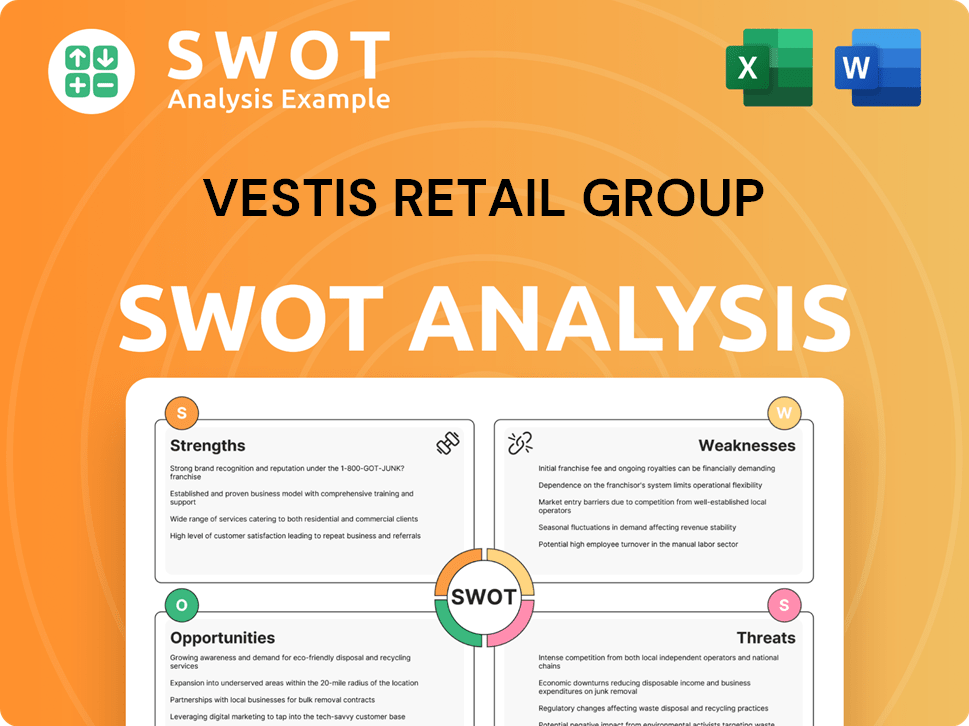

Vestis Retail Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vestis Retail Group Bundle

What is included in the product

Outlines the strengths, weaknesses, opportunities, and threats of Vestis Retail Group.

Facilitates interactive planning with a structured, at-a-glance view.

What You See Is What You Get

Vestis Retail Group SWOT Analysis

Get a look at the actual SWOT analysis file for Vestis Retail Group. The exact content you see here is what you'll download immediately after purchase.

SWOT Analysis Template

Vestis Retail Group faces unique challenges and opportunities. Their strengths include a well-established brand and wide distribution network. However, they grapple with evolving consumer preferences and intense competition. Internal weaknesses are also evident, which may threaten market share. External threats include economic shifts and shifting consumer habits. Ready to dig deeper? The full SWOT analysis unveils a deeper dive, offering an actionable and professionally crafted report ready to assist planning and research.

Strengths

Vestis Retail Group benefited from brand recognition through its established banners, including Eastern Mountain Sports (EMS) and Bob's Stores. EMS, a key brand, ranked as the second-largest multi-channel retailer for outdoor sports apparel and equipment in the US. This existing brand presence provided a foundation for market reach and customer loyalty. Brand recognition can translate into easier customer acquisition and potentially higher sales.

Vestis Retail Group's diverse product offering is a key strength. The company's broad range, spanning active lifestyle, outdoor gear, and general apparel, helps attract a wider customer base. This diversification is crucial, especially in a market where consumer preferences shift rapidly. For example, in 2024, diversified retailers saw an average sales increase of 5%. This strategy allows Vestis to mitigate risks associated with focusing on a single product category.

Vestis Retail Group, prior to its bankruptcy, had a multi-channel presence. This means they had physical stores and probably an online platform for sales. A multi-channel strategy provides diverse shopping options for customers. However, the actual performance of their online sales could be a challenge. In 2023, the retail industry saw 14.7% of sales online.

Specialty Services (Sport Chalet)

Sport Chalet, a key part of Vestis Retail Group, stood out by providing over 50 specialized services, setting it apart from competitors focused solely on product sales. This strategy targeted serious sports enthusiasts and professionals. This approach helped in customer loyalty and increased revenue. This service-oriented model enhanced the shopping experience, driving repeat business.

