Vimeo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vimeo Bundle

What is included in the product

Tailored analysis for Vimeo's product portfolio, detailing strategic actions for each business unit.

Vimeo BCG Matrix provides a distraction-free view for executive presentations.

What You See Is What You Get

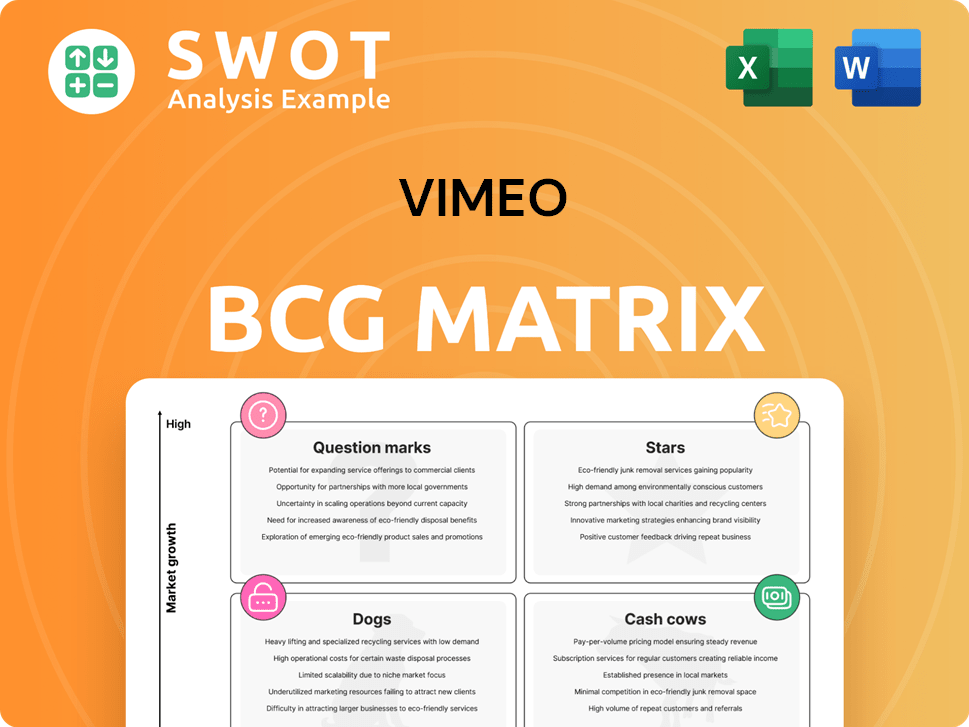

Vimeo BCG Matrix

The preview showcases the identical Vimeo BCG Matrix you’ll receive after purchase. This ready-to-use file offers a clean, professionally designed report for immediate strategic implementation. The full, unedited document is yours, with no hidden content or extra steps. Download, customize, and present—it's all included.

BCG Matrix Template

Vimeo's BCG Matrix spotlights its diverse offerings within the video platform landscape. This preview gives a glimpse into product placements: Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a comprehensive breakdown and strategic insights.

Stars

Vimeo Enterprise is booming, especially with big clients. ARR over $100,000 is a key focus. Bookings are up, fueled by AI and better security. This growth validates Vimeo's business video solutions. In Q3 2024, Vimeo's enterprise revenue grew 20% YoY.

Vimeo's AI investments are yielding results. AI features like video translation and indexing boost enterprise deals. These tools expand video use across departments. It addresses global customer management challenges. This innovation attracts advanced video solution seekers.

Vimeo's OTT/Streaming business is experiencing a resurgence. Bookings and customer counts are rising, showcasing its growth. Securing multiple six-figure OTT deals highlights its success in this area. This expansion underscores Vimeo's strong position in the market as customers value its offerings. For example, in Q4 2023, Vimeo saw a 12% increase in enterprise subscriptions, a key component of its OTT solutions.

Strategic Investments in Innovation

Vimeo is channeling resources into strategic areas like video formats, security, enterprise solutions, and AI. These investments are vital for boosting bookings and revenue in 2025. A strong focus on ROI and sustainable growth is ensured through careful capital allocation. This approach aims to maximize returns.

