VIA Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VIA Technologies Bundle

What is included in the product

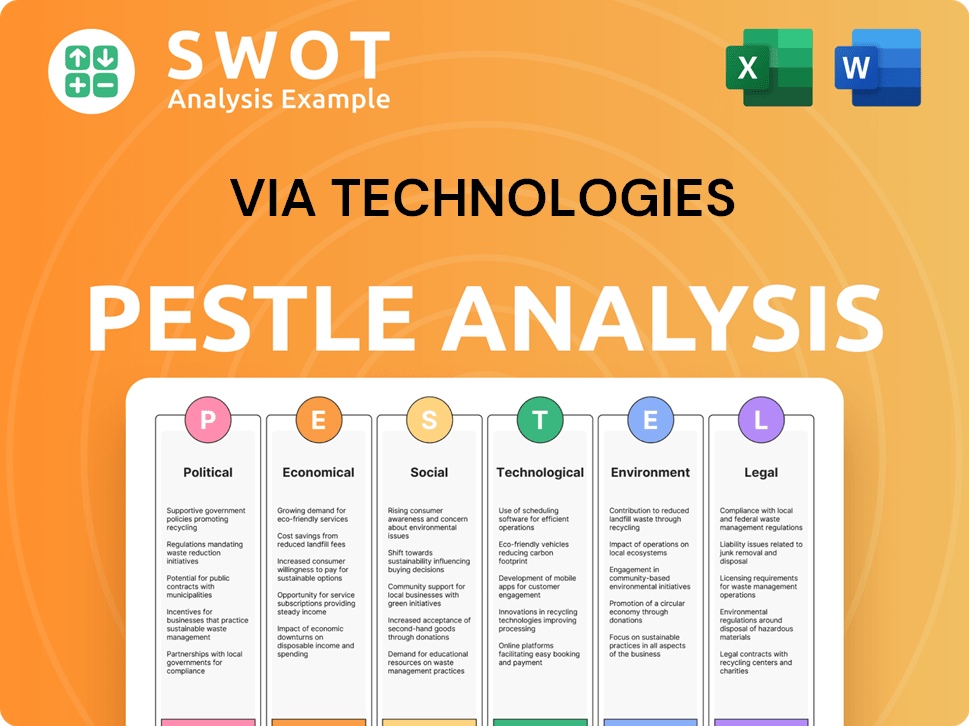

VIA Technologies' PESTLE analyzes external macro-environmental factors. Identifies opportunities, threats, supports proactive strategic design.

Allows teams to focus quickly by identifying VIA's major influencing external factors.

What You See Is What You Get

VIA Technologies PESTLE Analysis

The comprehensive VIA Technologies PESTLE analysis you see is the complete document. After purchase, you’ll get this exact same, fully prepared analysis. No revisions, no edits are required. It's instantly downloadable and ready for use. Get started right away!

PESTLE Analysis Template

Uncover the external factors shaping VIA Technologies. This PESTLE analysis examines political, economic, social, technological, legal, and environmental influences. Understand market trends and strategic challenges. Gain key insights for your business strategies. Enhance decision-making and identify opportunities with our complete analysis. Buy now for instant access to a competitive edge!

Political factors

VIA Technologies faces diverse government regulations globally. Trade policies, tariffs, and export controls significantly affect operations. For example, the U.S.-China trade tensions in 2024/2025 influence supply chains, potentially raising costs. Compliance with tech and manufacturing regulations is crucial. Changes in these policies directly impact VIA’s market access and profitability.

Geopolitical instability and trade wars pose risks for VIA. Dependence on specific regions for manufacturing or components can create operational disruptions. The US restrictions against China are a concern. VIA's reliance on Chinese orders makes it vulnerable. In 2024, global semiconductor sales were around $526 billion, a 13.2% increase from 2023.

Government incentives significantly influence the semiconductor sector. For example, the US CHIPS Act of 2022 allocated over $52 billion to boost domestic chip manufacturing and research. This type of support can spur VIA Technologies' R&D and market expansion. However, shifts in such government backing, like potential cuts or changes in subsidy programs, could reshape VIA's competitive position. In 2024, expect further policy adjustments.

