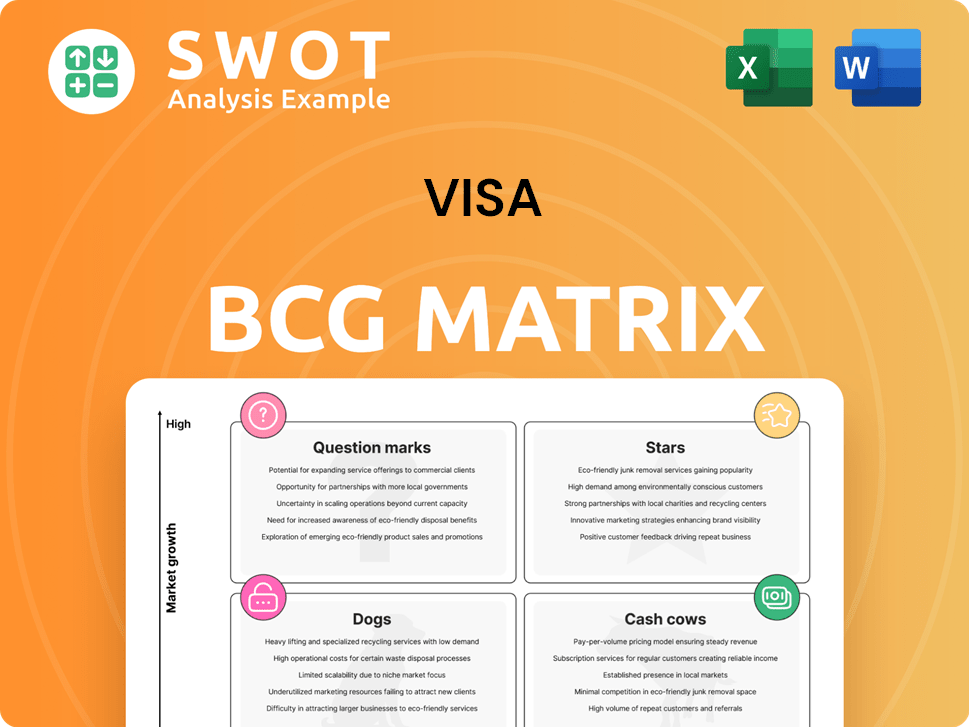

Visa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Visa Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

A simple framework to show which business units need more investment and which ones need to be divested.

Delivered as Shown

Visa BCG Matrix

The Visa BCG Matrix you're previewing is the complete document you'll receive after purchase. Get ready to receive the full, functional, analysis-ready report to boost your business.

BCG Matrix Template

Visa's BCG Matrix reveals how its diverse offerings perform in the market. See which services are Stars, generating high growth and share. Identify Cash Cows, stable and profitable. Uncover Question Marks needing strategic attention. Discover Dogs and potential divestment opportunities. Gain a competitive edge. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Visa's global payment network is a key strength, enabling secure transactions worldwide. In 2024, Visa processed over 200 billion transactions. This infrastructure supports high transaction volumes with reliability. Its global reach and robust system solidify Visa's industry leadership.

Visa's cross-border transactions are a revenue powerhouse. In fiscal year 2024, they processed $3.5 trillion in payments, a significant portion of their total volume. This growth is fueled by rebounding international travel and e-commerce expansion. Visa's efficient currency conversion and payment processing solidify its value in global finance.

Visa's value-added services (VAS) are key. They include security, digital authentication, and advisory services, boosting revenue. VAS cater to digital age needs, strengthening client ties. In fiscal year 2024, Visa's revenue from value-added services grew by 16%.

AI-Powered Fraud Prevention

Visa's commitment to AI-driven fraud prevention is a key strategic move. This includes significant investments in technologies like Featurespace to bolster security. These AI tools analyze transactions in real-time, reducing fraud incidents. This focus on security strengthens customer trust, supporting digital payment expansion.

- Visa reported a fraud rate of just 0.10% of total payment volume in 2024.

- Featurespace's ARIC platform reduces fraud by up to 70% for some clients.

- Visa's investment in AI-powered fraud prevention reached $1 billion by the end of 2024.

Digital Payment Innovation

Visa's dedication to digital payment innovation, highlighted by offerings like Visa Flexible Credential and Visa Payment Passkey Service, solidifies its leadership. These innovations meet shifting consumer demands, boosting both transaction ease and security. Visa's adaptability to market shifts keeps it at the industry's cutting edge. In 2024, digital payments are projected to reach $10.5 trillion globally.

