Village Farms Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Village Farms Bundle

What is included in the product

Tailored analysis for Village Farms' product portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, instantly sharing strategy and performance with key stakeholders.

What You See Is What You Get

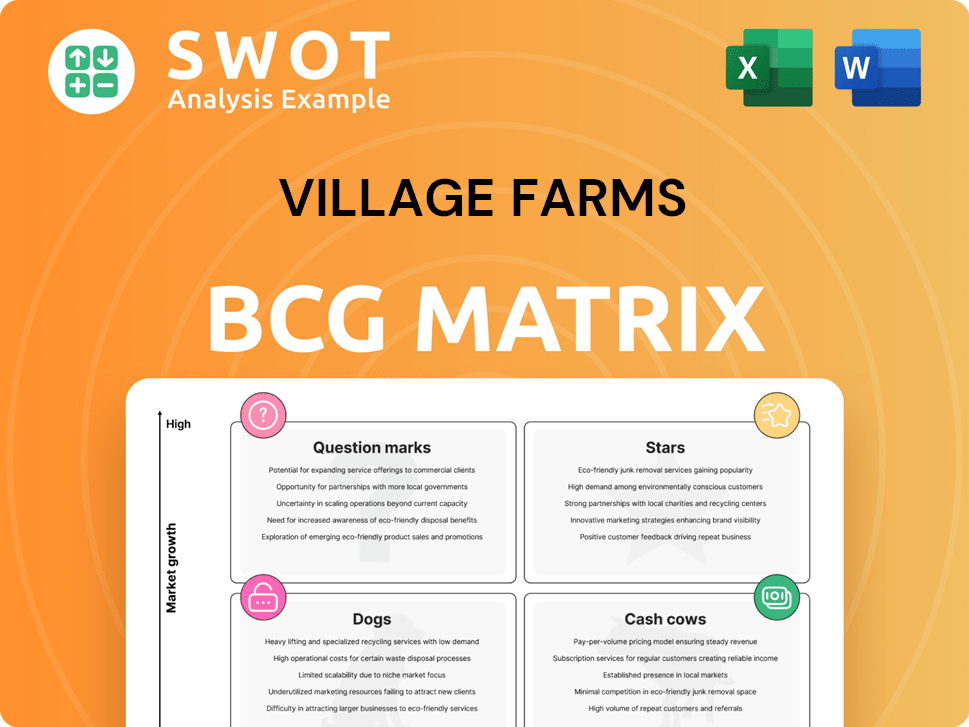

Village Farms BCG Matrix

The displayed preview is the complete Village Farms BCG Matrix you receive upon purchase. This ready-to-use, strategic tool is fully formatted and designed for seamless integration into your analysis, immediately available for download.

BCG Matrix Template

Village Farms' BCG Matrix offers a snapshot of its product portfolio. It helps identify stars, cash cows, question marks, and dogs within their offerings. Understanding this landscape reveals growth potential and resource allocation strategies. This initial glance merely scratches the surface.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Village Farms is a leader in the Canadian cannabis market, especially with dried flower and pre-rolls. In 2024, the company held the top spot in dried flower market share. It also ranked second in pre-rolls, showing strong consumer appeal. To keep this market position, investments are needed in quality, marketing, and distribution. The Canadian cannabis market size was valued at USD 4.8 billion in 2024.

Village Farms is aggressively growing its cannabis business internationally. International cannabis sales surged by 113% year-over-year in Q4 2024. The company forecasts a tripling of international sales by 2025. This expansion leverages its EU GMP-certified Canadian facility and Dutch cultivation.

Village Farms prioritizes operational efficiencies across its segments. They aim to boost profitability and competitiveness by optimizing processes and cutting costs. For instance, in 2024, they consolidated Canadian operations. They are also using new tech to boost yields and cut waste.

Strategic Refinancing

Village Farms' strategic refinancing in 2024 is a key "Star" move, enhancing financial health. The company renegotiated its Canadian cannabis credit agreement. This gives it more flexibility for reinvestment. It aligns with long-term growth targets and lowers financial risks.

- Refinancing extends debt maturity.

- Interest costs are reduced.

- Financial covenants are revised.

- Supports reinvestment in growth areas.

Leli Holland (Dutch Cannabis Operations)

Village Farms, via Leli Holland, is strategically positioned in the Dutch recreational cannabis market. Leli Holland, which started sales in February 2025, is a star due to its high growth potential and market share. A new facility, set to boost production, is scheduled for Q4 2025. The Netherlands is a key entry point to the European market, offering substantial expansion opportunities.