Political Stability in Operating Regions

VIA Technologies' operational success hinges on the political stability of its operating regions. Taiwan, where VIA has its headquarters, demonstrates relative political stability, which supports consistent business operations. However, any shifts in leadership or policy could introduce uncertainties. Political stability directly impacts the investment climate and market conditions for VIA.

- Taiwan's GDP growth in 2024 is projected at 3.1%.

- VIA's revenue in 2023 was approximately $150 million USD.

- Changes in trade policies could affect VIA's supply chain.

Intellectual Property Protection

Intellectual property (IP) protection is crucial for VIA Technologies, a fabless semiconductor company. Government policies and international agreements on IP rights are vital. Strong legal frameworks help prevent infringement and maintain a competitive edge. In 2024, global IP infringement cost businesses an estimated $3 trillion. Robust IP protection is essential for VIA to safeguard its designs and innovations.

- VIA's patents and designs are valuable assets.

- IP protection laws vary by country.

- International agreements like the TRIPS Agreement are important.

- Counterfeiting and IP theft pose significant risks.

Political factors significantly impact VIA Technologies' operations. Trade policies and geopolitical tensions affect supply chains and costs, as seen in U.S.-China trade dynamics. Government incentives like the CHIPS Act influence R&D, potentially altering VIA's competitive landscape. IP protection, crucial for VIA, depends on government policies and international agreements, with global infringement costing $3T in 2024.

| Factor | Impact on VIA | Data/Fact (2024/2025) |

|---|---|---|

| Trade Policies | Affects supply chains, costs | U.S.-China trade tensions impact operations. |

| Government Incentives | Spurs R&D, market expansion | The US CHIPS Act allocated $52B for domestic chip manufacturing. |

| IP Protection | Safeguards designs and innovations | Global IP infringement cost businesses ~$3T. |

Economic factors

Global economic conditions significantly affect VIA Technologies. Strong global economic growth, as seen in early 2024 with moderate growth in the Eurozone and the US, boosts demand for electronic products. Conversely, recessionary periods, like the projected slowdown in China's GDP growth to around 4.6% in 2024, can reduce demand and impact VIA's sales. Inflation rates, which were around 3.5% in the US as of March 2024, also influence consumer spending on electronics and thus affect VIA's market.

VIA Technologies, as a global entity, faces currency exchange rate risks. For example, a strong USD against the TWD can boost reported revenues if sales are in USD, but increase costs if expenses are in TWD. In early 2024, the TWD/USD exchange rate fluctuated, impacting profitability. A weaker TWD makes exports cheaper, potentially boosting sales.

VIA Technologies heavily relies on the steady supply of raw materials and components. Supply chain disruptions significantly affect VIA's production costs and ability to deliver products on time. During the COVID-19 pandemic, many companies, including VIA, faced increased costs and delays. According to a 2024 report, global supply chain issues are expected to persist, impacting manufacturing timelines.

Market Competition and Pricing Pressure

VIA Technologies faces fierce competition in the semiconductor market. This competition, involving giants like Intel and AMD, creates significant pricing pressures. VIA must balance competitive pricing with the substantial R&D investments needed to innovate. This dynamic directly impacts profitability, as seen in the industry's fluctuating gross margins.

- Intel's Q1 2024 revenue was $12.7 billion, highlighting the competitive landscape.

- AMD's Q1 2024 revenue was $5.47 billion, demonstrating market rivalry.

- VIA's revenue in 2023 was $40 million, reflecting a small market share.

Investment and Funding Environment

VIA Technologies' ability to secure investment and funding is critical for its research and development, business expansion, and strategic acquisitions. The prevailing economic climate, particularly interest rates and investor sentiment, significantly impacts the accessibility and expense of capital. In 2024, the global semiconductor market saw fluctuations, with funding rounds influenced by geopolitical factors and technological advancements. For instance, in Q1 2024, venture capital investment in the semiconductor sector totaled approximately $3.5 billion.

