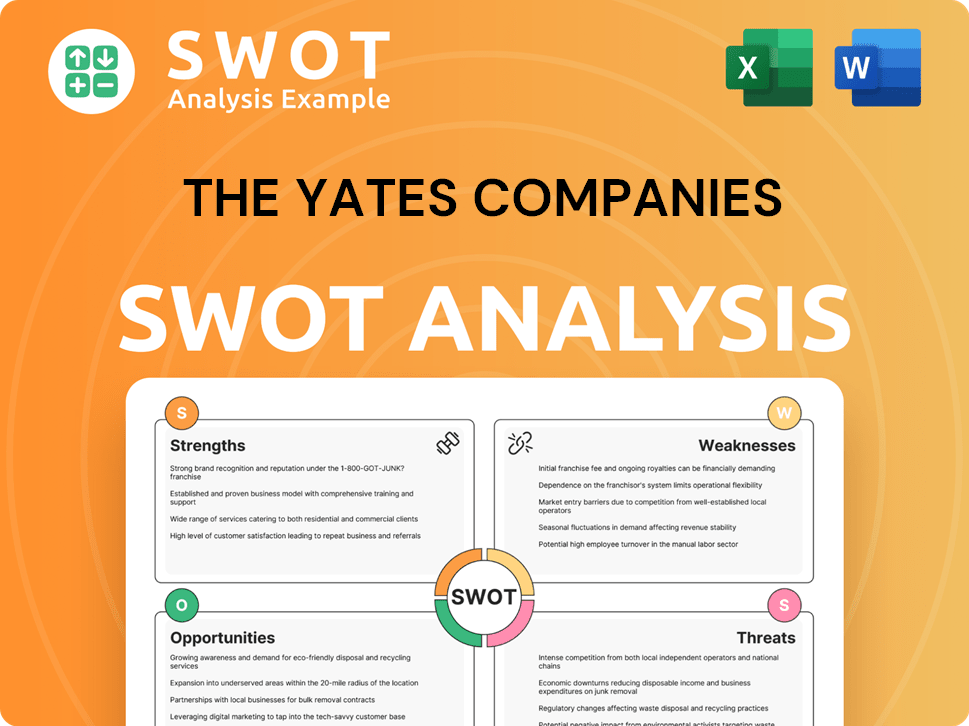

The Yates Companies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Yates Companies Bundle

What is included in the product

Analyzes The Yates Companies’s competitive position through key internal and external factors.

Streamlines communication with visual, clean SWOT formatting.

Preview Before You Purchase

The Yates Companies SWOT Analysis

You are seeing the real SWOT analysis document for The Yates Companies right now. This preview showcases the complete content and quality. Upon purchase, you’ll instantly gain access to the full report. Everything you see here is included.

SWOT Analysis Template

The Yates Companies faces unique challenges and opportunities. This overview reveals its core strengths, such as its established market presence. It also highlights vulnerabilities like evolving industry trends and potential risks. You'll also discover growth prospects and competitive threats. Want deeper insights and actionable intelligence? Purchase the full SWOT analysis to gain access to a detailed, research-backed report in Word and Excel.

Strengths

The Yates Companies, established in 1964, boasts a rich history, showcasing stability and vast experience in construction. This longevity signifies a deep market understanding and proven processes. Their portfolio includes diverse projects like casinos and courthouses, demonstrating versatility. With over 60 years in business, they've likely navigated numerous economic cycles. This history provides a strong foundation for future projects.

The Yates Companies boasts a diverse project portfolio spanning commercial, industrial, and institutional sectors. This diversification strategy includes civil, federal, healthcare, and retail projects. In 2024, this approach helped Yates navigate fluctuating market demands. Diversification across construction types like education and entertainment projects minimized risk exposure.

Yates Construction benefits from a strong reputation, consistently ranking among the top construction firms. In 2024, Engineering News-Record placed them at #29 on the Top 400 Contractors list. They also excel in specialized sectors. This high standing enhances their ability to secure projects and attract talent.

Emphasis on Safety and Quality

The Yates Companies' focus on safety and quality is a significant strength in the construction sector. This commitment is vital for project success and client trust. High-quality work and a strong safety record often lead to repeat business, boosting revenue. Such dedication also enhances the company's reputation, making it a preferred choice.

- In 2024, construction industry safety incidents cost firms $17.5 billion.

