Vietin Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vietin Bank Bundle

What is included in the product

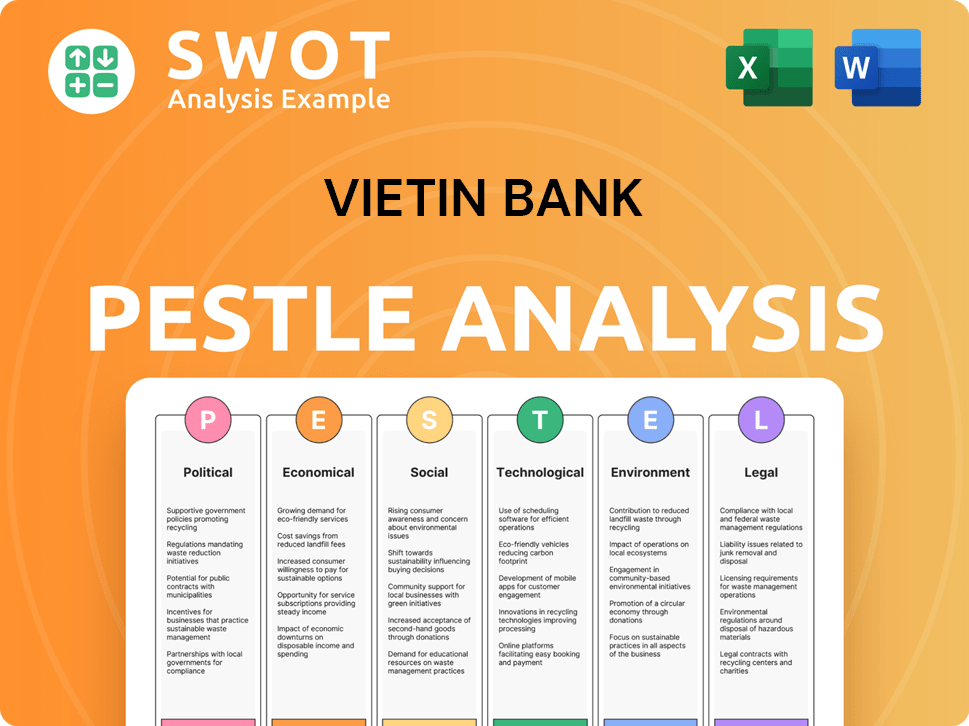

The PESTLE analysis examines how external macro-environmental forces influence Vietin Bank, using data and trends.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Vietin Bank PESTLE Analysis

This PESTLE analysis preview is the full document.

It contains the complete analysis of VietinBank.

You'll receive this very same file upon purchase.

Download it instantly, ready to use!

PESTLE Analysis Template

Explore Vietin Bank's strategic landscape with our in-depth PESTLE Analysis.

Understand how political factors, like regulatory changes, influence the bank's operations.

Uncover economic forces, from interest rates to market competition.

Analyze social trends impacting customer behavior and values.

Weigh technological advancements transforming financial services.

Grasp legal and environmental impacts affecting Vietin Bank.

Gain actionable insights - download the full version for instant access.

Political factors

The State Bank of Vietnam (SBV) heavily influences VietinBank. SBV directives shape monetary policy and credit growth. In 2024, the SBV aimed for 14-15% credit growth. These policies directly impact VietinBank's operations and strategy.

As a state-owned entity, VietinBank operates under significant government influence. The State Bank of Vietnam (SBV) holds a majority stake, shaping the bank's strategic direction. In 2024, the SBV maintained its dominant role, impacting VietinBank's operations.

The Vietnamese government's active role in financial sector restructuring, particularly involving banks, significantly impacts VietinBank. In 2024, the State Bank of Vietnam continued overseeing mergers and acquisitions to consolidate the banking system. VietinBank may face both opportunities and hurdles depending on these restructuring plans. For instance, if VietinBank acquires a smaller bank, it can expand its market share, but integration challenges could arise.

Political Stability

Vietnam's political stability fosters a conducive environment for businesses, including banking. A stable climate minimizes risk, attracting investment and supporting bank growth. VietinBank benefits from this stability, which encourages expansion and financial health. This stability is reflected in consistent GDP growth, reaching 5.05% in 2024.

- Vietnam's political stability rating is consistently high, indicating a low risk environment.

- Foreign direct investment (FDI) into Vietnam has increased by 15% in 2024, signaling confidence in the political and economic outlook.

