Volvo Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volvo Group Bundle

What is included in the product

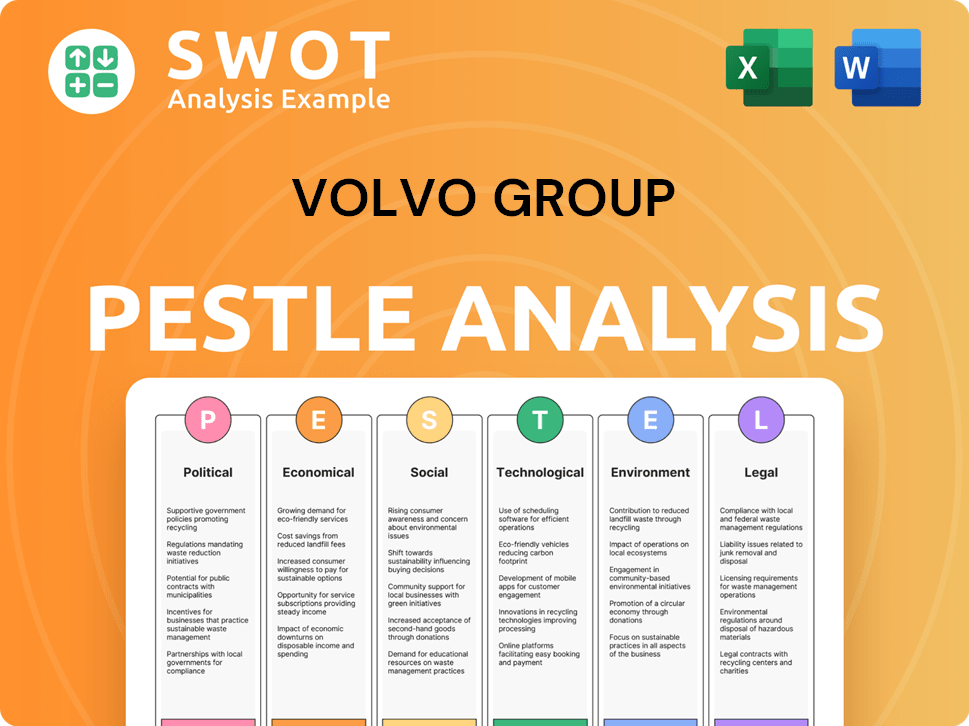

Examines external factors affecting Volvo across political, economic, social, tech, environmental, and legal areas.

Helps support discussions on external factors for market positioning and strategic alignment.

What You See Is What You Get

Volvo Group PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Volvo Group PESTLE analysis, reflecting political, economic, social, technological, legal, and environmental factors, is ready. There are no content differences after purchase.

PESTLE Analysis Template

Explore the forces shaping Volvo Group's future with our PESTLE analysis. Discover political impacts, economic trends, social changes, technological disruptions, legal considerations, and environmental factors affecting their strategy. Understand the external landscape, anticipate risks, and identify growth opportunities. Equip yourself with a complete understanding to make informed decisions. Download the full version now for actionable insights!

Political factors

Geopolitical instability globally affects Volvo's market demand and creates uncertainty. Trade tariffs, especially on electric vehicle imports, pose challenges. In 2024, Volvo faced supply chain disruptions. The company's strategy involves production relocation and supply chain adjustments. Volvo's 2024 revenue was SEK 553.4 billion.

Government regulations on emissions heavily affect Volvo's product development and market strategies. Incentives for EVs and infrastructure significantly boost adoption. In 2024, EU regulations drove Volvo to increase EV sales. Governments worldwide offer subsidies; for example, the U.S. offers tax credits. These incentives impact fleet viability.

Volvo Group's global presence, spanning approximately 180 markets, underscores the significance of political stability. Political instability can disrupt operations. For instance, in 2024, geopolitical tensions impacted supply chains. These disruptions can lead to increased operational costs.

International Relations and Trade Agreements

Volvo Group's extensive global footprint makes it highly susceptible to international relations and trade pacts. Trade agreements can drastically influence Volvo's import and export processes. For instance, the EU-Canada Comprehensive Economic and Trade Agreement (CETA) facilitates smoother trade flows. Alterations to such agreements directly impact costs and competitiveness.

- In 2024, 40% of Volvo's sales came from outside Europe.

- Tariffs can increase costs, impacting profitability.

- Trade wars can disrupt supply chains.

Government Procurement and Defense Spending

Government procurement and defense spending significantly influence Volvo Group. Increased defense spending boosts demand for vehicles like those from Mack Defense Canada. In 2024, Canada's defense budget is projected at $26.6 billion CAD, potentially benefiting Volvo. This spending can translate into substantial contracts for specialized vehicles.

