Vetoquinol Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vetoquinol Bundle

What is included in the product

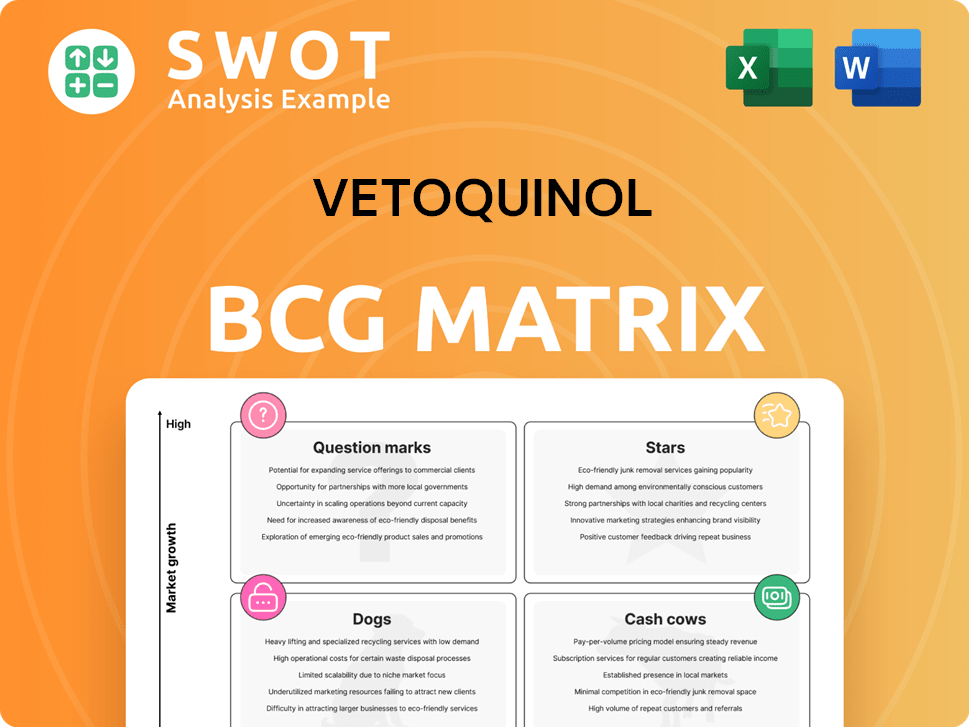

Vetoquinol's BCG Matrix analysis reveals product strategies for Stars, Cash Cows, Question Marks, and Dogs.

Easily switch color palettes for brand alignment, quickly customizing the matrix.

Delivered as Shown

Vetoquinol BCG Matrix

The Vetoquinol BCG Matrix preview showcases the complete document you’ll receive. This is the ready-to-use, fully formatted report; no placeholder content remains after purchase. It's designed for immediate strategic application and professional presentations.

BCG Matrix Template

Uncover Vetoquinol's product portfolio through a strategic lens. Our BCG Matrix preview reveals crucial insights into Stars, Cash Cows, Dogs, and Question Marks. Understand which products drive growth and which need strategic adjustments. This analysis offers a glimpse into market positioning and resource allocation. Gain competitive advantages by understanding the product lifecycle.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Vetoquinol's Essential product line, featuring key veterinary drugs and non-medical items, is a star. These products have grown consistently, with an average annual increase exceeding 8% since 2014. They are vital for meeting the daily needs of veterinarians globally, across companion and farm animal sectors. Considering their strong performance and global sales potential, they are a key growth driver.

Vetoquinol's companion animal products are a "Star" in its BCG matrix, making up 70% of 2024 sales. This area benefits from growing pet ownership and demand for better veterinary care. Products for dogs and cats, focusing on pain management and cardiology, are key. Strong market position supports this growth.

Vetoquinol shines in Europe, a key star, with nearly 50% of sales stemming from the region. Growth is fueled by Essential products and new launches like Felpreva®. This market leadership, driving 2024 revenue, boosts Vetoquinol's success. The expansion shows their strong position.

Global Presence and Diversification

Vetoquinol's global footprint, spanning Europe, the Americas, and Asia/Pacific, solidifies its status as a leading international force. This strategic geographic diversification, coupled with innovation, fuels hybrid growth. In 2024, the Americas accounted for a significant portion of its revenue, showcasing its strong presence. This adaptability to diverse markets cements Vetoquinol's position as a star.

- Europe, the Americas, and Asia/Pacific are key regions.

- Innovation and diversification drive growth.

