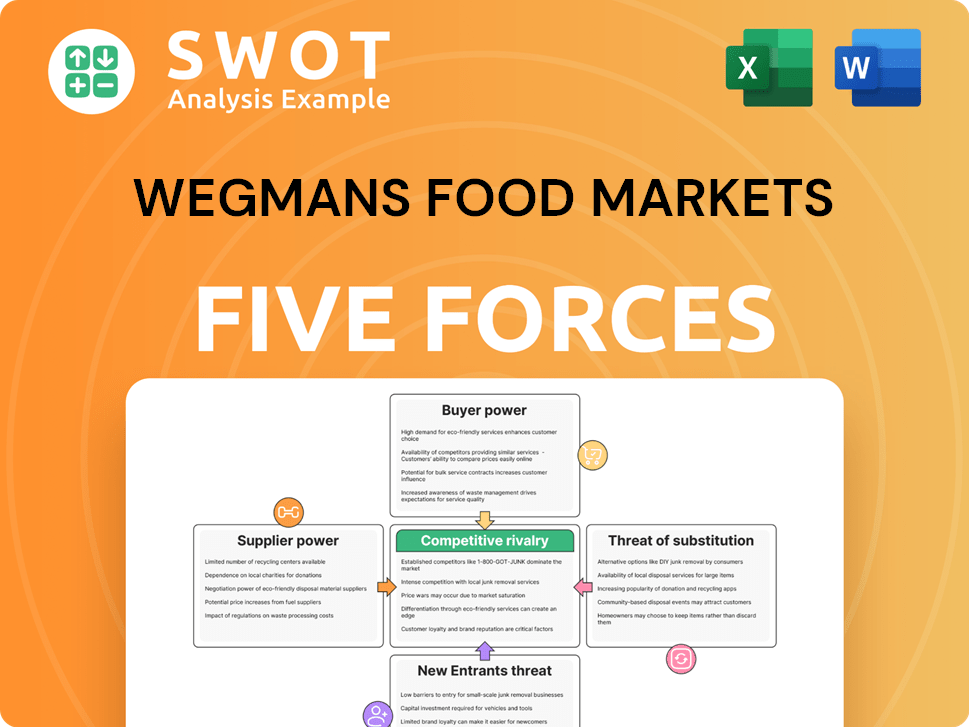

Wegmans Food Markets Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wegmans Food Markets Bundle

What is included in the product

Tailored exclusively for Wegmans, analyzing its position within its competitive landscape.

Instantly visualize competitive dynamics with an intuitive radar chart for Wegmans' market position.

Preview Before You Purchase

Wegmans Food Markets Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of Wegmans reveals insights into its competitive landscape. The document meticulously examines each force, including competitive rivalry, supplier power, and buyer power. It also assesses the threat of new entrants and substitutes. This is the complete, ready-to-use analysis file. What you're previewing is what you get—professionally formatted and ready for your needs.

Porter's Five Forces Analysis Template

Wegmans Food Markets faces robust competition, particularly from established grocery chains, impacting pricing and market share. Buyer power is strong due to consumer choice and readily available alternatives. Supplier leverage is moderate, as Wegmans diversifies its sourcing. The threat of new entrants is relatively low, yet technological advancements pose a challenge. Substitute products, like online grocery services, also exert pressure.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Wegmans Food Markets’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Wegmans' strong supplier relationships, built on collaboration, significantly reduce supplier power. They prioritize quality and ethical practices, evident in partnerships like Bell & Evans. These alliances ensure a dependable supply chain. Wegmans' approach limits supplier leverage. In 2024, their focus on direct sourcing and long-term contracts further buffered against supplier price hikes.

Wegmans enforces strict quality and safety standards, requiring suppliers to meet rigorous criteria. Suppliers of Wegmans Brand items must be GFSI-certified. This limits the supplier pool. In 2024, GFSI-recognized certifications continue to be vital for food safety compliance, impacting supplier selection.

Wegmans' vertical integration strategy significantly impacts supplier bargaining power. Owning warehouses and farms gives Wegmans more control over distribution. This reduces dependence on external suppliers, enhancing cost and quality control. In 2024, this approach helped manage over $12 billion in revenue.