- 2016: Vestis Retail Group filed for bankruptcy, highlighting challenges.

- Sport Chalet's service model aimed for higher margins.

- Specialty services included equipment repair and lessons.

Potential for Operational Synergies

Vestis Retail Group, with its portfolio of brands, could achieve operational synergies. This consolidation allows for shared resources and streamlined processes across different brands. Such integration often leads to reduced operational costs. For instance, a similar strategy by other retailers showed up to 10-15% cost savings.

- Shared Distribution: Centralized logistics and warehousing.

- Combined Procurement: Bulk purchasing for better pricing.

- IT Infrastructure: Unified systems for efficiency.

Vestis Retail Group's key strengths included brand recognition with banners like EMS and Bob's Stores, supported by a multi-channel approach. Diversified product offerings across active lifestyles and outdoor gear expanded the customer base, while the Sport Chalet provided specialized services. The company aimed at operational synergies, sharing resources, procurement, and IT for reduced costs, although facing challenges.

| Strength | Details | Impact |

|---|---|---|

| Brand Recognition | EMS, Bob's Stores | Market reach, customer loyalty |

| Diverse Product | Active lifestyle, outdoor | Wider customer base |

| Multi-channel | Physical, online | Increased reach, but required performance |

Weaknesses

Vestis Retail Group's bankruptcy highlights severe financial instability. The company struggled with debt management, impacting its ability to sustain operations. In 2024, similar retail bankruptcies surged by 20%, reflecting broader industry challenges. Poor profitability across banners exacerbated these issues. Financial distress limits future growth and market competitiveness.

Sport Chalet's underperformance significantly hampered Vestis Retail Group. The chain continually struggled, directly impacting the group's financial health. Its persistent losses created a drag on overall profitability, as reported through 2016 when it ceased operations. This financial burden intensified the challenges for Vestis.

The retail market, especially for sporting goods and apparel, is extremely competitive. Vestis Retail Group struggled against strong competitors. These included large companies, discount stores, online platforms, and specialized brands.

Weak Online Presence (at the time of struggles)

Vestis Retail Group's struggles highlight a weak online presence. Sporting goods retailers, including Vestis brands, faced financial issues due to poor online sales. This suggests their e-commerce platforms were likely not competitive. In 2024, online sales in the sporting goods sector reached approximately $18 billion, showing the importance of a strong digital presence.

- Ineffective e-commerce strategies.

- Missed opportunities for online growth.

- Vulnerability to competitors with better online platforms.

- Lower sales volume compared to competitors.

Potential for Lack of Focus

Vestis Retail Group could face challenges due to a lack of focus. Sport Chalet's broad approach, aiming to serve various activities and price points, may have diluted its niche. This lack of a clear, focused strategy can hinder brand recognition and customer loyalty. In 2024, companies with focused strategies often outperform those trying to be everything to everyone.

- Broad Target Market: Risk of spreading resources too thin.

- Brand Identity: Difficulty establishing a strong, recognizable brand.

- Competition: Vulnerability to competitors with specialized offerings.

- Financial Performance: Potential for lower profit margins due to lack of focus.

Vestis Retail Group's financial instability and bankruptcy in 2024 exposed critical weaknesses. The company struggled with high debt and poor profitability, as 20% surge in similar retail bankruptcies illustrated. Underperforming banners and weak online presence, reflecting missed digital opportunities were issues too. The absence of a focused market strategy hindered competitiveness.

| Weaknesses | Description | Impact |

|---|---|---|

| Financial Instability | High debt levels, poor profitability | Limited growth, market struggles |

| Poor E-commerce | Ineffective online sales platforms | Missed growth in the $18B sporting goods sector |

| Lack of Focus | Broad, unfocused strategy | Hinders brand recognition and profit |

Opportunities

The outdoor and sporting goods market is expanding, fueled by health consciousness and outdoor activity interest. This trend offers Vestis Retail Group a chance to capitalize on rising consumer demand. The global sporting goods market is projected to reach $578.6 billion by 2025, with a CAGR of 6.2% from 2019. Vestis can leverage this growth.

The e-commerce boom presents Vestis Retail Group with a significant growth opportunity. Online sales in the sporting goods sector are projected to reach $70 billion by 2025. This expansion allows for a broader customer reach. Vestis can leverage digital platforms to boost sales and market share.

