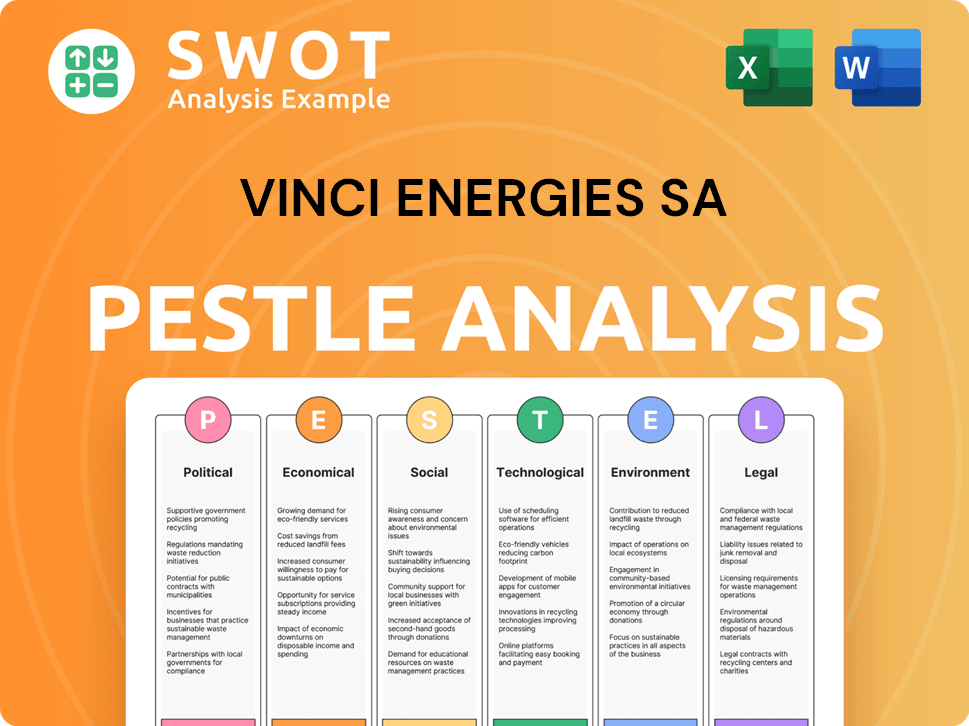

VINCI Energies SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VINCI Energies SA Bundle

What is included in the product

Analyzes the external macro-environment factors' impact on VINCI Energies SA. It provides valuable insights into strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions. Quickly pinpoint key areas.

Preview Before You Purchase

VINCI Energies SA PESTLE Analysis

The content in this preview showcases the complete VINCI Energies SA PESTLE analysis.

You'll receive the same structured and professionally prepared document instantly after purchase.

Everything you see here – content, formatting, and layout – is what you'll get.

Ready to download and use right away!

PESTLE Analysis Template

Explore the external forces impacting VINCI Energies SA with our comprehensive PESTLE Analysis. Uncover political risks, economic opportunities, social shifts, technological advancements, legal changes, and environmental impacts. Gain a competitive edge by understanding how these factors influence the company's strategy and performance. Download the full analysis and transform your strategic decision-making.

Political factors

Government infrastructure spending heavily impacts VINCI Energies. In 2024, global infrastructure spending is projected to reach $4.5 trillion. Urban development, housing, and transportation policies drive demand for their services. This includes projects in energy, transport, and communication infrastructure.

VINCI Energies faces evolving regulatory frameworks globally. Changes in building codes and safety standards directly affect project design and execution. Environmental compliance regulations are also crucial, impacting costs. In 2024, VINCI Energies reported €19.3 billion in revenue, reflecting the impact of these regulations. The company must adapt to stay competitive.

Political stability significantly impacts VINCI Energies' operations, particularly in regions with ongoing projects. Geopolitical risks, such as trade wars or conflicts, can hinder supply chains and increase costs. For example, in 2024, disruptions in certain regions affected project timelines. Uncertainties can lead to investment delays. The company closely monitors political developments to mitigate these risks.

Government Policies on Energy Transition

Government policies significantly affect VINCI Energies, especially those promoting energy transition. Initiatives like renewable energy investments and low-carbon mobility boost the company. VINCI's focus on energy efficiency and digital tech aligns with these policies. This drives demand for its energy solutions. For example, the EU aims for 42.5% renewable energy by 2030.

- EU’s target: 42.5% renewable energy by 2030.

- VINCI Energies' solutions support these goals.