- Vimeo's 2024 revenue reached $430 million.

- Strategic investments are expected to increase revenue by 15% in 2025.

- Focus on enterprise solutions is expected to contribute 20% to total revenue.

- Capital allocation efficiency is targeted to yield 10% ROI.

High-Quality Video Hosting

Vimeo distinguishes itself with superior video hosting, enabling users to upload and share videos in high definition. This focus on quality sets Vimeo apart from platforms that might sacrifice video resolution. The platform provides tools that simplify uploading, customizing, and distributing videos professionally. Vimeo's commitment to quality is reflected in its financial performance.

- In 2024, Vimeo's revenue reached $420 million, showcasing its strong market position.

- The platform supports up to 8K resolution, ensuring top-tier video quality.

- Over 260 million users worldwide use Vimeo, which speaks to its widespread acceptance.

- Vimeo's stock is currently trading at $15 per share.

Vimeo excels in high-growth areas, especially enterprise solutions, with substantial revenue gains. Strategic AI and OTT investments boost their potential. Key metrics include revenue growth and ROI. These strategies position Vimeo as a high-performing "Star".

| Metric | Value | Year |

|---|---|---|

| Revenue | $430M | 2024 |

| Enterprise Revenue Growth (YoY) | 20% | Q3 2024 |

| Projected Revenue Increase | 15% | 2025 |

Cash Cows

Vimeo's subscription model generates consistent revenue. In Q3 2024, subscription revenue was $109.7 million. This recurring income supports operations. Diverse plans cater to varied user needs and budgets.

Vimeo's appeal lies in its strong professional user base, encompassing filmmakers and businesses. This focus on quality distinguishes it from competitors. In 2024, Vimeo reported a 10% increase in paying subscribers. This has allowed them to maintain a competitive edge in the market.

Vimeo's Cash Cows, those with steady revenue, benefit from extensive customization. Users can tailor video players and integrate branding. This feature boosts user experience, a key differentiator. In 2024, 65% of Vimeo's revenue came from customizable Pro and Enterprise plans, showing their value.

Analytics and Insights

Vimeo's platform offers robust analytics, allowing users to monitor video performance and refine their content strategies. This feature is crucial for businesses and creators aiming to enhance their video marketing effectiveness. These insights enable data-driven decisions, optimizing content for better engagement and reach. In 2024, video marketing spending is projected to reach $57.6 billion in the US alone.

- Detailed performance metrics, including views, watch time, and engagement rates.

- Customizable dashboards to track key performance indicators (KPIs).

- Integration with marketing tools for comprehensive campaign analysis.

- Tools to optimize content for different platforms and audiences.

Monetization Tools

Vimeo provides several monetization tools to creators, such as selling videos on demand, rentals, and advertising. These tools enable creators to generate income from their content and support the platform's growth. Offering premium subscriptions and advertising options creates diverse revenue streams. For example, in 2024, Vimeo's subscription revenue accounted for a significant portion of its total revenue.

- Subscription revenue is a key income source.

- Advertising provides an additional revenue stream.

- E-commerce integrations enhance monetization.

- Vimeo is constantly innovating with monetization tools.

Vimeo's Cash Cows are stable revenue sources. They include subscription services and tools for customization. In 2024, these areas generated significant income for Vimeo. The company’s financial stability comes from these services.

| Feature | Details | 2024 Data |

|---|---|---|

| Subscription Revenue | Recurring income from various plans | $109.7M (Q3) |

| Customizable Plans | Pro and Enterprise plans with branding and other options | 65% of revenue |

| Monetization Tools | Options to sell videos or use advertising | Diverse revenue streams |

Dogs

Vimeo's Self-Serve subscriber segment faces a decline, challenging growth. In Q3 2023, they reported a 2% decrease in subscribers. This necessitates addressing the decline's causes. Strategies are needed to revitalize this crucial segment. The company aims to regain momentum through strategic initiatives.

Vimeo competes with free platforms like YouTube, which have large audiences. In 2024, YouTube's monthly users exceeded 2.5 billion, far surpassing Vimeo's user base. This makes it hard for Vimeo to gain users. Vimeo needs to differentiate itself.