Local Sourcing

Wegmans' commitment to local sourcing significantly impacts its supplier relationships. The company actively supports regional farmers and economies by prioritizing local producers. This strategy allows Wegmans to offer fresh, seasonal products and foster strong community ties, although supply may be limited at times. In 2024, Wegmans increased its spending on local products by 15%, enhancing its market position.

- Local sourcing enhances Wegmans' product freshness.

- Building strong community ties is a priority.

- Supply limitations can occur seasonally.

- Increased local spending improves market position.

Fair Trade Practices

Wegmans Food Markets emphasizes fair trade practices, treating suppliers as partners. They cultivate collaborative relationships, aiming to minimize supplier power. This approach is enhanced by encouraging suppliers to adopt sustainable farming standards. These practices ensure a stable supply chain, supporting ethical and environmental responsibility. In 2024, Wegmans reported a 3% increase in sustainable product sourcing.

- Collaborative supplier relationships.

- Encouragement of sustainable farming.

- Stable supply chain.

- Ethical and environmental responsibility.

Wegmans curtails supplier power through collaboration, quality standards, and vertical integration. Direct sourcing and long-term contracts further buffer against supplier influence. In 2024, they increased local spending by 15%, impacting market position.

| Strategy | Impact on Supplier Power | 2024 Data |

|---|---|---|

| Collaboration & Contracts | Reduces leverage | Direct sourcing focus |

| Quality Standards | Limits supplier pool | GFSI certifications vital |

| Vertical Integration | Enhances control | $12B+ in revenue |

| Local Sourcing | Strengthens ties | 15% increase in spending |

Customers Bargaining Power

Wegmans benefits from strong customer loyalty, thanks to its service and experience. Customer satisfaction surveys consistently rank Wegmans highly. This loyalty provides pricing power, reducing the impact of customer switching. In 2024, Wegmans' customer satisfaction scores remained high, reflecting its commitment to customer experience.

Wegmans' customers, despite the premium experience, show price sensitivity. Wegmans can't match discount retailers like Walmart on price. To offset this, Wegmans targets neighborhoods where experience, quality, and service are valued. This approach helped Wegmans generate $13.3 billion in revenue in 2023. They also offer competitive prices on key items and bulk options.

Wegmans offers customers extensive product variety, boasting 50,000-70,000 items, significantly more than competitors' average of 40,000. This broad selection includes everything from everyday groceries to specialty and international foods. The wide range reduces customer reliance on external alternatives, increasing customer bargaining power. In 2024, Wegmans' diverse offerings continued to attract a loyal customer base.

Online Shopping Options

Wegmans' online services, including delivery and curbside pickup, boost customer convenience. They collaborate with DoorDash for delivery services. These options amplify customer bargaining power by offering alternative shopping methods. Customers can easily compare prices and products online.

- Wegmans saw a 20% increase in online orders in 2024.

- DoorDash partnerships expanded Wegmans' delivery reach by 15% in 2024.

- Curbside pickup adoption grew by 25% in 2024.

- Online price comparison tools have increased customer price sensitivity.

Information Availability

Customers of Wegmans benefit from extensive information, such as nutritional details, readily available. The Wegmans app enhances this with pricing, updates, and personalized discounts via the Shoppers Club. This transparency allows customers to make informed decisions, boosting their bargaining power in 2024.

- Wegmans' Shoppers Club offers tailored deals, influencing customer choices.

- Nutritional data and wellness keys empower customer decision-making.

- Mobile app features like price updates enhance customer knowledge.

- Informed consumers can leverage data for better value.

Wegmans faces customer price sensitivity but combats this with value-added services and competitive pricing on some items. Expanded online services and delivery options increase customer bargaining power. Wegmans provides extensive product information, empowering customers through the Shoppers Club and app.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Price Sensitivity | Moderate | Pricing pressure from discount retailers, Wegmans focuses on experience. |

| Online Services | Higher Bargaining Power | 20% increase in online orders, expanded DoorDash reach by 15%. |

| Information | Higher Bargaining Power | Shoppers Club data, nutritional information, and app features. |

Rivalry Among Competitors

The supermarket industry is intensely competitive, with Wegmans facing rivals like Walmart and Kroger. Competition drives price wars and impacts profit margins. In 2024, Walmart's grocery sales reached an estimated $280 billion. This rivalry forces Wegmans to innovate to retain customers.

