Vonovia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vonovia Bundle

What is included in the product

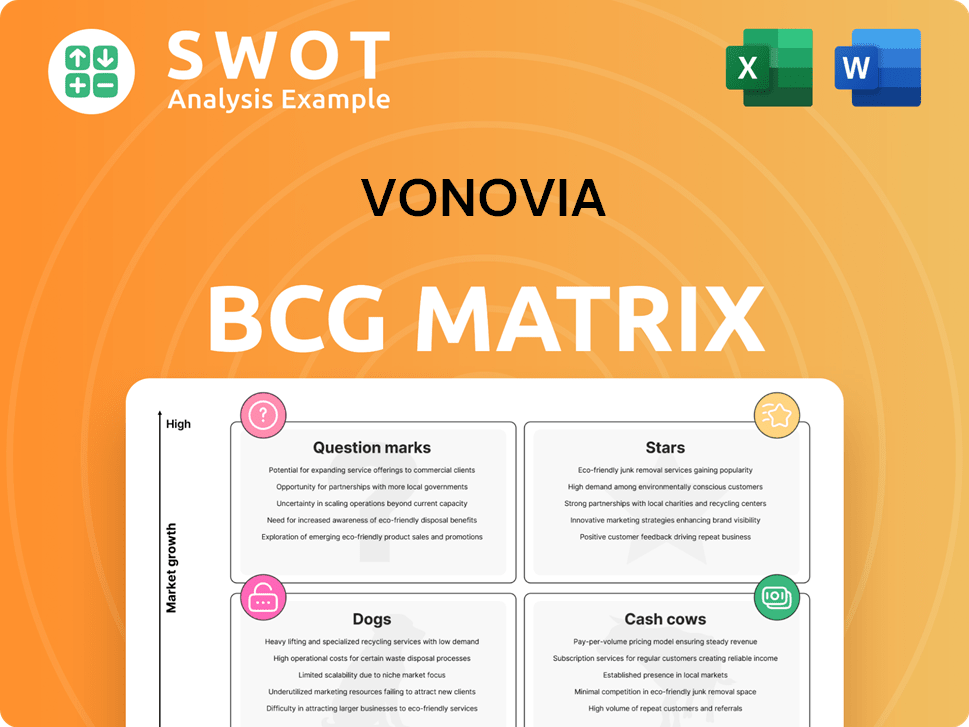

Vonovia's BCG matrix analysis explores real estate portfolio, detailing investment, hold, or divest strategies.

Clean, distraction-free view optimized for C-level presentation.

What You’re Viewing Is Included

Vonovia BCG Matrix

The Vonovia BCG Matrix you're previewing is the final document you'll receive. Ready for immediate use, this version offers clear strategic insights and is fully customizable.

BCG Matrix Template

Uncover Vonovia's market positioning with the BCG Matrix! This sneak peek shows where their products stand: Stars, Cash Cows, Dogs, or Question Marks.

See how Vonovia's portfolio is strategically aligned. Learn about their growth strategies. Discover their investments and areas of divestment.

Gain a complete market analysis and strategic insights you can act on.

Purchase the full BCG Matrix and get detailed quadrant placements, data-backed recommendations, and a strategic roadmap.

Take control of your investment decisions and make informed choices.

Stars

Vonovia is a "Star" in the BCG matrix, dominating the German rental market. It thrives in urban growth areas, where demand vastly outstrips supply. This drives rental growth, a cornerstone of Vonovia's strategy. In 2024, rents in major German cities increased by about 5%. As the market leader, Vonovia is poised to capitalize on these favorable trends.

Vonovia's strategy involves strategic acquisitions. The Deutsche Wohnen acquisition expanded its portfolio significantly. This boosts market position and allows economies of scale. In 2024, Vonovia's portfolio includes around 550,000 units. Integrating Deutsche Wohnen aids sustainability goals.

Vonovia's sustainability drive, targeting a near climate-neutral building stock by 2045, is a key differentiator. The company is investing in green construction to cut its environmental impact. This commitment boosts its image, drawing in eco-minded tenants and investors. In 2024, Vonovia allocated €1.3 billion for energy-efficient building upgrades.

Value-Add Services

Vonovia's Value-Add Services are positioned as Stars within its BCG Matrix, reflecting high growth and market share. The company is strategically expanding maintenance services and resuming new construction projects. This segment's growth is crucial for boosting adjusted EBITDA and diversifying revenue. Vonovia targets a significant increase in the contribution from value-add segments by 2028.