- Companies with top safety programs see a 20% reduction in insurance costs.

- Client satisfaction scores directly correlate to project profitability.

Geographic Presence

The Yates Companies benefits from a strong geographic presence, primarily focusing on the Southeastern and East Coast regions of the United States. This strategic concentration allows for deeper market penetration and localized expertise. They maintain offices across multiple states, facilitating better client and subcontractor relationships. This regional focus helps them manage projects effectively across a considerable part of the country.

- Operational efficiency is enhanced by regional hubs.

- Strong local ties aid in securing projects and resources.

- The company can adapt to regional market dynamics.

- This presence supports quicker response times.

The Yates Companies leverages its long history, enhancing market understanding and versatility, with over 60 years of operation. A diverse project portfolio across sectors and geographic locations contributes to its stability, crucial in a volatile market.

Yates maintains a strong industry reputation, backed by its high ranking among contractors and specialized sector expertise. This commitment boosts project success, client trust, and overall profitability. Their dedication to safety and quality, including its geographic presence in the U.S. strengthens operational efficiency.

| Strength | Impact | Data |

|---|---|---|

| Longevity & Experience | Market Understanding | Over 60 years, stable operations |

| Project Diversification | Risk Mitigation | 2024 construction spending $2 Trillion |

| Industry Reputation | Client Attraction | Top 400 Contractors List #29 |

| Safety Focus | Cost Reduction | Safety incidents cost firms $17.5B (2024) |

| Geographic Presence | Local Expertise | Southeastern and East Coast regions |

Weaknesses

The construction industry is highly susceptible to economic fluctuations, particularly interest rates and inflation. Rising interest rates can make borrowing more expensive, potentially slowing down projects. In 2024, the residential sector saw a decrease in building permits due to these challenges. Reduced demand from the commercial sector due to economic uncertainty can also negatively impact Yates Companies.

The Yates Companies faces labor shortages, a persistent issue in construction. In 2024, the industry had over 400,000 job openings. This limits project staffing and could delay completion. Increased labor costs are a likely consequence.

Material cost volatility remains a significant challenge, even with some price stabilization. Unpredictable material costs can squeeze project margins. This volatility complicates accurate forecasting and budgeting for Yates Companies. For instance, steel prices fluctuated significantly in 2024, impacting construction costs.

Dependence on Project Pipeline

The Yates Companies' profitability hinges on a consistent flow of new projects, making it vulnerable to pipeline fluctuations. A lean project pipeline, especially in specialized construction areas, could lead to revenue drops. The construction industry saw a slight decrease in new projects in early 2024, with a 2% drop in non-residential construction starts. Limited project diversity may concentrate risk. This dependence increases the need for robust business development strategies.

- Market volatility can impact project starts.

- Economic downturns may delay or cancel projects.

- Competition could reduce the number of secured contracts.

Competition

The Yates Companies faces intense competition in the construction market. Numerous firms, both large and small, compete for projects across various sectors and regions. This competition can drive down profit margins and make securing new projects challenging. For instance, the construction industry's profit margins have been fluctuating, with an average of 5-7% in 2024.

- Increased competition can lead to bid price pressure.

- Smaller firms may offer lower prices.

- Large firms have more resources.

- Competition affects market share.

Yates Companies struggles with economic and labor pressures. These issues include volatile material costs, exemplified by 2024's steel price swings, and labor shortages. Also, project pipeline variability causes financial risks.

| Weakness | Impact | Data Point (2024) |

|---|---|---|

| Economic Volatility | Delays/Cancellations | 2% drop in non-residential construction starts |

| Labor Shortages | Delayed projects | 400,000+ industry job openings |

| Material Costs | Margin Squeezing | Steel price fluctuations |

| Pipeline Dependency | Revenue drops | New project decline in early 2024 |

| Competition | Lower Margins | 5-7% average profit margin |

Opportunities

The Yates Companies can capitalize on growth in key construction sectors. Manufacturing, warehousing, and data center projects are projected to increase. Infrastructure spending, spurred by the Infrastructure Investment and Jobs Act, presents further opportunities. The construction industry's total output is forecast to reach $2.06 trillion by the end of 2024.

Embracing tech like BIM and digital twins can boost Yates' efficiency. Adoption of robotics and automation could streamline operations. This could lead to better resource use and lower project costs. The global construction robotics market is projected to reach $2.3 billion by 2025.

