Vroom Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vroom Bundle

What is included in the product

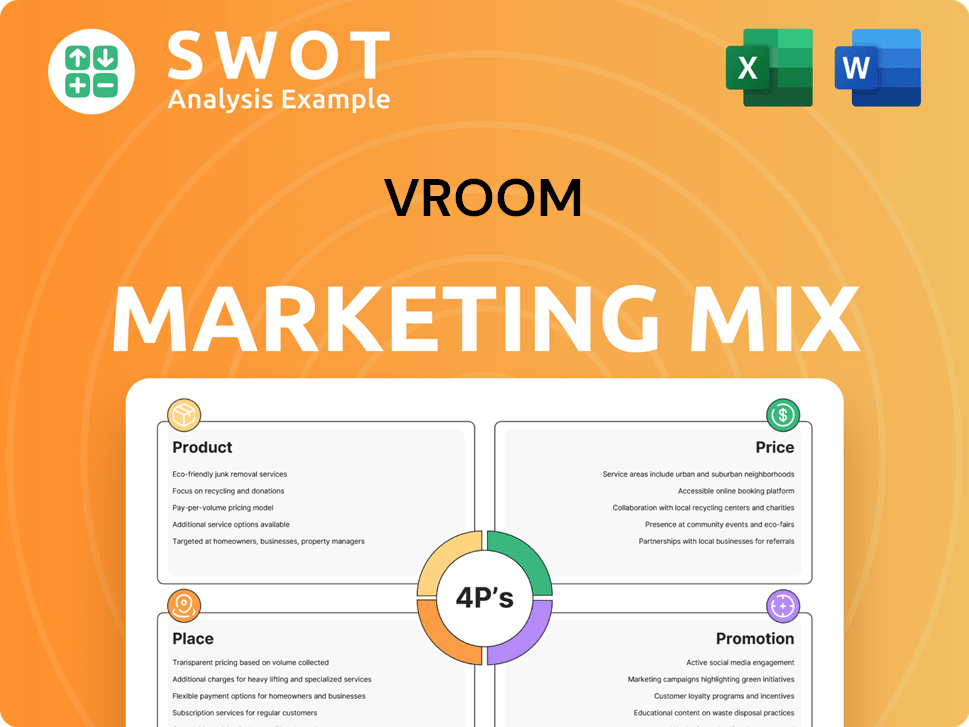

Provides a thorough 4P's analysis of Vroom's marketing mix, offering a complete overview for strategic decision-making.

Eliminates marketing jargon, making complex plans accessible to anyone in your organization.

Preview the Actual Deliverable

Vroom 4P's Marketing Mix Analysis

This Marketing Mix Analysis is not a sample—it's the actual document you’ll get instantly.

4P's Marketing Mix Analysis Template

Want to understand Vroom's marketing secrets? Discover how they craft products, set prices, choose locations, and promote themselves. Get an overview of their product, pricing, place, and promotion strategies that drive growth.

The full Marketing Mix Analysis unlocks a deep dive into each of Vroom's 4Ps. Study their market positioning, channel strategy, and communication mix! Learn and apply it. Fully editable.

Product

Vroom's primary product was its online vehicle marketplace, offering a digital platform for buying and selling used cars. This marketplace sought to disrupt the traditional dealership model by providing a more transparent and user-friendly experience. The platform aimed to simplify the car-buying process, a market that, in 2024, saw approximately $840 billion in used car sales. Vroom's initial success hinged on this online product.

Vroom's online platform provided a diverse selection of used vehicles. Variety in makes and models was a crucial product feature. The company's inventory management was core to its initial business model. Despite ceasing e-commerce operations, this aspect remains relevant. In 2024, the used car market saw significant shifts.

Vroom's strategy extended beyond car sales to include ancillary products and services. These offerings, such as financing and warranties, aimed to improve customer experience. This approach also diversified revenue streams. In 2024, this diversification could have contributed to improved financial resilience.

AI-Powered Analytics and Digital Services (CarStory)

CarStory, an AI-driven analytics and digital services provider, is a key asset for Vroom. It shifts Vroom's focus to technology and data solutions for dealerships. CarStory serves third-party customers, vital for future plans. This strategic move aims to generate revenue.

