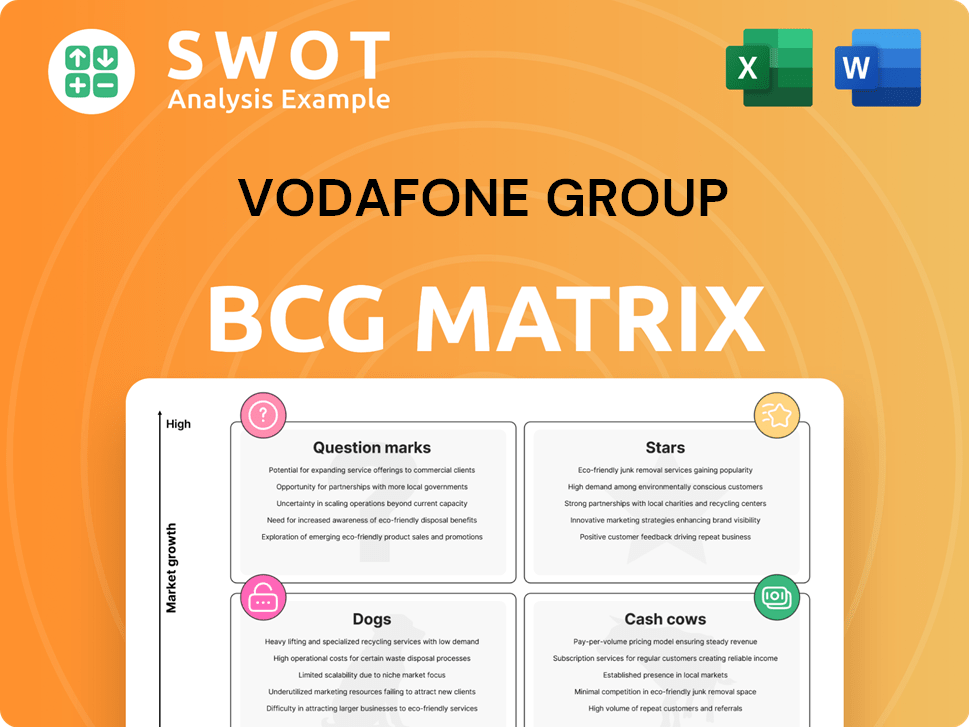

Vodafone Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vodafone Group Bundle

What is included in the product

Tailored analysis for Vodafone's product portfolio across all BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs, providing clear Vodafone Group unit strategies.

What You See Is What You Get

Vodafone Group BCG Matrix

This is the full Vodafone Group BCG Matrix you'll receive upon purchase, identical to this preview. It's a ready-to-use document providing strategic insights into Vodafone's business portfolio. Download it instantly and start your analysis.

BCG Matrix Template

Vodafone, a telecommunications giant, operates in a complex landscape. Its diverse offerings can be visualized using the BCG Matrix. This framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks. Identifying these positions highlights Vodafone's strengths and weaknesses. Understanding this is vital for strategic decision-making.

Uncover Vodafone's exact quadrant placements with the full BCG Matrix report. It's your shortcut to strategic clarity and smart investment decisions. Purchase now for actionable insights.

Stars

Vodafone Business's digital services, especially cloud and security, are booming. They're tapping into the digital transformation needs of SMEs and public sector clients. Vodafone is investing and partnering, like with Microsoft, to boost cloud and AI capabilities. In 2024, Vodafone's cloud revenue grew significantly, showcasing strong market potential. This positions them for sustained growth and leadership.

Vodafone's IoT platform is a Star in the BCG Matrix. Gartner recognizes its strong execution in the managed IoT connectivity services market. Vodafone boasts a massive global footprint with millions of connections. Partnerships, like the one with Microsoft, boost its market presence. In 2024, Vodafone's IoT revenue was substantial.

Vodafone's 5G rollout is a "Star" in its BCG Matrix, focusing on key markets with high 5G device penetration. The company has partnered with Ericsson, Nokia, and Samsung. This strategic approach aims to boost revenue and improve ARPU. Vodafone invested approximately €1.4 billion in its networks in the first half of fiscal year 2024.

Vodafone UK Consumer Business

Vodafone UK's consumer business is experiencing solid growth. This is fueled by enhanced customer experiences and an expanding customer base. Converged plans, bundling mobile and fixed-line services, boost ARPU and market share. The introduction of 'One Touch Switching' supports broadband gains.

- Service revenue growth is evident, reflecting strategic investments.

