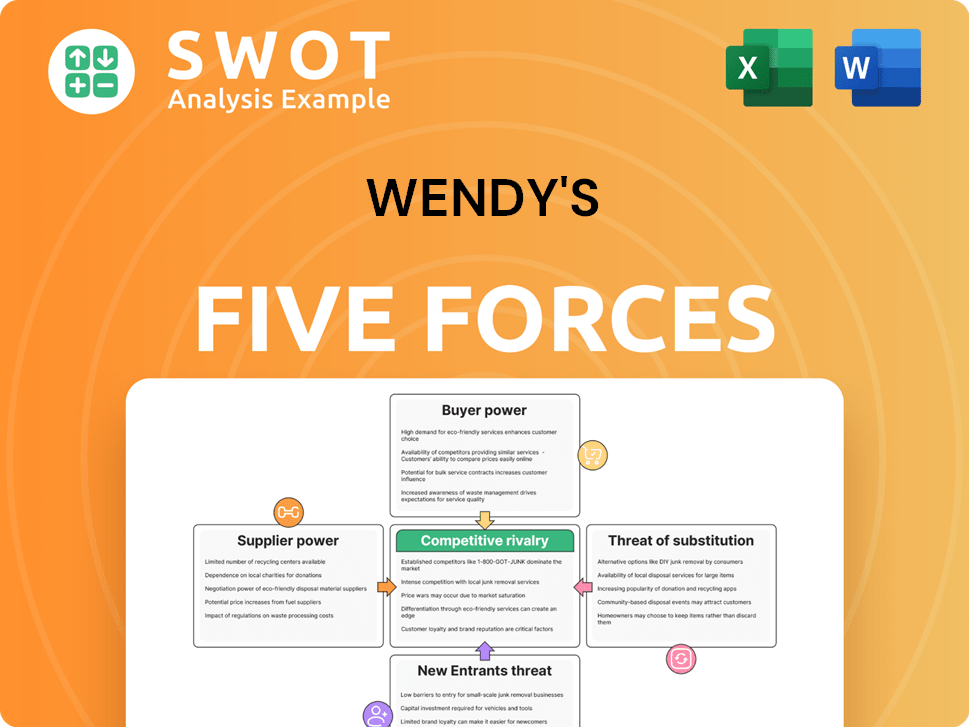

Wendy's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wendy's Bundle

What is included in the product

Analyzes Wendy's competitive landscape using Porter's Five Forces, evaluating its market position and key industry dynamics.

Instantly see Wendy's forces with a powerful spider/radar chart, revealing strategic pressure.

Preview Before You Purchase

Wendy's Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This Wendy's Porter's Five Forces analysis explores competitive rivalry, supplier power, buyer power, the threat of new entrants, and the threat of substitutes. It provides a comprehensive understanding of Wendy's market position. The analysis is ready for immediate use—no further action needed after your purchase. This is the complete, ready-to-use analysis file.

Porter's Five Forces Analysis Template

Wendy's faces intense competition in the fast-food industry, particularly from larger players and evolving consumer preferences. Its supplier power is moderate, balancing commodity prices with strong purchasing power. Buyer power is high, with many choices available to consumers. The threat of new entrants is significant, given low barriers like franchising. The threat of substitutes, from other food options, is also high.

The complete report reveals the real forces shaping Wendy's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Wendy's faces supplier power due to a limited number of major providers for essential items. For example, the beef industry is dominated by a few key players, potentially giving them leverage in price negotiations. This concentration allows suppliers to influence Wendy's costs, affecting profitability. In 2024, the cost of goods sold for Wendy's was a significant portion of revenue.

Wendy's benefits from the standardized nature of many inputs, like beef and potatoes. This limits supplier power because they can easily switch suppliers. According to recent data, the cost of beef, a key input, has fluctuated, showing Wendy's ability to manage supplier costs. However, suppliers of unique ingredients may wield more power.

Wendy's purchases can be significant, especially for smaller suppliers. In 2024, Wendy's had over 7,000 restaurants globally, indicating substantial buying power. Suppliers depend on Wendy's volume, making them more responsive to Wendy's demands. This dependency increases Wendy's leverage in negotiations, affecting pricing and service.

