billion by 2024. This technology is used for secure transaction processing and data management within VCREDIT.

- Blockchain market size expected to reach $94.05 billion by 2024.

- Blockchain adoption can improve transparency and security.

- VCREDIT uses blockchain for efficient data management.

Innovation in Financial Products and Services

Technological advancements continually reshape financial products and services. VCREDIT must harness technology to create innovative offerings and improve customer experiences. The fintech sector is experiencing rapid growth; in 2024, global fintech investments reached $157.2 billion. Staying competitive requires continuous technological adaptation.

- Fintech market valued at $300 billion in 2024, projected to reach $600 billion by 2030.

- Blockchain technology adoption in finance grew by 40% in 2024.

- AI and machine learning spending in financial services increased by 25% in 2024.

VCREDIT's tech use includes AI for risk assessment; this improved efficiency. Digital platforms in China, with over 1 billion mobile internet users in 2024, are vital. Cybersecurity and blockchain are essential, given the increasing threat landscape, with the global blockchain market at $94.05 billion in 2024.

| Technology Aspect | Impact | 2024/2025 Data |

|---|---|---|

| AI in Credit | Enhanced Risk Management | AI in fintech market: $26.1 billion by 2025. AI reduced default rates by 15% for similar firms in 2024. |

| Digital Platforms | Customer Acquisition and Service | China's mobile internet users in 2024: over 1 billion. Fintech market valued at $300 billion in 2024. |

| Cybersecurity | Data Protection | Cyberattacks cost financial institutions ~$18.2M in 2024. Cybercrime to cause $10.5T in damages by 2025. |

| Blockchain | Transparency & Efficiency | Blockchain market: $94.05B in 2024. Blockchain adoption in finance grew by 40% in 2024. |

| Innovation | Product & CX Improvement | Global fintech investments reached $157.2B in 2024. AI/ML spending in FS up 25% in 2024. |

Legal factors

VCREDIT faces intricate fintech regulations in China. Adapting to laws on online lending and consumer finance is crucial. The People's Bank of China (PBOC) has increased scrutiny in 2024. Stricter rules impact operational adjustments and financial reporting. Staying compliant is essential for its long-term viability.

China's strict data privacy and security laws, like the Personal Information Protection Law (PIPL), significantly influence VCREDIT's operations. These laws mandate how VCREDIT handles customer data, impacting everything from data collection to storage and usage. Compliance with PIPL and related regulations is crucial for VCREDIT to avoid hefty fines and maintain its operational license. Failure to comply can lead to penalties of up to 5% of annual revenue, as seen in recent cases involving tech companies.

Consumer protection laws are crucial for VCREDIT. These laws, such as those enforced by the CFPB in the U.S., regulate lending practices. They ensure fair disclosure and dispute resolution. For 2024, the CFPB has issued over $100 million in penalties. This impacts how VCREDIT manages borrower interactions. Robust compliance frameworks are essential to avoid penalties.

Anti-Corruption and Anti-Fraud Regulations

VCREDIT faces legal obligations to combat corruption and fraud. Compliance involves adhering to anti-corruption laws and anti-fraud regulations. Robust internal controls and policies are crucial for ethical business practices. This helps maintain legal compliance and protect the company's reputation. In 2024, the U.S. Department of Justice reported over $2.8 billion in penalties for corporate fraud.

- Compliance costs: 5-10% of operational budgets for large firms.

- Fraud detection: Investment in AI-driven systems up by 15% in 2024.

- Legal penalties: Average fine for corruption cases is $10-50 million.

- Risk assessment: Regular audits and risk assessments are essential.

Laws Related to Funding Partners and Collaborations

VCREDIT's operations are significantly shaped by legal factors, especially concerning partnerships. It must adhere to regulations governing collaborations with financial institutions and funding partners. Compliance is crucial, particularly in joint modeling and risk-sharing, to maintain the viability of its business model. Failure to comply with these legal obligations could result in financial penalties or even legal action. The legal framework in 2024/2025 will continue to evolve, requiring VCREDIT to stay updated and adaptable.

- Regulatory changes in 2024/2025 could impact partnership agreements.

- Compliance costs related to legal requirements could increase.

- Legal disputes with partners could affect financial performance.

- The legal landscape's impact on funding availability.

Legal factors significantly impact VCREDIT. It must comply with regulations on partnerships, data privacy, consumer protection, and anti-fraud measures. Compliance with changing fintech regulations is vital for financial performance and operational sustainability.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Compliance Costs | Financial burden | 5-10% of operational budgets |

| Fraud Detection | Investment need | AI system investment up 15% |

| Legal Penalties | Financial risks | Avg. fine $10-50M for corruption |

Environmental factors

VCREDIT, though not environmentally intensive, must comply with environmental laws in its operational areas. This includes regulations for office waste and energy use. Compliance is crucial to avoid penalties and maintain a good corporate image. In 2024, companies faced increased scrutiny, with fines up 15% for non-compliance. The trend continues into 2025.

Corporate Social Responsibility (CSR) is increasingly vital. VCREDIT, like other financial entities, must show environmental responsibility. In 2024, about 70% of consumers preferred eco-friendly companies. VCREDIT promotes green office policies. It also boosts environmental awareness among its employees.

Climate change poses an indirect risk, potentially impacting economic stability, which could influence borrowers' finances. The World Bank estimates that climate change could push 100 million people into poverty by 2030. Extreme weather events, linked to climate change, are projected to cause $1.5 trillion in annual damages globally by 2030.

Resource Consumption in Operations

VCREDIT's office-based operations, while not resource-intensive, still have an environmental footprint. Energy consumption for powering offices and using paper for documentation are key considerations. Addressing these aspects through energy-saving initiatives and recycling programs is crucial. This aligns with growing investor and stakeholder expectations for sustainability. Consider that global energy consumption in 2024 is projected to increase by about 2%.

- Energy Efficiency: Implementing energy-efficient lighting and equipment.

- Paper Reduction: Promoting digital documentation and reducing paper usage.

- Recycling Programs: Establishing comprehensive recycling programs for paper, plastics, and other materials.

- Sustainable Procurement: Sourcing eco-friendly office supplies.

Stakeholder Expectations Regarding Environmental Performance

Stakeholder expectations regarding environmental performance are evolving. Investors are increasingly assessing environmental, social, and governance (ESG) factors, with ESG-focused assets reaching trillions of dollars globally by 2024. Customers favor eco-friendly companies, and public perception significantly impacts brand value. Even though VCREDIT's direct environmental impact might be less than other sectors, showcasing environmental responsibility is crucial for maintaining a positive image and attracting investment.

- ESG assets under management (AUM) globally reached $40.5 trillion in 2024.

- Companies with strong ESG scores often outperform those with weak scores.

- Public awareness of environmental issues continues to grow, influencing consumer behavior.

VCREDIT must comply with environmental regulations, facing scrutiny and potential fines; non-compliance fines rose 15% in 2024. CSR, like showing eco-friendly actions, is increasingly crucial to meet growing stakeholder and customer demands. Climate change poses indirect risks through economic impacts; extreme weather projected $1.5T damages by 2030.

| Aspect | Details | 2024 Data |

|---|---|---|

| Regulatory Compliance | Adhering to environmental laws | Fines up 15% for non-compliance |

| CSR Importance | Demonstrating environmental responsibility | 70% consumers prefer eco-friendly firms |

| Climate Change Impact | Indirect risks from economic instability | $1.5T in projected damages by 2030 |

PESTLE Analysis Data Sources

The VCREDIT PESTLE leverages global market reports, governmental policies, economic forecasts, and industry-specific data to deliver comprehensive analysis.