- Canada's defense budget in 2024: $26.6 billion CAD.

- Mack Defense Canada is a division of Volvo Group Canada.

Political factors significantly influence Volvo Group's global operations. International trade agreements affect import and export processes, impacting costs. Government defense spending and procurement also influence demand. For instance, in 2024, Canada's defense budget reached $26.6 billion CAD.

| Factor | Impact | Example (2024 Data) |

|---|---|---|

| Geopolitical Instability | Disrupts supply chains, market demand. | Supply chain issues affected Volvo's operations. |

| Trade Agreements | Influences import/export, costs. | EU-Canada CETA affects trade flows. |

| Government Spending | Boosts demand. | Canada's $26.6B defense budget. |

Economic factors

Market demand normalized in 2024, impacting Volvo's sales volumes. Economic uncertainty and slowing growth pose challenges in 2025. Volvo's Q1 2024 sales decreased by 10% compared to 2023. Anticipated market growth is around 2-3% for 2025. This requires strategic adaptation.

Inflation significantly influences Volvo's operational costs, including raw materials and manufacturing. In 2024, the Eurozone's inflation rate fluctuated, impacting material prices. Higher interest rates, such as those observed in 2024, can increase the cost of vehicle financing, which may affect Volvo's sales volume. For instance, the European Central Bank (ECB) raised rates multiple times in 2024, affecting consumer borrowing costs.

Currency exchange rate fluctuations significantly impact Volvo Group's financials. In Q1 2025, these fluctuations negatively affected net sales and operating income. For instance, a stronger Swedish Krona can reduce the value of international sales when converted back. This necessitates careful hedging strategies to mitigate risk and maintain profitability.

Fuel Prices

Fuel prices remain a crucial factor for Volvo Group, even with the rise of electric vehicles. High fuel costs can deter customers from purchasing or utilizing combustion engine vehicles, impacting sales and operational expenses. The average gasoline price in the U.S. in early 2024 was about $3.50 per gallon. Fluctuations in fuel costs directly affect the total cost of ownership and operational profitability for Volvo's customers.

- Rising fuel prices can decrease the demand for traditional combustion engine vehicles.

- Lower fuel prices can make combustion engine vehicles more attractive, boosting sales.

- Fuel costs affect the profitability and operational expenses for Volvo Group's customers.

Consumer Income and Purchasing Power

Consumer income and purchasing power are critical for Volvo Group, as they directly influence demand for its products. Strong economic growth and high employment rates boost consumer spending, including on commercial vehicles. Conversely, economic downturns can lead to decreased demand and impact sales. For example, in 2024, the global truck market saw fluctuations, influenced by regional economic performance.

- Global truck sales in 2024 were around 3.2 million units.

- The European market showed moderate growth.

- North American demand remained stable.

- Emerging markets displayed variable trends.

Market dynamics shaped Volvo's 2024/2025 sales, with 2024 sales down 10% in Q1. Economic uncertainty and market growth expectations (2-3% in 2025) are major influences. Strategic adaptability is vital amidst these fluctuations.

| Economic Factor | 2024 Data | 2025 Forecast |

|---|---|---|

| Market Demand | Q1 Sales Decline | 2-3% Growth |

| Inflation | Eurozone Fluctuation | TBD |

| Interest Rates | ECB Rate Hikes | TBD |

Sociological factors

Consumers increasingly favor sustainable options, boosting demand for EVs. Volvo's EV sales rose, with battery-electric trucks up 25% in Q1 2024. This shift aligns with rising environmental awareness, influencing purchasing decisions. Volvo's adaptation to meet this demand is crucial for market success.

Urbanization boosts demand for transport and infrastructure, key to Volvo Group. Globally, urban populations are growing, with over 55% living in cities as of 2024. This trend fuels the need for efficient urban mobility and logistics solutions. Volvo Group's focus on sustainable transport aligns with this shift. Challenges include congestion and emissions, requiring innovative solutions.

Growing health and environmental awareness compels Volvo to minimize its impact. This drives the need for eco-friendly products and manufacturing. In 2024, Volvo invested significantly in sustainable technologies. They aim to have 100% electric vehicles by 2030, reflecting the shift towards cleaner solutions, with 2024 sales showing a 23% increase in electric vehicle sales.

Workforce and Labor Relations

Volvo Group's global workforce exceeds 100,000 individuals. Labor relations and workforce availability are critical for its production and operational efficiency. The company must navigate potential workforce adjustments, as seen in the US market. These changes can result from market fluctuations and strategic realignments. In 2024, Volvo Group's net sales reached SEK 550.8 billion.

