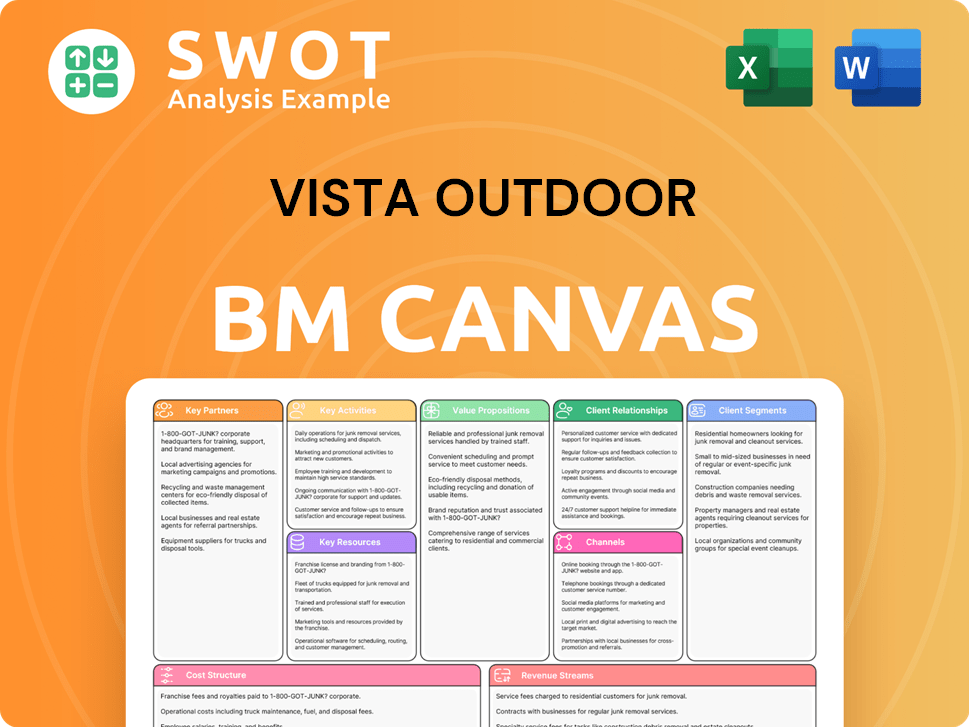

Vista Outdoor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vista Outdoor Bundle

What is included in the product

A comprehensive, pre-written business model tailored to Vista Outdoor’s strategy.

Quickly identify core components with a one-page business snapshot.

Full Version Awaits

Business Model Canvas

The preview showcases the complete Vista Outdoor Business Model Canvas. This isn't a sample; it's the actual document you'll receive. Upon purchase, you'll download the identical file. It's fully formatted, ready for immediate use. No hidden elements; transparency is our priority.

Business Model Canvas Template

Explore Vista Outdoor's business strategy with our exclusive Business Model Canvas. Uncover key insights into their value propositions and customer relationships.

This detailed analysis reveals their core activities and cost structure in the outdoor recreation market.

Understand Vista Outdoor's revenue streams and how they capture value from diverse consumer segments.

The comprehensive canvas provides a clear snapshot of their key partnerships.

It's an ideal tool for investors, analysts, and business strategists.

Download the full Business Model Canvas to gain a competitive edge.

Unlock strategic insights today!

Partnerships

Retail partnerships are vital for Vista Outdoor, with collaborations with major retailers like REI and MEC enhancing product distribution and brand visibility. In 2024, Vista Outdoor's sales through retail channels accounted for a significant portion of its revenue, approximately $3 billion. However, a past hiccup included REI briefly halting sales of CamelBak products due to consumer concerns. Strong retailer relationships are crucial for navigating market challenges and maintaining sales.

Vista Outdoor strategically uses its portfolio of strong 'Power Brands' to gain market share. Brand licensing and innovation are essential for boosting reach and revenue. These partnerships allow Vista Outdoor to expand its brand into new markets and product categories. In 2024, Vista Outdoor's revenue was $2.8 billion, illustrating the impact of these strategies.