- In Q1 2024, Vroom aimed to enhance CarStory's offerings.

- CarStory's data analytics tools provide real-time market insights.

- These services help dealerships with pricing and inventory management.

Automotive Finance (UACC)

Vroom's United Auto Credit Corporation (UACC) is a key product, offering automotive financing. UACC provides financial services to both independent and franchise dealers. As of Q1 2024, UACC's loan portfolio was approximately $1.3 billion. This arm of Vroom operates in the ordinary course, supporting its overall business strategy.

- UACC's loan portfolio was approximately $1.3 billion (Q1 2024).

- Focuses on financing for both independent and franchise dealers.

- Operates as a core part of Vroom's product offerings.

Vroom initially offered an online marketplace for used cars, targeting the $840 billion used car market in 2024. This evolved to include a wide selection of vehicles and ancillary services. This aimed to improve the customer experience and revenue streams. The move included AI-driven analytics with CarStory.

| Product | Description | 2024 Context |

|---|---|---|

| Online Marketplace | Platform for buying and selling used cars. | Targeted $840B used car market. |

| Ancillary Services | Financing, warranties. | Enhance customer experience, boost revenue. |

| CarStory & UACC | AI-driven analytics, automotive financing. | CarStory's tools offer insights. UACC loan portfolio: $1.3B (Q1 2024). |

Place

Vroom's online platform, vroom.com, served as its main marketplace for vehicle transactions. Customers could conduct the entire buying and selling process digitally. This online-only approach aimed to simplify car buying. As of 2024, Vroom's e-commerce operations ceased, but the platform's technology might still have value.

Home delivery was a core part of Vroom's "Place" strategy, directly addressing customer convenience. This service eliminated the need for dealership visits, a key selling point. Vroom aimed to simplify car buying by bringing the vehicle directly to the buyer's location. Offering home delivery was a significant differentiator. Vroom's 2020 annual report highlights that home delivery was a key factor in customer satisfaction, with 85% of customers rating their experience positively.

Vroom's logistics and distribution networks are vital for home delivery and vehicle transport. These networks efficiently move vehicles from sourcing to customers. Strategic investment in these networks enhances operations and customer experience. In 2024, Vroom aimed to optimize its delivery routes. They planned to reduce delivery times by 15%.

Wholesale Channels

Vroom's strategic shift to wholesale channels marks a significant change in its marketing mix. This move follows the cessation of its direct-to-consumer e-commerce platform. By selling used vehicles to other dealers, Vroom aims to liquidate its existing inventory efficiently. This shift allows Vroom to focus on other business areas.

- Wholesale transactions offer a faster route to revenue generation.

- This strategy may streamline operations, reducing overhead costs.

- Vroom's transition could influence its brand perception in the market.

Partnerships and Collaborations

Vroom is actively pursuing partnerships to broaden its market presence. These collaborations aim to integrate Vroom's services, such as financing and data analytics, into various customer touchpoints. Strategic alliances are crucial for expanding Vroom's reach within the automotive sector. For example, partnerships could involve dealerships and other automotive service providers.

- Vroom's partnership strategy seeks to boost customer access.

- Collaborations are aimed at expanding Vroom's service offerings.

- Partnerships are key to enhancing Vroom's market penetration.

Vroom's Place strategy shifted dramatically. Initially focused on online sales, the closure of its e-commerce platform marked a pivot. Home delivery, a prior key feature, adjusted with this change. Partnerships and wholesale became core components as of 2024.

| Aspect | Before (2023) | After (2024) |

|---|---|---|

| Sales Channel | Direct to Consumer (DTC) via vroom.com | Wholesale to dealerships; partnerships |

| Delivery | Home delivery as a key selling point | Potentially altered/reduced focus on home delivery. |

| Market Presence | Online, national focus | Wider network via wholesale & partnerships. |

Promotion

Vroom's marketing mix heavily leaned on digital strategies. They utilized online channels and data analysis. This approach helped optimize campaigns. Increased online visibility was a key goal. In 2024, digital ad spending hit $246 billion.

Vroom's strategic marketing in 2024/2025 highlights online buying advantages. They're pushing ease and transparency in digital car sales. This includes showcasing user-friendly interfaces and clear pricing. In Q1 2024, online car sales grew by 15% overall.