- Globally, Volvo Group employs over 100,000 people.

- Labor relations significantly impact Volvo's operations.

- Workforce adjustments can occur due to market changes.

- Volvo Group's net sales in 2024 were SEK 550.8 billion.

Brand Loyalty and Cultural Influences

Volvo Group benefits from its strong brand reputation and customer loyalty. This is crucial during economic downturns or geopolitical instability. Cultural factors significantly influence product choices and the acceptance of innovations like electric vehicles across various regions. For instance, in 2024, Volvo's electric vehicle sales saw varied uptake across Europe and North America, reflecting differing consumer preferences.

- Brand perception directly affects sales figures.

- Cultural nuances impact market strategies.

- Customer trust is a key asset.

Sociological factors influence Volvo's market strategies, from environmental awareness to workforce dynamics.

Consumer demand for sustainable products continues to grow, impacting sales. Electric vehicle sales increased in 2024.

Cultural differences also affect product choices.

| Factor | Impact | Example (2024 Data) |

|---|---|---|

| Sustainability | Drives EV adoption | EV sales up 23% |

| Urbanization | Boosts transport demand | 55% live in cities |

| Workforce | Affects operations | Over 100,000 employees |

Technological factors

Advancements in electric vehicle (EV) technology are vital for Volvo's future. Rapid progress in battery tech, charging infrastructure, and electric powertrains impacts EV adoption rates and costs. In 2024, Volvo increased EV sales by 40%, driven by these technological leaps. Volvo aims for EVs to represent 50% of its sales by 2027, showing the importance of tech.

Volvo Group is heavily invested in autonomous driving and AI. They are using AI in manufacturing, like AI-powered transporters. The autonomous driving market is forecasted to reach $65 billion by 2024, which is set to drastically change transport and logistics. Volvo's tech advancements align with these trends.

Volvo Group leverages connectivity and IoT to boost customer experiences. This includes features like real-time vehicle data and remote diagnostics. In 2024, Volvo Trucks saw a 19% increase in connected services usage. These technologies enhance fleet management efficiency, reducing downtime and optimizing routes. Data-driven services also create new revenue streams. Volvo's investment in digital solutions reached $700 million in 2024.

Advanced Manufacturing and Automation

Volvo Group is leveraging advanced manufacturing and automation to boost operational efficiency. This includes integrating AI into production for enhanced flexibility. In 2024, Volvo invested heavily in automation, aiming for a 15% reduction in production costs by 2026. The company anticipates a 20% increase in production capacity due to these advancements.

- AI-driven production optimization.

- Investment in automation technologies.

- Targeted cost reduction by 2026.

- Production capacity expansion.

Development of Alternative Fuels

Volvo Group is actively developing alternative fuel solutions to reduce its carbon footprint, moving beyond pure electrification. This includes exploring hydrogen fuel cell technology and the use of liquefied biogas to offer diverse sustainable options. In 2024, Volvo Trucks delivered its first hydrogen fuel cell trucks to customers. Volvo's investment in R&D for alternative fuels reached $1.5 billion in 2024, demonstrating its commitment.

- Hydrogen fuel cell trucks delivered in 2024.

- R&D investment in alternative fuels: $1.5B (2024).

- Focus on liquefied biogas as a sustainable option.

Technological factors significantly impact Volvo's strategy, including EV advancements. Investment in autonomous driving and AI technologies is substantial. Connectivity and IoT boost customer experience, enhancing fleet management, which increased usage by 19% in 2024.

| Technology Area | Key Developments | Financial Data (2024) |

|---|---|---|

| EV Technology | 40% increase in EV sales | EV Sales Growth: 40% |

| AI & Autonomous Driving | AI-powered transporters in manufacturing, market is forecast at $65B by 2024 | Investment in digital solutions: $700M |

| Connectivity & IoT | 19% increase in connected services usage, focus on remote diagnostics | R&D in alternative fuels: $1.5B |

Legal factors

Volvo Group must adhere to strict vehicle safety standards. The U.S. NHTSA sets these, and compliance is non-negotiable. Non-compliance could lead to hefty fines. In 2024, NHTSA issued over $150 million in penalties to automakers. Volvo's commitment to safety impacts its legal standing and public trust.

Volvo Group faces stringent emission standards, especially in North America and Europe. These regulations significantly impact vehicle design and manufacturing processes. The EPA's stricter standards affect product development timelines. In 2024, Volvo invested heavily in sustainable transport solutions, with 45% of sales being electric vehicles.