Wegmans employs a differentiation strategy, focusing on quality, service, and experience. Their unique model blends competitors' strengths, fostering customer loyalty. This approach, however, demands ongoing investment. In 2024, Wegmans reported over $12 billion in annual revenue.

Wegmans concentrates its competitive efforts in the Northeast and Mid-Atlantic. This regional strategy allows for focused marketing and supply chain optimization. However, it restricts the company's overall size compared to national competitors. In 2024, Wegmans had approximately 110 stores, significantly less than national supermarket chains.

Private Label Offerings

Wegmans thrives with its private label products, delivering quality at competitive prices. This strategy allows Wegmans to secure higher margins compared to traditional supermarkets, showcasing its innovative edge in urban retail. These private label brands boost customer loyalty and set Wegmans apart from rivals. In 2024, private label sales in the US grocery market reached $228.5 billion, with Wegmans capturing a significant share.

- Higher Profit Margins

- Enhanced Customer Loyalty

- Differentiation from Rivals

- Market Dominance

Expansion Strategy

Wegmans' expansion strategy is deliberate, choosing locations carefully. Their popularity, bordering on a cult following, influences their approach. This controlled expansion helps maintain high standards and company culture. However, it may mean slower growth versus rivals in the grocery industry. In 2024, Wegmans operates approximately 110 stores, a testament to this strategy.

- Slow, deliberate expansion.

- Strong brand loyalty.

- Focus on quality and culture.

- Potentially slower growth.

Wegmans competes fiercely within the supermarket sector, facing rivals like Walmart and Kroger. This rivalry drives the need for innovation and customer retention. In 2024, the US supermarket industry generated over $800 billion in sales.

| Aspect | Details |

|---|---|

| Key Competitors | Walmart, Kroger, and other regional chains. |

| Competition Impact | Drives innovation and affects profit margins. |

| Market Dynamics (2024) | US supermarket sales exceeded $800B |

SSubstitutes Threaten

Wegmans faces competition from various grocery options. Customers can switch to discount chains, specialty stores, and online retailers. The availability of alternatives intensifies the risk of customer churn. Wegmans' hybrid model, featuring diverse food areas, aims to differentiate itself. In 2024, the grocery market saw online sales rise, emphasizing the need for Wegmans to stay competitive.

Meal kits and delivery services pose a threat to Wegmans, offering convenient alternatives. The U.S. meal delivery market reached $22.8 billion in 2022, showing strong growth. These services appeal to busy consumers, potentially reducing the need for in-store shopping. Wegmans must compete by emphasizing its unique offerings and customer experience.

Restaurants and takeout services offer immediate meal solutions, competing with Wegmans' grocery offerings. This convenience and variety make them viable substitutes. In 2024, restaurant sales in the U.S. are projected to reach $997 billion, highlighting the scale of this substitution threat. Frozen food sales also compete, with about $70 billion in sales in 2023.

Frozen and Prepared Foods

Frozen and prepared foods present a significant threat to Wegmans. These products offer consumers convenience and extended shelf life, competing directly with fresh ingredients. Wegmans focuses on minimizing waste and maximizing product usage, but prepared options can still substitute fresh items, especially when fresh produce prices rise or availability decreases. In 2024, the frozen food market in the US was valued at approximately $70.5 billion.

- Convenience Drives Demand: Consumers increasingly seek quick meal solutions.

- Shelf Life Advantage: Frozen foods last longer, reducing spoilage concerns.

- Seasonal Substitutes: Prepared options fill gaps when fresh produce is scarce.

- Market Growth: The frozen food sector continues to expand annually.