Taxation Policies

Taxation policies significantly influence VINCI Energies SA. Recent tax changes, like the new tax on long-distance transport infrastructure operators in France, could decrease earnings. This affects VINCI's concessions, potentially impacting the broader group. For example, in 2024, changes in French infrastructure taxes led to a 2% decrease in related revenue. These policies demand strategic financial planning.

- 2% decrease in related revenue due to infrastructure taxes in 2024.

- Tax changes require strategic financial planning.

Political factors are crucial for VINCI Energies, significantly affecting its operations and revenue. Government infrastructure spending and policies, especially those related to energy transition, drive demand. Geopolitical risks, such as trade wars, and tax policies demand strategic planning to mitigate impacts and optimize financial performance.

| Factor | Impact | Example/Data (2024) |

|---|---|---|

| Government Spending | Drives demand for services. | Global infrastructure spending at $4.5 trillion. |

| Regulatory Frameworks | Affects project design, execution, and costs. | VINCI Energies reported €19.3B revenue. |

| Taxation | Influences financial performance. | 2% revenue decrease due to French infrastructure taxes. |

Economic factors

Economic growth and stability are crucial for VINCI Energies. The construction and energy markets are highly sensitive to economic fluctuations. In 2024, the Eurozone's GDP growth is projected around 0.8%, while the US might reach 2.1% (IMF). Inflation rates also play a role, with the EU at 2.7% and the US at 2.4% (2024 estimates).

Rising inflation and interest rates can significantly affect VINCI Energies. Increased material costs and project financing expenses pose challenges. The construction segment, with its tighter margins, may struggle to offset these rising costs. In 2024, Eurozone inflation hovered around 2.6%, influencing project profitability. The ECB's interest rate decisions remain critical.

Market demand for energy transition and digital transformation is a key economic driver for VINCI Energies. This boosts business and order intake, especially in energy and construction. In 2024, the energy transition market grew significantly. For example, VINCI Energies reported strong order intake in Q1 2024. This growth trend is expected to continue through 2025.

Acquisition-Driven Growth

VINCI Energies actively pursues acquisitions to fuel its growth. This strategy allows expansion into new markets and enhances existing capabilities. Acquisitions are a significant driver of revenue, contributing substantially to the company's economic results. In 2024, VINCI Energies completed several acquisitions to strengthen its market position. These acquisitions are a strategic move to increase market share and diversify service offerings.

- In 2024, VINCI Energies completed 20 acquisitions.

- Acquisitions contributed to a 6% increase in revenue in 2024.

- The acquisitions focused on expanding in the ICT and energy sectors.

- The total investment in acquisitions in 2024 was approximately €500 million.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly affect VINCI Energies, given its global presence. These fluctuations impact the translation of revenues and expenses from various international markets into its reporting currency, the Euro. A stronger Euro can reduce the reported value of foreign earnings, while a weaker Euro can boost them. For instance, in 2024, the EUR/USD exchange rate fluctuated, impacting VINCI Energies' reported financials.

- Impact on Reported Earnings: Currency fluctuations directly affect the company's reported revenues and profits.

- Hedging Strategies: VINCI Energies employs hedging strategies to mitigate currency risks.

- Geographic Diversification: A diversified geographic presence helps balance currency risks.

Economic factors strongly impact VINCI Energies. GDP growth and inflation rates affect project profitability and costs. Market demand for energy and digital transformation drives business growth, as seen in strong order intake.

Currency fluctuations significantly influence financial results. Hedging strategies mitigate these risks, alongside geographic diversification. VINCI Energies completed 20 acquisitions in 2024.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Influences project volume | Eurozone: 0.8%, US: 2.1% |

| Inflation | Affects costs, margins | EU: 2.7%, US: 2.4% (Est.) |

| Acquisitions | Boost revenue | 6% revenue increase in 2024 |

Sociological factors

Rapid urbanization and population growth boost infrastructure demands. This fuels construction and energy markets. VINCI Energies benefits from these trends. In 2024, global urban population reached 56.2%, impacting market strategies. The construction sector grew by 3.8%.

Changing lifestyles drive construction trends, with smart homes and sustainable buildings gaining traction. VINCI Energies, in 2024, saw a 12% increase in projects related to energy efficiency, reflecting this shift. This demand necessitates innovation in building design and materials, impacting VINCI Energies' strategies. Their digital tech and energy focus meet these evolving preferences.

VINCI Energies strongly emphasizes employee well-being and safety across its operations. In 2024, the company invested significantly in programs promoting physical and mental health, aiming for a 10% reduction in workplace accidents. This includes competitive salaries and diverse development programs. VINCI Energies fosters an inclusive environment, as reflected in its 2024 diversity report. The company's commitment strengthens its social responsibility and stakeholder relations.