Supplier concentration

The bargaining power of suppliers significantly impacts Wendy's. If the supplier industry is more concentrated than the restaurant industry, suppliers wield greater influence. A few large suppliers can dictate prices and terms, squeezing Wendy's margins. This is particularly relevant for key ingredients. For example, the global potato market is dominated by a few major suppliers.

- Supplier concentration affects Wendy's profitability.

- Limited supplier options can increase costs.

- Wendy's must negotiate favorable terms.

- Supply chain disruptions pose risks.

Potential for backward integration

Wendy's could consider backward integration, perhaps by processing its own beef or farming produce. This move could enhance Wendy's negotiating position with current suppliers. The mere possibility of Wendy's producing its own supplies can exert pressure on them. However, the endeavor necessitates substantial capital and proficiency.

- Wendy's capital expenditures in 2023 were approximately $185 million.

- Backward integration could lead to increased operational complexity.

- The beef industry faces volatile pricing, a key factor for consideration.

- A strategic goal of Wendy's is to improve supply chain efficiencies.

Wendy's grapples with supplier power, especially for essential ingredients like beef, where a few major players control the market. The company's vast purchasing volume, however, gives it leverage, influencing supplier responsiveness. Backward integration remains a strategic option, despite the capital and operational complexities involved.

| Factor | Impact on Wendy's | Data/Example |

|---|---|---|

| Supplier Concentration | Increases supplier power | Beef industry: few dominant suppliers. |

| Wendy's Buying Power | Enhances negotiation leverage | Over 7,000 global restaurants (2024). |

| Backward Integration | Potential to reduce supplier power | 2023 CapEx: ~$185 million. |

Customers Bargaining Power

Wendy's faces high customer bargaining power due to the abundance of dining choices. Customers can easily switch to competitors like McDonald's or Burger King. In 2024, the fast-food industry's intense competition means Wendy's must offer competitive pricing and promotions to attract and retain customers. This focus is reflected in its marketing strategies and menu adjustments.

Customers face low switching costs when choosing fast-food options. They can quickly switch from Wendy's to competitors like McDonald's or Burger King. This ease of switching gives customers significant bargaining power. In 2024, McDonald's and Burger King's combined market share was over 40% in the US, highlighting the competition. This forces Wendy's to offer competitive pricing and promotions.

Fast food customers are often very price-sensitive, especially during economic downturns. Wendy's carefully balances pricing with value to keep customers. Promotions and value menus are key for managing this. In 2024, the fast-food industry saw increased price sensitivity, with value meals gaining popularity. Wendy's needs to stay competitive.

Availability of information

Customers wield significant power due to readily available information. Online platforms and apps provide easy access to prices, menus, and promotions. This transparency allows customers to compare offerings, enhancing their ability to negotiate. In 2024, 75% of consumers research restaurants online before visiting.

- Price Comparison: Websites and apps enable easy price comparisons.

- Menu Access: Online menus allow for informed choice.

- Promotion Awareness: Customers quickly find the best deals.

- Competitive Options: Customers can readily switch brands.

Brand loyalty

Brand loyalty in the fast-food sector, including Wendy's, isn't exceptionally robust. Customers frequently explore alternatives based on deals or ease of access. Wendy's needs to consistently highlight its brand's worth and distinguish itself to keep customers. In 2024, the fast-food industry saw promotional offers driving customer choices.

- Promotions and convenience heavily influence fast-food choices.

- Wendy's must continuously reinforce its brand value.

- Differentiation is key to maintaining customer loyalty.

- Competitive pricing and offers are critical for customer retention.

Wendy's faces strong customer bargaining power due to easy switching and price sensitivity. Competitors like McDonald's and Burger King have a significant market share, intensifying competition. This requires Wendy's to offer competitive pricing and promotions.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low | Over 40% market share held by top 2 US fast-food chains. |

| Price Sensitivity | High | Value meal popularity increased by 15%. |

| Information Availability | High | 75% research restaurants online before visiting. |

Rivalry Among Competitors

The fast-food industry is incredibly competitive, with Wendy's facing stiff competition. McDonald's and Burger King are key rivals, alongside many others. This rivalry pushes Wendy's on pricing and marketing strategies. In 2024, McDonald's had over $25 billion in revenue, highlighting the intense competition Wendy's faces.

