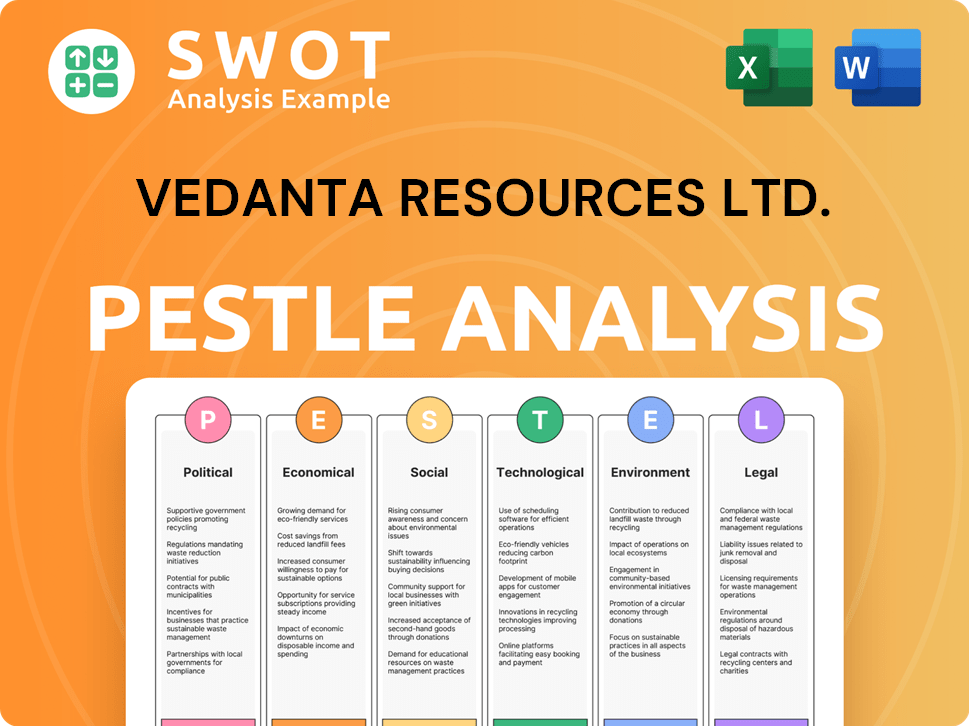

Vedanta Resources Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vedanta Resources Ltd. Bundle

What is included in the product

This analysis dissects the external factors shaping Vedanta Resources across six key dimensions.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Preview Before You Purchase

Vedanta Resources Ltd. PESTLE Analysis

This is a real preview of the Vedanta Resources Ltd. PESTLE Analysis you'll receive. Examine the analysis of political, economic, social, technological, legal, and environmental factors.

PESTLE Analysis Template

Discover Vedanta Resources Ltd. through a PESTLE lens, uncovering critical external factors. Political risks and environmental regulations significantly impact operations. Economic volatility and social trends add further complexities. Technological advancements and legal frameworks also shape the landscape. Unravel the complete picture and make informed decisions. Download the full version now and gain a strategic advantage.

Political factors

Vedanta Resources faces political risks due to government policies in India and Zambia. Mining licenses, environmental rules, and export laws directly affect its business. For example, in 2024, India's mining sector saw policy shifts impacting operational costs. Regulatory changes can quickly alter production and profit margins. The company's ability to navigate these policies is crucial for its financial health.

Political stability significantly impacts Vedanta's operations. Unstable regions can cause policy changes and operational disruptions. The Konkola Copper Mines in Zambia highlight these risks, where Vedanta recently regained control after a dispute. Political risks directly affect investment viability and profitability.

International trade policies, tariffs, and agreements significantly impact Vedanta's mineral and metal exports and imports. For example, in 2024, changes in steel tariffs by the EU affected global prices. These shifts directly influence Vedanta's production costs. They also affect the competitiveness of its products in the global market.

