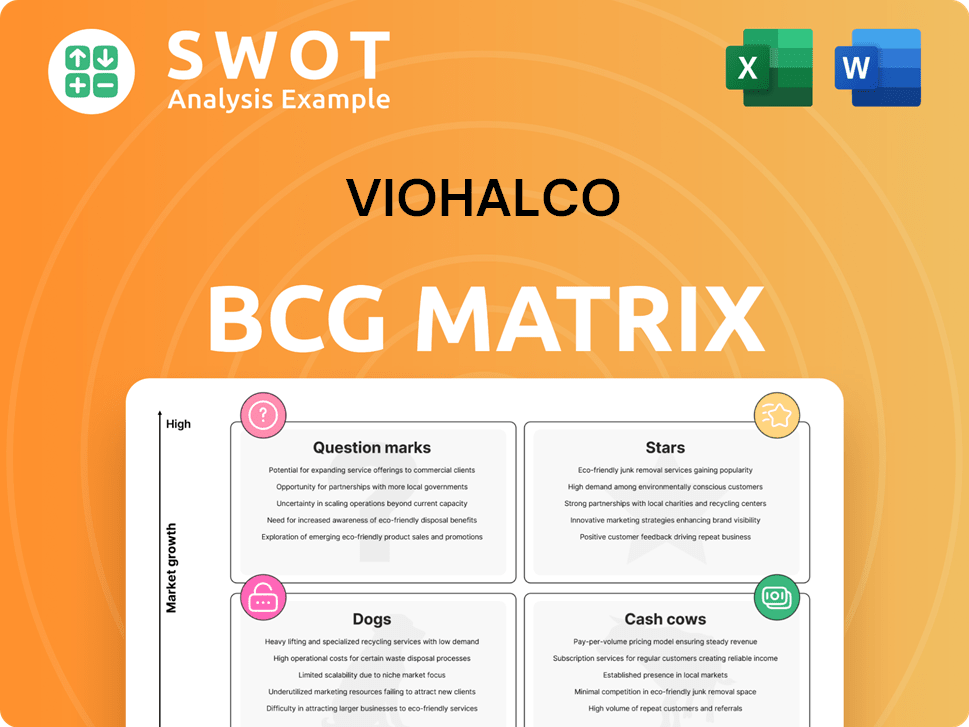

Viohalco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Viohalco Bundle

What is included in the product

Analysis of Viohalco's business units in each BCG Matrix quadrant.

Quickly assess Viohalco's portfolio with an intuitive BCG Matrix.

Preview = Final Product

Viohalco BCG Matrix

The BCG Matrix preview you're seeing mirrors the downloadable report. Upon purchase, you'll receive this fully functional, ready-to-analyze Viohalco BCG Matrix file—no extra steps required.

BCG Matrix Template

Viohalco's BCG Matrix helps categorize its diverse portfolio, from booming Stars to struggling Dogs. This snapshot gives a glimpse of product performance within the market. Understand the balance between market growth and relative market share with this analysis. This preview only scratches the surface. Buy the full BCG Matrix for detailed quadrant placements, strategic insights, and a roadmap for informed decisions.

Stars

The aluminum segment is a "star" in Viohalco's BCG matrix. It benefits from growing demand in recyclable packaging and energy-efficient infrastructure. Elval's investments boosted capacity and efficiency, increasing sales. This segment's automotive focus, with projects for top European companies, supports its growth. In 2024, the aluminum segment's revenue grew by 15%.

The cables segment shines as a Star, fueled by successful project execution. This strategy boosted adjusted EBITDA significantly. Viohalco invested in expansion, including a US facility. In 2024, this segment's growth continues to be a key driver.

Corinth Pipeworks' Tier-1 status boosts this segment. Capacity enhancements boosted volumes. A strong order backlog fuels success. In 2024, the steel pipes segment saw increased demand. It achieved a 15% revenue increase.

R&D and Technology

Viohalco's "Stars" in the BCG matrix is R&D and Technology, focusing on industrial research and technological advancement. This segment boosts innovation across all units, crucial for high-value products. Continuous R&D investment keeps Viohalco competitive in metal processing. In 2024, Viohalco allocated a significant portion of its budget to R&D, aiming for technological leadership.

- R&D investments are essential for maintaining a competitive edge.

- Technological advancements drive the creation of high-quality products.

- Continuous investment in R&D is a key strategy.