- Vonovia aims to increase the contribution of its Value-add, Development, and Recurring Sales segments to adjusted EBITDA from 9% to 20-25% by 2028.

- Expansion of maintenance services boosts adjusted EBITDA.

- Resuming new construction projects.

Digital Transformation

Vonovia's digital transformation is a "Star" in its BCG matrix, focusing on property management and customer service. This involves digital platforms and AI-driven data systems. These upgrades boost efficiency and enhance customer satisfaction. In 2024, Vonovia allocated €100 million for digital initiatives. The company reported a 15% increase in customer satisfaction scores due to digital tools.

- Digital transformation enhances property management.

- AI-powered data management systems are implemented.

- Technological advancements improve efficiency.

- Customer satisfaction scores increased by 15% in 2024.

Vonovia's "Stars" like value-add services and digital transformation drive growth. They hold high market share and offer significant expansion potential. Digital initiatives boosted customer satisfaction by 15% in 2024. The company aims to increase value-add EBITDA contribution by 2028.

| Initiative | Impact | 2024 Data |

|---|---|---|

| Digital Transformation | Efficiency and Customer Satisfaction | €100M investment, 15% satisfaction increase |

| Value-Add Services | EBITDA Growth | Targeting significant contribution increase by 2028 |

| Green Building Upgrades | Sustainability and Image | €1.3B allocated for upgrades |

Cash Cows

Vonovia's core rental business is a cash cow, generating a substantial part of its adjusted EBITDA. In 2024, the company reported high occupancy rates, showing strong demand. Organic rental growth further boosts consistent cash flow. The focus on property maintenance and modernization secures continued rental income.

Vonovia's property management platform efficiently handles its vast portfolio. This streamlined approach enables cost savings through economies of scale. They use regional, local services, and centralized centers for optimal efficiency. In 2024, property management expenses were approximately €1.1 billion, showcasing efficiency.

Vonovia's recurring sales strategy involves selling non-core assets, boosting cash flow and aiding deleveraging. This allows portfolio optimization, concentrating on core markets. In 2024, Vonovia aimed to sell €2 billion in assets. The company has been successfully executing its sales program, generating revenue for debt reduction and maintaining financial stability.

Strong Financial Performance

Vonovia's robust financial health is a cornerstone of its strategy. The company's adjusted EBITDA and operating cash flow support expansion. Vonovia has shown adaptability, expecting a return to growth by 2025. The 2024 financial results, met guidance, reflecting their solid performance.

- Adjusted EBITDA provides a stable base.

- Operating cash flow supports growth initiatives.

- The company aims for growth in 2025.

- 2024 results met financial targets.

High Occupancy Rates

Vonovia's high occupancy rates showcase strong demand for its properties. This leads to stable rental income and cash flow, critical for its cash cow status. In 2024, occupancy remained above 95%, a key indicator of success. Effective property management ensures continued attractiveness.

- Occupancy rates consistently above 95% in 2024.

- Stable rental income and cash flow.

- Effective property management.

Vonovia's cash cow status is anchored by a stable rental income, bolstered by high occupancy rates. The firm's efficient property management and strategic asset sales further solidify its financial position. Strong financial results in 2024, meeting guidance, confirm its robust performance.

| Metric | 2024 Data | Impact |

|---|---|---|

| Occupancy Rate | Above 95% | Stable Rental Income |

| Property Management Expenses | Approx. €1.1B | Efficiency & Cost Savings |

| Asset Sales Target | €2B | Deleveraging, Portfolio Optimization |

Dogs

Properties in less desirable locations or needing significant modernization are often considered Dogs. These properties may struggle with lower occupancy rates and reduced rental income. For instance, Vonovia's 2023 report highlighted challenges in modernizing older units. Expensive turnaround plans might prove ineffective. Divestiture, as a result, becomes a more practical choice. In 2024, the company focused on selling off some of these assets.

Buildings with high energy consumption and low efficiency are "Dogs", particularly with stricter environmental rules. They could have higher running costs and less tenant interest. In 2024, energy-efficient buildings saw a 10% rise in value. Retrofitting is key to avoid losses. The EU's Energy Performance of Buildings Directive impacts these properties.

Certain non-strategic business units at Vonovia, like smaller property segments, could be viewed as Dogs. These units might not significantly boost overall revenue or profitability. For example, in 2024, Vonovia's focus was on core markets. Divesting these units helps Vonovia concentrate on key areas.

