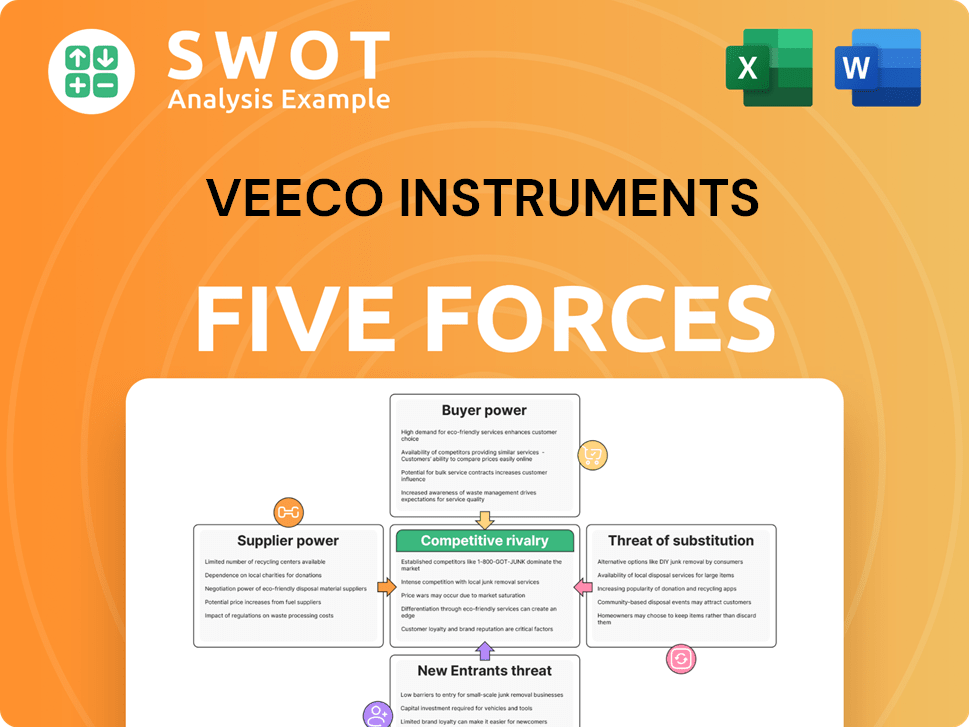

Veeco Instruments Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Veeco Instruments Bundle

What is included in the product

Analyzes Veeco's position, evaluating competitive forces, supplier/buyer control, and market entry barriers.

Instantly understand strategic pressure with a powerful spider/radar chart.

What You See Is What You Get

Veeco Instruments Porter's Five Forces Analysis

This preview is the full Veeco Instruments Porter's Five Forces analysis you'll receive. It assesses competitive rivalry, supplier power, buyer power, threat of substitutes, & threat of new entrants. The document examines these forces within Veeco's industry, providing a comprehensive overview. You'll gain instant access to this exact, ready-to-use file upon purchase. The analysis offers valuable insights for strategic decision-making.

Porter's Five Forces Analysis Template

Veeco Instruments faces moderate competition, marked by concentrated supplier power and a fragmented customer base. The threat of new entrants is relatively low, offset by the potential for substitute products. Intense rivalry exists, driven by industry consolidation. The full analysis reveals the strength and intensity of each market force affecting Veeco Instruments, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Veeco benefits from dispersed supplier power. The semiconductor equipment industry features numerous suppliers, reducing the risk of any single entity dictating terms. Veeco actively manages supplier relationships to ensure a reliable supply chain. This approach helps maintain competitive costs and operational stability. In 2024, Veeco's cost of revenue was approximately $400 million.

Veeco benefits from using standardized components, which lowers its dependency on individual suppliers. This approach gives Veeco flexibility in sourcing and negotiating. In 2023, Veeco's cost of revenues was about $560 million, showing its scale in procurement. This strategy helps manage supplier power effectively.

Veeco's supplier switching costs aren't a major concern. Its ability to qualify new suppliers and integrate components gives it leverage. In 2024, Veeco's gross profit margin was approximately 45%, indicating some pricing power. The company can negotiate favorable terms due to its design capabilities.

