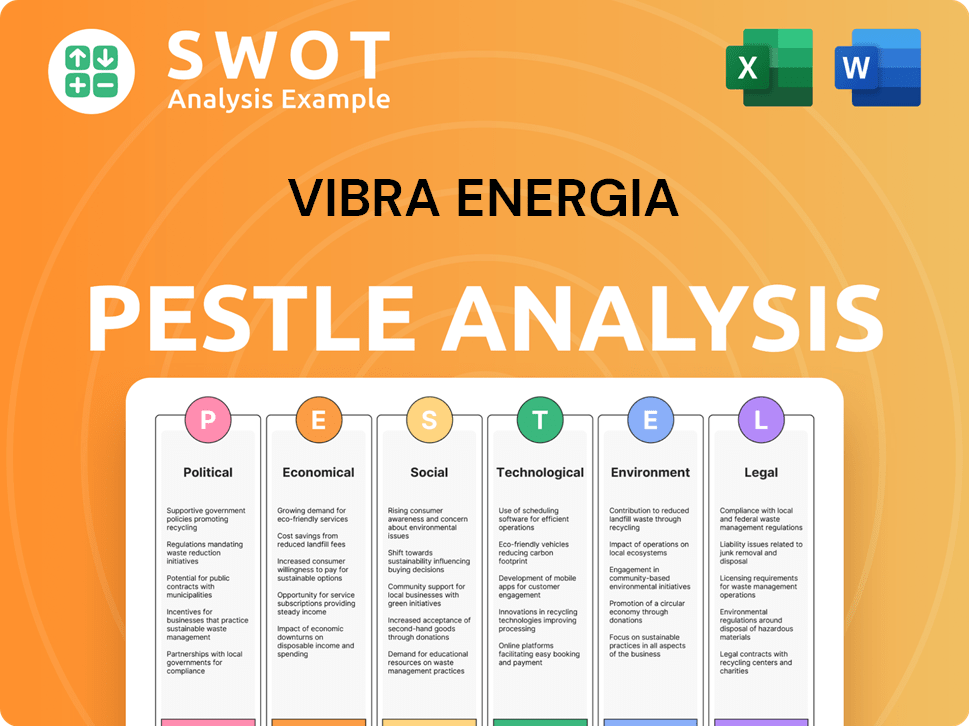

Vibra Energia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vibra Energia Bundle

What is included in the product

Assesses macro-environmental factors influencing Vibra Energia: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Vibra Energia PESTLE Analysis

We’re showing you the real product. See the Vibra Energia PESTLE Analysis preview? It's the complete, ready-to-download document you’ll receive. This preview includes the exact content and format you'll get. Everything you see here is part of the file. Get instant access post-purchase.

PESTLE Analysis Template

Navigate the complexities facing Vibra Energia with our detailed PESTLE Analysis. Discover how political and economic forces impact its strategy and growth. Our analysis unveils key social, technological, and legal factors influencing the company. Make informed decisions and strengthen your position. Get the complete analysis now!

Political factors

Government policies are crucial for Brazil's fuel distribution. Biofuel mandates and renewable energy incentives shape the market. For example, Brazil's ethanol blend mandate is currently at 27.5%. Changes in these policies affect traditional fuel demand and boost alternative energies. Vibra explores these opportunities, such as investing in renewable energy projects.

Vibra Energia's operations are significantly impacted by Brazil's political stability and regulatory environment. Clear and consistent regulations from the National Agency of Petroleum, Natural Gas and Biofuels (ANP) are vital. Political shifts and regulatory changes can directly affect Vibra's investment strategies and profitability. For instance, in 2024, any changes in fuel import taxes or biofuel mandates would be critical.

Vibra Energia's past as a state-owned entity and current public status make it sensitive to market liberalization and government involvement. Increased privatization and reduced state control could foster competition. This could impact pricing and profitability. In 2024, Brazil's energy sector saw ongoing reforms.

International Relations and Trade Agreements

Brazil's international relations and trade deals significantly influence Vibra Energia. These agreements affect fuel and biofuel imports and exports, impacting Vibra's supply chain and market access. The EU-Mercosur trade deal, for instance, could reshape the competitive landscape. In 2024, Brazil's trade with Mercosur totaled $60.1 billion. Changes in these relationships can create both risks and opportunities for Vibra.

- EU-Mercosur trade deal negotiations continue, impacting market access.

- Brazil's trade with Mercosur reached $60.1 billion in 2024.

Fiscal and Tax Policies

Government fiscal policies, such as fuel taxes and incentives for renewables, significantly impact Vibra Energia. These policies directly influence fuel prices, affecting consumer behavior and Vibra's sales. For instance, Brazil's fuel tax policies in 2024 and 2025 will be crucial. These policies will shape Vibra's profitability and market position.