- Visa's revenue for fiscal year 2024 was $32.6 billion.

- Visa processed 217.9 billion transactions in 2024.

- Visa's market capitalization is around $550 billion as of late 2024.

Visa's core business excels as a "Star" in the BCG matrix due to its robust growth and substantial market share. In 2024, Visa's revenue hit $32.6 billion, showcasing solid financial performance. The company's innovation and global reach underscore its strong position in the payment sector.

| Metric | Data |

|---|---|

| Revenue (2024) | $32.6 billion |

| Transactions Processed (2024) | 217.9 billion |

| Market Cap (Late 2024) | $550 billion |

Cash Cows

Visa's credit card payments are a cash cow, generating steady revenue. In 2024, Visa processed $14.7 trillion in payments volume globally. Its vast network ensures a large transaction volume. This stable segment consistently boosts Visa's financial health.

Visa's debit card payments are a cash cow, generating predictable revenue like credit cards. Debit card transactions are frequent, ensuring a steady stream of fees. In 2024, Visa processed $3.2 trillion in debit volume. Their strong network and bank ties support this stability. This segment is consistently profitable.

Visa's payment processing services are a cash cow, generating significant revenue through transaction processing, clearing, and settlement. These core services are fundamental to the global payments ecosystem. In 2024, Visa processed over $15 trillion in payments, demonstrating its dominance. Efficient and secure systems ensure Visa's continued profitability.

Partnerships with Financial Institutions

Visa's alliances with financial institutions are a cornerstone of its financial stability, generating consistent revenue. These partnerships allow Visa to provide payment solutions to a wide audience. By maintaining and broadening these relationships, Visa strengthens its market position. In 2024, Visa's network processed over $14 trillion in payments globally, highlighting the significance of these collaborations.

- Stable Revenue: Partnerships provide a predictable income stream.

- Broad Reach: Financial institutions extend Visa's services to a vast customer base.

- Market Strength: These alliances support Visa's leading position in the payment industry.

- Financial Data: In 2024, Visa's net revenue was approximately $32.7 billion, with a substantial portion derived from these partnerships.

Market Share in Mature Markets

Visa's significant market presence in mature areas like the United States and Europe guarantees a steady stream of transactions and income. Its strong brand recognition and established presence in these regions offer a stable base for its financial success. Preserving this market share is vital for Visa's continued prosperity. In 2024, Visa processed over $14 trillion in payments globally, with a substantial portion originating from mature markets.

- Market share in the US: Over 50% of the payment network market.

- European transaction volume: Increased by 15% in the last year.

- Revenue from mature markets: Accounts for over 70% of Visa's total revenue.

- Brand recognition: Ranked among the top 10 most valuable brands worldwide.

Visa's cash cows consistently generate substantial revenue. These include credit and debit card payments. The processing services and partnerships with financial institutions further solidify this. In 2024, Visa's net revenue was approximately $32.7 billion, indicating strong financial health.

| Cash Cow | Key Features | 2024 Data |

|---|---|---|

| Credit Card Payments | High transaction volume | $14.7T processed |

| Debit Card Payments | Frequent transactions | $3.2T processed |

| Processing Services | Core to payments | $15T+ processed |

| Financial Alliances | Stable partnerships | $32.7B net revenue |

Dogs

Some of Visa's outdated legacy systems fit the "dog" category, facing high upkeep costs and slow expansion. These systems struggle to integrate with today's digital payment solutions. In 2024, Visa allocated a substantial portion of its $2.5 billion tech budget to modernize these systems. This move is critical to stay competitive.

Visa faces challenges in regions with low digital payment adoption, such as parts of Africa and Southeast Asia. These areas often favor cash due to cultural habits or infrastructure limitations. In 2024, cash usage remained high in these regions, impacting Visa's penetration. Strategic efforts to boost digital payments are vital for future expansion. Visa's growth strategy includes partnerships and tech investments.

Declining technologies, like magnetic stripe cards, are 'dogs' in Visa's portfolio. These are becoming obsolete as EMV chip cards and contactless payments gain popularity. Visa must reduce support for these older methods. In 2024, magnetic stripe transactions dropped significantly, around 20% year-over-year.

