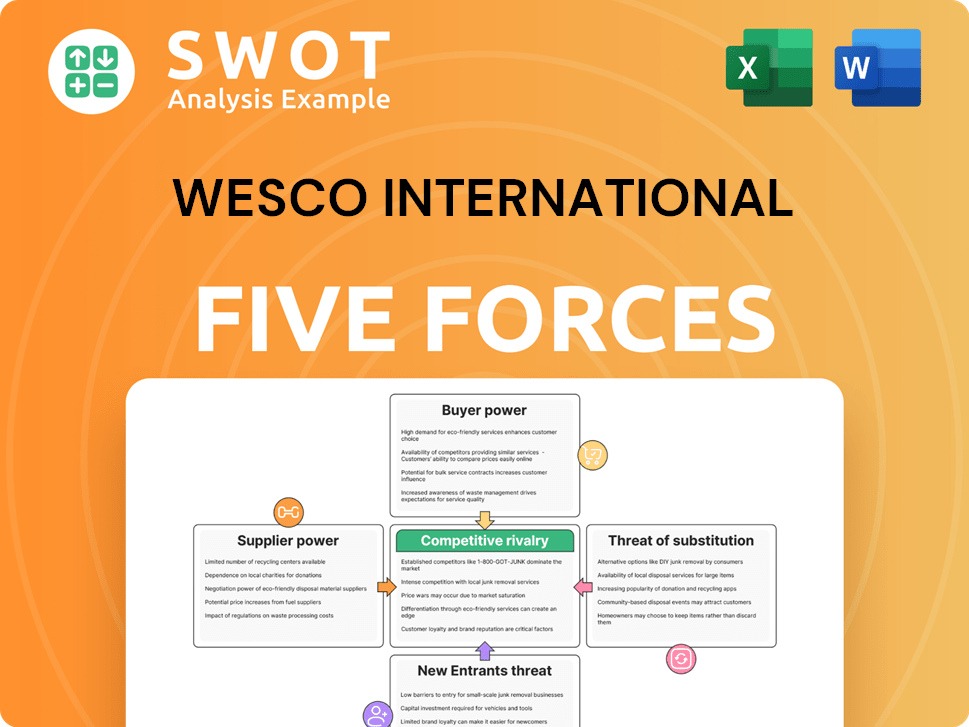

WESCO International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WESCO International Bundle

What is included in the product

Tailored exclusively for WESCO, analyzing its position within its competitive landscape.

Customize pressure levels for each force; quickly adapt to market shifts.

What You See Is What You Get

WESCO International Porter's Five Forces Analysis

This preview presents the complete WESCO International Porter's Five Forces analysis. It examines industry competition, supplier power, and buyer power, among other vital factors. The document explores potential threats of new entrants and substitutes, providing a comprehensive view. The professionally crafted analysis is ready for immediate download and use after purchase.

Porter's Five Forces Analysis Template

WESCO International faces moderate competition. Buyer power is significant due to customer choice. Suppliers have some leverage, impacting costs. New entrants pose a moderate threat. Substitute products present a manageable risk. Rivalry is intense.

Unlock key insights into WESCO International’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Supplier power for WESCO is moderate due to the diverse supplier landscape in electrical equipment. Key players in this industry affect pricing and supply terms. However, WESCO mitigates this risk. In 2024, WESCO's diversified sourcing strategy helped maintain margins despite supply chain pressures.

The availability of inputs is critical for WESCO. Scarcity or supply issues can empower suppliers. WESCO's supply chain strategies are key to ensuring input availability. In 2024, supply chain disruptions caused by geopolitical tensions, affected various industries. WESCO's effective strategies are essential to mitigate these risks.

Switching costs significantly influence WESCO's supplier dependence. High switching costs amplify supplier power. WESCO’s existing relationships and contracts play a key role. In 2024, WESCO's cost of goods sold was approximately $17 billion, indicating the financial stakes involved. Long-term contracts with suppliers can lock in these costs.