Aging Infrastructure

Aging infrastructure across developed nations creates substantial demand for VINCI Energies' services. This includes maintenance, upgrades, and operational support. The U.S. alone faces a substantial infrastructure investment gap.

- The American Society of Civil Engineers estimates a $2.59 trillion investment gap in U.S. infrastructure by 2029.

- VINCI Energies' revenue in 2023 was €17.6 billion, with a significant portion from maintenance and operations.

- Governments globally are increasing infrastructure spending to address these needs.

This drives business for companies like VINCI Energies.

Social Acceptance of Infrastructure Projects

Public acceptance of infrastructure projects significantly affects their viability and schedule. Social unrest, like that faced by VINCI Autoroutes, can disrupt operations. Community support, or lack thereof, can lead to delays or project abandonment. Positive public perception can streamline project approvals and enhance VINCI Energies' reputation. It's a critical aspect of project success.

- Public perception directly influences project timelines.

- Social unrest, as seen with VINCI Autoroutes, can cause operational disruptions.

- Community support is crucial for project approvals.

- Positive perception enhances VINCI Energies' reputation.

Societal shifts drive infrastructure needs. Urbanization and evolving lifestyles boost demand. Aging infrastructure across developed nations, combined with a need for sustainability, presents growth opportunities. However, social factors such as public acceptance of infrastructure projects have an impact.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Urbanization | Increased infrastructure demand. | Global urban pop. reached 56.2% in 2024, Construction grew by 3.8%. |

| Lifestyle changes | Growth in smart homes and sustainable buildings. | VINCI Energies saw a 12% rise in energy efficiency projects in 2024. |

| Aging infrastructure | Needs for maintenance & upgrades. | US infra gap by 2029, estimated at $2.59T by ASCE. |

Technological factors

VINCI Energies leverages digital tech to enhance its services. They use AI for energy optimization and operational efficiency. In 2023, VINCI Energies' revenue was €17.6 billion, showing its commitment to digital transformation. This tech integration supports smart city solutions and industrial process optimization.

Technological factors are significantly impacting VINCI Energies. Advancements in construction techniques and materials, like low-carbon concrete, are vital. The company leverages these innovations to boost efficiency and cut environmental footprints. For instance, in 2024, the global green building materials market was valued at $320 billion, showing growth.

The smart infrastructure market is expanding globally, driven by automation and IoT. VINCI Energies excels in energy efficiency and digital solutions. The smart cities market is projected to reach $820.7 billion by 2025. VINCI Energies' projects include smart grids and building automation. This growth offers VINCI Energies significant opportunities.

Robotics and Automation

Robotics and automation are pivotal for VINCI Energies. Actemium, part of VINCI Energies, specializes in industrial robotics integration. The global industrial robotics market is projected to reach $81.93 billion by 2025. This growth highlights VINCI Energies' strategic positioning.

- Actemium's expertise aligns with rising automation demands.

- Market growth supports expansion within VINCI Energies.

- Investments in robotics boost operational efficiencies.

Renewable Energy Technologies

Technological factors significantly influence VINCI Energies. Advancements in renewable energy, like solar and wind, fuel market growth. VINCI Energies participates in these projects, boosting infrastructure development. The global renewable energy market is projected to reach $1.977 trillion by 2030.

- Solar PV capacity additions globally reached 351 GW in 2023.

- Wind power capacity grew significantly, with offshore wind showing strong growth.

- VINCI Energies is involved in the construction and maintenance of renewable energy infrastructure.

- Investments in smart grids are also crucial.

VINCI Energies thrives on tech, integrating AI for operational gains. Its revenue hit €17.6B in 2023. Smart infrastructure and robotics, critical for efficiency, offer expansion avenues.

| Tech Area | Market Size (2024) | Growth Outlook |

|---|---|---|

| Green Building Materials | $320B | Growing |

| Smart Cities (2025) | $820.7B (projected) | Expanding |

| Industrial Robotics (2025) | $81.93B (projected) | Increasing |

Legal factors

VINCI Energies faces complex legal landscapes globally. It must adhere to national and international regulations, including those on business ethics. In 2024, regulatory fines for non-compliance in similar sectors averaged $1.5 million. Environmental and labor laws also require strict adherence. This ensures operational legality and stakeholder trust.

VINCI Energies thrives on long-term infrastructure concessions. Legal terms and government changes significantly affect operations. In 2024, VINCI's concessions brought in €29.6 billion in revenue. Changes in regulations can impact future profitability.

VINCI Energies faces stringent environmental regulations concerning emissions, waste, and habitat preservation. In 2024, the company allocated €150 million to environmental protection measures. They are actively using digital tools to monitor and reduce their environmental impact, aiming for a 40% reduction in carbon emissions by 2030.