- Interest rate hikes by central banks can increase borrowing costs, affecting VIA's funding options.

- Investor confidence, driven by economic forecasts and market performance, influences the willingness to invest in the tech sector.

- Government incentives and subsidies for semiconductor manufacturing can provide additional funding avenues.

- VIA's financial performance and strategic initiatives play a role in attracting investors and securing funding.

Economic conditions shape VIA's prospects. Global growth, as seen in early 2024, impacts demand; a projected Chinese slowdown affects sales. Inflation, around 3.5% in the US (March 2024), also influences consumer spending and impacts VIA's market.

| Economic Factor | Impact on VIA | 2024 Data/Forecast |

|---|---|---|

| GDP Growth | Demand for electronics | Eurozone: Moderate growth, China: ~4.6% |

| Inflation | Consumer spending | US: ~3.5% (March 2024) |

| Currency Exchange | Revenue & costs | TWD/USD rate fluctuations impact profitability. |

Sociological factors

The surge in demand for connected devices and IoT is a boon for VIA Technologies. Smart homes and industrial automation fuel the need for their energy-efficient systems. The global IoT market is projected to reach $1.8 trillion by 2025, according to Statista, creating huge opportunities. VIA's embedded solutions are well-positioned to capitalize on this growth.

VIA Technologies relies on a skilled workforce, including engineers and designers. The availability of tech talent is influenced by demographics and education. In Taiwan, where VIA is based, the tech sector's attractiveness and educational attainment rates (over 90% completion of secondary education) are key. The unemployment rate in Taiwan was around 3.4% in early 2024, indicating a competitive job market for skilled workers.

Lifestyle shifts and tech adoption rates significantly affect VIA's market. Remote work and digital communication boost demand for VIA's computing solutions. In 2024, global spending on digital transformation is projected to reach $3.9 trillion, indicating a strong market for VIA's products. The trend towards smart devices and IoT further fuels this demand.

Social Acceptance of AI and Automation

VIA Technologies needs to consider public attitudes toward AI and automation. Positive perceptions and ethical AI practices can boost market adoption. However, job displacement concerns and ethical debates might slow growth. The global AI market is projected to reach $1.81 trillion by 2030.

- Public trust in AI is crucial for market expansion.

- Ethical AI development and deployment are increasingly important.

- Job displacement fears can create market resistance.

- Regulatory frameworks impact AI adoption rates.

Corporate Social Responsibility and Ethics

VIA Technologies' success is increasingly tied to its commitment to corporate social responsibility (CSR) and ethical conduct. Consumer and investor sentiment is heavily influenced by a company's CSR performance. Companies with strong CSR records often see improved brand perception and loyalty. For instance, in 2024, companies with robust ESG (Environmental, Social, and Governance) ratings saw a 15% increase in investor interest.

- Ethical sourcing is vital, with 60% of consumers preferring brands with transparent supply chains.

- Adherence to labor standards and fair wages is crucial for building a positive reputation.

- Community engagement, such as supporting local initiatives, can boost VIA's brand image.

- Failure to meet ethical standards can lead to boycotts and reputational damage.

VIA Technologies must consider societal views on AI and automation, where ethical practices and public trust significantly affect market adoption. The rising importance of corporate social responsibility (CSR) impacts brand perception and loyalty. Ethical sourcing is vital, with 60% of consumers preferring transparent supply chains.

| Factor | Impact | Data |

|---|---|---|

| Public Perception of AI | Affects market adoption & trust | AI market to $1.81T by 2030 |

| CSR and Ethical Conduct | Influences brand reputation | ESG ratings saw 15% increase in 2024 investor interest |

| Ethical Sourcing | Consumer preference for transparent supply chains | 60% consumers prefer brands with transparent supply chains |

Technological factors

VIA Technologies heavily relies on rapid semiconductor advancements. The company needs to innovate smaller, more powerful, and energy-efficient chips. In 2024, the global semiconductor market reached $526.8 billion, showing a 13.3% increase from 2023. This growth highlights the importance of VIA's ability to compete. The company's focus on cutting-edge chip design is crucial.

