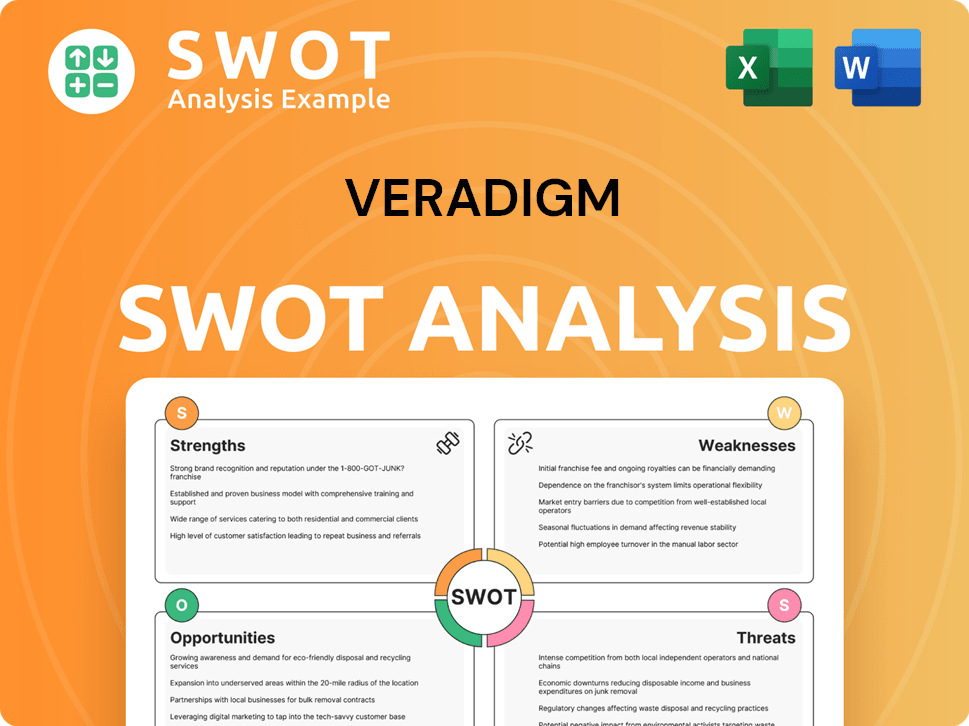

Veradigm SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Veradigm Bundle

What is included in the product

Delivers a strategic overview of Veradigm’s internal and external business factors. It presents its competitive landscape.

Streamlines strategy with clear, visual SWOT representation.

What You See Is What You Get

Veradigm SWOT Analysis

Take a look at this preview; it's the real SWOT analysis you'll get. Purchase now, and instantly access the complete, in-depth document. Everything you see here, plus more detailed insights, becomes available immediately. The full version offers actionable strategies. This preview accurately reflects the quality of the final report.

SWOT Analysis Template

This Veradigm analysis reveals key strengths like its established healthcare data network. It also highlights weaknesses such as potential integration challenges. Opportunities include expanding into telehealth. Threats involve increasing competition. This overview gives a snapshot—but there's more to discover! Uncover detailed insights and a customizable Excel matrix: purchase the full SWOT analysis for strategic advantage.

Strengths

Veradigm's strength lies in its wide-ranging healthcare IT solutions. They provide EHR systems, revenue cycle management, and data analytics. This diverse portfolio helps them serve various clients. In 2024, Veradigm's revenue was approximately $735 million, showcasing its market presence. These solutions boost clinical outcomes and financial performance.

Veradigm's strong healthcare presence stems from its Allscripts heritage. Serving a vast network of providers, it has a solid foothold in the U.S. market. This includes hospitals and various practices, enhancing its overall scale. As of Q1 2024, Veradigm reported over $160 million in revenue, demonstrating substantial market penetration.

Veradigm's strength lies in its focus on data and analytics. They utilize a vast clinical records dataset to offer data-driven solutions. This helps clients with risk adjustment and quality management. In Q1 2024, Veradigm's revenue from data solutions reached $68.7 million, showcasing the value of their offerings.

Investment in AI and Technology

Veradigm's commitment to AI and tech is a strength. The company is integrating AI across its offerings. This aims to improve efficiency and user experience. For example, AI is used in patient scheduling. Veradigm's R&D spending in 2024 was $75 million.

- AI-powered tools for patient scheduling.