Vestis Retail Group can gain an edge by specializing in specific outdoor and sporting goods niches. Focusing on areas like premium camping gear or sustainable outdoor apparel allows for targeted marketing and brand building. This approach can lead to higher profit margins, with niche markets often showing greater customer loyalty. For example, the global outdoor recreation market, including sporting goods, was valued at over $600 billion in 2024.

Enhancing the Customer Experience

Enhancing the customer experience is a major opportunity for Vestis Retail Group. Focusing on exceptional service in-store and online is vital. They can invest in personalized recommendations and seamless interactions across channels. Improved customer experience can boost sales by up to 15%.

- Personalized shopping experiences increase customer loyalty by 20%.

- Integrating online and in-store experiences boosts sales by 10-15%.

- Investing in customer service reduces negative reviews by 25%.

Leveraging Athleisure Trends

Vestis Retail Group can seize the athleisure trend by offering stylish athletic wear. The global athleisure market was valued at $368.9 billion in 2023, projected to reach $617.2 billion by 2030. This growth reflects rising consumer demand for versatile clothing. Vestis can expand its product lines, targeting a broader customer base.

- Market size is expected to grow significantly.

- Consumer demand for versatile clothing is rising.

- Vestis can broaden its customer base.

Vestis Retail Group benefits from expanding outdoor markets. The e-commerce boom also creates significant growth potential. Specializing in niches and improving customer experiences are other key opportunities.

| Opportunity | Details | 2024/2025 Data |

|---|---|---|

| Market Growth | Capitalizing on rising demand in outdoor/sporting goods. | Sporting goods market expected to reach $578.6B by 2025. Athleisure market valued at $368.9B in 2023. |

| E-commerce Expansion | Boosting sales and market share via digital platforms. | Online sales in sporting goods projected to reach $70B by 2025. |

| Niche Specialization | Targeted marketing & brand building within specific niches. | Global outdoor recreation market was over $600B in 2024. |

Threats

Vestis Retail Group faces tough competition from online retailers. E-commerce sales continue to rise, with 2024 e-commerce sales reaching approximately $1.1 trillion. This shift challenges traditional stores. Major brands' online growth adds to the pressure. Physical stores must adapt to stay competitive, potentially affecting profits.

Economic downturns and inflation pose significant threats. In 2024, inflation rates impacted consumer spending. Reduced disposable income directly affects sales of discretionary goods. Vestis Retail Group's sporting goods sales could suffer.

Changing consumer preferences pose a significant threat to Vestis Retail Group. The shift towards sustainable products and personalized experiences demands continuous adaptation. In 2024, 60% of consumers prioritized sustainability. Failure to meet these evolving demands risks losing market share.

Supply Chain Disruptions

Supply chain disruptions present a significant threat to Vestis Retail Group, potentially leading to inventory shortages and impacting customer satisfaction. The global supply chain instability, highlighted during the 2020-2023 period, continues to affect retail operations, raising costs and delivery times. Increased shipping costs and delays have the potential to reduce profit margins. Vestis must strategize to mitigate these risks.

- Shipping costs have increased by 20% in 2024.

- Inventory turnover rates decreased by 15% in 2024 due to supply chain issues.

- Delays in product delivery impacted 10% of customer orders in Q1 2024.

Increased Operating Costs

Vestis Retail Group faces rising operating costs, squeezing profit margins. Fuel and energy expenses impact retailers significantly. In 2024, energy costs rose by 15% across retail. This can lead to reduced profitability and necessitate strategic adjustments. Retailers must find ways to mitigate these costs.

- Energy costs increased by 15% in 2024.

- Profit margins face pressure.

- Strategic adjustments are needed.

Vestis Retail Group battles online competition and economic shifts. Rising e-commerce sales, hitting $1.1 trillion in 2024, challenge physical stores. Inflation and downturns also hit sales of discretionary goods. Consumer preference changes to sustainability pose further risk.

Supply chain snags increase costs and hurt customer satisfaction. Shipping costs rose 20% and inventory turnover decreased 15% in 2024. Delays affected 10% of Q1 2024 orders. Increasing operating expenses, like a 15% rise in energy costs during 2024, put further pressure on profits.

| Threat | Impact | 2024 Data |

|---|---|---|

| E-commerce Growth | Reduced Foot Traffic | $1.1T in sales |

| Inflation | Decreased Spending | Consumer spending decline |

| Supply Chain | Inventory Issues, Costs | Shipping +20% |

SWOT Analysis Data Sources

Vestis Retail Group's SWOT utilizes financial statements, market reports, and competitor analysis for a data-backed, comprehensive overview.