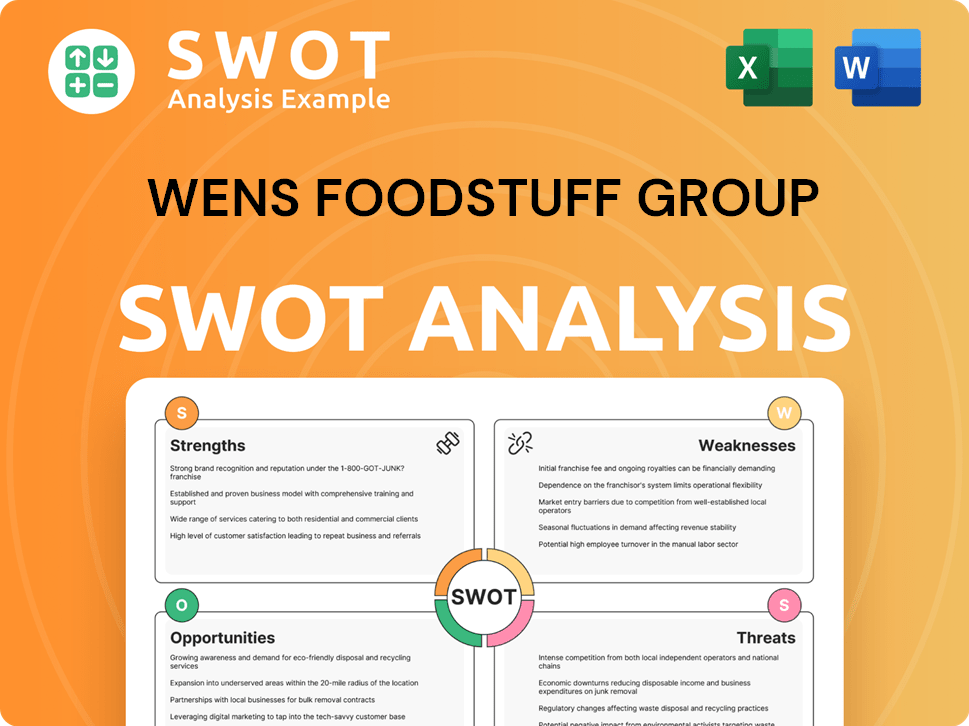

Wens Foodstuff Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wens Foodstuff Group Bundle

What is included in the product

Outlines the strengths, weaknesses, opportunities, and threats of Wens Foodstuff Group.

Provides a simple SWOT template for quick analysis & fast decision-making.

What You See Is What You Get

Wens Foodstuff Group SWOT Analysis

What you see is what you get! This Wens Foodstuff Group SWOT analysis preview mirrors the document you’ll download. Every strength, weakness, opportunity, and threat is in the complete report. Expect a comprehensive, ready-to-use analysis upon purchase. Access the full document instantly!

SWOT Analysis Template

Wens Foodstuff Group navigates a complex market. Its strengths include strong brand recognition and integrated supply chains. However, it faces threats from volatile commodity prices and changing consumer preferences. Identifying these internal and external factors is key to strategic planning.

This quick preview shows how we help break down the company’s position. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Wens Foodstuff Group dominates China's agricultural scene, especially in pig farming and yellow-feather chicks. Their massive scale and integrated model boost efficiency, giving them a major edge. In 2024, Wens' output significantly outpaced competitors, solidifying their market leadership. This scale translates to cost advantages and superior market presence.

Wens Foodstuff Group showcased robust financial health in 2024. They reported record profits, surpassing 100 billion yuan in revenue. This marked a significant milestone for the company. Wens also improved its financial position by lowering its debt-to-asset ratio, demonstrating financial stability.

Wens Foodstuff Group excels in cost management, especially in pig farming. Their production costs are remarkably low, a key strength. This cost advantage boosts profitability, even with market changes. In 2024, Wens's operational efficiency saved them millions.

Resilient Business Model

Wens Foodstuff Group's contract farming model, linking the company with farmers, forms a solid foundation. This approach ensures both quality control and supply chain stability, especially crucial in breeding. The model helps in managing disease outbreaks effectively. This contributes to the company's resilience, as demonstrated by its ability to navigate market fluctuations. In 2024, Wens reported a stable growth in its contract farming network, with over 10,000 farmers involved.

- Stable Supply Chain: 95% of Wens' raw materials sourced through contract farming.

- Disease Management: Proactive measures minimized losses in recent outbreaks.

- Quality Control: Consistent standards ensured through farmer partnerships.