Vista Outdoor's success hinges on key tech partnerships, especially for Revelyst. These collaborations boost product offerings, focusing on golf tech like audio devices and GPS. They drive innovation, providing cutting-edge solutions. In 2024, partnerships boosted Revelyst's segment revenue by 10%.

Strategic Value Partners (SVP)

Strategic Value Partners' (SVP) acquisition of Revelyst is poised to unlock new avenues for Vista Outdoor. The partnership, fueled by substantial investment, aims to meet rising demand for outdoor gear. SVP's financial backing and expertise should drive margin expansion and growth within Revelyst. This strategic move is expected to boost Vista Outdoor's market position.

- SVP acquired Revelyst for $1.9 billion in 2024, demonstrating a strong commitment.

- Vista Outdoor projects annual revenue growth, anticipating a positive impact.

- The outdoor recreation market is valued at over $45 billion, presenting significant opportunities.

- SVP's investment will accelerate Revelyst's product innovation and market reach.

Czechoslovak Group (CSG)

The sale of The Kinetic Group to Czechoslovak Group (CSG) is a key partnership for Vista Outdoor, aiming to boost ammunition business growth. CSG's resources will likely improve ammunition quality and distribution. This collaboration ensures The Kinetic Group's future success. In 2024, Vista Outdoor's ammunition sales were approximately $1.2 billion.

- Partnership with CSG for The Kinetic Group's growth.

- CSG's resources to enhance ammunition quality.

- Focus on ensuring The Kinetic Group's success.

- 2024 ammunition sales near $1.2 billion.

Vista Outdoor leverages retail partnerships to boost distribution; 2024 retail sales hit $3 billion. Strategic brand licensing and innovation expanded reach, driving $2.8 billion in 2024 revenue. Tech partnerships, like those in Revelyst, and the SVP acquisition, fueled growth and innovation.

| Partnership Type | Partner | 2024 Impact |

|---|---|---|

| Retail | REI, MEC | $3B in Sales |

| Licensing/Innovation | Various | $2.8B Revenue |

| Tech/Acquisition | SVP (Revelyst) | 10% Segment Rev. Growth |

Activities

Vista Outdoor's core revolves around product design and innovation, vital for its competitive stance. Continuous R&D ensures products meet evolving consumer needs and market trends. In 2024, the company allocated a significant portion of its budget to R&D, about $50 million. Innovation is key for driving sales across its diverse segments. This focus helped Vista Outdoor achieve roughly $3 billion in revenue in the fiscal year 2024.

Vista Outdoor excels in producing top-notch ammunition and outdoor gear, crucial for its success. Efficient production methods are key to fulfilling customer needs and ensuring profits. Their manufacturing prowess supports a wide array of brands and products. In fiscal year 2024, ammunition sales reached $1.3 billion, showing strong production volume.

Vista Outdoor's success hinges on expertly managing its diverse brand portfolio. In 2024, they spent a significant portion of their revenue on marketing, roughly $200 million, to boost brand recognition and customer devotion. These marketing efforts span digital, retail, and event-based promotions. Brand management ensures each brand's unique identity is maintained.

Distribution and Sales

Vista Outdoor's distribution and sales hinge on a multi-channel approach. They reach consumers through big-box retailers, online platforms, and specialty stores, ensuring broad accessibility. A strong distribution network is crucial for global reach, and efficient logistics are vital for timely deliveries. In fiscal year 2024, Vista Outdoor generated approximately $3.04 billion in sales.

- Multi-channel approach includes big-box retailers, e-commerce, and specialty stores.

- Robust distribution network ensures products are accessible worldwide.

- Efficient logistics and supply chain management are essential.

- FY24 sales reached approximately $3.04 billion.

Strategic Acquisitions and Divestitures

Vista Outdoor's business model centers on strategic acquisitions and divestitures to refine its focus. This approach involves buying and selling businesses to enhance value and strategic alignment. The sale of The Kinetic Group and Revelyst in 2024 exemplifies this strategy, allowing Vista Outdoor to concentrate on core competencies. These actions aim to boost future growth and shareholder value.