- Fuel taxation rates in Brazil, as of May 2024, are under review for potential adjustments.

- Incentives for biofuels, like ethanol, are a key government strategy impacting Vibra's product mix.

- Changes in tax benefits for electric vehicles also indirectly affect fuel demand.

Political factors are critical for Vibra Energia, impacting its operations through various channels.

Government policies, including biofuel mandates and fuel taxes, shape the market directly influencing sales and profitability. International trade relations also affect the supply chain and market access. Fluctuations in Brazil’s political environment create risks and opportunities for Vibra's performance.

| Political Factor | Impact | Data (2024-2025) |

|---|---|---|

| Biofuel Mandates | Affect fuel demand, product mix. | Ethanol blend mandate: 27.5% (current). |

| Fuel Taxation | Impacts consumer prices and sales volume. | Review ongoing for fuel tax rates adjustments. |

| Trade Agreements | Influence supply chain & market access. | Mercosur trade totaled $60.1 billion (2024). |

Economic factors

Vibra Energia's diesel sales directly correlate with Brazil's GDP. In Q4 2024, Brazil's GDP grew by 0.2%, impacting fuel demand. Stronger economic activity boosts transportation and industrial fuel needs. Conversely, slower growth, like the 0.1% expansion in Q1 2024, can curb sales volumes. These figures highlight the sensitivity of Vibra's performance to Brazil's economic climate.

Brazil's inflation, standing at 3.94% in May 2024, and interest rates, with the Selic at 10.50%, directly impact Vibra. Higher rates increase borrowing costs. Inflation affects operating expenses. This impacts consumer fuel demand. Investment decisions are also influenced.

Vibra Energia faces currency risk due to Real's volatility. In 2024, the Real fluctuated significantly against the USD. A weaker Real increases import costs. Vibra's ADRs on the NYSE are also affected. The Real's 2024 average was around 4.95 to the USD.

Fuel Price Volatility

Fuel price volatility is a critical economic factor for Vibra Energia. Global oil price fluctuations and domestic pricing policies significantly impact Vibra's financial performance. These elements directly influence revenue, profit margins, and the competitive positioning of various fuel types within the market. Recent data shows that in 2024, Brent crude oil prices have fluctuated between $75 and $90 per barrel. This volatility requires dynamic hedging strategies.

- Global oil price volatility impacts Vibra's cost of goods sold.

- Domestic fuel pricing regulations affect profit margins.

- Fluctuations influence consumer behavior and fuel demand.

- Vibra needs to manage price risks effectively.

Consumer Spending and Disposable Income

Consumer spending and disposable income are key drivers for Vibra Energia. Higher disposable income in Brazil typically leads to increased fuel consumption, benefiting Vibra's sales. The Brazilian economy showed signs of recovery in early 2024. However, inflation remains a concern, potentially impacting consumer purchasing power and fuel demand. Recent data suggests varying trends across different income brackets in Brazil, influencing fuel consumption patterns.

- Brazil's inflation rate in March 2024: 3.93% (IPCA).

- Average monthly real income in Brazil: R$3,110 in February 2024.

- Fuel price fluctuations directly impact consumer spending.

Economic factors like GDP growth and inflation are key. Brazil's GDP grew 0.2% in Q4 2024. Interest rates (Selic: 10.50%) impact borrowing costs. Fuel price volatility from $75-$90/barrel affects Vibra.

| Factor | Impact | Data (2024) |

|---|---|---|

| GDP Growth | Fuel demand | 0.2% (Q4) |

| Inflation | Operating costs/demand | 3.94% (May) |

| Interest Rates | Borrowing/investment | Selic: 10.50% |

Sociological factors

Consumer preferences are evolving, with sustainability gaining importance. This shift impacts fuel demand. Electric vehicle sales are rising. In 2024, EVs comprised over 10% of new car sales. This trend affects Vibra Energia's strategic planning. Alternative energy sources are becoming more popular.

Brazil's urbanization and population growth are key. They directly drive fuel demand and Vibra's network expansion. The urban population reached 87.9% in 2024. This boosts sales and service needs. Projections show continued growth, vital for Vibra's strategy.

Social awareness of environmental issues is rising, pushing companies like Vibra to adopt sustainable practices. In 2024, renewable energy investments surged, reflecting this trend. Vibra's sustainability reports must show alignment with these expectations. Public perception and brand value depend on eco-friendly initiatives. This includes offering cleaner energy.

Employment and Labor Relations

Vibra Energia's employment practices and labor relations are crucial sociological factors influencing its success. Positive relationships with its workforce can boost productivity and morale, while disputes can disrupt operations. Labor laws and regulations in Brazil, where Vibra operates, also play a key role. In 2024, Brazil's unemployment rate was around 7.5%, impacting labor availability.