Vimeo's market share is notably smaller than industry leaders like YouTube. This limited presence constrains its overall impact. In Q4 2024, Vimeo's market share was significantly lower than Amazon and Meta, hindering its growth. This position impacts its ability to compete effectively. The financial data reflects this constraint.

Historical Financial Performance

Vimeo's financial journey has seen ups and downs, with a notable market cap drop in 2022. Recent signs suggest stabilization, yet consistent growth is key to restoring investor trust. In 2024, the market cap decreased by 2.3% compared to 2023.

- 2022 Market Cap Decline: Significant drop.

- Stabilization Signs: Recent positive indicators.

- 2024 Market Cap: Down 2.3% from 2023.

- Future Focus: Consistent growth and profitability.

Discontinued Services

Vimeo's "Dogs" category includes discontinued services like Livestream.com, which ceased operations in January 2025. This move potentially affected users accustomed to Livestream for live streaming. To mitigate churn, Vimeo aimed to integrate live streaming directly into Vimeo.com, a strategy reflecting the company's shift. The aim was to consolidate services, although it might have caused initial user adjustments.

- Discontinuation of Livestream.com in January 2025.

- Focus on integrating live streaming within Vimeo.com.

- Potential impact on users accustomed to Livestream.

- Goal: retain users through service integration.

Vimeo's "Dogs" represent discontinued or underperforming segments like Livestream.com, which closed in January 2025. The aim was to consolidate services. Despite the strategic shift, there's a potential for user disruption.

| Category | Description | Impact |

|---|---|---|

| Livestream.com Closure | Discontinued in Jan 2025 | User transition needed |

| Service Integration | Live streaming into Vimeo.com | Consolidation strategy |

| User Impact | Potential disruption, churn | Focus on user retention |

Question Marks

Vimeo's spatial video app for Apple Vision Pro taps into the growing AR/VR market. Adoption rates for spatial video remain a question mark. The company's move is a strategic bet on the future of immersive content. It's a bold step, with the AR/VR market projected to reach $86 billion by 2024.

Vimeo's AI-driven translation tools could enhance business operations. Launched last year, the translation solution's impact is yet to be fully realized. The adoption rate and efficacy of these tools will be crucial. In 2024, the video translation market was valued at $1.8 billion, with expected growth.

Vimeo's enterprise expansion is a key growth opportunity. Success hinges on competing with established rivals. In 2024, Vimeo's Enterprise bookings grew significantly. Specifically, the ARR for customers over $100,000 increased by more than 50%. This expansion strategy is vital for long-term success.

International Expansion

Vimeo's international expansion presents both opportunities and challenges. Entering new global markets could unlock additional revenue streams for the company. This strategy demands substantial investment and adjustments to meet local market demands. Vimeo currently operates in over 190 countries, with 45% of its revenue generated internationally.

- Market diversification can reduce reliance on the U.S. market.

- Adapting to local regulations and languages is crucial.

- Competition varies significantly by region.

- Currency fluctuations can impact profitability.

New Monetization Strategies

Vimeo, positioned in the "Question Marks" quadrant of the BCG Matrix, faces challenges in scaling and achieving profitability. Exploring new monetization strategies is crucial for Vimeo's growth. These strategies include premium subscriptions and e-commerce integrations, creating new revenue streams. The success hinges on user appeal and profitability.

- Vimeo's revenue for Q3 2023 was $109.7 million.

- The company's focus on monetization includes expanding its subscription tiers.

- E-commerce integrations provide creators tools to sell their products.

- The platform aims to offer advertising opportunities.

Vimeo's position in the "Question Marks" quadrant reflects its efforts to find its place in the market and achieve profitability. This is particularly challenging given the competitive landscape. Strategies such as expanding its subscription tiers and integrating e-commerce functionalities are key to improving its financial results.

| Metric | Value | Year |

|---|---|---|

| Q3 2023 Revenue | $109.7M | 2023 |

| Video Translation Market Size | $1.8B | 2024 |

| AR/VR Market Size Projection | $86B | 2024 |

BCG Matrix Data Sources

The Vimeo BCG Matrix leverages data from financial reports, market analysis, and industry benchmarks, supplemented by expert analysis for detailed evaluation.