VIA Technologies' emphasis on AI and computer vision means that advancements in these fields directly influence its products. The AI hardware market is projected to reach $194.9 billion by 2025. Developments in machine learning and computer vision boost demand for specialized hardware. The global computer vision market is expected to hit $25.1 billion in 2024, growing to $43.2 billion by 2029.

The embedded systems market, crucial for VIA Technologies, is rapidly changing. New applications demand more powerful, connected, and intelligent solutions. This impacts VIA's product development, especially in industrial automation and transportation. The global embedded systems market is expected to reach $235 billion by 2025.

Connectivity Technologies

VIA Technologies relies on advancements in connectivity technologies like 5G and Wi-Fi 6. These standards enhance their embedded systems and IoT solutions. Increased connectivity boosts functionality in VIA's markets. For example, the global 5G market is projected to reach $667.19 billion by 2029.

- 5G adoption is expected to grow significantly through 2025.

- Wi-Fi 6 is becoming a standard in new devices.

- VIA's products must support these technologies.

Research and Development Investment

VIA Technologies' investment in research and development is essential for its competitiveness. R&D spending directly impacts its ability to innovate and introduce new products. In 2024, the company allocated a significant portion of its budget to R&D, aiming to enhance its product offerings. This investment is vital for staying ahead of technological advancements and meeting market demands.

- R&D investment is critical for innovation.

- It enables new product development.

- VIA's 2024 R&D budget allocation was substantial.

- Investment supports staying competitive.

VIA Technologies must continuously adapt to rapid technological changes, particularly in semiconductor advancements, focusing on AI and connectivity like 5G, which is forecasted at $667.19 billion by 2029. Research and development (R&D) spending, crucial for innovation, saw significant allocation in 2024. Adapting to these trends is essential for maintaining a competitive edge.

| Technological Factor | Impact on VIA | Market Data (2024-2025) |

|---|---|---|

| Semiconductor Advancements | Requires continuous innovation | Global market: $526.8B (2024) |

| AI and Computer Vision | Drives product development | AI hardware market: $194.9B (2025) |

| Connectivity (5G, Wi-Fi 6) | Enhances product functionality | 5G market: $667.19B (2029 projection) |

Legal factors

Patent laws and intellectual property litigation are crucial for VIA Technologies. The company's history includes legal battles over patent infringement. A robust legal strategy and patent portfolio are essential. VIA's ability to protect its innovations directly impacts its market position. In 2024, the tech sector saw a 15% rise in IP litigation cases.

VIA Technologies must adhere to stringent product safety and liability regulations, especially for its embedded systems. These systems often operate in critical sectors such as automotive and industrial automation. In 2024, the global embedded systems market reached $180 billion, highlighting the stakes. Compliance is crucial to avoid legal issues and maintain market access.

VIA Technologies faces increasing scrutiny from data privacy and security laws. The General Data Protection Regulation (GDPR) and similar regional laws affect its connected device and system development. Compliance with these regulations is vital for VIA. In 2024, GDPR fines reached €1.7 billion, highlighting the stakes. Companies failing to comply risk significant penalties and reputational damage.

Employment Laws and Labor Regulations

VIA Technologies must navigate a complex web of employment laws across its global operations. These laws dictate working hours, wages, and employee benefits, varying significantly by country. Non-compliance can lead to hefty fines and reputational damage, as seen with other tech firms. For instance, in 2024, labor disputes cost companies an average of $1.5 million each.

- Compliance costs can represent up to 5% of operational expenses.

- Recent changes include stricter enforcement of data privacy in employee records.

- VIA needs to stay updated on regulations in key markets like Taiwan and the US.

Environmental Regulations and Compliance

VIA Technologies must adhere to environmental laws and regulations, particularly those concerning hazardous substances in electronics and waste management. Compliance is vital for avoiding penalties and maintaining operational licenses. The global market for green electronics is growing, with a projected value of $874.3 billion by 2025. Non-compliance can lead to significant fines, such as the $100 million fine imposed on a major electronics manufacturer in 2023 for environmental violations.

