VSE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VSE Bundle

What is included in the product

Analyzes VSE’s competitive position through key internal and external factors.

Provides a clear and concise way to identify Strengths, Weaknesses, Opportunities, and Threats.

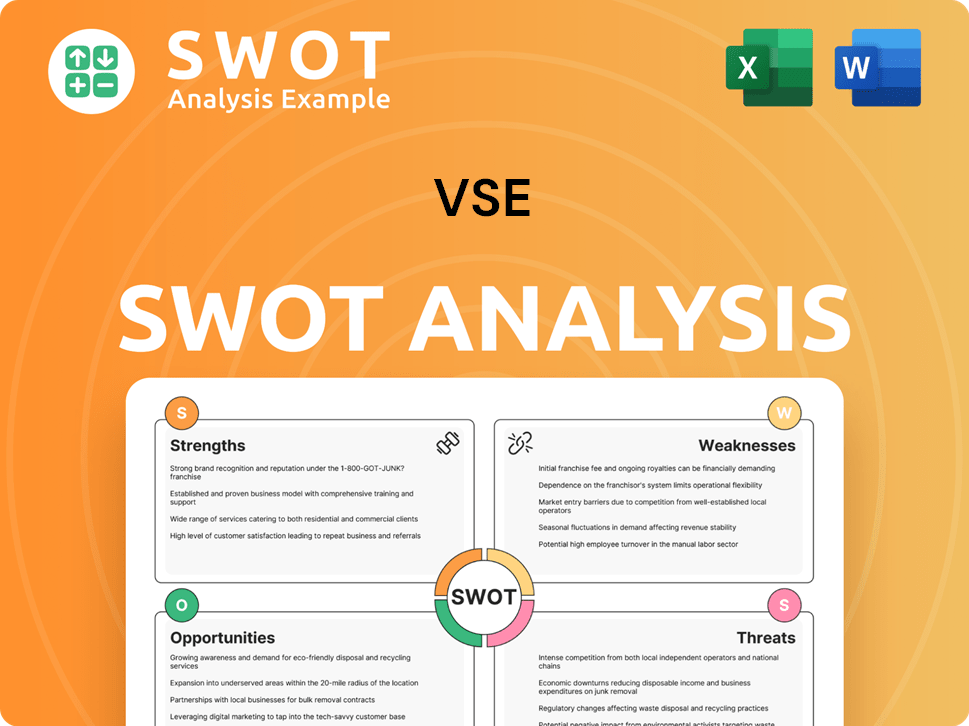

Preview Before You Purchase

VSE SWOT Analysis

Take a peek at the very document you'll receive! The SWOT analysis you see here is identical to what you'll get after purchasing.

SWOT Analysis Template

The VSE SWOT analysis highlights key areas, giving you a glimpse into strengths and weaknesses. See potential opportunities and threats in the business landscape. But this is just the beginning of the complete strategic analysis. Uncover VSE’s full potential with detailed insights and actionable strategies. Purchase the full SWOT analysis for an in-depth, research-backed perspective and editable tools.

Strengths

VSE Corporation's Aviation segment is a key strength, showcasing robust financial results. In 2024, the Aviation segment experienced substantial revenue growth. This success is fueled by high market demand. Further growth is expected in 2025, driven by expanded partnerships.

VSE Corporation's strategic acquisitions, including Turbine Controls Inc., Kellstrom Aerospace, and Turbine Weld Industries, are significant strengths. These moves bolster its Maintenance, Repair, and Overhaul (MRO) services, enhancing its market position. The aviation aftermarket is expected to reach $110 billion by 2025, presenting growth opportunities. These acquisitions are projected to improve profitability.

VSE's strategic shift to a pure-play aviation aftermarket model is a key strength. This concentration streamlines their operations, focusing on maintenance, repair, and overhaul (MRO) services and parts distribution. The aviation aftermarket is experiencing robust growth; for example, the global MRO market is projected to reach $109.7 billion by 2025. This focus enables VSE to capitalize on this expanding sector.

Improved Financial Flexibility and Liquidity

VSE's improved financial flexibility and liquidity stem from strategic debt refinancing and robust operational cash flow. This enhanced financial standing allows VSE to capitalize on growth opportunities, including strategic acquisitions. For instance, VSE's cash and cash equivalents reached $34.9 million by Q1 2024. This financial health supports VSE's ability to navigate market uncertainties and invest in long-term value creation. The company's focus on generating substantial free cash flow, about $18 million in Q1 2024, further strengthens its financial position.

- Refinancing initiatives enhance financial health.

- Strong cash flow supports growth and acquisitions.

- Financial flexibility aids in market navigation.

- Q1 2024 cash and equivalents: $34.9M.