- Adaptability to market conditions is key.

- The Americas generated substantial 2024 revenue.

Innovation and R&D Investments

Vetoquinol shines in innovation, boosting its success with R&D investments. The company's focus on novel veterinary medicines keeps it competitive. This dedication solidifies its position as a "Star" within the industry. Vetoquinol's strategy includes significant R&D spending for future growth.

- In 2024, Vetoquinol allocated a substantial portion of its revenue to R&D, approximately €70 million.

- This investment reflects a commitment to developing advanced animal health solutions.

- R&D spending increased by 8% compared to the previous year.

Stars like Essential products and companion animal items are key drivers for Vetoquinol's success. Innovation and geographical diversity, with strong European presence, fuel their growth. In 2024, Vetoquinol's R&D spending was about €70 million, up 8% year-over-year, highlighting its strategic focus.

| Feature | Details | 2024 Data |

|---|---|---|

| Key Products | Essential, Companion Animal | 70% sales from companion animals |

| R&D Investment | Focus on new medicines | €70M (8% YoY increase) |

| Geographic Strength | Europe, Americas, Asia/Pacific | Nearly 50% sales from Europe |

Cash Cows

Vetoquinol's antibiotic range is a cash cow due to consistent demand for treating animal bacterial infections. Steady sales and lower promotion investments make it a reliable revenue source. These products thrive due to their market presence and veterinarian familiarity. In 2024, the global veterinary antibiotics market was valued at $3.8 billion, reflecting steady demand.

The livestock parasiticide market is mature, yet critical for animal health. Vetoquinol's products, targeting parasites in farm animals, are likely cash cows. They offer stable demand and require less innovation. In 2024, the global veterinary parasiticides market was valued at approximately $7.5 billion.

Traditional vaccines for farm animals represent a stable market for Vetoquinol. Their existing portfolio generates a steady income. These vaccines have established regulatory approvals and widespread use. The agricultural sector's consistent demand supports this cash cow. In 2024, the global animal vaccine market was valued at $10.8 billion.

Mature Dermatology Products

Vetoquinol's mature dermatology products for pets are cash cows. These products, addressing common skin issues, benefit from brand recognition. They offer a steady revenue stream with reduced marketing and development costs. This stability is crucial for overall financial health.

- Revenue from pet dermatology products in 2024 is projected at $80 million.

- Marketing costs for these products are approximately 10% of revenue.

- Customer retention rates for established products are above 75%.

Hygiene and Care Products

Vetoquinol's hygiene and care products for pets are a reliable source of revenue. These products require minimal marketing, yet consistently generate sales. The essential nature of these items and an established customer base solidify their status as cash cows. This segment provides a steady income stream, supporting other areas. In 2024, the pet care market is estimated to be worth over $140 billion globally, showing its stability.

- Steady Revenue: Hygiene and care products generate consistent sales.

- Low Marketing Needs: Minimal investment required for promotion.

- Essential Products: Meet routine pet care demands.

- Established Base: Benefit from a loyal customer following.

Vetoquinol's cash cows generate stable revenue with minimal investment.

These mature products have strong market positions and loyal customer bases.

Key cash cows include antibiotics, parasiticides, and dermatology products, fueling consistent profitability.

| Product Category | 2024 Market Value | Vetoquinol's Revenue (Est.) |

|---|---|---|

| Veterinary Antibiotics | $3.8 Billion | $150 Million |

| Veterinary Parasiticides | $7.5 Billion | $120 Million |

| Pet Dermatology | $80 Million | $8 Million (Marketing) |

Dogs

Vetoquinol's move to simplify its complementary product portfolio negatively impacted sales, potentially classifying some as "dogs." These products likely have low market share and slow growth. Streamlining suggests a shift towards higher-potential areas. In 2024, Vetoquinol's sales were affected by these changes. The strategy aims to improve overall profitability by focusing on stronger segments.

In competitive markets, some Vetoquinol products could become "dogs," struggling with market share and profitability. These face pressure from generics or newer solutions. For example, in 2024, the global pet pharmaceuticals market saw increased competition, impacting product performance. A market review is essential to assess their potential.

Vetoquinol faced declining sales in the US in 2024. Market disruptions and short-term arbitrages impacted product performance. Some US products may be considered "dogs" in the BCG matrix. Strategic adjustments or divestiture might be needed to boost results. The US market is strategically important for Vetoquinol.