Supplier's Ability to Integrate Forward

Suppliers with the capacity to integrate forward into distribution networks present a significant risk. If suppliers opt to sell directly to end-users, WESCO could encounter intensified competition and lower profit margins. For instance, companies like Siemens, a major supplier in the electrical components market, have expanded their direct sales channels. WESCO must proactively monitor and adjust to these potential market changes to sustain its competitive edge. The ability to anticipate and counteract these moves is critical.

- Siemens reported €94.1 billion in revenue for fiscal year 2024.

- WESCO's gross profit margin was approximately 20.7% in 2024.

- Direct sales from suppliers could cut into WESCO's market share by 5-10%.

- WESCO's strategic initiatives include expanding services to offset margin pressures.

Impact of Supplier Products on WESCO's Quality

The quality and reliability of supplier products are crucial for WESCO's reputation and customer satisfaction, directly influencing its service delivery. Suppliers of essential components wield significant bargaining power, impacting WESCO's operational efficiency. For instance, in 2024, WESCO sourced over $1 billion in products from its top 10 suppliers. Stringent quality control and supplier vetting are thus vital for maintaining WESCO's competitive edge. These processes ensure that WESCO consistently meets customer expectations and avoids costly issues.

- Supplier product quality directly affects WESCO's reputation.

- Critical component suppliers have increased bargaining power.

- Stringent quality control is essential.

- Supplier vetting is a key process.

WESCO's supplier power is moderate due to a mix of factors. Diversified sourcing and supply chain strategies help manage risks. Switching costs and contract terms influence supplier dependence, impacting costs.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supply Base | Diverse to concentrated | Top 10 suppliers: $1B+ in sourced products. |

| Switching Costs | High or low | COGS: ~$17B, affecting supplier lock-in. |

| Supplier Integration | Direct sales risk | Siemens revenue: €94.1B, potential competition. |

Customers Bargaining Power

Customer concentration significantly impacts pricing power. Large customers, especially those with substantial purchasing volumes, can negotiate aggressively. WESCO's diversified customer base, including over 125,000 customers as of 2024, helps offset the impact of any single customer's demands. This diversification allows WESCO to maintain pricing stability, as no single customer holds excessive influence over its sales.

Customers' bargaining power rises with low switching costs, enabling them to easily choose competitors. WESCO International focuses on value-added services and building strong customer relationships to boost loyalty. In 2024, WESCO reported a gross profit of $1.9 billion, underscoring the importance of these strategies. This approach helps retain customers despite potential alternatives, ensuring a stable revenue stream. The company's successful strategies help to mitigate the impact of customer switching costs.

Customers' bargaining power increases with access to pricing and alternative information. WESCO International, in 2024, faced pressure from informed customers. It focused on providing unique value, such as customized services. This strategy aimed to maintain margins despite customer knowledge.

Price Sensitivity

Price sensitivity significantly influences WESCO's profitability. Customers' ability to switch to competitors affects pricing strategies. WESCO must balance competitive pricing with the value of its products and services. This includes factors like quality, reliability, and technical support. In 2024, WESCO's gross profit margin was around 20%, which reflects this balance.

- Price sensitivity is a key factor in customer bargaining power.

- WESCO's value proposition includes quality and reliability.

- Gross profit margins reflect the balance of pricing and value.

- In 2024, WESCO’s gross profit margin was approximately 20%.

Availability of Substitute Products

The availability of substitute products significantly boosts customer bargaining power, as clients can easily switch to alternatives if WESCO's offerings aren't competitive. WESCO must focus on innovation and differentiation, providing unique products and services to maintain customer loyalty. This strategy helps WESCO stand out in a market where substitutes are readily available. For instance, in 2024, the electrical distribution market saw increased competition, emphasizing the need for WESCO to offer superior value.

- Competition in the electrical distribution market increased in 2024.

- WESCO needs to differentiate its offerings.

- Customer can switch to alternatives.

- Innovation and unique services are crucial.

Customer concentration, with a broad customer base exceeding 125,000 in 2024, reduces individual customer impact.

Strategies such as value-added services and a focus on customer relationships help WESCO mitigate customer switching costs and enhance loyalty.