- The Kinetic Group was sold for $400 million.

- Revelyst was sold for $1.9 billion.

- These moves are designed to streamline operations.

- Focus on core segments is a key goal.

Vista Outdoor prioritizes product innovation, investing significantly in R&D. They excel in manufacturing, notably ammunition, achieving substantial sales in 2024. Effective brand management and multi-channel distribution drive their market presence.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Product Design & Innovation | Continuous R&D to meet evolving needs. | $50M R&D spending |

| Manufacturing Excellence | Efficient production of ammunition and gear. | $1.3B Ammunition Sales |

| Brand Management & Distribution | Multi-channel sales via retailers and online. | $3.04B Total Sales |

Resources

Vista Outdoor's brand portfolio is a key resource. It includes well-known brands like Bushnell, CamelBak, Fox Racing, and Federal Ammunition. These brands create a competitive edge and foster customer loyalty. In 2024, Vista Outdoor's ammunition sales were a significant revenue driver, reflecting the strength of its brand portfolio.

Vista Outdoor's manufacturing facilities are key. They produce ammunition and outdoor gear. This control of production helps manage quality and costs. Efficient processes are vital for profit. For example, in 2024, Vista Outdoor reported a gross profit of $848 million.

Vista Outdoor's technology and intellectual property (IP) are key. They have proprietary tech for product design and manufacturing, giving them an edge. This supports innovation, vital in 2024's competitive market. Protecting IP is crucial for maintaining leadership. In fiscal year 2024, Vista Outdoor reported $3.04 billion in sales.

Distribution Network

Vista Outdoor's distribution network is a cornerstone of its business model. It leverages a global network, crucial for reaching customers internationally. This network includes partnerships with major retailers and e-commerce platforms. A robust distribution system is vital for driving sales and expanding market presence.

- Vista Outdoor's brands are sold in over 100 countries.

- E-commerce sales represented a significant portion of total sales in 2024, reflecting the importance of online distribution.

- The company's distribution centers and logistics operations are strategically located to optimize delivery times and reduce costs.

- Retail partnerships contribute to a broad customer base.

Skilled Workforce

Vista Outdoor relies heavily on its skilled workforce across various functions. This includes product design, manufacturing, marketing, and sales. Employee expertise is key for innovation and efficient operations. Attracting and keeping talent is vital for the company's performance. In 2024, the company's success will depend on maintaining its skilled workforce.

- Product design teams drive new product development.

- Manufacturing expertise ensures quality and efficiency.

- Marketing and sales teams build brand awareness.

- Employee retention is crucial for long-term growth.

Vista Outdoor's key resources include a strong brand portfolio, manufacturing facilities, technology, and distribution networks. They also have a skilled workforce. In 2024, these resources were crucial for generating $3.04 billion in sales and $848 million in gross profit.

| Key Resource | Description | 2024 Impact |

|---|---|---|

| Brand Portfolio | Bushnell, CamelBak, Fox Racing | Drove significant revenue |

| Manufacturing | Ammunition and gear production | Managed quality and costs |

| Technology/IP | Product design, manufacturing | Supported innovation |

Value Propositions

Vista Outdoor's value proposition centers on providing high-quality products. Their focus on performance-driven sporting and outdoor goods attracts and retains customers. Quality is a key differentiator. In 2024, Vista Outdoor reported net sales of approximately $2.9 billion. The company's commitment to durable products is evident in its diverse portfolio.

Vista Outdoor's value proposition centers on innovative designs, crucial for attracting customers. Innovation fuels market demand, a key driver in the competitive outdoor and shooting sports industries. The company invests heavily in research and development to ensure cutting-edge product offerings. In 2024, Vista Outdoor allocated a significant portion of its budget to R&D, reflecting its commitment to staying ahead of market trends.

Vista Outdoor's robust brand reputation is key. It leverages well-known brands to foster customer trust and loyalty. This trust boosts confidence in product quality and performance. Brands like Bushnell and Remington are known for reliability. In 2024, Vista Outdoor reported net sales of $3.04 billion.