Resource Nationalism

Resource nationalism poses a significant political factor for Vedanta Resources Ltd. Some nations with abundant natural resources are increasingly implementing policies that favor domestic companies or bolster government control over mining assets. These actions directly influence Vedanta's ownership stakes, operational authority, and profitability within those geographical areas. Such shifts can lead to increased taxes, royalties, or even nationalization, impacting the company's financial projections. For example, in 2024, several African nations have increased mining royalties.

- Increased taxes and royalties can directly reduce Vedanta's profit margins.

- Nationalization of assets can lead to significant financial losses.

- Changes in ownership structure may require Vedanta to adjust its operational strategies.

Government Support and Incentives

Government support significantly shapes Vedanta's operations. Incentives like tax breaks and subsidies can boost profitability and expansion. Infrastructure investments by governments directly affect Vedanta's operational efficiency and cost structure. For instance, in 2024, the Indian government allocated over $10 billion for infrastructure projects relevant to the mining sector. Such support can lower operational costs and enhance Vedanta's competitive edge.

- Tax breaks and subsidies can reduce operational costs.

- Infrastructure investments improve efficiency.

- Government policies influence expansion strategies.

- Regulatory changes affect compliance costs.

Vedanta faces political risks in India and Zambia from government policies, influencing operational costs. Political stability impacts Vedanta's operations, as seen with the Konkola Copper Mines dispute in Zambia. International trade policies like tariffs affect exports; EU steel tariffs in 2024 impacted global prices.

Resource nationalism, seen in increased mining royalties by some African nations in 2024, impacts ownership and profitability.

| Political Factor | Impact | Example (2024/2025) |

|---|---|---|

| Policy Shifts | Alters Costs/Margins | India's mining policy changes |

| Political Instability | Disrupts Operations | Konkola Copper Mines |

| Trade Policies | Affects Costs/Competitiveness | EU Steel Tariffs |

Economic factors

Vedanta's financials are significantly impacted by global commodity prices such as zinc, iron ore, aluminum, copper, and oil & gas. These commodities' prices are influenced by worldwide supply and demand, economic expansions, and geopolitical situations, causing earnings instability. For instance, in 2024, zinc prices fluctuated between $2,500 and $3,000 per metric ton, directly affecting Vedanta's revenue. The company's profitability hinges on managing these price volatilities effectively.

India's GDP growth is projected at 6.5% in FY25, influencing Vedanta's operations. Construction and manufacturing are key sectors. Demand for Vedanta's products like aluminum and zinc is tied to these sectors. Economic fluctuations in India can significantly affect Vedanta's revenue.

Vedanta Resources faces currency exchange rate risks due to its global operations. Fluctuations between the USD and local currencies directly impact its financials. For instance, a stronger USD can reduce the value of revenue from operations in countries with weaker currencies. In 2024, currency impacts were a significant factor.

Access to Capital and Financing

Vedanta Resources' access to capital is vital for funding projects and managing debt. The company's credit ratings directly impact its ability to secure favorable financing. As of late 2024, Vedanta's debt levels remain a key concern, influencing investor confidence. Securing cost-effective financing is essential for sustaining operations and growth.

- Vedanta's debt stood at $8.7 billion as of March 2024.

- Credit rating agencies have assigned varying ratings, reflecting financial health.

- Interest rate fluctuations impact financing costs.

- Access to capital markets is crucial for refinancing debt.

Inflation and Cost of Operations

Inflation significantly affects Vedanta Resources Ltd.'s operational costs, impacting raw materials, energy, and labor expenses. The company must actively manage these costs to sustain profitability within the global market. For example, in 2024, the average inflation rate in India, where Vedanta has significant operations, was around 5.5%. High inflation can lead to increased production costs, squeezing profit margins. Effective cost management is critical for Vedanta's financial health and competitiveness.

- 2024 Indian inflation: ~5.5%

- Impact: Increased production costs

- Challenge: Maintaining profit margins

Vedanta's profitability faces global commodity price fluctuations affecting revenues, demonstrated by zinc price swings between $2,500 and $3,000/MT in 2024. India's projected 6.5% GDP growth in FY25, pivotal to Vedanta's construction and manufacturing, influences demand for key products, reflecting economic impacts on revenue.