- Converged plans increase ARPU and strengthen market positioning.

- 'One Touch Switching' aids in broadband net additions.

M-PESA Mobile Money Platform (Africa)

M-PESA, a star in Vodafone's portfolio, shines brightly across Africa, driving financial inclusion and significant growth. It leverages mobile tech to offer accessible financial services, boasting a large customer base. Vodafone's strategic expansion of M-PESA fuels revenue and positive social impact. In 2024, M-PESA processed transactions worth over $30 billion, showcasing its dominance.

- 2024 transaction value exceeded $30 billion.

- Dominant player in African mobile money.

- Focus on expanding services.

- Significant growth and social impact.

Vodafone's Stars include thriving services like cloud, IoT, 5G, consumer business in UK and M-PESA. These areas show strong growth and market leadership. They are fueled by strategic investments and partnerships. Each Star leverages technology and partnerships for expansion.

| Star | Key Metric | 2024 Data |

|---|---|---|

| Vodafone Business (Cloud) | Revenue Growth | Significant Growth |

| IoT Platform | Connections | Millions |

| 5G Rollout | Network Investment | €1.4B (H1 FY24) |

| M-PESA | Transaction Value | $30B+ |

Cash Cows

Vodafone's mobile and fixed-line services are cash cows in Europe. These services provide consistent revenue, supported by a large customer base and network infrastructure. For example, in 2024, Vodafone generated approximately €10 billion in service revenue from its European markets. Offering converged plans and added services maintains customer loyalty and cash flow.

Vodacom South Africa, a cash cow, holds a strong market position. It benefits from a large mobile contract base and high data usage, ensuring consistent revenue streams. Vodacom's 'VodaPay' super-app and cloud services contribute to revenue growth. In 2024, Vodacom reported strong financial results, with service revenue up by 4.6%.

Vodafone's wholesale business, offering connectivity services to other operators, is a cash cow. This segment sees stable revenue from long-term contracts. In 2024, it benefited from rising network capacity demand. Vodafone's wholesale arm ensures consistent cash flow. The wholesale segment contributed significantly to Vodafone's revenue in 2024.

Vodafone Partnerships

Vodafone's strategic alliances, such as those with Google and Microsoft, are key to enhancing its service offerings and boosting revenue through joint ventures. These partnerships allow Vodafone to introduce AI-driven content, devices, and cloud services to its customers, as well as improve its internal efficiency. The long-term nature of these collaborations secures a steady revenue stream and access to advanced technologies.

- Vodafone and Microsoft expanded their partnership in 2024 to include AI-powered services.

- A 2024 report showed partnerships contributed 15% to Vodafone's total revenue.

- Google Cloud and Vodafone collaborated in 2024 to offer advanced data analytics solutions.

- These partnerships are expected to yield a 10% increase in operational efficiency by 2025.

Cost Optimization Initiatives

Vodafone's cost optimization efforts, such as job cuts and simplified operations, are crucial for boosting profitability and cash flow. Streamlining and reducing expenses enable better financial performance and reinvestment in growth. These initiatives are vital for competitiveness and maximizing returns in a tough market. Vodafone's 2024 plan included €1 billion in cost savings.

- Job cuts and operational simplification drive cost savings.

- Improved financials support reinvestment and growth.

- Essential for staying competitive in the market.

- Vodafone aims for €1 billion in savings by 2024.

Cash cows, like Vodafone's European services and Vodacom South Africa, generate stable revenue. These segments, including wholesale and strategic alliances, ensure consistent cash flow. Cost optimization efforts further boost profitability.

| Segment | 2024 Revenue (Approx.) | Key Strategies |

|---|---|---|

| European Services | €10B+ | Converged plans, added services |

| Vodacom SA | Strong growth | VodaPay, cloud services |

| Wholesale | Stable | Long-term contracts |

Dogs

Vodafone Germany's fixed broadband is a "Dog" in the BCG Matrix. Facing fierce competition and regulatory hurdles, it struggles with customer and revenue declines. In Q1 2024, Vodafone Germany saw a 3.2% drop in fixed-line revenue. Substantial investment is needed for a turnaround, with uncertain short-term gains. The MDU TV law change further complicates matters.

Vodafone's legacy mobile services, especially 3G, struggle in some markets. Customer shifts to 4G/5G cause declining revenue. Maintaining old networks is costly. In 2024, 3G sunsetting continues. Strategic network decisions are needed to cut losses.