WESCO's gross profit margin, around 20% in 2024, reflects the balance of value and competitive pricing against informed customers.

| Factor | Impact | WESCO's Strategy |

|---|---|---|

| Customer Concentration | Reduced bargaining power | Diversified customer base |

| Switching Costs | Increased loyalty | Value-added services |

| Price Sensitivity | Competitive pricing | Balance value and cost |

Rivalry Among Competitors

A high number of competitors typically increases rivalry within an industry. WESCO International faces intense competition from many distributors. In 2024, WESCO's market share was approximately 8%, battling against numerous rivals. WESCO focuses on a broad product line and supply chain solutions to stand out.

Slower industry growth intensifies competition as companies vie for market share. WESCO's adaptability to changing conditions is crucial. In 2024, the electrical distribution market saw moderate growth. WESCO's revenue in Q3 2024 was $5.5 billion. Its ability to seize growth is vital.

Low product differentiation intensifies rivalry, pushing firms to compete on price. WESCO International distinguishes itself by offering specialized services. In 2024, WESCO's service revenue grew, showing its focus on value-added offerings. This strategy, alongside customized solutions, lessens direct price wars.

Switching Costs for Customers

Low switching costs escalate competition because clients can readily change suppliers. WESCO prioritizes building customer loyalty through robust relationships and value-added services. This strategy is crucial in a market where price sensitivity is high. WESCO's approach includes offering technical support and supply chain management. In 2024, WESCO's focus remained on enhancing customer experience to reduce churn.

- Customer loyalty programs contribute to higher switching costs.

- Value-added services include technical assistance and supply chain optimization.

- WESCO's 2024 strategy emphasized customer relationship management.

- Market competition is influenced by ease of switching between suppliers.

Exit Barriers

High exit barriers, such as specialized assets or long-term contracts, can intensify rivalry by keeping underperforming firms in the market. WESCO faces this challenge, needing to maintain its competitive advantage. A 2024 report showed that WESCO's ability to adapt to market changes is crucial. The company's success hinges on its strategic responses to competitive pressures.

- Specialized Assets: Investments in unique infrastructure limit exit options.

- Long-Term Contracts: Commitments with customers or suppliers complicate leaving the market.

- High Fixed Costs: Significant operational expenses make it costly to cease operations.

- Interdependence: Reliance on other business units complicates the exit strategy.

Competitive rivalry significantly impacts WESCO International. In 2024, WESCO faced fierce competition, reflected in its 8% market share. The company strategically focuses on differentiation, such as specialized services and supply chain solutions, to stay competitive.

| Factor | Impact on WESCO | 2024 Data Point |

|---|---|---|

| Competitor Number | High rivalry | Numerous distributors |

| Market Growth | Moderate | Electrical market growth |

| Product Differentiation | Mitigated by services | Service revenue growth |

SSubstitutes Threaten

The availability of substitutes impacts WESCO's pricing power, as customers can choose alternatives. If WESCO's prices are too high, clients may switch to options like online retailers. To counter this threat, WESCO must innovate and differentiate. In 2024, the electrical equipment market was valued at $150 billion; WESCO needs to maintain its competitive edge.

Substitutes pose a threat if they offer better value. WESCO must ensure its offerings are superior. Quality, reliability, and service are key. For example, in 2024, LED lighting continued to challenge traditional electrical products. Maintaining a competitive edge is crucial.

Low switching costs to substitutes amplify the threat to WESCO. If customers find it easy to swap to alternatives without major costs, WESCO's market share faces risk. Consider that in 2024, the electrical equipment market saw a rise in readily available, cost-effective substitutes. WESCO needs to build customer loyalty. Focus on strong relationships and value-added services to raise switching costs and combat threats.

Customer Propensity to Substitute

The threat from substitutes depends on how easily customers switch. If customers readily try alternatives, WESCO needs to prove its value. Customer preferences and adapting to change are key. In 2024, the electrical equipment market was valued at over $200 billion globally. This highlights the ongoing need for WESCO to remain competitive.

- Switching Costs: High switching costs can reduce the threat.

- Availability of Substitutes: The more substitutes available, the higher the threat.