Properties with Rent Control Issues

Properties with rent control issues, like those in Berlin, face income growth limits. These constraints can lower profitability and property appeal. For instance, Berlin's rent freeze from 2020-2021 saw a 2.5% drop in rental income. Managing such properties requires careful planning to offset these impacts.

- Rent control regulations limit rental income growth potential.

- Profitability and attractiveness of properties are directly affected.

- Berlin's rent freeze illustrates income decline risks.

- Strategic adjustments are crucial for compliance and value.

Unsuccessful Development Projects

Unsuccessful development projects at Vonovia, classified as "Dogs" in the BCG matrix, fail to meet return expectations. These projects consume capital without generating sufficient revenue, hindering overall financial performance. Discontinuing or selling these projects is crucial for freeing up capital for more profitable ventures. For instance, in 2024, Vonovia might have faced challenges with specific projects, leading to a strategic reassessment.

- Examples of Dogs: Projects with low occupancy rates or high construction costs.

- Impact: Drain on resources, reduced profitability.

- Strategy: Divestment or restructuring to minimize losses.

- Financial Data: In 2024, potential write-downs or impairments.

Vonovia's "Dogs" in the BCG matrix often include properties in undesirable locations or those needing modernization, leading to lower occupancy and rental income. Buildings with high energy consumption and low efficiency also fall into this category. Non-strategic business units and properties with rent control issues, like those in Berlin, further exemplify "Dogs," impacting profitability and appeal. Unsuccessful development projects failing to meet return expectations are also considered "Dogs," draining resources.

| Category | Characteristics | Impact |

|---|---|---|

| Properties in Undesirable Locations | Low occupancy, need for modernization | Reduced rental income. |

| Inefficient Buildings | High energy consumption | Higher running costs. |

| Non-Strategic Units | Smaller property segments | May not boost revenue. |

Question Marks

New construction projects in emerging markets or with new tech are question marks. These projects offer high growth potential, but also high risk. Successful ventures could bring big returns. Failure may lead to losses. Vonovia's 2024 plans include expanding in these areas, with investments of €1.5B in new construction.

Expanding into new geographic markets, like Vonovia's ventures, places them in the Question Mark quadrant of the BCG Matrix. These expansions demand substantial investments and thorough market research. The potential for substantial growth exists, yet the risk of failure is significant if market conditions are unfavorable. For example, in 2024, Vonovia invested significantly in expanding its portfolio in Sweden, a move that carried both opportunities and risks.

Vonovia's PropTech investments are Question Marks. These investments aim to revolutionize property management. The sector saw $1.6B in funding in Q3 2023. Success is uncertain, requiring careful tech integration. PropTech's future is still developing.

Sustainable Housing Initiatives

Vonovia's pursuit of affordable, eco-friendly homes is a strategic move, though challenging. These projects aim to meet sustainability targets, calling for novel approaches and substantial financial commitment. The viability of these efforts hinges on consumer interest and favorable regulations. In 2024, Vonovia invested heavily in green building, with a goal to reduce carbon emissions by 50% by 2030.

- Vonovia invested €1.3 billion in 2024 for sustainability initiatives.

- Aiming for a 50% reduction in carbon emissions by 2030.

- Focus on energy-efficient renovations and new constructions.

- Targets include building 60,000 new apartments by 2028.

Healthcare Services Division

Vonovia's healthcare services division, particularly if not fully integrated, fits the Question Mark category within the BCG Matrix. This segment includes related properties and faces uncertainty. Vonovia has explored selling this division, signaling potential strategic shifts. The future hinges on decisions about its alignment with the core residential real estate focus.

- Healthcare services represent a smaller portion of Vonovia's overall business.

- The potential sale reflects a strategic evaluation of non-core assets.

- Market conditions and strategic priorities influence the division's fate.

- Focusing on core business may improve efficiency and returns.

Question Marks for Vonovia include new markets and PropTech. High growth and high risk are key. Sustainability efforts and healthcare services also fall into this category. Decisions about these will shape the future.

| Initiative | Description | 2024 Data |

|---|---|---|

| New Construction | Expansion into new markets. | €1.5B invested |

| PropTech | Tech integration in property management. | $1.6B sector funding (Q3 2023) |

| Sustainability | Eco-friendly home initiatives. | €1.3B invested, 50% emissions cut by 2030 |

BCG Matrix Data Sources

The Vonovia BCG Matrix leverages company reports, market data, and analyst assessments, delivering insights with reliability.