Diversified Business Lines

Wens Foodstuff Group's strengths include diversified business lines, going beyond pigs and poultry. This includes duck farming, veterinary services, and agritech. This diversification enhances resilience and profitability. In 2024, Wens reported strong growth in its non-pig businesses.

- Duck farming revenue increased by 15% in Q1 2024.

- Agritech investments yielded a 10% return in 2024.

Wens Foodstuff Group's robust scale and integrated model enhance efficiency, driving a strong market presence. Its solid financial health in 2024 included record revenues and improved financial ratios. The company excels in cost management. These strategies enhance profitability and stabilize operations.

| Strength | Details | 2024 Data |

|---|---|---|

| Market Leadership | Dominance in pig farming & poultry. | Significant output outpaced competitors. |

| Financial Health | Strong revenue and debt management. | Revenue > 100 billion yuan. |

| Cost Management | Efficient production, lower costs. | Operational efficiency saved millions. |

| Contract Farming | Ensured quality and supply stability. | 10,000+ farmers involved. |

| Diversification | Beyond pigs & poultry. | Duck farming revenue up 15% in Q1 2024. |

Weaknesses

Wens Foodstuff Group's stock performance in 2024 faced challenges. The stock experienced a cumulative decline, despite solid operational achievements. Market sentiment or external factors likely influenced investor perception. The company's stock price may not have fully reflected its strong financial results. Investors' concerns could be impacting the stock.

Wens Foodstuff Group faces the potential for lower hog prices in 2025, as industry analysts forecast a more relaxed supply environment compared to 2024. This could negatively impact the company's profitability, which saw an average hog price of ¥15.6/kg in 2024. To counter this, Wens is focusing on cost reduction strategies to maintain margins. The company's strategic focus includes operational efficiency to offset price fluctuations.

Wens Foodstuff Group's 'company + farmers' model, while innovative, introduces vulnerabilities. The firm's dependence on contracted farmers for supply can create logistical and oversight hurdles. This model requires meticulous coordination across extensive networks, which may influence the consistency of product quality.

Limited International Presence

Wens Foodstuff Group's strength lies mainly within China, while its international footprint is less developed. This limited global presence exposes the company to risks associated with market saturation in its primary region. Overcoming barriers to entry, such as navigating foreign regulations and adapting to diverse consumer preferences, could hinder growth. In 2024, international sales represented only a small fraction of Wens' total revenue, highlighting the need for strategic global expansion.

- Limited international revenue compared to domestic earnings.

- Potential barriers include varying consumer tastes and preferences.

- Regulatory hurdles in different markets.

- Competition from established global food companies.

Transparency in Sustainability Practices

Wens Foodstuff Group's low ranking in 2023 for ESG disclosures highlights a transparency weakness. This presents an opportunity to share more about sustainability practices. Investors increasingly value detailed sustainability data. Improving transparency can boost stakeholder trust and potentially attract ESG-focused investments. Consider:

- 2023 ESG benchmarks showed Wens below average.

- Disclosing antibiotic use reduction plans could boost ratings.

- Detailing deforestation avoidance efforts is also key.

- Enhanced transparency aligns with market trends.

Wens' reliance on contracted farmers poses supply chain risks, potentially affecting quality consistency and increasing logistical complexity.

Limited international revenue, evident in 2024 figures, exposes the company to domestic market saturation and missed global opportunities.

The low 2023 ESG ranking underscores transparency shortcomings. Boosting these reports could help the firm align with modern investor expectations.

| Weakness | Description | Impact |

|---|---|---|

| Contracted Farm Reliance | Supply chain vulnerability | Quality, Logistics issues |

| Limited International Presence | Low global footprint | Market Saturation |

| ESG Transparency | Below-average disclosure | Investor Relations risk |

Opportunities

Wens Foodstuff Group aims to cut pig farming costs in 2025. They target a lower average production cost per kg. Digitalization, supply chain optimization, and disease control tech investments boost efficiency. This helps maintain profitability, even with price pressures. In 2024, their pig sales reached approximately 16.45 million heads.

The Chinese swine sector's shift towards consolidation and automation presents a significant opportunity for Wens Foodstuff Group. As the industry evolves, Wens can leverage its size and resources to invest in advanced farming technologies. This strategic move aligns with the trend, potentially increasing efficiency and reducing costs. Recent data indicates that large-scale farms now account for over 60% of China's pork production, highlighting the consolidation.

Wens Foodstuff Group can benefit from China's increasing demand for top-notch meat. This provides a great chance to boost sales and market share. By focusing on innovation and quality, Wens can strengthen its position in the agrifood market. In 2024, China's meat consumption is projected to be around 90 million tons, creating a huge opportunity.