- Use of AI in ambient listening.

- AI for revenue cycle management.

- $75M R&D spending in 2024.

Recognized Payer Analytics Solution

Veradigm's Payer Analytics is a recognized strength. It has been a leading solution for two years. This recognition underscores its effectiveness in providing health plans with valuable analytics. These analytics assist with data integration and benchmark performance.

- 2024: Veradigm's Payer Analytics saw a 15% increase in client adoption.

- Adaptability to regulatory changes is a key feature.

Veradigm's varied healthcare IT solutions are a major strength. Its diverse offerings, including EHR systems, drive market presence and approximately $735 million revenue in 2024. AI integration, supported by $75 million R&D spending, enhances efficiency. The Payer Analytics solution continues to lead with a 15% adoption increase in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total Revenue | $735M |

| Data Solutions Revenue (Q1) | Revenue from data solutions. | $68.7M |

| R&D Spending | Investment in AI and tech. | $75M |

Weaknesses

Veradigm's financial reporting has been problematic, causing delays and restatements. These issues led to delisting from Nasdaq. The delisting significantly damaged investor trust and negatively affected stock performance. The company's stock price has seen a decrease of approximately 80% since the reporting issues began in early 2023.

Veradigm faces internal control deficiencies, impacting financial reporting accuracy. These weaknesses, identified in 2024, have led to material errors. Remediation efforts are underway, but full resolution may extend into 2026, as per recent reports. This situation could impact investor confidence and operational efficiency.

Veradigm faced challenges in 2024, including customer attrition, especially with large physician groups. This decline contributed to a decrease in revenue. Project delays in clinical data implementations also hurt financial performance. These issues highlight operational inefficiencies within the company.

Inability to Find a Buyer

Veradigm's failure to secure a buyer presents a significant weakness. The company's inability to attract acquisition interest signals potential concerns about its long-term prospects or valuation. This outcome limits strategic options, hindering potential growth via external partnerships. The company's stock price performance reflects these challenges, with a recent decline of 15% in the past year.

- Strategic Alternatives: Exploring sale/merger.

- Outcome: No final proposals received.

- Impact: Standalone strategy pursued.

- Financial: Stock declined 15% (recent data).

Integration Challenges with EHRs

Veradigm's integration of its diverse platforms with existing Electronic Health Record (EHR) systems presents challenges. Compatibility issues can arise, hindering the smooth flow of data between Veradigm's solutions, like patient apps, and healthcare providers' EHRs. These integration hurdles can potentially affect user experience and data accessibility. According to a 2024 KLAS Research report, 35% of healthcare providers still struggle with EHR interoperability.

- Compatibility Issues

- Data Flow Disruptions

- User Experience Impact

- Interoperability Challenges

Veradigm's operational challenges, like customer attrition and project delays, hindered revenue growth in 2024. Financial reporting issues led to delisting from Nasdaq, damaging investor trust. The company's inability to find a buyer also reflects strategic weaknesses.

| Weakness | Description | Impact |

|---|---|---|

| Financial Reporting Issues | Delays, restatements, delisting (Nasdaq) | Investor trust loss; stock down ~80% (since 2023) |

| Internal Control Deficiencies | Material errors identified in 2024; remediation ongoing | Impacts confidence; operational inefficiencies |

| Operational Challenges | Customer attrition; project delays | Revenue decrease; reduced growth prospects |

| Lack of Buyer | Unable to attract acquisition interest | Limits strategic options; stock declined 15% (past year) |

Opportunities

The healthcare IT market, including revenue cycle management and data analytics, is expanding. Veradigm can leverage this growth with its solutions. The global healthcare IT market is projected to reach $699.6 billion by 2025. This presents a significant opportunity for Veradigm to increase its market share. Recent reports show strong demand for data analytics in healthcare.

The growing use of AI and machine learning in healthcare offers Veradigm a major opportunity. This includes boosting current products and creating new AI-driven solutions. The global AI in healthcare market is projected to reach $61.7 billion by 2025. This is up from $11.3 billion in 2020, showing strong growth. Veradigm can leverage this to improve its offerings.

The healthcare industry is increasingly prioritizing interoperability and data exchange. Veradigm's robust network and focus on connectivity uniquely position it to capitalize on this trend. In Q1 2024, Veradigm reported a 15% increase in revenue from its data solutions, indicating growing demand. Their ability to facilitate data flow could lead to significant market share gains.