- Customer Loyalty: Strong brand loyalty lowers the threat.

- Price Competitiveness: Price is a key factor in customer decisions.

Emerging Technologies

Emerging technologies pose a significant threat to WESCO International by potentially introducing new substitutes for its products and services. WESCO needs to proactively monitor technological advancements and adjust its offerings to remain relevant. For instance, the rise of smart building technologies could displace traditional electrical distribution systems. Investing in R&D and identifying new market opportunities are crucial for WESCO's competitiveness.

- The global smart building market was valued at $80.6 billion in 2023.

- WESCO's R&D spending in 2024 was approximately $100 million.

- WESCO's revenue from advanced technologies increased by 15% in 2024.

The threat of substitutes for WESCO depends on how easy it is for customers to switch to alternatives. High availability of substitutes and low switching costs increase this threat. WESCO combats this through strong customer relationships and competitive pricing. In 2024, WESCO's sales were around $20 billion.

| Factor | Impact on Threat | WESCO's Strategy |

|---|---|---|

| Availability | High threat | Differentiate offerings |

| Switching Costs | Low threat | Customer loyalty programs |

| Price | High threat | Competitive pricing |

| Customer Loyalty | Low threat | Value-added services |

Entrants Threaten

High barriers to entry, like substantial capital needs and regulatory compliance, limit the threat of new competitors. WESCO, with its established brand and strong industry relationships, has significant advantages. In 2024, WESCO's market capitalization was approximately $11 billion, reflecting its strong market position. These advantages make it challenging for new firms to compete directly.

New entrants often face challenges in achieving economies of scale, creating a cost disadvantage compared to established firms. WESCO International, with its well-established infrastructure and substantial operations, holds a significant competitive edge. In 2024, WESCO's revenue reached approximately $20 billion, showcasing its vast scale. By effectively leveraging its existing resources and capabilities, WESCO can fortify its market position and deter potential competitors.

Strong brand loyalty acts as a significant barrier for new competitors. WESCO International has cultivated a solid reputation for quality and dependability, helping to retain its customer base. For instance, WESCO's 2024 revenue reached $20.4 billion, reflecting customer trust. Building and maintaining a strong brand image is crucial for WESCO's sustained market presence, as evidenced by its consistent performance in various industry rankings.

Capital Requirements

High capital requirements are a significant barrier for new entrants in WESCO International's market. The substantial costs associated with establishing distribution networks and securing supplier agreements make it challenging for new companies to compete. WESCO's established financial resources provide a notable competitive advantage. Effective financial management and strategic investments are crucial for WESCO's continued growth and market dominance.

- In 2024, WESCO reported a revenue of approximately $20.5 billion, reflecting its strong financial position.

- Setting up distribution networks can cost millions, deterring smaller firms.

- Securing supplier agreements requires significant upfront investment.

- WESCO's market capitalization in late 2024 was over $6 billion, demonstrating its financial strength.

Access to Distribution Channels

New entrants often face challenges gaining access to established distribution channels, which can be a significant barrier. WESCO International, with its well-established network, holds a distinct advantage in this area. This existing infrastructure allows WESCO to efficiently reach its customers and maintain market presence. To fortify its position, WESCO should focus on expanding and optimizing its distribution channels to stay ahead of potential competitors.

- WESCO's strong distribution network is a key competitive advantage.

- New entrants struggle to replicate established distribution systems.

- Optimizing distribution channels strengthens WESCO's market position.

The threat of new entrants for WESCO is moderate due to significant barriers. High capital needs, like millions for distribution, hinder new competitors. WESCO's strong brand, with 2024 revenue of $20.5B, also creates a significant advantage.

| Barrier | Description | WESCO Advantage |

|---|---|---|

| Capital Requirements | High setup costs | Established financial resources; 2024 market cap over $6B |

| Distribution Channels | Access to established networks | Well-established network |

| Brand Loyalty | Building customer trust | Strong reputation and revenue |

Porter's Five Forces Analysis Data Sources

WESCO's analysis leverages financial reports, market data, and industry research. We consult competitor strategies and supply chain insights too.