International Relations and Trade Agreements

Vietnam's involvement in international trade agreements and its relationships with other nations significantly affect its banking sector. Changes in foreign investment rules, trade finance prospects, and sensitivity to global economic shifts are all influenced by these factors. For instance, the EU-Vietnam Free Trade Agreement (EVFTA) has increased trade, potentially boosting trade finance for banks like VietinBank. In 2024, Vietnam's total trade reached $683 billion.

- EVFTA has led to a 20% increase in trade between Vietnam and the EU since its implementation.

- VietinBank's international transactions grew by 15% in 2024 due to increased trade activities.

- Vietnam's GDP growth is projected at 6% in 2025, partly due to favorable trade conditions.

Political stability in Vietnam is consistently high, fostering a favorable business environment. The State Bank of Vietnam (SBV) significantly influences VietinBank's strategy through monetary policy and oversight. Government involvement in bank restructuring, including mergers and acquisitions, presents both opportunities and challenges.

| Aspect | Details |

|---|---|

| Credit Growth Target (2024) | 14-15% |

| FDI Increase (2024) | 15% |

| Vietnam Total Trade (2024) | $683 billion |

| GDP Growth (2025 Projected) | 6% |

Economic factors

Vietnam's economy is forecasted to grow strongly in 2025, providing a favorable environment for VietinBank. This growth, with projections around 6-6.5%, will likely boost demand for banking services. Increased demand supports the bank's growth and profitability. For example, in 2024, the GDP grew by 5.66%.

The State Bank of Vietnam (SBV) establishes yearly credit growth targets to foster economic growth. VietinBank must achieve these goals while preserving asset quality. In 2024, SBV set a credit growth target of 14-15% for the banking system. Meeting this is vital for VietinBank's success and aiding Vietnam's economy.

Inflation in Vietnam, a key factor, impacts VietinBank's net interest margins. The State Bank of Vietnam (SBV) manages interest rates, influencing the cost of funds. In 2024, inflation was around 4%, affecting lending and deposit rates. VietinBank balances deposit attraction with affordable credit, crucial in this environment.

Non-Performing Loans (NPLs)

Managing non-performing loans (NPLs) remains a key challenge for VietinBank. The bank's success in managing its NPL ratio directly affects its financial stability and operational effectiveness. As of the end of 2023, VietinBank's NPL ratio was reported at 1.16%, showing an improvement over the previous year's 1.47%. Effective debt recovery strategies are crucial for VietinBank's long-term financial health and profitability.

- VietinBank's NPL ratio improved from 1.47% in 2022 to 1.16% by the end of 2023.

- Effective debt recovery strategies are vital for sustained financial health.

Increased Foreign Investment

VietinBank stands to benefit from heightened foreign investment, spurred by government initiatives and possible expansions in foreign ownership limits. This influx of capital can drive growth and introduce advanced technologies. Enhanced competition could also push VietinBank to improve its services. In 2024, Vietnam's FDI reached $23.18 billion, reflecting strong investor confidence.

- FDI inflows in 2024: $23.18 billion.

- Potential benefits: New capital, technology, and expertise.

- Impact: Increased competition and improved services.

Vietnam's solid economic growth, forecasted around 6-6.5% in 2025, offers VietinBank opportunities. Credit growth targets set by SBV are essential, and VietinBank's asset quality management is crucial. The inflation rate around 4% in 2024 influences interest rates, which impacts profitability.

| Factor | Details | Impact on VietinBank |

|---|---|---|

| GDP Growth (2025) | Projected at 6-6.5% | Boosts demand for banking services, supports growth |

| Credit Growth Target (2024) | SBV set 14-15% | Requires strategic planning for loan disbursement |

| Inflation (2024) | Approximately 4% | Influences interest rate policies affecting margins |

| NPL Ratio (End of 2023) | Reported at 1.16% | Requires effective debt recovery to ensure financial stability |

Sociological factors

Vietnam's rising middle class and rapid urbanization are fueling demand for retail banking services. This includes mortgages, consumer loans, and digital banking solutions. VietinBank should focus on expanding its retail offerings to meet this growing need. In 2024, urban population growth was approximately 3.6%.

Consumer behavior is changing, with digital tech adoption rising. Financial literacy is also growing, impacting how people manage money. VietinBank must adapt, offering digital services to meet new demands. In 2024, digital banking users in Vietnam grew by 25%. Enhance financial education to serve informed clients.

VietinBank's success relies heavily on its workforce. As of Q1 2024, the bank employed over 20,000 people, highlighting the need for skilled professionals. Investment in training programs and competitive salaries, crucial for attracting and retaining talent, amounted to approximately $25 million in 2023. These factors directly influence service quality and operational efficiency, key drivers for VietinBank's performance.