- February 2025: Leli Holland began recreational cannabis sales.

- Q4 2025: New facility expected to quadruple production capacity.

- Dutch market: Significant opportunity for European cannabis market presence.

Village Farms' "Stars" are its high-growth, high-market-share ventures. Key examples include its leadership in the Canadian dried flower market. Additionally, the Dutch market entry through Leli Holland showcases a strategic "Star" move.

| Market Segment | 2024 Market Share | Strategic Initiative |

|---|---|---|

| Canadian Dried Flower | #1 | Maintain quality, marketing, distribution investments. |

| International Cannabis Sales | +113% YoY (Q4 2024) | Expand EU GMP-certified facility. |

| Leli Holland (Dutch) | New entry, high potential | New facility Q4 2025; quadrupling capacity. |

Cash Cows

Village Farms' produce, like tomatoes, is a cash cow, offering stable revenue. They have strong ties with retailers in the US and Canada. In Q3 2023, produce sales were $56.8 million. The company is focusing on its own brand to boost profits.

Village Farms' EU GMP-certified facility in Canada facilitates high-margin medical cannabis exports. This enables sales to countries like Germany, the UK, and Australia. These exports generated $10.5 million in revenue in Q3 2023. Maintaining certification and expanding exports are vital for growth.

Balanced Health Botanicals, Village Farms' CBD subsidiary, is a cash cow. CBDistilleryTM, its e-commerce platform, and 4,000+ retail locations generate consistent revenue. Despite market uncertainties, its established brand is valuable. In 2024, the CBD market was valued at $2.8 billion.

Rose LifeScience (Quebec Cannabis Commercialization)

Village Farms, through its 80% ownership of Rose LifeScience, has a strong presence in Quebec's cannabis market. Rose LifeScience acts as a vital commercialization expert. This strategic position significantly boosts Village Farms' revenue. Continued investment is crucial for Rose LifeScience's expansion.

- Rose LifeScience commercializes cannabis products in Quebec.

- Village Farms owns 80% of Rose LifeScience.

- Investment is key to maintaining market share.

- Rose LifeScience contributes to Village Farms' revenue.

Renewable Energy Initiatives

Village Farms' renewable energy initiatives, particularly through Village Farms Clean Energy (VFCE), represent a cash cow. VFCE, in partnership with Terreva Renewables, utilizes landfill gas at its Delta RNG facility. This generates clean energy and provides VFCE with royalties on all revenue. The partnership significantly reduces greenhouse gas emissions.

- VFCE's Delta RNG facility reduces Vancouver's emissions by 475,000 metric tons of CO2 annually.

- This generates incremental cash flow for Village Farms.

Village Farms' cash cows include its produce, cannabis exports, CBD subsidiary, and renewable energy projects. These segments generate stable revenue and cash flow. The company leverages strong market positions and strategic partnerships. In 2024, the global cannabis market is projected to reach $44.4 billion.

| Cash Cow | Revenue Source | Key Feature |

|---|---|---|

| Produce | Tomato Sales | Strong Retail Ties |

| Cannabis Exports | Medical Cannabis | EU GMP Certified |

| CBD | CBDistilleryTM | Established Brand |

| Renewable Energy | VFCE | Landfill Gas |

Dogs

In Q4 2024, Village Farms faced a $10.5 million non-cash impairment, impacting non-flower cannabis inventory due to quality issues. This suggests potential challenges in quality control or market demand. The write-down may lead to the discontinuation or re-evaluation of certain products. The financial impact reflects challenges within the Canadian cannabis market.

Within Village Farms' produce segment, some varieties face challenges. In 2024, underperforming areas might include specific tomato or pepper types. These issues can stem from market shifts or operational inefficiencies. Addressing these, perhaps by switching crops, is vital for profit. For example, in Q3 2024, some specialty tomatoes saw lower margins.

Some of Balanced Health Botanicals' older CBD offerings may face low margins, possibly due to tough competition or shifting consumer tastes. Streamlining the product line and prioritizing CBD products with better margins could boost profits. This strategic shift might involve dropping or updating specific product lines. In 2024, the CBD market saw a 10% price drop in some segments, highlighting margin pressures.