- 2024-2025: Focus on sustainable practices.

- Regulatory compliance is essential.

- The green electronics market is expanding.

Legal factors significantly impact VIA Technologies' operations. Intellectual property protection, including patent laws, is essential for safeguarding innovations; in 2024, IP litigation cases in the tech sector increased by 15%. Compliance with data privacy regulations like GDPR, and environmental standards is crucial to avoid penalties. In 2024, GDPR fines reached €1.7 billion.

| Aspect | Impact | 2024 Data |

|---|---|---|

| IP Litigation | Protect innovation | Tech sector litigation up 15% |

| Data Privacy (GDPR) | Avoid penalties/maintain trust | GDPR fines €1.7B |

| Employment Laws | Ensure fair practices | Avg. labor dispute cost: $1.5M |

Environmental factors

VIA Technologies' commitment to energy-efficient computing addresses rising concerns about electronic device and data center energy consumption. The global data center energy consumption is projected to reach over 1,000 TWh by 2025. VIA's energy-saving platforms help reduce power usage, thereby lowering the environmental impact of technology. This approach supports sustainability efforts within the tech industry.

The surge in global electronic waste poses a major environmental issue. VIA, as an electronics manufacturer, must address the environmental impact of its products. In 2023, approximately 57.4 million metric tons of e-waste were generated worldwide, a figure expected to reach 82 million tons by 2025. VIA should focus on product lifecycle and e-waste reduction strategies.

Environmental factors are crucial, particularly in supply chains. VIA Technologies' dependence on external foundries makes its partners' eco-friendliness vital. The semiconductor industry faces scrutiny; in 2024, it aimed for a 20% reduction in water usage. Sustainable sourcing directly affects VIA's reputation and operational costs.

Climate Change and Extreme Weather Events

Climate change presents indirect challenges for VIA Technologies. Extreme weather can disrupt supply chains and manufacturing, impacting production timelines. Resource scarcity, another climate change consequence, could affect the availability of materials used in chip production. Although chip design isn't directly affected, broader environmental shifts create operational risks. These risks can lead to increased costs and delays.

- According to the World Economic Forum, climate-related risks could cost the global economy $8.5 trillion by 2050.

- In 2024, extreme weather events caused over $100 billion in damages in the United States alone (NOAA).

Customer Demand for Sustainable Products

Customer demand for sustainable products is increasing. VIA Technologies can capitalize on this trend. They can offer energy-efficient solutions. These solutions can improve efficiency and reduce environmental impact. This is especially true in transportation and automation.

- Market research indicates a 20% year-over-year growth in demand for eco-friendly tech.

- VIA's focus on low-power processors aligns well with the sustainability trend.

- Companies are increasingly seeking suppliers with strong ESG credentials.

Environmental factors significantly influence VIA Technologies' operations and strategy. The tech industry's high energy consumption and e-waste production require sustainable solutions. Extreme weather and climate change create risks for supply chains and operational costs, as global climate-related risks may reach $8.5 trillion by 2050, as reported by the World Economic Forum. VIA's focus on energy efficiency aligns with growing demand for eco-friendly products.

| Environmental Aspect | Impact on VIA | 2024-2025 Data/Trends |

|---|---|---|

| Energy Consumption | Operational Costs, Reputation | Data center energy use will exceed 1,000 TWh by 2025 |

| Electronic Waste | Product Lifecycle, Brand Image | E-waste expected to hit 82 million tons by 2025 |

| Supply Chain Sustainability | Partner Reliance, Costs | Semiconductor water use reduction target 20% (2024) |

| Climate Change Risks | Production Delays, Supply Issues | US damages from extreme weather events exceeded $100 billion in 2024 |

PESTLE Analysis Data Sources

Our VIA Technologies PESTLE Analysis is built using a mix of market research reports, financial data, and government publications.