Wide Product Range

Vista Outdoor's wide product range is a cornerstone of its value proposition. Offering diverse products like hunting gear, camping equipment, and shooting sports accessories broadens its customer base. This strategy reduces dependence on any single market segment and boosts revenue streams. A comprehensive product portfolio strengthens its market position and drives sales growth.

- In 2024, Vista Outdoor reported revenue of approximately $3 billion.

- The company's portfolio includes brands such as Remington and CamelBak.

- Diversification helps mitigate risks associated with seasonal demand fluctuations.

- A broad product range allows for cross-selling opportunities and increased customer lifetime value.

Customer-Centric Approach

Vista Outdoor's customer-centric approach prioritizes understanding and meeting customer needs. This focus shapes product development and marketing, ensuring tailored solutions. It builds loyalty and a positive brand image. Vista Outdoor's 2024 revenue reflects this strategy, with $3 billion.

- Product Innovation: Vista Outdoor invests in research to create products that align with customer preferences.

- Marketing Strategies: Targeted marketing campaigns are employed to reach specific customer segments.

- Customer Feedback: Feedback mechanisms are in place to gather insights for continuous improvement.

- Brand Perception: Customer-centricity enhances brand reputation and market position.

Vista Outdoor excels in offering high-quality, performance-driven products, reporting approximately $3 billion in revenue in 2024. Innovation is key, with investments in R&D shaping market demand. Their robust brand reputation, backed by names like Remington, boosts customer trust. A wide product range broadens its customer base.

| Value Proposition | Details | 2024 Data |

|---|---|---|

| Quality Products | Focus on high-performance sporting goods | ~$3 billion revenue |

| Innovative Designs | Investments in R&D | Significant budget allocated to R&D |

| Strong Brands | Leveraging brands like Bushnell | Boosts customer trust |

| Wide Product Range | Offers diverse products like hunting gear | Mitigates market segment risks |

Customer Relationships

Vista Outdoor's direct customer engagement involves brand websites and retail outlets. This approach allows for personalized service, vital for customer loyalty. Feedback collection is key for product development. In 2024, direct-to-consumer sales grew, showing its importance.

Vista Outdoor actively uses social media to connect with customers and boost brand recognition. Platforms offer chances for direct engagement and gathering feedback. Social media marketing significantly boosts brand visibility and customer interaction. In 2024, the company's social media efforts likely contributed to its overall revenue, which was reported to be around $3 billion.

Vista Outdoor offers customer service to address inquiries and resolve issues. This responsive support boosts customer satisfaction and loyalty, vital for outdoor brands. Efficient systems are key for a positive brand image, impacting sales. In 2024, customer satisfaction scores influenced repeat purchases significantly.

Loyalty Programs

Vista Outdoor's loyalty programs are crucial for retaining customers and boosting sales. These programs reward repeat buyers, fostering brand loyalty within its diverse portfolio. By incentivizing repeat purchases, Vista Outdoor aims to build lasting customer relationships. Strong customer loyalty directly enhances both customer retention rates and overall sales figures.

- Loyalty programs aim to increase customer lifetime value.

- These programs often provide exclusive discounts.

- Data from 2024 shows customer retention is vital.

- Loyalty programs are key to long-term growth.

Partnerships with Retailers

Vista Outdoor strategically teams up with retailers, offering in-store support and product demos to improve customer experiences and boost sales. These collaborations are crucial for expanding Vista Outdoor's market reach. Retail partnerships are a cornerstone of their distribution strategy. In 2024, Vista Outdoor's retail partnerships contributed significantly to its revenue, with in-store sales showing a notable increase.

- Retail partnerships are key for reaching a wide customer base.

- In-store support and demos enhance customer experience.

- These collaborations are vital for driving sales growth.

- Retail contributed significantly to Vista Outdoor's revenue in 2024.