Currency exchange rate risks, particularly between the USD and other currencies, influence financials, while debt levels ($8.7 billion as of March 2024) and credit ratings directly affect financing costs and investor confidence. Inflation in India at ~5.5% in 2024 necessitates strict cost management to protect profit margins.

| Economic Factor | Impact on Vedanta | Data (2024/2025) |

|---|---|---|

| Commodity Prices | Revenue Volatility | Zinc prices: $2,500-$3,000/MT (2024) |

| GDP Growth | Demand for Products | India's GDP growth (FY25): 6.5% (projected) |

| Currency Exchange | Financial Risk | USD/Local Currency Fluctuations |

| Debt and Credit | Financing Costs, Confidence | Vedanta debt (Mar 2024): $8.7B |

| Inflation | Cost Management | India Inflation (2024): ~5.5% |

Sociological factors

Vedanta's success hinges on strong community relations. It must address local concerns about land use and environmental effects. In 2024, community investment was approximately $50 million. This supports education, healthcare, and infrastructure in operational areas. Positive community relations help secure the social license to operate, crucial for long-term sustainability.

Vedanta's workforce is globally diverse, reflecting its operations across multiple countries. Successful management of this diversity is crucial for operational efficiency. Labor relations, including fair wages and safe working conditions, are key. In 2024, labor disputes in the mining sector saw an increase of 7%, emphasizing the importance of proactive engagement.

Vedanta Resources Ltd. prioritizes health and safety, essential for its workforce and operations. A strong safety record prevents reputational harm, legal issues, and production delays. In 2024, Vedanta aimed to reduce workplace incidents by 15% across all sites. This commitment is crucial for sustainable business practices.

Contribution to Local Economies

Vedanta's activities significantly influence local economies, primarily through employment opportunities. They source materials and services from local vendors, boosting regional economic activity. Community development projects, such as educational and healthcare initiatives, further integrate Vedanta into the social fabric.

- In 2024, Vedanta invested $25 million in community development.

- The company's operations support over 50,000 jobs directly and indirectly.

- Local procurement accounted for 60% of total spending in 2024.

Public Perception and Reputation

Vedanta's public image hinges on its social and environmental record, affecting brand value, investor interest, and regulatory compliance. Controversies, such as those related to the Sterlite Copper plant, have significantly damaged its reputation. A positive perception can boost market capitalization; for example, companies with strong ESG ratings often see increased investment. Conversely, negative publicity can lead to boycotts and regulatory scrutiny.

- In 2023, Vedanta faced increased scrutiny over its environmental practices, affecting its stock price.

- Stakeholder activism and media coverage significantly influence public opinion of the company.

- Positive ESG performance correlates with higher investor confidence and market valuations.

- Regulatory responses to controversies can lead to significant financial penalties and operational restrictions.

Vedanta focuses on community relations and addressing environmental concerns to secure its operational license. Community investment totaled around $50 million in 2024. Labor relations and workforce diversity are crucial for efficiency. Proactive engagement is important to avoid disputes, especially given a 7% rise in mining sector labor disputes in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Community Investment | Supporting local education, healthcare, infrastructure | $50 million |

| Labor Disputes | Impact of labor-related challenges in mining sector | 7% increase |

| Workplace Incidents | Target reduction | Aiming 15% decrease |

Technological factors

Vedanta Resources Ltd. can significantly benefit from adopting advanced mining and extraction technologies. These technologies, including automation and AI, boost efficiency, cut operational costs, and improve worker safety. Vedanta's strategic investments in technological advancements are vital for staying competitive. In 2024, the mining industry saw a 15% increase in tech adoption, highlighting the trend. Vedanta allocated $100 million to tech upgrades in 2024.

Vedanta Resources Ltd. is increasingly focused on automation and digitalization across its operations. This includes integrating AI and IoT to refine processes. For example, in 2024, Vedanta invested significantly in digital transformation projects, allocating approximately $150 million to enhance operational efficiency. These technological advancements aim to optimize production and improve decision-making. This strategy is projected to yield a 10-15% increase in operational efficiency by the end of 2025.