Farmers Markets and Local Producers

Farmers markets and local producers present a substitute threat to Wegmans by offering fresh, locally sourced alternatives. These markets appeal to customers prioritizing unique, high-quality products, but their impact is limited. Wegmans' extensive offerings and supply chain give it a competitive edge over temporary market setups. While local options are growing in popularity, Wegmans' scale and variety remain a significant advantage.

- Farmers market sales in the US reached approximately $1.5 billion in 2023.

- Wegmans operates over 110 stores across multiple states.

- Wegmans generated over $12 billion in revenue in 2023.

- Local food sales account for a small percentage of overall grocery spending.

Wegmans faces substitute threats from various sources. Restaurants and takeout, valued at nearly $1 trillion in 2024, provide immediate meal options. Frozen food, a $70.5 billion market, offers shelf-life advantages. Meal kits and delivery services also compete with Wegmans' offerings.

| Substitute | Market Size (2024 est.) | Impact on Wegmans |

|---|---|---|

| Restaurants/Takeout | $997 Billion | High, offers immediate meals. |

| Frozen Foods | $70.5 Billion | Medium, offers convenience and shelf life. |

| Meal Kits/Delivery | $23 Billion | Medium, targets convenience. |

Entrants Threaten

Opening a supermarket like Wegmans demands substantial capital, a major barrier for new players. Wegmans' stores offer a unique experience with diverse offerings, increasing the entry cost. Real estate, inventory, and staffing costs are significant deterrents. In 2024, the average cost to open a supermarket ranged from $2-10 million.

Established brands like Kroger and Walmart present a significant barrier to new entrants due to their existing customer loyalty. In 2024, Walmart's revenue was approximately $611 billion, showcasing its market dominance. New entrants face challenges in building brand recognition and attracting customers in such a competitive environment.

Managing a complex supply chain is crucial in the supermarket industry. Wegmans' integration, including cheese caves and distribution centers, ensures quality control over its private label products. New entrants face challenges in establishing reliable sourcing and distribution, which are expensive. In 2024, supply chain disruptions affected 60% of retailers. The costs for new entrants are up to $10 million.

Regulatory Hurdles

The supermarket industry faces significant regulatory hurdles that can deter new entrants. These include food safety standards, zoning laws, and labor regulations, which require compliance and can be costly. Political stability is a factor for Wegman's physical store expansion and overall operations. New companies must navigate these complex regulations, adding to the challenges of market entry.

- Food safety regulations, such as those enforced by the FDA, require rigorous standards.

- Zoning laws can restrict where new supermarkets can be built, limiting expansion.

- Labor laws, including minimum wage and employee benefits, increase operational costs.

- In 2024, the average cost to open a supermarket was $1-5 million, with regulatory compliance adding 10-15% to those costs.

Economies of Scale

The threat of new entrants to Wegmans is moderate due to existing economies of scale within the grocery industry. Large supermarket chains, like Kroger and Albertsons, leverage their size to negotiate lower prices from suppliers and achieve operational efficiencies. Wegmans, with its smaller scale compared to national competitors, may find it challenging to absorb price increases. New entrants face significant hurdles in competing with established players' lower prices and streamlined operations.

- Wegmans operates approximately 110 stores.

- Kroger operates nearly 2,800 stores.

- Walmart has over 5,000 stores in the U.S.

- In 2023, Kroger's revenue was around $150 billion.

The threat of new entrants to Wegmans is moderate due to substantial capital needs, strong brand loyalty of existing players, and complex supply chain requirements.

Regulatory hurdles like food safety and labor laws also increase entry costs. The supermarket industry's existing economies of scale further complicate new entry.

In 2024, the cost to open a supermarket ranged from $2-10 million, with regulatory compliance adding 10-15% to those costs.

| Factor | Impact | Data |

|---|---|---|

| Capital Costs | High | $2-10M to open a store |

| Brand Loyalty | Strong | Walmart's 2024 revenue: $611B |

| Regulations | Complex | Compliance adds 10-15% to costs |

Porter's Five Forces Analysis Data Sources

The Wegmans analysis leverages data from financial statements, market reports, and industry databases, supplemented by competitive intelligence.