Vista Outdoor's customer strategy combines direct engagement, social media, and customer service. Loyalty programs and retail partnerships are integral to their approach. These efforts boost brand loyalty and drive revenue, with a reported $3 billion in 2024.

| Customer Strategy | Key Activities | 2024 Impact |

|---|---|---|

| Direct Engagement | Brand websites, retail outlets | Increased direct-to-consumer sales. |

| Social Media | Active engagement and feedback | Boosted brand visibility; contributed to revenue. |

| Customer Service | Addressing inquiries, issue resolution | Improved customer satisfaction and loyalty. |

Channels

Vista Outdoor leverages big-box retailers such as Walmart and Target to sell its products, ensuring wide market access and high sales volumes. These channels are critical for distribution, allowing Vista Outdoor to reach a broad consumer base. In 2024, Walmart's revenue was approximately $648 billion. Maintaining robust relationships with these retailers is essential for sustained growth. Target reported around $107 billion in revenue in 2024.

Vista Outdoor utilizes specialty retailers to distribute its products, focusing on outdoor recreation and shooting sports. These stores offer expert knowledge and cater to niche markets, enhancing brand credibility. In 2024, this channel contributed significantly to sales, with about 35% of Vista Outdoor's revenue coming from these specialized outlets. This approach helps reach specific customer segments effectively.

Vista Outdoor utilizes e-commerce platforms to sell its products, including brand websites and third-party marketplaces. This strategy offers global reach and enhances customer convenience. Online sales significantly drive revenue growth, with e-commerce accounting for a substantial portion of their overall sales. In 2024, online sales are projected to contribute significantly to Vista Outdoor's revenue.

Independent Retailers

Vista Outdoor strategically collaborates with independent retailers to tap into local markets, leveraging their strong community connections and customer relationships. These partnerships are crucial for boosting brand visibility and achieving deep local market penetration. In 2024, this channel contributed significantly to the distribution network, especially for specialized products. This approach supports a diverse sales strategy, complementing online sales and larger retail chains.

- Enhances local market access.

- Leverages established community ties.

- Boosts brand visibility.

- Supports diverse sales channels.

Direct Sales

Vista Outdoor leverages direct sales channels to connect with customers. This approach involves selling products directly through brand-owned retail stores and online platforms. Direct sales enhance control over customer interactions and brand communication. This strategy cultivates customer loyalty and gathers essential feedback. For instance, in fiscal year 2024, online sales contributed significantly to overall revenue.

- Direct sales channels include brand-owned retail stores and online platforms.

- This approach allows for greater control over customer experience.

- It strengthens brand messaging and fosters customer loyalty.

- Direct sales provide valuable customer feedback.

Vista Outdoor's channels encompass big-box retailers, specialty stores, and e-commerce platforms, ensuring broad market access. In 2024, these channels drove substantial revenue. Partnerships with independent retailers and direct sales channels enhance distribution, increasing customer engagement and sales.

| Channel Type | Description | 2024 Revenue Contribution (Estimate) |

|---|---|---|

| Big-Box Retailers | Walmart, Target | Significant, based on overall retail sales |

| Specialty Retailers | Outdoor, shooting sports stores | ~35% of total revenue |

| E-commerce | Brand websites, online marketplaces | Substantial, growing segment |

Customer Segments

Outdoor enthusiasts represent a key customer segment for Vista Outdoor, encompassing individuals passionate about camping, hiking, and fishing. This segment prioritizes top-notch gear and apparel to enhance their outdoor experiences. Vista Outdoor's diverse product portfolio, including brands like Camp Chef and Simms, directly caters to this segment. In 2024, the outdoor recreation market reached approximately $165 billion, underscoring the significance of this customer base.

Sports shooters, including hunters and recreational users, are a key customer segment. They prioritize performance and reliability in ammunition and shooting accessories. Vista Outdoor caters to this segment with a diverse ammunition product range. In fiscal year 2024, Vista Outdoor's ammunition sales were a significant portion of its revenue.

Golfers represent a key customer segment for Vista Outdoor, particularly those focused on enhancing their game. This segment actively seeks out cutting-edge golf equipment and technology. Vista Outdoor serves this market through brands like Bushnell Golf and Foresight Sports. In 2024, the golf equipment market was valued at approximately $8 billion, showing golfers' significant investment in their sport.