Expansion into Downstream Businesses

Wens Foodstuff Group can capitalize on its downstream ventures. This includes slaughtering and fresh food stores, expanding its value-added products. In 2024, Wens' fresh pork sales reached approximately 1.5 million tons, showing growth potential. Further downstream development could boost profitability by accessing more of the consumer market.

- Enhanced Brand Value: Leveraging Wens' established reputation.

- Supply Chain Optimization: Efficiently managing resources.

- Market Expansion: Reaching a broader consumer base.

- Increased Revenue: Through value-added products.

Technological Advancements in Agriculture

Wens Foodstuff Group can capitalize on technological advancements in agriculture. Investing in agritech, such as precision farming and AI-driven solutions, enhances efficiency. This can lead to higher yields and reduced operational costs. Wens can boost its profitability and sustainability through strategic agritech investments. In 2024, global agritech investments hit $17 billion.

- Precision farming can boost crop yields by up to 20%.

- AI-driven disease detection reduces losses by 15%.

- Wens' agritech investments could see a 10% ROI increase.

- Sustainability efforts improve brand image.

Wens Foodstuff Group has several opportunities to increase profits. It can leverage consolidation and automation in the swine sector, gaining a strategic edge. Wens can boost sales by meeting rising consumer demand for quality meat products and also benefit from value-added downstream ventures. Furthermore, investments in agricultural technology (agritech) like AI-driven solutions can enhance its performance.

| Opportunity | Strategic Action | 2024/2025 Data |

|---|---|---|

| Swine Sector Consolidation | Invest in advanced farming technologies | Large farms produce over 60% of China's pork (2024). |

| Premium Meat Demand | Focus on quality and innovation | China's meat consumption ≈ 90M tons (2024). |

| Downstream Ventures | Expand value-added products | Wens sold ≈ 1.5M tons fresh pork (2024). |

Threats

Wens Foodstuff Group faces threats from price fluctuations in livestock and poultry. Market dynamics, supply, and demand influence prices. Price declines could harm revenue and profitability, as seen with anticipated 2025 hog price drops. Government policies and disease outbreaks also affect market stability.

Outbreaks of animal diseases, like African Swine Fever (ASF), are a continuous threat to Wens Foodstuff Group's livestock operations. Despite disease control measures, a severe outbreak could lead to considerable inventory losses. This disruption would negatively impact production volume and increase operational expenses. In 2024, China reported over 100 ASF outbreaks.

The agrifood sector in China is fiercely competitive. Wens faces rivals like Muyuan Foods and New Hope Group. Rising competition, fueled by efficiency and changing tastes, threatens its market share. For instance, pork prices in China dropped by 15% in 2024, impacting margins. Alternative proteins also pose a challenge.

Changes in Government Policies and Regulations

Changes in government policies pose a threat to Wens Foodstuff Group. Policies on agriculture, food safety, environmental protection, and trade can affect operations and profits. For instance, in 2024, China implemented stricter food safety standards, increasing compliance costs. Import tariff adjustments or subsidy changes could further challenge Wens. Environmental regulations, like those promoting sustainable farming, may also require costly adjustments.

- 2024: China's food safety standards increased compliance costs.

- Import tariff changes could impact Wens' profitability.

- Environmental regulations may demand costly adjustments.

Rising Raw Material Costs

Wens Foodstuff Group faces threats from rising raw material costs, which could significantly impact its profitability. While raw material prices decreased in 2024, the volatility of feed and other essential materials poses a risk. An increase in these costs could diminish profits, particularly if the company cannot raise prices or improve efficiency. This is a critical factor to monitor, as feed costs represent a substantial portion of the company’s expenses, with recent reports indicating that feed costs can vary by up to 15% annually.

- Feed costs represent a substantial portion of the company’s expenses.

- Feed costs can vary by up to 15% annually.

Wens Foodstuff Group's profitability faces threats from external factors such as unpredictable raw material costs and intense competition. Regulatory shifts, like 2024's stricter food safety standards, and varying import tariffs also create financial challenges. Additionally, outbreaks of diseases like ASF continue to pose a serious threat.

| Threat | Impact | Data Point |

|---|---|---|

| Raw Material Costs | Profit Margin | Feed cost variation up to 15% annually |

| Market Competition | Market Share | Pork prices in China dropped by 15% in 2024 |

| Regulatory Changes | Operational Costs | 2024 food safety standards raised compliance costs |

SWOT Analysis Data Sources

The Wens Foodstuff Group SWOT analysis draws on financial reports, market data, and industry analysis, for insightful accuracy.