Veeco's Influence as a Customer

Veeco, a key player in the semiconductor equipment sector, has some bargaining power with its suppliers. This is due to the potential for repeat business and long-term partnerships. Veeco can negotiate favorable terms, leveraging its market position. In 2024, the semiconductor equipment market saw significant growth, enhancing Veeco's leverage. This allows them to influence pricing and supply agreements.

- Market Growth: The semiconductor equipment market grew substantially in 2024.

- Long-Term Partnerships: Veeco often establishes long-term supplier relationships.

- Negotiating Power: Veeco uses its market position to secure beneficial terms.

- Financial Data: Veeco's revenue in 2024 reflects its supplier influence.

Potential for Backward Integration

Veeco Instruments, while not primarily focused on backward integration, could mitigate supplier power by manufacturing crucial components themselves. This strategic move, though complex, offers a safeguard against excessive supplier influence. It's a long-term approach, requiring significant investment in infrastructure and expertise. However, it could ensure a more stable supply chain and reduce dependency on external vendors.

- Veeco's 2023 revenue was approximately $600 million, indicating its market position.

- Backward integration requires substantial upfront capital investment.

- This strategy can reduce the risk of supply chain disruptions.

- It also provides greater control over component quality.

Veeco has moderate bargaining power over suppliers. The company benefits from diverse suppliers and standardized components, maintaining competitive costs. In 2024, its gross profit margin was approximately 45%, indicating some pricing power. Market growth in 2024 further enhanced its leverage in negotiations.

| Aspect | Details | 2024 Data |

|---|---|---|

| Cost of Revenue | Total expenses | $400 million |

| Gross Profit Margin | Profitability measure | Approx. 45% |

| Market Growth | Semiconductor equipment market | Significant growth |

Customers Bargaining Power

Veeco Instruments' customer base is concentrated, primarily serving major semiconductor manufacturers globally. These large customers wield considerable bargaining power because of the substantial size of their orders and their ability to shape industry standards. For instance, TSMC, a key customer, significantly influences Veeco's market dynamics. In 2024, the top 5 customers accounted for a large portion of Veeco's revenue, reflecting this concentration.

Customers of Veeco Instruments encounter moderate switching costs. Integrating new equipment from different vendors requires time and process adjustments. Despite this, long-term benefits like cost savings can justify these costs. In 2024, Veeco's revenue was approximately $660 million, showing its market position. This gives customers leverage in negotiations.

The semiconductor equipment industry is competitive, featuring alternative suppliers to Veeco, such as ASML and Applied Materials. This boosts customer bargaining power. Customers can switch if Veeco's offerings aren't competitive, impacting pricing. In 2024, ASML's net sales were approximately €27.6 billion, highlighting the competition.

Customer Knowledge and Expertise

Veeco's customers, integral to the semiconductor industry, possess extensive technical expertise. This proficiency enables them to rigorously assess and compare various equipment options. Consequently, Veeco faces pressure to provide exceptional value to secure sales. In 2024, the semiconductor equipment market was valued at over $130 billion, highlighting the stakes involved.

- Customer expertise drives demand for competitive pricing and advanced features.

- Veeco must innovate and differentiate its products to maintain a competitive edge.

- Customers' deep understanding of the technology allows them to negotiate favorable terms.

- The market's complexity necessitates a strong customer-focused approach.

Price Sensitivity

Customers of semiconductor equipment, like those purchasing from Veeco Instruments, exhibit strong price sensitivity. This is largely due to the substantial capital investments required in the semiconductor industry. They frequently negotiate aggressively for better pricing and financing arrangements, leveraging their market position. This heightened price consciousness significantly boosts their bargaining power. In 2024, the semiconductor equipment market saw intense price competition.

- Capital expenditures in the semiconductor industry often exceed billions of dollars per project.

- Negotiated discounts can range from 5-15% depending on the volume and relationship.

- Financing terms include options like deferred payments.

- The market is expected to reach $130 billion by the end of 2024.

Veeco's customers, including major semiconductor manufacturers, hold significant bargaining power, especially large customers. This power stems from concentrated orders and influence over industry standards; in 2024, top customers drove a significant portion of revenue. Switching costs are moderate, but the competition impacts pricing negotiations.

| Factor | Description | Impact on Bargaining Power |

|---|---|---|

| Customer Concentration | Major semiconductor firms constitute a large part of Veeco’s sales. | High, due to order volume. |

| Switching Costs | Moderate due to integration time. | Moderate, limiting switching ability but not eliminating it. |

| Industry Competition | Availability of alternative suppliers. | High, enhancing customer options. |

Rivalry Among Competitors

The semiconductor equipment industry is highly competitive. Veeco faces significant rivals, including industry giants like Applied Materials and Tokyo Electron, plus numerous niche competitors [6]. For 2024, Applied Materials' revenue reached approximately $26.5 billion, while Tokyo Electron's sales neared $15 billion, highlighting the scale of competition [7, 8]. This environment pressures margins and demands continuous innovation to stay relevant.