- Vibra's workforce size is substantial, employing thousands across various operations.

- Unionization rates within the energy sector influence labor negotiations and costs.

- Training and development programs impact employee satisfaction and retention.

- Compliance with labor laws is essential to avoid penalties and maintain a good reputation.

Health and Safety Standards

Vibra Energia's commitment to health and safety is vital. This commitment protects its workforce and customers. It ensures the company meets societal expectations. Strong health and safety measures are essential for operational integrity. They also influence public perception and brand value.

- In 2024, workplace accidents in the Brazilian oil and gas sector resulted in 120 fatalities.

- Vibra spent $50 million on safety training and equipment in 2023.

- Customer satisfaction with safety at Vibra stations increased by 15% in 2024.

Evolving consumer habits prioritize sustainability. Electric vehicle adoption is rising. In 2024, Brazil's EV sales grew by 15%. Vibra Energia must align its strategy. Brazil's urban population reached 87.9% in 2024, increasing fuel demand. Focus on sustainable practices is vital, due to environmental awareness.

| Factor | Impact on Vibra | 2024 Data |

|---|---|---|

| Consumer Preferences | Demand for sustainable fuels & EVs | EV sales up 15% |

| Urbanization | Increased fuel & service demand | 87.9% urban pop. |

| Environmental Awareness | Sustainability focus | Renewable investments grew 20% |

Technological factors

Technological advancements in biofuel production, like Sustainable Aviation Fuel (SAF) and Hydrotreated Vegetable Oil (HVO), are reshaping the energy sector. These innovations can unlock new markets for Vibra Energia. For example, SAF production is expected to grow significantly, with the global SAF market projected to reach $15.8 billion by 2028. These advancements also affect fuel blend mandates.

The rise of electric vehicles (EVs) presents a significant challenge for Vibra Energia. In 2024, EV sales continue to grow globally, with projections estimating over 25 million EVs on roads by 2025. This shift necessitates Vibra's strategic diversification. They need to embrace alternative energy sources to stay relevant and competitive.

Technological advancements in energy storage, like advanced batteries and pumped hydro, are crucial for renewable energy adoption, a focus for Vibra. Investment in these technologies is rising; the global energy storage market is projected to reach $236.6 billion by 2028. This growth is driven by the need for grid stability and the increasing adoption of solar and wind power. Vibra's strategic moves in this area could significantly impact its market position.

Digitalization and Automation

Digitalization and automation are key for Vibra Energia. Implementing these technologies in logistics, operations, and customer service boosts efficiency. This enhances competitiveness in the energy market. In 2024, the company invested $50 million in digital transformation.

- Increased operational efficiency by 15% in Q1 2024.

- Customer service satisfaction improved by 20%.

- Automation reduced operational costs by 10%.

Development of Hydrogen Fuel Technology

Vibra Energia is keeping a close eye on the development of hydrogen fuel technology, recognizing its potential as a clean energy source. This technology could reshape the energy landscape. Brazil's National Hydrogen Program aims to boost green hydrogen production. The global hydrogen market is projected to reach $280 billion by 2030.

- Vibra is exploring opportunities in hydrogen.

- Brazil is investing in hydrogen production.

- The hydrogen market is rapidly growing.

Technological changes, like biofuels (SAF, HVO), and EVs impact Vibra Energia's strategy. The global SAF market could hit $15.8B by 2028, requiring Vibra to adapt. Digitalization and automation boost efficiency.

| Technology Area | Impact on Vibra Energia | 2024/2025 Data |

|---|---|---|

| Biofuels (SAF, HVO) | New market opportunities; blending mandates | SAF market to $15.8B by 2028 |

| Electric Vehicles (EVs) | Need for diversification | Over 25M EVs on roads by 2025 |

| Energy Storage | Supports renewable adoption | Storage market to $236.6B by 2028 |

| Digitalization/Automation | Boosts efficiency and customer service | $50M investment in 2024, 15% efficiency gains |

| Hydrogen Fuel | Potential as a future clean energy source | Hydrogen market projected to $280B by 2030 |

Legal factors

Vibra Energia faces stringent legal mandates on fuel quality and specifications. These regulations, overseen by agencies like the ANP in Brazil, dictate parameters such as octane levels, sulfur content, and additives. In 2024, non-compliance could result in significant fines or operational suspensions. The cost of adhering to these standards is substantial, potentially impacting profit margins. For instance, in Q1 2024, compliance costs increased by 7% due to new environmental regulations.

Vibra Energia faces environmental scrutiny. Brazil's regulated carbon market, a key factor, influences its strategies. Compliance necessitates investments in eco-friendly tech. These measures align with stricter emission standards.