Price wars are frequent in fast food as firms vie for customers. This can slash profit margins, pressuring Wendy's on pricing. In 2024, Wendy's same-store sales rose, but profitability is key. Wendy's must wisely manage its prices to stay profitable.

Wendy's stands out with its square burgers, fresh ingredients, and customizable choices, setting it apart from rivals. They invest in marketing and product development to stay competitive. Differentiation helps attract and keep customers in a competitive fast-food market. In 2024, Wendy's reported a 4.5% increase in same-store sales, showing its differentiation efforts work.

Advertising and promotions

Advertising and promotions are vital for attracting customers and building brand awareness in the fast-food industry. Wendy's allocates significant resources to marketing campaigns, showcasing its products and value propositions to stay competitive. Effective marketing is crucial for distinguishing Wendy's in a crowded market, where rivals constantly vie for consumer attention. In 2024, Wendy's marketing expenses were approximately $400 million, reflecting its commitment to maintaining a strong brand presence.

- Wendy's marketing spend in 2024 was around $400 million.

- Marketing is crucial for differentiating Wendy's from competitors.

- Advertising builds brand awareness and attracts customers.

- Promotions highlight value offerings to consumers.

Geographic expansion

Companies vigorously compete for market share, often through geographic expansion and new restaurant openings. Wendy's actively competes with major fast-food chains to secure advantageous locations and increase its market presence. Strategic location decisions are critical for success in the fast-food sector. In 2024, Wendy's plans to open approximately 200 new restaurants globally, focusing on both domestic and international markets. This expansion strategy underscores the intense competitive rivalry in the fast-food industry, where securing prime real estate is essential.

- Wendy's aims for 200 new restaurant openings worldwide in 2024.

- Strategic locations are crucial for gaining market share.

- Competition includes securing prime real estate.

- Expansion targets both domestic and international markets.

Wendy's faces intense competition, mainly from McDonald's and Burger King, influencing pricing and marketing.

The rivalry drives price wars, potentially squeezing profit margins. Wendy's differentiates itself with product innovation and strong marketing, exemplified by its 4.5% same-store sales increase in 2024.

Strategic geographic expansion, including around 200 new restaurant openings globally in 2024, showcases competitive efforts.

| Aspect | Details | 2024 Data |

|---|---|---|

| Rivals | Key competitors | McDonald's, Burger King |

| Marketing Spend | Approximate expenditure | $400 million |

| New Openings | Planned restaurant openings | 200 globally |

SSubstitutes Threaten

Other fast-food chains, like McDonald's and Burger King, are direct substitutes, offering hamburgers and chicken. These competitors provide similar convenience and price points, making them accessible alternatives. In 2024, McDonald's generated approximately $25 billion in revenue in the U.S. alone. The ease of switching between these options intensifies the competitive landscape.

Casual dining restaurants pose a moderate threat to Wendy's due to their different offerings. They provide a relaxed dining experience, but at a higher price. For instance, in 2024, casual dining sales totaled approximately $80 billion. These restaurants compete for customers seeking diverse menus. However, Wendy's focus on quick service somewhat shields it from direct substitution.

Grocery stores and home cooking serve as substitutes for Wendy's, particularly for health-conscious consumers. Preparing meals at home offers both cost savings and control over ingredients. In 2024, the average cost of a meal at home was notably lower than dining out, approximately $4.30 versus $14.00. This appeals to a significant market segment.

Convenience stores

Convenience stores pose a limited threat to Wendy's. They offer quick, on-the-go food options, appealing to consumers prioritizing speed and ease. The convenience factor is key, as these stores provide immediate access to meals and snacks. However, their menu variety and quality typically lag behind fast-food chains like Wendy's. According to recent data, the convenience store market is valued at $270.3 billion in 2024.

- Limited Threat: Convenience stores offer quick alternatives.

- On-the-Go Focus: They target consumers needing fast options.

- Menu & Quality: Usually less diverse than fast food.

- Market Size: The convenience store market reached $270.3B in 2024.