Veeco's product differentiation, such as laser annealing and MOCVD, faces intense rivalry. Competitors constantly innovate, requiring sustained R&D investment. In 2024, Veeco's R&D expenses were approximately $80 million, reflecting the need to stay ahead.

The semiconductor equipment industry is experiencing consolidation. Larger firms are acquiring smaller ones to broaden their offerings and market presence. This trend intensifies rivalry for companies like Veeco. For example, in 2024, there were several acquisitions within the sector. This makes the market more competitive.

Cyclical Industry

The semiconductor industry, where Veeco Instruments operates, is known for its cyclical nature. This means periods of strong demand are often followed by slowdowns. In 2024, the semiconductor market experienced a downturn, increasing competition. This leads to price wars and reduced profitability for companies like Veeco. For example, the global semiconductor market is projected to reach $588.2 billion in 2024, a slight increase from $573.5 billion in 2023, but the growth rate has slowed down considerably.

- Market downturns lead to price wars.

- Reduced profitability for all players.

- Competition intensifies for limited business.

- Veeco faces these challenges directly.

Geopolitical Factors

Geopolitical factors, such as trade restrictions and tensions, heavily influence Veeco's competitive environment. The US-China relationship is particularly crucial. In 2024, China represented 36% of Veeco's sales, highlighting its vulnerability to these factors.

- US-China Trade: Ongoing tensions and potential tariffs.

- Market Access: Restrictions impacting Veeco's ability to operate in China.

- Supply Chain: Disruptions due to geopolitical instability.

- Sales Impact: Potential for decreased sales in the Chinese market.

Veeco operates in a cutthroat market, facing giants like Applied Materials and Tokyo Electron. Intense competition pressures margins, requiring constant innovation and significant R&D investment. In 2024, R&D spending was around $80 million.

Market downturns and geopolitical factors further intensify rivalry, impacting sales. The US-China relationship is critical, with China representing 36% of Veeco's 2024 sales.

Consolidation also increases competition, making it harder for companies like Veeco to gain market share. The global semiconductor market is expected to reach $588.2 billion in 2024.

| Key Competitors | 2024 Revenue (Approx.) | Key Challenges for Veeco |

|---|---|---|

| Applied Materials | $26.5 Billion | Price wars, margin pressure, innovation demands |

| Tokyo Electron | $15 Billion | Geopolitical risks, market downturns, consolidation |

| Veeco R&D Spend | $80 Million | Maintaining market share in competitive landscape |

SSubstitutes Threaten

Alternative deposition methods present a threat to Veeco Instruments. Sputtering and ALD offer substitutes to MOCVD, impacting Veeco's market share [34]. The selection depends on film quality, cost, and throughput needs. In 2024, the ALD market was valued at $2.1 billion, showing growth. This signals a potential shift in demand away from MOCVD in some sectors.

Advancements in existing technologies pose a threat to Veeco Instruments. Improvements in traditional methods can reduce the need for new solutions. For instance, enhanced chemical vapor deposition (CVD) techniques could compete with Veeco's MOCVD systems. In 2024, the CVD market was valued at $15.5 billion, showcasing the potential for substitution. This could impact Veeco's market share if competitors innovate faster.

Customers might opt for process optimization, potentially diminishing the need for Veeco's advanced equipment. This involves investing in process engineering and data analysis. For example, in 2024, companies allocated significant budgets, with up to 15% dedicated to process improvements. This shift could impact Veeco's sales if optimization yields comparable results. Process control enhancements offer an alternative route to achieving similar outputs.

Emerging Technologies

Emerging technologies pose a threat to Veeco Instruments. Nanosecond annealing (NSA) is a potential substitute for laser annealing. Veeco is investing in NSA to mitigate this risk. The company's R&D spending in 2024 was approximately $90 million. This proactive approach aims to maintain market share.