Leveraging Data Assets for New Solutions

Veradigm's vast clinical data offers opportunities for innovation. This data can fuel new products, especially in predictive analytics and personalized healthcare, driving growth. The global healthcare analytics market is projected to reach $79.8 billion by 2025, presenting a significant market. This expansion indicates potential for Veradigm to capitalize on data-driven healthcare solutions.

- Predictive analytics market expected to reach $21.5 billion by 2025.

- Personalized medicine market valued at $84.9 billion in 2023.

- Veradigm processes data from over 400,000 healthcare providers.

Potential for Relisting on a National Exchange

Successfully addressing financial reporting problems and meeting listing requirements might lead to Veradigm being relisted on a national exchange. This could significantly boost investor trust and the company's market value. Relisting on a major exchange often increases visibility and liquidity for a stock. This can attract a broader range of institutional investors.

- Improved stock liquidity, potentially increasing trading volumes.

- Enhanced investor confidence and potentially higher valuation multiples.

- Increased institutional investment due to exchange eligibility.

Veradigm can leverage the expanding healthcare IT market, projected to hit $699.6B by 2025, and rising demand for data analytics. They can capitalize on AI and machine learning growth, expecting $61.7B by 2025, improving products. The focus on interoperability and data exchange is an advantage too.

| Opportunity | Details | Data |

|---|---|---|

| Market Growth | Leverage healthcare IT expansion. | $699.6B market by 2025 |

| AI Integration | Develop AI-driven solutions. | $61.7B AI in healthcare by 2025 |

| Data Exchange | Capitalize on interoperability. | 15% revenue increase in Q1 2024 |

Threats

Intense competition poses a significant threat. The healthcare IT market is crowded, with many vendors providing similar products. Veradigm battles established firms and startups. In 2024, the global healthcare IT market was valued at over $70 billion, with growth slowing due to increased competition. This environment pressures pricing and market share.

Veradigm faces regulatory threats, particularly concerning data privacy and security regulations such as HIPAA. The healthcare industry is heavily regulated, and any shifts in these rules can significantly affect Veradigm's operations. Compliance adjustments may necessitate substantial changes to their solutions, potentially increasing costs. The U.S. healthcare spending reached $4.5 trillion in 2022, highlighting the impact of regulatory changes.

Veradigm faces significant threats from data security breaches. Healthcare data is highly valuable to cybercriminals. The costs associated with breaches can be substantial. In 2024, the average cost of a healthcare data breach was $10.9 million.

Inability to Resolve Financial Reporting Issues

Veradigm faces threats if it can't fix its financial reporting issues. Failing to address internal control weaknesses could damage its reputation. This might erode investor trust and hinder operational effectiveness. Such issues can lead to significant financial repercussions. For example, in 2024, companies with reporting problems saw stock price drops.

- Reputational damage.

- Loss of investor confidence.

- Operational inefficiencies.

- Potential financial penalties.

Economic Downturns and Healthcare Spending Cuts

Economic downturns and cuts in healthcare spending pose significant threats to Veradigm. Reduced budgets for healthcare providers and payers could decrease demand for Veradigm's solutions. The healthcare sector's spending growth slowed to 4.2% in 2023, as reported by CMS, and future cuts could further strain Veradigm. This could limit the adoption of its services and negatively impact its financial performance.

- CMS projects healthcare spending to grow 5.3% in 2024.

- Veradigm's revenue growth could be affected by these external factors.

- Healthcare providers might delay or scale back technology investments.

Veradigm faces fierce competition and regulatory hurdles, with the global healthcare IT market exceeding $70 billion in 2024. Data security threats remain high, especially with average healthcare data breach costs hitting $10.9 million in 2024.

Financial reporting issues could severely damage investor trust, reflecting recent market trends.

Economic downturns and healthcare spending cuts, with CMS projecting 5.3% growth in 2024, present a significant threat.

| Threat | Description | Impact |

|---|---|---|

| Competition | Crowded market with many vendors. | Pressured pricing and market share. |

| Regulations | Data privacy, security (e.g., HIPAA). | Compliance costs; operational changes. |

| Data Breaches | Cyberattacks; healthcare data value. | Costs averaging $10.9M in 2024. |

SWOT Analysis Data Sources

This Veradigm SWOT analysis uses financial reports, market analysis, and industry publications for accurate, strategic evaluation.