Sustainable Development Initiatives

Viohalco's commitment to sustainable development is a key aspect of its strategy. They've embraced the Corporate Sustainability Reporting Directive (CSRD) and are investing in renewable energy. This focus on the circular economy, responsible sourcing, and safety helps attract eco-conscious customers and investors. In 2024, Viohalco allocated €150 million to sustainable projects.

- CSRD implementation for enhanced transparency.

- €150 million investment in sustainable projects (2024).

- Focus on circular economy and responsible sourcing.

- High standards in occupational health and safety.

Viohalco’s "Stars" are segments experiencing high growth with significant market share. These include aluminum, cables, steel pipes, and R&D/technology. All segments demonstrated impressive revenue growth in 2024.

| Segment | 2024 Revenue Growth | Key Driver |

|---|---|---|

| Aluminum | 15% | Recyclable packaging, automotive focus |

| Cables | Significant | Successful project execution, US expansion |

| Steel Pipes | 15% | Strong order backlog, capacity enhancements |

| R&D/Technology | N/A | Industrial research, technological advancement |

Cash Cows

The copper segment of Viohalco is a cash cow, benefiting from a favorable product mix, lower energy prices, and increased scrap use. Despite economic challenges, Sofia Med, a subsidiary of ElvalHalcor, showed resilient sales. Initiatives to expand Sofia Med's production will ensure continued profitability. In 2024, copper prices remained relatively stable, supporting the segment's performance.

Noval Property, Viohalco's real estate arm, is a cash cow. It provides steady revenue from its diverse property portfolio. Rental income growth is fueled by active asset management. In 2024, the division saw a 7% increase in rental revenue.

Steel rebar and mesh sales in Greece remain strong, fueled by construction sector growth, acting as a reliable revenue source. Stable scrap supply supports consistent product delivery, even with economic challenges. In 2024, the Greek construction sector saw a 7% increase. These factors position this area as a valuable Cash Cow.

Automotive Extrusion Products

Viohalco's strategic pivot to automotive extrusion products has proven lucrative, securing projects with leading European automotive firms. This focus on specialized, high-value products ensures steady revenue. The emphasis on premium original equipment manufacturers (OEMs) supports stable growth and profitability. In 2024, the automotive sector represented a significant portion of aluminum extrusion revenues.

- 2024: Automotive extrusion revenue growth of 12%

- Focus on premium OEMs ensures stable demand

- Higher value-added products

- Successful projects with top European automotive companies.

High-Value Added Foil Products

Viohalco's aluminium segment shines with high-value foil products, acting as a reliable "Cash Cow". Focusing on converters and lacquered foil creates a more stable demand. Cost optimization and yield improvements boost flat-rolled product volumes. This strategic product mix ensures consistent, profitable revenue.

- In 2024, the global market for aluminum foil is projected to reach $39.5 billion.

- High-value-added foil products often yield profit margins 10-15% higher than standard foil.

- Demand for aluminum foil is expected to grow by 3-5% annually through 2028.

Viohalco's Cash Cows generate steady revenue and high profitability. These segments benefit from strong market positions and efficient operations. They include copper, real estate, steel rebar, automotive extrusion, and aluminum foil. These areas consistently deliver strong financial results, supporting the company's overall performance.

| Segment | Key Driver | 2024 Performance Highlights |

|---|---|---|

| Copper | Favorable product mix | Stable prices |

| Real Estate | Rental Income | 7% increase in revenue |

| Steel Rebar | Construction growth | Stable supply |

| Automotive | Premium OEMs | 12% revenue growth |

| Aluminum Foil | High-value products | $39.5B market |

Dogs

In 2024, European commodity steel products fit the "Dog" category due to negative trends. The market faces global oversupply and low-cost imports. Revenue is slightly down, with weak demand expected in construction and manufacturing. Careful management is needed to mitigate losses in this segment.

Non-strategic real estate holdings in the Dogs category for Viohalco's Noval Property include properties not aligned with its core strategy. These holdings may yield little revenue. High maintenance costs can result in financial drain. In 2024, divestiture of such assets is being considered to improve profitability and focus.

Underperforming cable product lines, facing competition or obsolescence, are "Dogs." Divestiture is often the best strategy. For example, in 2024, some cable segments saw revenue declines. Turnaround plans are rarely fruitful. Consider selling these assets.

Low-Margin Copper Tube Products

Copper tube products with low margins and weak demand fit the "Dogs" quadrant. These products struggle in the manufacturing sector. Maintaining market share demands substantial resources. These products may not be attractive compared to others.