Established Relationships and Expertise

VSE benefits from established relationships with Original Equipment Manufacturer (OEM) suppliers, crucial for aftermarket distribution. They boast a strong history in providing repair services, enhancing their market position. Their expertise in Maintenance, Repair, and Overhaul (MRO) for diverse engine platforms offers a significant competitive advantage. This specialized knowledge allows VSE to cater to specific client needs efficiently.

- VSE's 2023 revenue from aviation aftermarket services was $625.5 million.

- The global MRO market is projected to reach $108.1 billion by 2025.

- VSE's strategic partnerships with OEMs provide access to critical parts and technology.

VSE's strengths include its thriving Aviation segment and strategic acquisitions like Turbine Controls Inc., Kellstrom Aerospace, and Turbine Weld Industries. These acquisitions bolstered VSE's position in the Maintenance, Repair, and Overhaul (MRO) services market. Focused on the aviation aftermarket, VSE is well-positioned to leverage significant growth opportunities, with the MRO market projected to reach $109.7 billion by 2025.

| Strength | Details | 2024/2025 Data |

|---|---|---|

| Aviation Segment | Focus on MRO and Parts Distribution | Expected aftermarket to reach $110B by 2025 |

| Strategic Acquisitions | Expanding MRO capabilities | $625.5M Revenue from aftermarket services in 2023 |

| Financial Flexibility | Refinancing and Cash Flow | Q1 2024 Cash and Equivalents: $34.9M |

Weaknesses

VSE's heavy dependence on the aviation market is a considerable weakness. This concentration exposes the company to sector-specific risks. For example, a decline in air travel, like the 2020 pandemic, significantly hurts revenue. In Q1 2024, aviation maintenance spending grew by only 3%, indicating potential market instability.

Acquisitions, while offering growth, introduce integration risks. Integrating operations and staff is vital for synergy and avoiding asset write-downs. For instance, in 2024, 30% of mergers failed due to integration issues. Successful integration is key for VSE's success. The failure to do so can lead to significant financial losses.

VSE's expansion plans, including potential acquisitions, might increase its debt levels. This could reduce the company's financial flexibility. Higher leverage exposes VSE to interest rate fluctuations, impacting profitability. As of Q1 2024, VSE's debt-to-equity ratio was 0.45, but this could rise with future investments. This financial risk needs careful management.

Customer Concentration

VSE Corporation faces customer concentration risks, as a significant portion of its revenue stems from specific clients, including defense and government contracts. This dependence heightens vulnerability to budget fluctuations and shifts in spending. For instance, in 2024, approximately 60% of VSE's revenue came from U.S. government contracts. Any changes in these contracts could significantly affect VSE's financial performance. This concentration demands careful management to mitigate potential financial impacts.

- 2024: ~60% of VSE's revenue from U.S. government contracts.

- Risk: Budget cuts or changes in government priorities.

- Impact: Potential decline in revenue and profitability.

- Mitigation: Diversification of client base is crucial.

Supply Chain Disruptions

VSE faces supply chain disruptions, a significant weakness. The aviation aftermarket heavily relies on a smooth supply chain. Geopolitical events and other issues can cause delays and raise costs, affecting financial performance. This vulnerability demands robust mitigation strategies to ensure operational efficiency and profitability. For example, in 2024, supply chain issues increased operating costs by 7% for some aerospace companies.

- Reliance on external suppliers for critical components.

- Potential for increased lead times and reduced availability.

- Impact on inventory management and working capital.

- Risk of project delays and customer dissatisfaction.

VSE’s heavy aviation market focus and reliance on specific clients, particularly U.S. government contracts, create substantial concentration risks. Integration issues post-acquisitions and the potential for rising debt also pose significant challenges to financial stability. Supply chain disruptions further threaten profitability by impacting operations and increasing costs. These vulnerabilities require strategic mitigation.

| Risk Factor | Impact | 2024 Data/Trends |

|---|---|---|

| Market Concentration | Revenue Fluctuations | ~60% from U.S. Gov. contracts. Aviation maintenance spending growth slowed to 3%. |

| Acquisition Integration | Operational Disruptions | 30% of mergers failed due to integration challenges. |

| Financial Leverage | Increased Interest Costs | Debt-to-equity ratio at 0.45 (Q1 2024), potential rise. |

Opportunities

The aviation aftermarket is poised for growth, with projections indicating a steady rise in demand. This expansion is fueled by aging aircraft fleets and the need for maintenance, repair, and overhaul (MRO) services. VSE's strategic emphasis on this sector allows it to leverage this upward trend. The global aviation MRO market is expected to reach \$109.8 billion by 2028, according to a 2024 report.

VSE can boost revenue by expanding MRO and diversifying services. The global MRO market is projected to reach $100B by 2025. Strategic moves can increase market share. This approach aligns with VSE's growth strategy.