Social Responsibility and Community Engagement

VietinBank's dedication to social responsibility strengthens its brand. The bank's support for social welfare programs and CSR initiatives improves its public image, fostering customer loyalty and trust. In 2024, VietinBank allocated approximately VND 500 billion to social and community projects. This commitment is evident in its environmental sustainability efforts and support for educational programs. These actions boost stakeholder confidence and align with evolving societal values.

Demographic Trends

Vietnam's youthful population, with a median age of around 32, offers a significant customer base for VietinBank. This demographic, particularly those aged 18-35, is increasingly tech-savvy and open to digital banking solutions. Understanding the financial behaviors of different age groups, income levels, and geographic locations is vital for tailored product development and marketing strategies. The bank can tap into the growing demand for financial services among young professionals and entrepreneurs.

- Median Age: Approximately 32 years old (2024).

- Digital Banking Adoption: Increasing among younger demographics.

- Target Market: Young professionals and entrepreneurs.

VietinBank's performance is greatly affected by societal factors like demographics and digital shifts. The youthful population and the rise in financial literacy shape service demands. The bank's investment in CSR, about VND 500 billion in 2024, strengthens its public image. Understanding these societal trends is key to crafting effective banking strategies.

| Factor | Details |

|---|---|

| Median Age (2024) | Approximately 32 years old |

| Digital Banking Growth (2024) | 25% increase |

| CSR Spending (2024) | ~VND 500 billion |

Technological factors

VietinBank faces rapid digital transformation. Continuous tech investment is crucial. This boosts efficiency and customer experience via digital channels. In 2024, digital banking transactions rose 30%. New products and services are vital for competitiveness.

Fintech advancements intensify competition for VietinBank. The bank needs to adopt fintech to stay competitive. In 2024, Vietnam's fintech market grew by 30%, highlighting the need for digital adaptation. Partnering with fintech firms or developing its own solutions is crucial. This helps meet changing customer demands.

Cybersecurity and data protection are paramount due to VietinBank's digital shift. In 2024, global cybercrime costs hit $8.4 trillion, highlighting the risks. VietinBank needs significant investment in advanced security systems to safeguard customer information. This includes measures like AI-driven threat detection and robust data encryption, crucial for maintaining customer trust and regulatory compliance.

Development of Digital Infrastructure

Vietnam's digital infrastructure is rapidly evolving, boosting VietinBank's tech adoption. Internet penetration reached 79.4% in 2024, supporting digital banking. Mobile connectivity is also increasing, with over 70 million mobile internet subscribers as of late 2024. This growth enables VietinBank to expand digital services and implement new technologies effectively.

- Internet penetration: 79.4% (2024)

- Mobile internet subscribers: 70+ million (late 2024)

Application of Emerging Technologies

VietinBank's embrace of emerging tech is crucial. AI, blockchain, and IoT offer chances for innovation and efficiency. These technologies can enable personalized services. In 2024, digital banking transactions rose by 30%. VietinBank's tech investments are projected to reach $150 million by 2025.

VietinBank must navigate rapid technological change, focusing on digital banking and fintech adoption to remain competitive. Investment in cybersecurity and data protection is critical as cybercrime costs continue to rise globally. In 2024, digital transactions surged 30%, emphasizing tech's impact. VietinBank's tech investment projected to $150M by 2025.

| Technology Factor | Impact on VietinBank | 2024/2025 Data |

|---|---|---|

| Digital Transformation | Boosts efficiency, customer experience | 30% rise in digital banking transactions (2024) |

| Fintech Competition | Necessitates fintech adoption | Vietnam fintech market grew 30% (2024) |

| Cybersecurity | Protects data, ensures compliance | Global cybercrime cost $8.4T (2024) |

Legal factors

VietinBank is governed by Vietnam's Law on Credit Institutions, setting operational standards. Regulatory changes affect capital needs and banking activities. In 2024, new regulations focused on risk management and digital banking. These updates aim to strengthen the financial sector. Recent data shows compliance costs increased by 5% due to these changes.

The State Bank of Vietnam (SBV) regularly releases directives and circulars. These documents offer specific instructions on monetary policy, credit, and risk management, which VietinBank must strictly follow. In 2024, the SBV issued over 50 circulars impacting banking practices. Non-compliance can lead to significant penalties, as seen in the 2024 fines totaling over VND 10 billion for various banks.

Recent regulatory shifts in Vietnam could reshape VietinBank's foreign ownership dynamics. In 2024, the State Bank of Vietnam might adjust foreign ownership limits. This could attract more foreign investment or alter VietinBank's competitive position. For instance, if the cap rises, it might boost the bank's access to capital and expertise. However, it also means more competition from foreign-backed banks.