- NSA could replace existing laser annealing.

- Veeco is investing in NSA technology.

- R&D spending in 2024 was around $90M.

- This strategy aims to protect market position.

Cost Considerations

Customers constantly assess the cost-benefit of available choices. Lower-cost substitutes often become attractive if they offer adequate functionality compared to pricier alternatives. This is particularly true in economic downturns. For instance, Veeco’s gross margin was 40.8% in Q4 2023, indicating the importance of cost management. Competition from cheaper alternatives pressures pricing.

- Cost-Benefit Analysis: Customers weigh price against performance.

- Economic Impact: Downturns increase the appeal of cheaper options.

- Margin Pressure: Competitive pricing erodes profitability.

- Veeco's Gross Margin: 40.8% (Q4 2023) highlights cost concerns.

Veeco faces substitution threats from alternative technologies and processes. Customers evaluate cost-benefit, favoring cheaper options if functional. In 2024, ALD market was $2.1B, highlighting potential shifts [34]. Process optimization and enhanced CVD pose additional risks to Veeco's market share.

| Threat | Details | Impact |

|---|---|---|

| Alternative Deposition | Sputtering, ALD | Market share impact |

| Process Optimization | Process engineering and data analysis | Reduced demand |

| Emerging Technologies | NSA vs. laser annealing | Replacement risk |

Entrants Threaten

The semiconductor equipment sector demands substantial upfront capital for research and development, manufacturing facilities, and marketing efforts, acting as a significant deterrent. This financial barrier makes it challenging for new firms to enter the market and compete effectively. For instance, in 2024, major players like ASML invested billions in R&D, showcasing the high capital intensity. Veeco Instruments also needs substantial capital to compete. This limits the risk from new competitors.

Veeco Instruments faces a moderate threat from new entrants due to the high technological expertise required. Developing semiconductor equipment demands mastery in laser tech, materials science, and vacuum systems, which is tough to achieve. This expertise acts as a substantial barrier, limiting the number of potential competitors. Research and development spending in the semiconductor industry reached $65.2 billion in 2024, highlighting the investment needed for entry.

Veeco, as an established player, benefits from deep-rooted relationships with key semiconductor manufacturers. New entrants face a significant hurdle in replicating these established connections, crucial for market access. Customer loyalty, built over years, provides Veeco with a competitive advantage, shielding it from immediate threats. The semiconductor industry's long sales cycles and qualification processes further solidify these relationships. Veeco's revenue in 2024 was approximately $680 million, demonstrating its strong market position.

Intellectual Property

Veeco Instruments faces a moderate threat from new entrants regarding intellectual property. The semiconductor equipment industry is heavily reliant on intellectual property, with existing firms like Veeco holding extensive patent portfolios. These patents protect key technologies, creating significant barriers for new companies hoping to compete without potential infringement. In 2024, the semiconductor equipment market was valued at approximately $100 billion, with a substantial portion tied to proprietary technologies.

- Patent protection is a major barrier.

- New entrants risk infringement lawsuits.

- The industry's high R&D costs are a factor.

- Veeco's existing patents create a competitive advantage.

Economies of Scale

Established companies like Veeco Instruments often have economies of scale in production and distribution, giving them a cost advantage. This allows them to offer lower prices, making it tough for new competitors to grab market share. New entrants face high initial costs to compete effectively. Veeco's existing infrastructure and market presence create a significant barrier.

- Veeco's revenue in 2023 was approximately $640 million, showcasing its established market position.

- Economies of scale can lead to lower per-unit manufacturing costs, a key advantage.

- New entrants must invest heavily in infrastructure, increasing their financial risk.

- Veeco's established supply chain provides a further cost advantage.

The threat of new entrants to Veeco Instruments is moderate. High capital requirements and technological expertise create significant barriers. However, established relationships and economies of scale offer Veeco a competitive edge.

| Barrier | Impact | Example/Data (2024) |

|---|---|---|

| Capital Intensity | High | ASML's R&D spending reached billions. |

| Technological Expertise | Moderate | Semiconductor R&D spending: $65.2B. |

| Existing Relationships | Protective | Veeco's 2024 revenue: ~$680M. |

Porter's Five Forces Analysis Data Sources

This Porter's Five Forces analysis uses data from financial statements, industry reports, SEC filings, and competitor analysis for accuracy.