Vodafone's discontinued operations in Spain and Italy, sold in 2023, fit the "Dogs" quadrant of the BCG matrix. These disposals, though providing capital, resulted in a 15.3% decrease in Group revenue in FY24. The absence of these markets reduces Vodafone's scale. Vodafone now concentrates on core markets.

Low-Margin Equipment Sales

Vodafone's low-margin equipment sales, especially in price-sensitive areas, yield minimal profits. Selling hardware can distract from more profitable services. Improving returns needs strategic device partnerships and sales tactics. In 2024, Vodafone's hardware sales represented a small fraction of overall revenue.

- Low profit margins are typical in equipment sales.

- Focusing on hardware can shift resources away from high-margin services.

- Strategic changes are needed to improve profitability.

- Hardware sales constitute a small portion of overall revenue.

Project Revenue Slowdown (Business Segment)

Vodafone Business faces challenges with project revenue slowdown impacting short-term results, despite overall growth. Volatility arises from reliance on project-based income, creating uncertainty. Stabilizing performance requires a shift toward recurring revenue models and long-term contracts. This strategic move is crucial for sustained growth.

- Vodafone's 2024 financial results show a focus on streamlining operations within Vodafone Business.

- Project revenue slowdown is evident in specific markets, affecting short-term profitability.

- Transitioning to recurring revenue is a key strategic priority for long-term stability.

- Vodafone's strategic adjustments aim to enhance the business segment's performance.

Several Vodafone segments are "Dogs." These include fixed broadband in Germany, legacy mobile services, and operations in Spain and Italy, which were sold in 2023. Low-margin equipment sales and project revenue slowdown in Vodafone Business also contribute to this designation. Strategic adjustments are key to boosting profitability.

| Area | Challenge | Impact |

|---|---|---|

| Fixed Broadband (Germany) | Intense competition, regulatory hurdles | 3.2% drop in fixed-line revenue (Q1 2024) |

| Legacy Mobile | Customer shift to 4G/5G | Declining revenue in some markets |

| Spain/Italy (Sold in 2023) | Disposal of operations | 15.3% decrease in Group revenue (FY24) |

| Equipment Sales | Low profit margins | Minimal profits |

Question Marks

Vodafone's 5G private networks are in the question mark quadrant of the BCG Matrix. Vodafone Business aims to significantly increase these deployments by 2026. Despite 127 deployments across 80 countries, long-term success is uncertain. These networks require substantial investment and face competition. A strategic approach is vital for revenue growth.

Vodafone's AI investments, including generative AI and personalized experiences, are high-growth, high-risk ventures. Success hinges on execution, customer uptake, and competition. Their partnership with Google is key. In 2024, the global AI market is projected at $200 billion, with significant growth potential.

Vodafone's expansion in emerging markets, like Africa, faces risks. These ventures demand high investment and battle regulatory issues. Competition from local firms is fierce. Success hinges on market assessment and a clear strategy. Vodafone's 2024 data shows strategic shifts in these areas.

Cybersecurity Solutions for Businesses

Vodafone's push into cloud-native cybersecurity solutions is a Question Mark in its BCG matrix. This area offers growth potential, but faces stiff competition. Success hinges on effective threat protection and seamless IT integration. Strategic partnerships and tech investments are key.

- In 2024, the global cybersecurity market is valued at over $200 billion.

- Vodafone has invested heavily in partnerships with cybersecurity firms.

- Cloud security spending is expected to grow significantly in the coming years.

- The ability to integrate with existing systems is crucial for adoption.

Digital Financial Services (Beyond M-PESA)

Vodafone's digital financial services, beyond M-PESA, face hurdles despite M-PESA's success. Market adoption and regulatory compliance are significant challenges. Building customer trust and offering competitive products are essential for growth. A clear value proposition is critical for traction in the digital finance market.

- M-PESA processed $314.6 billion in transactions in the financial year 2024.

- Compliance costs can significantly impact profitability.

- Customer trust is crucial for adoption of new services.

- Competition from established players and fintechs is intense.

Vodafone's ventures, like cloud cybersecurity, are question marks in its BCG matrix. The global cybersecurity market is valued at over $200 billion in 2024. Vodafone’s success depends on partnerships and tech integration. Growth hinges on effective threat protection.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Value | Cybersecurity market | $200+ billion |

| Key Actions | Vodafone's investments | Partnerships, tech integration |

| Success Factors | Core requirements | Threat protection, IT integration |

BCG Matrix Data Sources

The Vodafone BCG Matrix relies on financial statements, market analyses, and telecom sector reports to identify each business unit's position.