Laws Related to Non-Performing Loan Resolution

VietinBank's asset quality management relies heavily on the legal framework for non-performing loan (NPL) resolution. The efficiency of Vietnam's legal processes for debt recovery significantly affects the bank's financial health. Effective laws and enforcement can minimize losses from bad loans. The legal environment's stability fosters investor confidence. In 2024, NPLs in the banking sector were around 1.73%, showing the importance of efficient legal mechanisms.

- Decree 08/2024/ND-CP on extension of debt restructuring.

- Circular 02/2023/TT-NHNN: guiding the rescheduling of debt repayment.

- The Law on Credit Institutions (amended in 2024) strengthens regulations on NPL resolution.

- The efficiency of the court system in handling debt-related cases.

Data Privacy and Cybersecurity Laws

VietinBank faces escalating data privacy and cybersecurity demands. These laws mandate stronger data protection measures. Compliance costs are rising, affecting operational budgets. Non-compliance risks significant penalties and reputational damage.

- The average cost of a data breach in Vietnam reached $3.88 million in 2024.

- Vietnam's cybersecurity market is projected to reach $1.2 billion by 2025.

- The government is increasing cybersecurity spending by 15% annually.

VietinBank's legal environment is shaped by Vietnamese banking laws and SBV directives, mandating strict compliance. Regulatory changes in 2024, particularly those related to risk and digital banking, increased compliance costs by 5%. Foreign ownership adjustments may alter VietinBank's investment landscape.

| Aspect | Details | 2024 Data |

|---|---|---|

| NPLs | Non-performing loans in the banking sector | 1.73% |

| Data Breach Cost | Average cost of a data breach in Vietnam | $3.88 million |

| Cybersecurity Market | Projected market value by 2025 | $1.2 billion |

Environmental factors

The rising global and local focus on Environmental, Social, and Governance (ESG) factors significantly shapes VietinBank's actions. It's now crucial for the bank to consider environmental impacts in its lending and support sustainable development. In 2024, ESG-linked assets are projected to constitute 15% of VietinBank's portfolio. This shows the bank's commitment.

VietinBank faces increasing pressure to fund green projects. Vietnam aims for net-zero emissions by 2050. In 2024, green bonds in Vietnam reached $1.2 billion, a key funding source. This aligns with global sustainable finance trends.

Climate change poses significant risks to VietinBank. Natural disasters, amplified by climate change, can disrupt operations and damage assets. Environmental degradation could affect the bank's loan portfolio, especially in sectors sensitive to climate impacts. According to the World Bank, Vietnam is highly vulnerable to climate change impacts. These factors necessitate strategic adaptation and risk management.

Environmental Regulations and Policies

Evolving environmental regulations and policies in Vietnam present both challenges and opportunities for VietinBank. The focus on sustainable development is increasing, influencing lending practices and investment decisions. VietinBank can tap into green finance initiatives, aligning with national goals to reduce carbon emissions and promote environmental sustainability. This includes financing renewable energy projects and supporting businesses adopting eco-friendly practices.

- Vietnam aims to reduce greenhouse gas emissions by 43.5% by 2030 compared to business-as-usual scenarios.

- The State Bank of Vietnam is promoting green credit, with guidelines for environmental risk management.

- Green credit outstanding in Vietnam reached approximately $14.5 billion in 2024.

Circular Economy Development

Vietnam's push for a circular economy offers VietinBank chances to back eco-friendly businesses. This involves providing specialized financial tools for companies shifting to sustainable practices. In 2024, the Vietnamese government allocated over $1 billion to green initiatives. VietinBank can tap into this by financing projects that reduce waste. This will boost the bank's ESG profile and support national sustainability goals.

- Government spending on green initiatives in Vietnam reached $1.1 billion in 2024.

- VietinBank can offer green loans and investments to businesses.

- Circular economy projects can include waste management and renewable energy.

VietinBank must adapt to stringent environmental regulations, focusing on green finance. In 2024, Vietnam saw green credit hit $14.5 billion. This includes backing businesses committed to reducing emissions.

| Environmental Factor | Impact on VietinBank | 2024 Data |

|---|---|---|

| Climate Change | Risk of natural disasters, asset damage, loan portfolio impacts | Green bond market in Vietnam: $1.2B |

| Green Finance | Opportunities in green projects, ESG goals | Green credit outstanding: $14.5B |

| Regulations | Influence on lending practices and investment decisions | Govt. spending on green: $1.1B |

PESTLE Analysis Data Sources

The Vietin Bank PESTLE relies on data from reputable sources like government reports, financial publications, and economic databases.