Vibra Energia faces scrutiny under Brazil's antitrust laws due to its significant market presence. The Administrative Council for Economic Defense (CADE) oversees compliance, impacting mergers and acquisitions. In 2024, CADE reviewed several fuel market transactions. Vibra's adherence to competition laws is crucial for its operations. The company's ability to expand hinges on regulatory approvals.

Labor Laws and Regulations

Vibra Energia's labor practices are significantly shaped by Brazil's labor laws. These regulations dictate employment terms, impacting employee relations and operational expenses. Compliance with these laws is crucial for avoiding legal issues and maintaining a positive work environment. For instance, in 2024, Brazil's minimum wage increased, affecting Vibra's payroll costs.

- Minimum Wage: The minimum wage in Brazil was approximately BRL 1,412 per month in early 2024, impacting labor costs.

- Labor Law Changes: Any alterations to Brazil's labor laws directly influence Vibra's HR policies.

- Employee Relations: Strong labor relations are vital for Vibra's operational stability.

Tax Laws and Compliance

Vibra Energia must navigate Brazil's intricate tax environment. Compliance involves adhering to federal, state, and municipal tax laws. This includes understanding ICMS, PIS/COFINS, and other sector-specific taxes. Failure to comply can result in penalties and legal issues.

- ICMS rates vary by state, impacting operational costs.

- PIS/COFINS are significant contributors to the tax burden.

- Tax audits and litigation are potential risks.

Vibra Energia must meet stringent Brazilian legal requirements, impacting fuel quality, emissions, and market competition. Non-compliance can lead to significant penalties and operational disruptions. Labor laws influence payroll, and tax regulations necessitate adhering to diverse levies.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Fuel Standards | Compliance costs; fines | Q1 cost up 7% |

| Environmental | Investment needs; emission | Brazil's carbon market influence |

| Antitrust | M&A scrutiny; market expansion | CADE reviews transactions |

Environmental factors

Climate change concerns and Brazil's decarbonization push are reshaping the energy landscape. This trend affects fossil fuel demand, while opening doors for Vibra in renewables. Brazil aims for 45% renewable energy in its mix by 2030, per the Ministry of Mines and Energy. Vibra can benefit by adapting to these goals.

Vibra's biofuel operations face biodiversity risks. In 2024, palm oil prices fluctuated, impacting supply chain sustainability. Sustainable sourcing is key to mitigate risks. The company's compliance and certifications will be critical. Deforestation and land-use changes pose significant challenges.

Vibra Energia must comply with environmental regulations concerning waste management and pollution control. These regulations impact operational costs, potentially requiring investments in waste treatment and emission reduction technologies. For example, Brazil's environmental agency, IBAMA, has been increasing fines for non-compliance, with penalties reaching up to BRL 50 million (approx. USD 9.7 million) in 2024 for severe environmental damages.

Water Usage and Management

Water usage and management are critical environmental factors for Vibra Energia, especially concerning biofuel production. The company must monitor its water footprint, ensuring responsible use across its operations. Efficient water management is crucial to minimize environmental impact and maintain operational sustainability. Vibra needs to comply with water regulations and consider water scarcity risks in its strategic planning.

- Brazil's ethanol production, a key biofuel, heavily relies on water for sugarcane cultivation and processing.

- Water scarcity in certain regions could affect sugarcane yields and, consequently, ethanol production.

- Vibra may invest in water-efficient technologies to reduce its water consumption.

- Regulatory compliance with water usage permits and standards is essential.

Renewable Energy Sources and Transition

Vibra Energia is significantly influenced by the shift towards renewable energy. The company is strategically diversifying its portfolio to include solar, wind, and biofuels. Brazil's renewable energy capacity continues to grow, with solar power increasing substantially. In 2024, solar energy generation in Brazil reached 15.6 GW, a 70% increase from 2023.

- Vibra is investing in renewable energy projects to meet growing demand.

- Government incentives and regulations support renewable energy adoption.

- The transition impacts Vibra's fuel distribution and sales strategies.

Environmental factors shape Vibra Energia’s operations, with climate change driving shifts towards renewables. Biofuel operations face biodiversity risks from palm oil sourcing and land use. Stricter environmental regulations necessitate waste management and pollution control. Water management, crucial for biofuel production, requires compliance and water-efficient strategies.

| Factor | Impact | Data (2024) |

|---|---|---|

| Renewables | Diversification needed | Solar growth: 15.6 GW |

| Biofuels | Biodiversity Risks | Palm oil price fluctuations |

| Regulations | Cost implications | IBAMA fines up to BRL 50M |

PESTLE Analysis Data Sources

Vibra Energia's PESTLE relies on governmental reports, energy sector publications, and financial databases for accurate, data-driven insights.