International expansion enables VSE to tap into new customer bases, potentially boosting sales and market share. For instance, in 2024, global e-commerce sales reached approximately $6.3 trillion, presenting a significant growth opportunity. This strategy diversifies risk, as economic downturns in one region may be offset by growth in another. Moreover, expanding internationally can enhance brand recognition and create a competitive advantage.

Technological Advancements

Technological advancements present significant opportunities for VSEs. Investing in digital solutions can boost operational efficiency, enabling better resource management. For instance, the adoption of AI in inventory management has shown a 15% reduction in holding costs for many VSEs. Furthermore, it opens doors to predictive maintenance and data analytics, enhancing decision-making.

- Operational efficiency gains through digital tools.

- Access to advanced data analytics for informed decisions.

- New revenue streams from tech-enabled services.

Strategic Partnerships

Strategic partnerships present significant opportunities for VSE. Collaborating with industry peers can foster growth and innovation. Such alliances can provide access to new customers, technologies, and markets. For instance, in 2024, the aerospace and defense industry saw a 7% increase in collaborative projects. These partnerships can lead to enhanced capabilities and shared resources.

- Access to new markets and customers

- Shared resources and reduced costs

- Technological advancements

- Increased innovation

VSE has opportunities in the expanding aviation aftermarket, which is forecast to hit \$109.8B by 2028. Digital advancements such as AI-driven inventory are poised to reduce holding costs. Furthermore, partnerships can fuel expansion and innovation.

| Opportunity | Benefit | Supporting Data |

|---|---|---|

| Aviation MRO Growth | Increased Revenue | Global market to \$109.8B by 2028 |

| Digital Solutions | Enhanced Efficiency | 15% holding cost reduction from AI |

| Strategic Partnerships | Expanded Market Reach | Aerospace collab up 7% in 2024 |

Threats

The government services and federal contracting sectors, along with the aviation aftermarket, are fiercely competitive environments. VSE encounters competition from major players and various service providers, potentially affecting its market share and pricing strategies. For instance, in 2024, the federal government awarded over $650 billion in contracts, highlighting the scale of competition. This intense rivalry could squeeze profit margins. VSE must continuously innovate to maintain its competitive edge.

Economic downturns pose a threat to VSE. Global economic conditions and cycles can decrease demand, especially in commercial aviation.

For example, the International Air Transport Association (IATA) projects a 4.8% growth in global passenger traffic in 2024, which is lower than the 8.4% growth in 2023.

A slowdown could reduce demand for VSE's services like engine maintenance and component repair.

Reduced airline profitability due to economic pressures could lead to budget cuts affecting VSE.

In Q1 2024, Delta Air Lines reported a net income of $37 million, significantly down from $1.2 billion in Q1 2023.

Changes in government spending and regulations pose a threat to VSE. Potential budget cuts, shifts in government spending priorities, and regulatory changes in defense and aviation could negatively affect VSE's government contracts. For instance, in 2024, defense spending faced scrutiny, potentially impacting VSE's revenue. Regulatory changes could increase compliance costs. These factors could reduce profitability.

Geopolitical Risks

Geopolitical risks present significant threats to VSE. Ongoing conflicts and political instability globally can severely disrupt supply chains. This can lead to increased costs and operational challenges. Furthermore, they can also impact foreign revenues and create contract volatility. The Russia-Ukraine war, for example, has caused a 20% increase in energy prices.

- Disrupted Supply Chains: Conflicts can halt the flow of materials.

- Impact on Revenues: Political instability can reduce sales.

- Contract Volatility: Conflicts can lead to contract renegotiations.

- Increased Costs: Supply chain disruptions can raise expenses.

Cybersecurity

Cybersecurity threats are a significant concern for VSE, with the sophistication of attacks increasing. Despite mitigation efforts, the evolving nature of these threats presents ongoing risks to operations and data security. In 2024, the global cost of cybercrime is projected to reach $9.5 trillion. The financial sector is a primary target, experiencing a 50% increase in attacks in the past year.

- Increasing cyberattacks on financial institutions.

- Data breaches and ransomware threats.

- Evolving tactics of cybercriminals.

Intense competition, particularly in government services and aviation, may compress profit margins. Economic downturns, like the projected slowdown in passenger traffic growth to 4.8% in 2024, can decrease demand for services. Potential government budget cuts and regulatory shifts, coupled with geopolitical risks impacting supply chains, also pose threats.

| Threat | Impact | Data (2024) |

|---|---|---|

| Competition | Margin Squeeze | Federal contracts: $650B+ |

| Economic Downturn | Reduced Demand | Passenger traffic growth: 4.8% |

| Government Changes | Revenue Reduction | Defense spending scrutiny |

SWOT Analysis Data Sources

The SWOT leverages data from financials, market analyses, and expert evaluations to provide reliable, in-depth insights.