Non-Strategic International Ventures

Village Farms might be involved in international ventures that aren't performing well, classified as "Dogs" in the BCG Matrix. These ventures may not be contributing significantly to the company's financial results. Divesting from underperforming international partnerships could free up capital for better opportunities. The focus should be on core markets and high-potential international areas. For example, the company's 2024 financial reports showed a need to optimize international investments.

- Review underperforming international ventures.

- Consider divestment from non-strategic partnerships.

- Reallocate capital to core markets.

- Prioritize high-potential international opportunities.

High-Cost Production Facilities

High-cost production facilities represent a challenge for Village Farms, particularly older or less efficient ones. These facilities often incur higher operating expenses than their modern counterparts, impacting profitability. Upgrading or consolidating these operations could improve overall efficiency and reduce costs. This might involve investing in new technologies or moving production to more advanced facilities. In 2024, Village Farms' cost of sales was $203 million, highlighting the importance of cost management.

- Higher operating costs impact profitability.

- Upgrades or consolidation can improve efficiency.

- Investments in tech or facility shifts are potential solutions.

- Village Farms' cost of sales in 2024 was $203M.

Dogs represent underperforming international ventures for Village Farms. These ventures show minimal financial contributions, necessitating strategic reviews. Divesting from these partnerships allows capital reallocation. Focus should shift to core markets and high-potential international areas.

| Metric | Value | Year |

|---|---|---|

| International Revenue | $15M (approx.) | 2024 |

| Net Loss (International) | -$3M (approx.) | 2024 |

| Investment in Dogs | $20M (estimated) | 2024 |

Question Marks

Village Farms aims to enter the US high-THC cannabis market using its Texas greenhouses. This move is a risky venture due to federal regulatory uncertainty. The US cannabis market was valued at $28 billion in 2023, with expected growth. Village Farms must watch regulations closely and adjust its approach.

Village Farms is eyeing international cannabis expansion, a move that could boost growth. New markets present opportunities but also regulatory hurdles and risks. In 2024, the global cannabis market was valued at approximately $30 billion. A strong market entry strategy is crucial for success. Proper due diligence is key to navigating these complex environments.

Village Farms is broadening its cannabis product line to include Cannabis 2.0 items like edibles, beverages, and vapes. These products aim for higher profit margins and attract more customers. However, they also need specialized production and marketing. Investing in these areas and creating new products is crucial. In 2024, the global cannabis edibles market was valued at $4.8 billion.

Hemp-Derived Cannabinoids Beyond CBD

Village Farms is strategically evaluating the market for hemp-derived cannabinoids beyond CBD, focusing on CBG and CBN, which could unlock new revenue streams. These cannabinoids are attracting interest for their distinct health benefits, targeting specific consumer segments. The company must invest in R&D and navigate regulatory hurdles to capitalize on these opportunities. For example, the global hemp cannabinoid market was valued at $4.7 billion in 2023 and is projected to reach $13.7 billion by 2028.

- Market Expansion: Explore CBG and CBN to diversify product offerings.

- Scientific Foundation: Invest in R&D to validate health benefits.

- Regulatory Compliance: Navigate approval processes for new cannabinoids.

- Consumer Targeting: Identify and cater to niche market segments.

Delta RNG Project Expansion

The Delta RNG Project expansion, a partnership between Village Farms Clean Energy and Terreva Renewables, falls under the "Question Mark" quadrant in the BCG Matrix. This signifies high market growth with low market share. Expanding such projects could generate additional revenue and boost sustainability efforts. However, it involves considerable capital investment and faces regulatory and operational risks. For instance, the initial investment for a similar RNG project can range from $20 million to over $50 million.

- High Growth Potential: Renewable energy markets are expanding rapidly.

- Capital Intensive: Requires significant upfront investment.

- Regulatory Risks: Subject to environmental regulations and permitting.

- Market Share: Village Farms needs to increase its market presence.

The Delta RNG Project represents a "Question Mark" due to its high growth potential but low market share. Expansion needs significant capital and faces regulatory risks. The renewable energy market is rapidly expanding. In 2024, the global renewable energy market was valued at $881.1 billion.

| Aspect | Details |

|---|---|

| Market Growth | High, driven by renewable energy demand. |

| Market Share | Low, requiring strategic market penetration. |

| Investment | Capital-intensive, with high upfront costs. |

| Risks | Regulatory hurdles, operational challenges. |

| Market Value (2024) | $881.1 billion for renewable energy market. |

BCG Matrix Data Sources

The Village Farms BCG Matrix is crafted using comprehensive sources like financial reports, market research, and expert evaluations.