Government investments in infrastructure are set to boost construction. Yates Companies can bid for public sector contracts. In 2024, U.S. infrastructure spending reached $400 billion. This creates opportunities for growth and project involvement.

Focus on Sustainability and Green Building

The Yates Companies can capitalize on the growing demand for sustainable construction. This involves adopting green building standards and practices. This approach can attract clients and set them apart. The global green building materials market is projected to reach $488.8 billion by 2027, up from $303.4 billion in 2020.

- Increased client base due to eco-conscious demands.

- Differentiation from competitors by offering green solutions.

- Potential for higher profit margins due to specialized services.

- Access to government incentives and tax benefits.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures offer Yates Construction avenues for expansion. These collaborations facilitate entry into new markets and project types, broadening their scope. For instance, the Norfolk Casino Resort project exemplifies successful joint venture execution. In 2024, the construction industry saw a 7% rise in joint venture projects.

- Increased market access.

- Shared resources and risks.

- Enhanced project capabilities.

- Access to specialized expertise.

The Yates Companies has strong growth opportunities within expanding construction sectors, like manufacturing, warehousing, and data centers. Infrastructure investments, bolstered by the Infrastructure Investment and Jobs Act, enhance potential project involvement. Also, strategic partnerships and eco-friendly initiatives open up new market access, fostering profit margins.

| Opportunity Area | Specific Advantage | Supporting Data (2024/2025) |

|---|---|---|

| Market Growth | Capitalize on rising sectors | Construction output: $2.06T (2024) |

| Tech Adoption | Boost efficiency | Robotics market: $2.3B by 2025 |

| Govt. Spending | Secure public contracts | US infrastructure: $400B (2024) |

| Sustainability | Attract clients and benefits | Green market: $488.8B (by 2027) |

| Strategic Alliances | Market & project diversification | JV increase: 7% (2024) |

Threats

Economic downturns and recession risks pose significant threats. Reduced investment in new projects is a key concern. The construction industry often suffers during economic slowdowns. For instance, in 2024, construction spending growth slowed to 2.8% due to economic uncertainty. Financial pressures increase on clients and firms.

Rising interest rates pose a significant threat, increasing project financing costs. This can lead to project delays or cancellations, impacting revenue. In 2024, the Federal Reserve maintained a high federal funds rate, peaking at 5.5%. This increases borrowing costs for The Yates Companies. Even if rates moderate, the risk remains until 2025.

The construction sector faces rising insolvencies, impacting suppliers and contractors. High interest rates and inflation increase financial strains, potentially disrupting supply chains. This could lead to project delays and cost overruns for Yates Companies. The industry saw a 20% rise in insolvencies in early 2024.

Supply Chain Disruptions

Supply chain disruptions pose a significant threat to The Yates Companies. Global conflicts and economic uncertainties can disrupt the flow of essential construction materials, leading to shortages and inflated costs. These issues can cause project delays, impacting profitability and client satisfaction. Recent data from 2024 indicates that supply chain volatility has increased construction material prices by an average of 10-15%.

- Increased material costs (10-15% increase in 2024).

- Project delays and potential penalties.

- Reduced profit margins on fixed-price contracts.

- Difficulty in meeting project deadlines.

Changing Regulations and Building Safety Standards

Evolving building safety regulations and standards pose a threat to The Yates Companies. Compliance with these changing rules can lead to project delays and increased expenses. For example, the U.S. construction industry faces an estimated 5-10% cost increase due to updated codes. These changes require firms to adapt quickly.

- Increased costs for materials and labor.

- Potential for project delays.

- Need for constant updates to stay compliant.

Economic downturns, interest rates, and rising insolvencies threaten The Yates Companies. Supply chain disruptions and material costs (10-15% increase in 2024) will lead to delays. Evolving safety regulations require continuous updates, adding costs.

| Threat | Impact | Mitigation |

|---|---|---|

| Economic Downturn | Reduced investment, project delays | Diversify projects, manage cash flow |

| Rising Interest Rates | Increased financing costs | Hedging, renegotiate contracts |

| Supply Chain Disruptions | Material shortages, cost increases | Diversify suppliers, inventory management |

SWOT Analysis Data Sources

The SWOT analysis leverages financial statements, market analyses, and expert opinions. It is grounded in reliable, industry-specific data for strategic accuracy.