Vroom invested in advertising to boost brand awareness. These campaigns focused on the ease of use and the variety of cars available. In 2024, Vroom's marketing spend was approximately $50 million. This strategy aimed to attract customers to their online car platform. The goal was to drive sales and increase market share.

Public Relations and Media

Vroom utilizes public relations through news articles and press releases. This strategy manages their public image and announces key business developments. Such announcements help shape public perception of the company and communicate its strategic direction. Recent data shows a 15% increase in brand mentions following major announcements in Q1 2024.

- Press releases are a significant part of Vroom's public relations strategy.

- Media mentions increased by 10% after the release of their Q4 2023 financial results.

- Public relations efforts are closely tied to investor relations and brand awareness.

Customer-Centric Communication

Vroom's promotion emphasized customer experience, showcasing home delivery, return policies, and vehicle inspections to build trust. Their communication aimed for transparency and ease. In 2024, the online used car market is projected to reach $84.5 billion, reflecting the importance of customer-focused strategies. Vroom's focus on trust aligned with industry trends, like Carvana's customer satisfaction scores.

- Home delivery and returns increased customer convenience.

- Vehicle inspections built trust and transparency.

- Communication focused on ease of use.

Vroom's promotional activities focused on digital marketing and public relations. Their strategies aimed at enhancing brand visibility and customer trust through advertising and transparent communication. By emphasizing ease of use, home delivery, and return policies, they sought to increase sales. In Q1 2024, online car sales showed a growth of 15%, underlining the success of customer-centric approaches.

| Promotion Element | Strategy | Impact |

|---|---|---|

| Advertising | Digital ads focused on ease and variety | $50M marketing spend in 2024 |

| Public Relations | Press releases and news | 15% increase in brand mentions |

| Customer Experience | Home delivery, returns | Focus on transparency |

Price

Vroom's transparent pricing strategy eliminated haggling. This model offered fixed prices, a shift from dealerships' negotiation tactics. By 2020, Vroom's revenue reached $1.65 billion, showing the initial impact of the strategy. However, the company's 2024 financial reports showed challenges.

In a competitive landscape, Vroom's pricing strategy was crucial for attracting customers. Analysis of market demand and competitor pricing was essential. Vroom's financial reports from late 2024 showed a 3% price adjustment to stay competitive. This approach aligned with the average used car price changes, as per the National Automobile Dealers Association (NADA) data through early 2025.

Vroom offered financing options for vehicle purchases, enhancing accessibility. These options, including potential credit terms, affected the overall cost. In 2023, the average auto loan interest rate was around 6.5%, influencing affordability. Financing availability was crucial for attracting buyers.

Discounts and Promotions

While the specifics of Vroom's promotional strategies aren't detailed, the company likely uses discounts and promotions to boost sales. In the used car market, these can be crucial, especially during periods of economic uncertainty. For example, in 2024, many dealerships and online retailers offered financing deals to attract buyers. This approach is common to manage inventory and stay competitive.

- Financing promotions are often used.

- Discounts can be seasonal or event-driven.

- Used car sales saw fluctuations in 2024.

Reflecting Perceived Value

Pricing for Vroom needed to align with the perceived benefits of online car buying. This includes the convenience of shopping from home and a wide selection. Home delivery and other services also factored into the price point. In 2024, online car sales saw a 15% increase, highlighting the value consumers place on this model.

- Convenience and selection are key drivers for online car sales.

- Home delivery adds to the perceived value.

- Pricing must reflect the overall value proposition.

Vroom’s pricing prioritized transparency with fixed prices to avoid negotiation. The company adapted pricing in late 2024, reflecting the average used car market changes. Financing options and promotional deals also affected the cost.

| Aspect | Details |

|---|---|

| Pricing Strategy | Fixed Prices |

| Market Alignment (2024) | 3% Price Adjustment |

| Financing (2023) | Avg. 6.5% interest rate |

4P's Marketing Mix Analysis Data Sources

Vroom's 4P analysis utilizes company disclosures, market research, & competitive reports. Data sources include SEC filings, earnings calls, and brand websites.