Changes in trade tariffs and import/export laws significantly affect Volvo's operations. For example, the EU's tariff on imported vehicles, currently at 10%, can shift production strategies. In 2024, Volvo's global sales were impacted by varying import duties across markets. Adjustments to these laws necessitate supply chain adaptations. Volvo must navigate these legal shifts to maintain competitiveness and manage costs.

Labor Laws and Employment Regulations

Volvo Group faces significant legal considerations, particularly regarding labor laws and employment regulations across its global operations. These laws dictate workforce management practices and directly impact operational costs. Compliance is crucial to avoid legal repercussions and maintain a positive corporate image. Understanding and adapting to varying labor standards in different regions is essential for strategic planning.

- In 2024, labor costs represented a substantial portion of operating expenses.

- Volvo Group's global workforce exceeded 100,000 employees.

- Compliance efforts are continually monitored, with legal teams actively involved.

Product Liability and Consumer Protection Laws

Volvo Group faces product liability and consumer protection laws globally, necessitating compliance with stringent quality and safety standards. These regulations vary across regions, demanding localized strategies for product design, manufacturing, and distribution. The company's commitment to safety is reflected in its investments in testing and quality control, with approximately SEK 4.5 billion allocated to R&D in Q1 2024. Failure to comply can result in recalls, legal liabilities, and reputational damage.

- Product recalls can cost millions; for example, the automotive industry faced over 300 recalls in 2023 in the US.

- Consumer protection laws like GDPR affect data handling in connected vehicles, increasing compliance costs.

- Volvo's safety record is a key selling point, with safety features being a core investment area.

Volvo Group must comply with stringent safety standards globally. The company faces emission regulations and trade laws. Labor laws and product liability also present significant legal challenges.

| Legal Aspect | Impact | 2024 Data/Example |

|---|---|---|

| Safety Standards | Compliance costs & potential fines. | NHTSA penalties exceeded $150M. |

| Emission Regulations | Vehicle design, mfg costs. | 45% sales EV, investment in sustainable transport. |

| Trade Laws | Production strategy & cost. | EU tariff 10% impacting import duties. |

Environmental factors

Volvo Group prioritizes sustainable solutions, driven by climate change. The company aims to cut greenhouse gas emissions. They are investing in electric vehicles and renewable energy sources. Volvo's sustainability report highlights progress, with continuous improvements expected in 2024/2025.

The shift to electric and fossil-free solutions is gaining momentum worldwide, driven by the need for decarbonization. Volvo Group is heavily investing in new tech and infrastructure to support this transition. In 2024, Volvo invested SEK 6.7 billion in R&D, focusing on electrification. The EU aims for a 55% emission reduction by 2030, further boosting this trend.

Volvo Group prioritizes resource efficiency and waste reduction across its operations and product lifecycles. They aim for landfill-free operations at their facilities. In 2023, Volvo reduced waste to landfill by 10%, with 70% of its production sites being landfill-free. The company is investing in circular economy solutions.

Renewable Energy Adoption

Volvo Group focuses on renewable energy adoption in its operations. This includes using renewable sources in production and backing renewable-powered charging infrastructure. For example, in 2024, Volvo increased its renewable energy use by 15% across its global facilities. The company has also invested $50 million in renewable energy projects.

- 15% increase in renewable energy use in 2024.

- $50 million investment in renewable energy projects.

Supply Chain Sustainability

Volvo Group actively addresses environmental impacts in its supply chain, focusing on emissions from material production and logistics to meet sustainability goals. In 2024, they aimed to reduce supply chain emissions by 30% compared to 2019 levels. This includes collaborating with suppliers to adopt cleaner technologies and practices.

- 2024 Target: 30% reduction in supply chain emissions compared to 2019.

- Focus: Cleaner technologies and practices with suppliers.

- Scope: Material production and logistics emissions.

Environmental factors significantly impact Volvo Group's operations, driving sustainable initiatives. The company aims to reduce greenhouse gas emissions through electric vehicles, investing SEK 6.7 billion in R&D in 2024. Resource efficiency, including waste reduction, is another key focus, with 70% of production sites being landfill-free.

| Initiative | 2024/2025 Focus | Data/Results |

|---|---|---|

| Renewable Energy | Increase adoption | 15% increase in use; $50M invested |

| Supply Chain | Reduce emissions | 30% reduction target (vs. 2019) |

| R&D investment | Electrification, Sustainability | SEK 6.7 billion in 2024 |

PESTLE Analysis Data Sources

The PESTLE analysis relies on data from financial institutions, governmental publications, industry reports, and tech forecasting sources.