Meal kit delivery services

Meal kit delivery services pose a growing threat to Wendy's. These services, like HelloFresh and Blue Apron, offer pre-portioned ingredients and recipes. They compete by providing convenience and variety, attracting consumers willing to pay more than fast food prices. In 2024, the meal kit market is estimated to be worth over $6 billion.

- Market growth: Meal kit services are expanding, with HelloFresh reporting over 8 million active customers globally as of Q4 2024.

- Price comparison: Meal kits often cost more per meal than fast food, but offer a perceived value in terms of health and variety.

- Convenience factor: Meal kits save time on grocery shopping and meal prep, a key advantage over traditional fast food.

The threat of substitutes for Wendy's varies significantly. Direct competitors like McDonald's and Burger King are strong substitutes due to similar offerings. However, casual dining presents a moderate threat, and meal kit services are a growing concern.

Grocery stores and home cooking offer cost-effective alternatives, particularly for budget-conscious consumers. Convenience stores provide limited substitution due to less diverse menus.

| Substitute Type | Threat Level | 2024 Market Data |

|---|---|---|

| Direct Competitors (McDonald's, Burger King) | High | McDonald's U.S. Revenue: ~$25B |

| Casual Dining | Moderate | Casual Dining Sales: ~$80B |

| Grocery/Home Cooking | Moderate | Avg. Home Meal Cost: ~$4.30 |

Entrants Threaten

Establishing a new fast-food chain requires substantial capital investment. High startup costs like real estate, equipment, and marketing deter many entrants. For example, McDonald's spent over $2 million to open a single restaurant in 2024. This limits the threat of new competition significantly.

Established fast-food brands like McDonald's and Burger King boast massive brand recognition, creating a substantial hurdle for new competitors. These giants have cultivated strong customer loyalty over decades, solidifying their market positions. New entrants face the daunting task of building brand awareness and trust, requiring substantial marketing expenditures. For example, in 2024, McDonald's spent over $2 billion on advertising. Overcoming this brand equity barrier is a significant challenge.

Established fast-food chains like Wendy's leverage economies of scale, particularly in purchasing and marketing. New entrants face challenges in matching these advantages, impacting profitability. Wendy's, with over 7,000 restaurants, benefits from lower per-unit costs. In 2024, Wendy's marketing spend was around $300 million. Achieving scale is vital in this competitive market.

Regulatory hurdles

Regulatory hurdles pose a significant threat to new entrants in the fast-food industry. These businesses face complex regulations concerning food safety, health, and labor. The costs associated with navigating and complying with these rules can be substantial. Compliance is critical for operating a fast-food restaurant, adding to the initial investment.

- Food safety standards, such as those enforced by the FDA, require rigorous protocols and inspections, costing businesses around $10,000 - $20,000 annually.

- Labor laws, including minimum wage and employee benefits, increase operational expenses. In 2024, the average hourly wage for fast-food workers is $14.78.

- Health regulations, like those promoting healthy menu options, require changes in supply chain and product development.

- Environmental regulations, such as waste disposal, add to operational overhead.

Access to distribution channels

New fast-food ventures face distribution hurdles. Wendy's, with its established network, has an advantage in securing ingredients and supplies. Newcomers often grapple with building cost-effective supply chains. Establishing these channels demands significant time and investment, posing a substantial barrier.

- Wendy's benefits from existing supplier relationships.

- New entrants face challenges in supply chain efficiency.

- Building distribution infrastructure requires capital.

- Established chains have a competitive edge.

The fast-food industry's high entry barriers limit the threat of new competitors. Significant capital, brand recognition, and economies of scale favor established chains. Regulatory compliance and distribution challenges further restrict entry. These hurdles protect existing brands like Wendy's.

| Factor | Impact on New Entrants | Example (2024 Data) |

|---|---|---|

| Capital Costs | High initial investment | McDonald's: $2M+ per restaurant |

| Brand Recognition | Difficult to build trust | McDonald's Ad Spend: $2B |

| Economies of Scale | Challenges with costs | Wendy's Marketing: $300M |

Porter's Five Forces Analysis Data Sources

The analysis incorporates data from SEC filings, market research, and industry publications, including competitor reports, to build a comprehensive framework.