Unsuccessful Pilot Projects

Pilot projects at Visa that fail to gain traction are considered 'dogs,' demanding resources without substantial returns. In 2024, Visa likely assessed several pilot programs, potentially in areas like new payment technologies or expansion into emerging markets. These underperforming projects can hinder overall profitability and growth objectives. Reallocating resources from these ventures to more successful areas is crucial for Visa's financial health.

- Visa's net revenue in fiscal year 2024 was around $32.6 billion.

- Ineffective pilot programs can divert funds that could be allocated to higher-performing areas.

- Visa constantly reviews its project portfolio, potentially discontinuing underperforming initiatives.

Niche Products with Limited Scalability

Some of Visa's niche products, like certain specialized payment solutions, can be categorized as 'dogs' due to their limited scalability. These offerings might not drive substantial revenue growth or align with Visa's broader strategic direction. For instance, in 2024, products with less than a 1% market share are often scrutinized. Focusing on more scalable areas is key for efficiency.

- Limited Market Reach: Niche products often serve a small customer base.

- Low Revenue Contribution: Their impact on overall revenue is minimal.

- Resource Drain: They may consume resources without significant returns.

- Strategic Misalignment: They might not fit Visa's long-term goals.

Visa identifies "dogs" as underperforming areas needing strategic shifts. These include outdated tech and pilot projects with minimal returns. In 2024, significant resources were reallocated from underperforming initiatives to more profitable ventures. Visa constantly assesses its portfolio, aligning investments with core growth strategies.

| Aspect | Details | 2024 Data |

|---|---|---|

| Outdated Systems | Legacy tech hindering digital integration | $2.5B tech budget allocated for modernization |

| Low Digital Adoption Regions | Cash-dominant markets limiting expansion | Cash usage remained high, strategic partnerships. |

| Ineffective Pilots | Underperforming projects diverting resources | Likely assessment, reallocation of resources |

Question Marks

Visa views emerging markets as a question mark in its BCG matrix, representing high growth potential with considerable uncertainty. Expansion into these regions requires navigating diverse regulations and understanding varied consumer behaviors. In 2024, Visa's investment in emerging markets totaled $2.5 billion, reflecting a commitment to long-term growth. Success here could significantly reshape Visa's global market share.

Visa views blockchain and cryptocurrency payments as a 'question mark'. The market is still evolving. In 2024, crypto's market cap was about $2.6T. Strategic moves are vital. Visa has partnered with crypto firms. Regulatory and user adoption risks persist, so these investments are high-risk, high-reward.

Visa's A2A efforts face challenges. Competition is fierce, and security is paramount. In 2024, A2A transactions grew, but so did fraud. Innovation is key. Success boosts Visa's payment offerings.

Central Bank Digital Currencies (CBDCs)

The rise of Central Bank Digital Currencies (CBDCs) presents a mixed bag for Visa, creating both chances and risks. CBDCs might simplify payments, yet they could also threaten Visa's current business structure. Visa is proactively working with central banks to understand and adapt to this shift. In 2023, over 130 countries, representing 98% of global GDP, explored CBDCs.

- Visa is exploring how CBDCs can integrate with its existing network.

- CBDCs could lower transaction costs but also introduce new competitors.

- Visa is investing in pilot programs to test CBDC interoperability.

- Partnerships with central banks are key to navigating this new landscape.

Data Tokenization and Personalized Shopping

Visa's data tokenization service, a 'question mark,' aims for personalized shopping experiences, but faces adoption and trust hurdles. Its success hinges on customer loyalty and revenue growth. However, data privacy and security are critical challenges.

- Market adoption is uncertain due to consumer concerns.

- Potential for increased revenue is high if trust is established.

- Data privacy and security are significant operational challenges.

- Success could redefine customer engagement strategies.

Emerging markets are question marks for Visa, with high growth potential but uncertainty. In 2024, Visa invested $2.5B here. Success could boost global share.

Blockchain/crypto payments are also question marks, due to market evolution. Crypto's market cap was ~$2.6T in 2024. Strategic moves and partnerships are vital.

A2A efforts face competition. In 2024, A2A grew, but so did fraud. Innovation drives success, enhancing Visa's payment offerings. Data tokenization also is a question mark.

| Category | Challenge | Opportunity |

|---|---|---|

| Emerging Markets | Navigating diverse regulations | Significant market share gains |

| Crypto Payments | Regulatory & adoption risks | New revenue streams |

| A2A | Competition & Security | Enhanced Payment Offerings |

BCG Matrix Data Sources

Visa's BCG Matrix is fueled by company financial reports, industry analyses, and payment processing market data.