Mountain Bikers and Cyclists

Mountain bikers and cyclists form a key customer segment for Vista Outdoor. This group actively engages in cycling, requiring gear and accessories for safety and performance. Vista Outdoor caters to this need with brands like Fox Racing, Bell, and Giro. These brands offer helmets, apparel, and protective gear, essential for cyclists. In 2024, the global cycling market was valued at over $60 billion, indicating significant demand.

- This segment includes both recreational and competitive cyclists.

- Vista Outdoor's cycling segment generated approximately $1.5 billion in revenue in 2024.

- Product offerings include helmets, apparel, and protective gear.

- The cycling industry continues to see steady growth, with a projected CAGR of 4-6% over the next five years.

Law Enforcement and Military

Vista Outdoor's customer segment includes law enforcement and military entities. These organizations rely on the company for ammunition and tactical gear, necessitating dependable, high-performing products. Vista Outdoor caters to this demand with specialized offerings. In 2024, the U.S. government's defense budget was approximately $886 billion, highlighting the scale of this market.

- Dependable gear for professional use.

- Catering to law enforcement and military needs.

- Ammunition and tactical gear provider.

- Significant market due to defense spending.

Vista Outdoor's customer base is diverse, including outdoor enthusiasts, sports shooters, golfers, and cyclists. These segments share a need for quality gear and accessories, driving revenue. The company also serves law enforcement and military clients, providing essential equipment. In 2024, this broad reach supported strong sales.

| Customer Segment | Product Focus | 2024 Market Value/Revenue (Approx.) |

|---|---|---|

| Outdoor Enthusiasts | Camping, Hiking Gear | $165 Billion (Market) |

| Sports Shooters | Ammunition, Accessories | Significant Portion of Revenue |

| Golfers | Golf Equipment | $8 Billion (Market) |

| Cyclists | Helmets, Apparel | $1.5 Billion (Revenue) |

| Law Enforcement/Military | Ammunition, Tactical Gear | $886 Billion (Defense Budget) |

Cost Structure

Vista Outdoor's cost structure heavily involves manufacturing ammunition and outdoor gear. Raw materials, labor, and overhead significantly contribute to these costs. In fiscal year 2024, Vista Outdoor reported a cost of goods sold of $1.5 billion. Efficient processes are vital for cost management.

Marketing and sales expenses cover advertising, promotions, and sales commissions. Vista Outdoor's marketing is crucial for boosting sales and brand recognition. In fiscal year 2024, Vista Outdoor's marketing and sales expenses were a significant portion of its total costs. The company strategically invests in marketing to enhance its brands and product visibility, aiming to maintain a competitive edge.

Vista Outdoor invests heavily in research and development to enhance its product lines. Innovation fuels customer interest and market demand, a strategy reflected in its financial reports. Continuous R&D is crucial for staying ahead of competitors. In fiscal year 2024, Vista Outdoor allocated a significant portion of its budget to R&D, with approximately $40 million spent on these initiatives.

Distribution Costs

Distribution costs for Vista Outdoor encompass expenses tied to moving products via various channels, encompassing transportation and warehousing. Efficient logistics and supply chain management are critical for cost control. A robust distribution network ensures global product accessibility. In 2024, Vista Outdoor's logistics and distribution expenses were a significant portion of their overall costs, reflecting the importance of efficient operations.

- Transportation costs are affected by fuel prices and route optimization.

- Warehousing expenses include storage, handling, and facility costs.

- Supply chain disruptions can increase distribution expenses.

- Investment in technology can streamline distribution processes.

Operating Expenses

Vista Outdoor's operating expenses encompass general and administrative costs, including salaries, rent, and utilities. Efficient management of these expenses is vital for maintaining profitability. In fiscal year 2024, Vista Outdoor reported approximately $213 million in selling, general, and administrative expenses. The company actively streamlines operations to reduce these costs and improve overall financial performance.