Technological advancements significantly impact material demand. Vedanta must monitor innovations like sustainable materials, which could disrupt its product portfolio. For example, in 2024, the global market for green materials reached $367 billion, with an expected annual growth of 12% through 2025.

Energy Efficiency Technologies

Vedanta Resources Ltd. can significantly benefit from energy efficiency technologies. Implementing these in mining and processing can slash energy use and costs, boosting economic and environmental sustainability. This includes adopting advanced equipment and smart energy management systems. Such strategies are increasingly vital for competitive advantage and regulatory compliance. For example, in 2024, the mining sector saw a 15% rise in adoption of energy-efficient technologies.

- Smart grids and energy storage systems can reduce operational costs by up to 20%.

- Adoption of LED lighting can reduce energy consumption by up to 70%.

- Implementing efficient motors and drives can save up to 30% in energy costs.

- By 2025, the global market for energy-efficient mining tech is projected to reach $5 billion.

Exploration and Resource Mapping Technologies

Vedanta Resources benefits from advanced tech in geological exploration. These technologies boost the discovery of new mineral deposits, crucial for long-term growth. Resource mapping aids in efficient extraction and reduces environmental impact. In 2024, the mining tech market was valued at $10.5 billion. By 2025, it's predicted to reach $11.8 billion, reflecting a rise in tech adoption.

- Geophysical surveys using drones and satellites enhance exploration efficiency.

- AI and machine learning tools analyze geological data for predictive modeling.

- 3D modeling and virtual reality improve mine planning and visualization.

- Real-time monitoring systems optimize resource extraction processes.

Vedanta leverages advanced tech like AI and automation for efficiency. Automation increased tech adoption by 15% in 2024; Vedanta spent $100M on upgrades. Green material markets grew to $367B in 2024, aiming for 12% growth through 2025.

| Technology Area | Specific Technology | Impact |

|---|---|---|

| Operational Efficiency | AI, IoT integration | 10-15% efficiency gains by 2025 |

| Energy Efficiency | Smart grids, LED lighting | Cost reduction up to 20% |

| Exploration | Drones, AI analysis | Enhances exploration efficiency, AI, and predictive modeling |

Legal factors

Vedanta Resources Ltd. operates within the strictures of mining laws and regulations specific to each nation where it conducts business. Securing and upholding licenses and permits is crucial for Vedanta's operational legality. Non-compliance could lead to hefty fines or operational shutdowns, significantly affecting profitability. For example, in 2024, Vedanta faced regulatory challenges in Zambia regarding its copper mining operations, impacting production output by approximately 15%.

Vedanta faces stringent environmental laws. Compliance includes managing emissions, waste, and water usage. They must secure environmental clearances to operate legally. In 2024, environmental fines impacted profits by approximately $50 million. Ongoing compliance costs are a significant operational expense.

Vedanta Resources must comply with labor laws and employment regulations across all operational regions. These laws cover wages, work hours, and worker safety standards. In India, for example, the Minimum Wages Act, 1948, and the Factories Act, 1948, are critical. The International Labour Organization (ILO) estimates that in 2024, 2.78 million workers died from work-related accidents and diseases globally.

Corporate Governance Regulations

Vedanta Resources Ltd. faces significant legal scrutiny due to corporate governance regulations. These regulations mandate stringent reporting, impacting financial disclosures and operational transparency. Effective board structures and the protection of shareholder rights are also crucial. Vedanta's compliance directly affects its market valuation and investor confidence.

- Compliance failures may lead to substantial financial penalties.

- Strong governance enhances investor trust and attracts capital.

- Recent regulatory changes emphasize board independence.

- Shareholder activism can pressure governance improvements.

International Sanctions and Trade Restrictions

Vedanta Resources faces risks from international sanctions and trade restrictions, which can limit its operations in specific regions. These restrictions can affect the import of materials, export of products, and access to financial services, directly impacting the company's supply chains and revenue. For example, sanctions on Russia have affected the global aluminum market, indirectly influencing Vedanta's operations due to its aluminum business. The ongoing geopolitical tensions and trade wars, as seen in 2024, continue to pose challenges.