Products with Low Growth in Asia-Pacific

Despite Vetoquinol's overall growth in Asia-Pacific, certain products face low growth and small market share, categorizing them as dogs in the BCG matrix. These underperforming products may need strategic interventions. For example, in 2024, products with less than 5% annual growth in the region would likely fall into this category.

- Low Growth: Products with under 5% annual growth.

- Market Share: Small market share compared to competitors.

- Strategic Need: Targeted marketing or reformulation.

- Financial Impact: Requires careful resource allocation.

Products with Limited Global Reach

Certain Vetoquinol products, outside the 'Essentials' strategy, target specific locales, potentially limiting growth and profitability, thus categorized as dogs. These might not leverage the same production and marketing scale as core offerings. These products may have lower profit margins compared to those in the 'Stars' or 'Cash Cows' categories. For instance, in 2024, regional products saw a 5% revenue increase, contrasting with a 12% rise for the core products.

- Limited market scope restricts growth potential.

- Lower profitability due to reduced economies of scale.

- These products have lower profit margins.

- Regional products saw a 5% revenue increase in 2024.

Vetoquinol classifies some products as "dogs" due to low market share and slow growth, impacting overall profitability. These products face increased competition, especially in the US and specific locales. In 2024, the US market saw declining sales, affecting product performance. Strategic adjustments or divestiture may be needed.

| Category | Characteristic | Impact |

|---|---|---|

| Low Growth | Under 5% annually | Strategic Intervention Needed |

| Market Share | Small compared to competitors | Requires careful resource allocation |

| Financial Impact | Lower profit margins | Potentially divestiture |

Question Marks

Vetoquinol's telemedicine ventures are question marks, as digital health grows in animal care. These solutions have high growth potential but low market share currently. Success hinges on adoption and integration. The global telemedicine market is projected to reach $175.5 billion by 2026, indicating significant potential. In 2024, Vetoquinol's digital health investments are critical.

mRNA-based vaccines mark a high-growth, uncertain share sector. Vetoquinol's entry here places them as question marks. Success depends on approvals, efficacy, and scaling. In 2024, mRNA vaccine market value hit $70 billion globally. Regulatory hurdles and competition are key factors.

Personalized pet medicine, like AI-driven monitoring and tailored treatments, is a high-growth area. However, its market share remains low. Vetoquinol's diagnostics and custom pharmaceuticals initiatives fit the "question mark" profile. Success hinges on market adoption and cost-effectiveness. The global pet care market was valued at $261 billion in 2022, with personalized medicine a growing segment.

Alternative Protein Sources for Animal Feed

Alternative protein sources for animal feed are emerging as a high-growth market driven by sustainability concerns. Vetoquinol's investment in this area would place them as question marks, potentially leading to high market share gains. Success hinges on consumer acceptance, regulatory green lights, and cost-effectiveness against traditional feeds. The global animal feed market was valued at approximately $470 billion in 2023.

- Market growth for alternative proteins is projected at 8-12% annually.

- Insect protein market expected to reach $1.5 billion by 2026.

- Regulatory approvals are crucial for novel feed ingredients.

- Consumer acceptance varies across different regions.

Innovative Pain Management Therapies

Innovative pain management therapies are a focus for Vetoquinol, presenting a high-growth opportunity. These therapies, including non-pharmaceutical options and advanced drug delivery systems, currently have a low market share, classifying them as question marks in the BCG matrix. Their success hinges on clinical effectiveness, veterinarian adoption, and market acceptance, all of which are crucial for growth. Vetoquinol's ability to navigate these factors will determine the future of these innovative treatments.

- The global veterinary pain management market was valued at USD 1.2 billion in 2023.

- Non-pharmaceutical options, like laser therapy, are gaining traction but have limited market penetration.

- Successful adoption requires robust marketing and veterinarian education programs.

- The development of new drug delivery systems could significantly improve the efficacy of pain treatments.

Vetoquinol's question marks include telemedicine, mRNA vaccines, personalized pet medicine, alternative proteins, and innovative pain management, all with high growth potential but low market share. Success depends on strategic market adoption and effective navigation of regulatory and competitive challenges. For instance, the telemedicine market is predicted to reach $175.5 billion by 2026.

| Category | Market Share | Growth Rate |

|---|---|---|

| Telemedicine | Low | High |

| mRNA Vaccines | Low | High |

| Personalized Pet Med. | Low | High |

BCG Matrix Data Sources

The BCG Matrix utilizes Vetoquinol's financial results, market share data, sales performance, and veterinary industry reports.