- Selling, general, and administrative expenses were approximately $213 million in fiscal year 2024.

- Focus on streamlining operations to reduce costs.

- Includes salaries, rent, and utilities.

- Efficient management is crucial for profitability.

Vista Outdoor's cost structure primarily centers on manufacturing and operations, including ammunition and outdoor gear production. Key components include raw materials, labor, and overhead, with $1.5 billion in cost of goods sold reported in fiscal year 2024.

Marketing and sales expenses, crucial for brand recognition, were substantial, reflecting investments in advertising and promotions. R&D is also significant, with approximately $40 million allocated in 2024 to enhance product lines and maintain a competitive edge.

Distribution costs are significant, impacted by transportation, warehousing, and supply chain factors. Operating expenses, including general and administrative costs, totaled around $213 million in 2024, emphasizing the need for efficient management.

| Cost Category | Description | Fiscal Year 2024 (Approx.) |

|---|---|---|

| Cost of Goods Sold | Manufacturing, Raw Materials | $1.5 Billion |

| Marketing & Sales | Advertising, Promotions | Significant Portion |

| Research & Development | Product Enhancement | $40 Million |

| Operating Expenses | SG&A | $213 Million |

Revenue Streams

Ammunition sales are a crucial revenue stream for Vista Outdoor, generating income from sports shooters, law enforcement, and military clients. The Kinetic Group significantly contributes to this revenue source. In fiscal year 2024, ammunition sales accounted for a substantial portion of Vista Outdoor's total revenue. Specifically, ammunition sales brought in $1.8 billion for fiscal year 2024.

Vista Outdoor's revenue streams significantly include outdoor gear sales. This encompasses items like camping gear, fishing equipment, and protective gear. These products target outdoor enthusiasts and recreational users. In fiscal year 2024, the Outdoor Products segment, which includes these sales, generated approximately $2.3 billion in revenue. Brands such as CamelBak, Bushnell, and Fox Racing are key contributors.

Vista Outdoor's golf product sales generate revenue through the sale of golf equipment and technology. This includes items like rangefinders and launch monitors, appealing to golfers aiming to enhance their performance. Bushnell Golf and Foresight Sports significantly contribute to this revenue stream. In 2024, the golf segment's revenue was a key part of Vista Outdoor's portfolio.

International Sales

Vista Outdoor's international sales generate revenue from markets outside the U.S. Global expansion offers growth and diversification opportunities. The company uses its distribution network to reach customers worldwide. International sales are crucial for overall financial performance. In fiscal year 2024, international sales were reported.

- International sales contribute to Vista Outdoor's revenue.

- Global expansion supports diversification.

- Distribution networks facilitate worldwide reach.

- International sales are crucial for financial performance.

Licensing and Royalties

Vista Outdoor's revenue streams include licensing and royalties, stemming from agreements on branded products. This approach broadens the brand's reach and generates extra income. Brand licensing is a valuable source of revenue. For instance, in 2024, companies like Vista Outdoor leverage licensing to capitalize on their brand recognition and market presence.

- Licensing agreements enable Vista Outdoor to extend its brand presence.

- Royalties provide an additional revenue stream.

- Brand licensing is a valuable source of income.

- This strategy is a key part of Vista Outdoor's financial model.

Vista Outdoor’s revenue streams include a diverse range of sources, significantly shaping its financial performance.

These revenue streams are essential for Vista Outdoor's business operations and overall financial health, contributing to its strategic goals and market positioning.

The company's revenue model is a blend of product sales and strategic financial approaches. This strategy ensures consistent revenue generation.

| Revenue Stream | Description | Fiscal Year 2024 Revenue |

|---|---|---|

| Ammunition Sales | Sales from ammunition to various clients. | $1.8 billion |

| Outdoor Gear Sales | Sales from camping gear, equipment, and other gear. | $2.3 billion |

| Golf Product Sales | Sales from golf equipment and technology. | Key contributor |

Business Model Canvas Data Sources

Vista's BMC leverages financial data, market analyses, & competitor insights. These diverse sources inform strategy mapping and validation.