- Impact on Aluminum production: Sanctions and trade restrictions can disrupt the supply of raw materials and impact production volumes.

- Financial Restrictions: Sanctions may limit access to international financial markets and banking services, affecting Vedanta's ability to finance projects or repatriate profits.

- Compliance Costs: The company must invest in compliance measures to ensure it adheres to international regulations, which can increase operational costs.

Vedanta faces stringent mining laws across its operational countries; failure to comply risks shutdowns and fines, which can be very costly. They are also bound by labor regulations, covering safety, wages, and work hours, requiring them to align with numerous rules such as India's Minimum Wages Act and Factories Act. Additionally, the company is impacted by legal challenges of international sanctions and trade restrictions that affect their ability to export and import, influencing supply chains.

| Legal Factor | Impact | 2024 Data/Examples |

|---|---|---|

| Mining & Permits | Non-compliance risks shutdowns and fines | Zambia regulatory challenges affected production by 15% in 2024. |

| Labor Laws | Affects operational costs and employee relations | Worldwide 2.78 million work-related deaths in 2024 (ILO data). |

| Sanctions & Trade | Disrupt supply chains & finances | Sanctions on Russia affected aluminum markets and, by implication, Vedanta's aluminum business. |

Environmental factors

Vedanta faces stricter environmental rules. These focus on pollution, protecting nature, and climate change. In 2024, environmental fines for similar firms rose by 15%. Vedanta's costs for compliance are expected to increase by 10-12% by the end of 2025. This impacts their operational expenses.

Climate change is a significant environmental factor, increasing pressure on companies to cut carbon emissions. Vedanta has set targets to reduce greenhouse gas emissions. For instance, they are investing in renewable energy projects. By 2024, Vedanta aimed to reduce its Scope 1 and 2 emissions by a certain percentage compared to a baseline year.

Mining and processing are water-intensive, posing a challenge for Vedanta. Water scarcity and stringent water usage regulations can significantly affect operational costs and production capabilities. Vedanta has invested in water recycling and conservation, aiming to reduce freshwater consumption. For instance, in 2024, the company reported a 15% decrease in water intensity across its operations.

Biodiversity and Land Use

Vedanta's mining operations inherently affect biodiversity and land use. The company must actively mitigate these impacts, especially in sensitive areas. For instance, in 2024, Vedanta's operations in India faced scrutiny regarding deforestation linked to mining projects. Effective rehabilitation of mined lands is crucial for environmental responsibility.

- Deforestation concerns linked to mining projects emerged in 2024.

- Rehabilitation of mined areas is crucial for environmental responsibility.

Waste Management and Tailings Disposal

Waste management and tailings disposal pose major environmental hurdles for Vedanta. The company must adhere strictly to global and local regulations, ensuring safe disposal and exploring waste utilization opportunities. Failure to do so can lead to significant environmental damage and financial penalties. For example, in 2024, environmental fines for non-compliance in the mining sector averaged $1.5 million per incident.

- Compliance with stringent environmental regulations is vital.

- Vedanta should invest in innovative waste management technologies.

- Waste utilization strategies can turn liabilities into assets.

- Regular audits and transparent reporting are crucial.

Environmental factors are critical for Vedanta. Strict regulations drive up compliance costs, with increases of 10-12% expected by the end of 2025. The firm actively manages its carbon footprint through renewable investments, targeting emission reductions. Water scarcity and land use also pose operational challenges.

| Aspect | Impact | Data |

|---|---|---|

| Compliance Costs | Increasing operational expenses | 10-12% rise in compliance costs by end of 2025 |

| Carbon Emissions | Need for emission reduction | Focus on reducing Scope 1 and 2 emissions, investment in renewable energy. |

| Water Management | Risk of water scarcity affecting production | Reported 15% decrease in water intensity in 2024 through recycling. |

PESTLE Analysis Data Sources

Vedanta Resources PESTLE analysis incorporates data from financial reports, government publications, and industry-specific databases. Insights are drawn from primary and secondary research.