- Copper prices decreased by 5.4% in 2024 due to weak demand.

- Manufacturing output dropped by 2.8% in Q3 2024, affecting copper tube sales.

- Low-margin products typically have profit margins under 5%.

Unoptimized Aluminium Production Lines

Unoptimized aluminium production lines, lacking recent Elval plant investments, fit the "Dogs" category. These lines likely face higher costs and reduced output, diminishing their competitiveness. For instance, older lines might see production costs up to 15% higher. This situation necessitates either substantial investment or potential closure to mitigate losses.

- Higher production costs due to outdated technology and processes.

- Lower output volumes compared to modern, optimized lines.

- Reduced profitability and market competitiveness.

- Potential for significant losses if not addressed.

Viohalco's "Dogs" represent underperforming segments in 2024. These include commodity steel, non-strategic real estate, and some cable products. Copper tube and unoptimized aluminum lines also fall into this category. Careful management or divestiture is crucial to minimize financial impact.

| Segment | Key Issue (2024) | Impact |

|---|---|---|

| Commodity Steel | Oversupply, low demand | Revenue down, losses |

| Real Estate | Non-strategic, high costs | Financial drain |

| Cable Products | Competition, decline | Revenue decline |

| Copper Tubes | Low margins, weak demand | Reduced profitability |

| Aluminum | Unoptimized lines | Higher costs, losses |

Question Marks

The new U.S. cables facility is a Question Mark in Viohalco's BCG matrix. It targets high-growth potential in North America. Yet, it faces market entry risks and regulatory hurdles. Success hinges on securing contracts in the competitive U.S. market. In 2024, U.S. infrastructure spending hit $1.2 trillion, boosting demand.

Viohalco's steel pipes segment eyes hydrogen and CCS projects, mirroring the shift toward sustainable energy. These ventures, while promising high returns, are nascent, facing tech, regulatory, and market adoption uncertainties. The global CCS market is projected to reach $6.46 billion by 2024. The risk profile here is significant, given the early stage of these technologies.

Viohalco's aluminum segment eyes the EV market's growth, a high-growth opportunity. This demands hefty R&D investments and partnerships. Success hinges on creating innovative EV solutions. In 2024, the EV component market is worth billions.

Sustainable Packaging Solutions

The increasing need for eco-friendly packaging presents a "Question Mark" for Viohalco's aluminum segment. To tap into this growing market, Viohalco needs to invest in recycling infrastructure and sustainable material development. This move requires demonstrating strong environmental commitment and meeting strict regulations. Success hinges on strategic investments and a proactive approach to sustainability.

- The global sustainable packaging market was valued at $280 billion in 2023.

- Aluminum recycling saves 95% of the energy needed to make new aluminum.

- EU regulations mandate higher recycled content in packaging.

- Viohalco's 2024 financial reports will show investments in recycling.

Digitalization and Smart Technologies in Steel Pipes

The industrial tubes market is increasingly adopting digitalization and smart technologies, presenting a growth opportunity for Viohalco's steel pipes segment. Developing smart steel pipes, which include advanced monitoring and control features, requires substantial investment in technology and specialized expertise. Success hinges on Viohalco's capacity to deliver innovative solutions tailored to the industry's evolving demands. This strategic shift could enhance operational efficiency and open new revenue streams.

- The global smart pipes market is projected to reach $3.2 billion by 2028, growing at a CAGR of 9.5% from 2021 to 2028.

- Investment in R&D for smart technologies can range from 5% to 10% of revenue.

- Implementing smart pipe solutions can reduce operational costs by up to 15%.

- Adoption rates of digital technologies in the steel industry have increased by 20% in the last 3 years.

Viohalco faces uncertainties in its Question Marks. These include its U.S. cables facility, sustainable energy ventures, and EV-focused aluminum. Successful market entry and strategic investments are crucial.

| Segment | Initiative | Market Status (2024) | Key Challenge | 2024 Market Data |

|---|---|---|---|---|

| Cables | U.S. Facility | High Growth, Emerging | Securing Contracts | $1.2T U.S. infra. spending |

| Steel Pipes | Hydrogen/CCS | Nascent | Tech Adoption | $6.46B CCS market |

| Aluminum | EV Market | High Growth | R&D Investment | Billions in EV components |

| Aluminum | Eco-Friendly Packaging | Growing | Sustainable investment | $280B global market (2023) |

BCG Matrix Data Sources

Viohalco's BCG Matrix uses financial statements, market reports, and competitor analyses, providing solid and precise assessments.