Labor Laws and Employment Regulations

VINCI Energies must adhere to diverse labor laws across its global operations, impacting its operational costs and practices. These laws cover working hours, wages, and employee benefits, varying significantly by country. For instance, France, where VINCI has a strong presence, mandates a 35-hour work week and robust social security contributions. Non-compliance can lead to hefty fines and reputational damage.

- In 2024, labor law violations cost global companies an average of $200,000 per incident.

- France's minimum wage (SMIC) was approximately €1,766.92 gross per month as of early 2024.

- VINCI Energies employed over 85,000 people worldwide as of 2024, increasing the complexity of compliance.

Data Protection and Privacy Laws

VINCI Energies, as a global entity, is significantly impacted by data protection and privacy laws. The company must adhere to regulations like the GDPR in Europe, which has led to substantial compliance costs. According to recent reports, companies in the EU face average GDPR compliance costs of approximately €1.5 million. Failure to comply can result in hefty fines.

- GDPR fines can reach up to 4% of annual global turnover.

- The global data privacy market is projected to reach $218.8 billion by 2025.

VINCI Energies navigates a complex web of global legal frameworks, impacting operations worldwide. Adherence to international laws on ethics and data protection, like GDPR, is crucial. Non-compliance with labor laws and regulations on emissions results in fines and reputational issues.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Compliance | Risk of fines and operational disruptions. | Average fine for non-compliance in related sectors: $1.5M (2024) |

| Environmental Regulations | Compliance costs and operational changes | €150M allocated to environmental protection in 2024, aiming for 40% emission cut by 2030 |

| Data Privacy | Compliance with GDPR and other laws, potential for hefty fines | EU GDPR compliance costs: approximately €1.5 million (2024) |

Environmental factors

Climate change significantly affects VINCI Energies, especially in infrastructure. They're adapting, focusing on resilient urban areas and rainwater management. VINCI Energies invested €1.4 billion in green solutions in 2024, aiming for a 40% reduction in CO2 emissions by 2030. This includes projects like smart grids and sustainable building solutions.

VINCI Energies actively supports the global energy transition, a key strategic focus. This includes climate action, environmental preservation, and resource optimization. In 2024, VINCI Energies reported €18.5 billion in revenue, with significant investments in sustainable solutions. The company aims to reduce its carbon footprint by 40% by 2030, furthering its commitment to environmental responsibility.

VINCI Energies actively embraces the circular economy. They aim to minimize waste, reuse materials, and boost resource efficiency. For example, they set goals for recycled aggregate use and waste reclamation. In 2024, VINCI Energies increased its use of recycled materials by 15% across its projects, contributing to a 10% decrease in waste sent to landfills.

Preservation of Natural Environments and Biodiversity

VINCI Energies emphasizes preserving natural environments and biodiversity, integrating this into its environmental strategy. This involves minimizing operational impacts on natural habitats. For example, in 2024, VINCI Energies invested €150 million in ecological engineering. The company aims to reduce its carbon footprint by 40% by 2030.

- €150 million invested in ecological engineering (2024).

- 40% reduction in carbon footprint target by 2030.

Carbon Emissions Reduction Targets

VINCI Energies is deeply committed to slashing carbon emissions, mirroring VINCI Group's environmental goals. They aim to cut direct emissions from their operations and assist partners in lessening their carbon footprint. In 2023, VINCI Group's carbon emissions were approximately 1.7 million tonnes of CO2 equivalent. The company's strategy includes energy efficiency improvements and transitioning to renewable energy sources. They aim for a 40% reduction in Scope 1 and 2 emissions by 2030 from a 2018 baseline.

- Target: Reduce Scope 1 & 2 emissions by 40% by 2030 (from 2018).

- Focus: Energy efficiency and renewable energy adoption.

- 2023: VINCI Group's emissions were roughly 1.7 million tonnes CO2e.

VINCI Energies targets a 40% carbon footprint reduction by 2030, investing €150M in eco-engineering (2024). The focus is on climate resilience, circular economy, and preserving nature. Green solutions brought €1.4B in investment during 2024, supporting the global energy shift.

| Aspect | Details | Data (2024) |

|---|---|---|

| Green Investment | Focus on Sustainable Solutions | €1.4 Billion |

| Emissions Reduction Target | Reduction Goal | 40% by 2030 |

| Eco-Engineering Investment | Investment in environmental projects | €150 Million |

PESTLE Analysis Data Sources

The VINCI Energies SA PESTLE analysis relies on economic reports, governmental publications, and industry-specific insights. Market trends and regulatory changes are sourced from reputable databases and research firms.