Wilbur-Ellis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wilbur-Ellis Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

One-page view quickly highlights portfolio strengths and weaknesses.

Full Transparency, Always

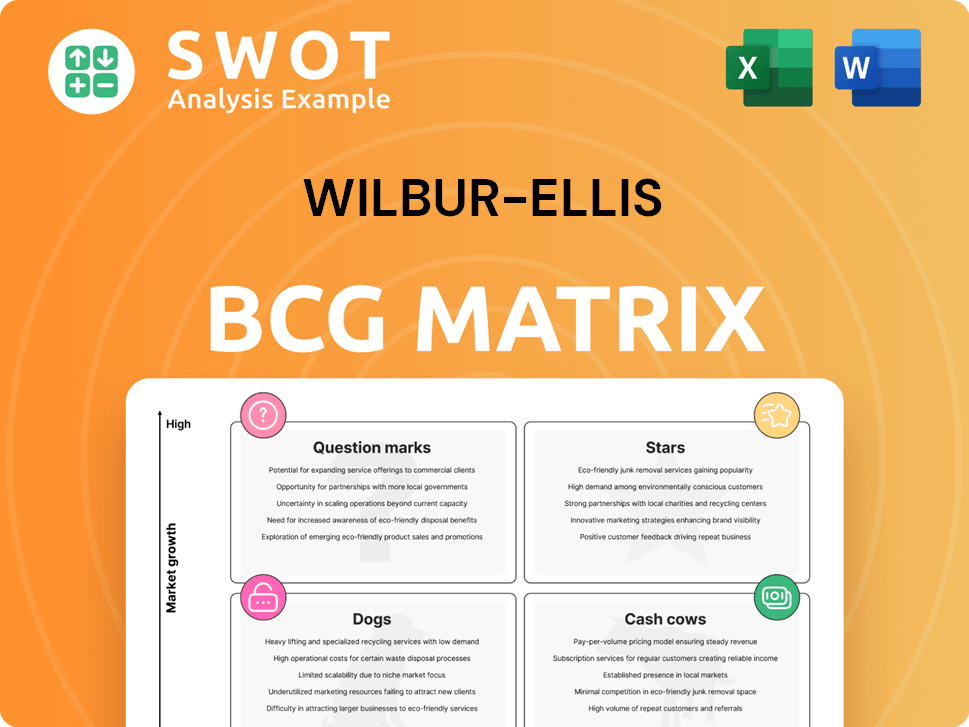

Wilbur-Ellis BCG Matrix

The Wilbur-Ellis BCG Matrix you're previewing is the complete document you'll receive after purchase. It's a ready-to-use strategic tool, fully formatted for your analysis. No hidden extras or watermarks, just the professional-grade report. It's designed for immediate strategic implementation and clear market insights. Get the full version for instant download and actionable intelligence.

BCG Matrix Template

Wilbur-Ellis's product portfolio can be tough to decipher. The BCG Matrix simplifies their market positioning: Stars, Cash Cows, Dogs, or Question Marks. This snapshot offers a glimpse into their strategic landscape. Understand which products drive growth and where resources are best allocated. Learn where they stand in a competitive market. Ready to make informed decisions? Purchase the full BCG Matrix for complete strategic insights.

Stars

Wilbur-Ellis's NUTRIO N-TUNE, a biological product launched in early 2025, is a star. It offers crops a consistent nitrogen supply, tackling deficiencies. The product features a resilient bacterium and boosts yields. Its potential for high growth and market share is significant. In 2024, the agricultural biologicals market was valued at $13.4 billion.

BenVireo TerraLux, launched in February 2025, is a Star. It offers organic growers a sustainable nitrogen source. The organic fertilizer market is projected to reach $15 billion by 2028. Its innovative features position it for strong growth.

FORTUS brand soybeans, launched in July 2024 with the Enlist E3 trait, are positioned as a "Star" in Wilbur-Ellis's BCG Matrix. The 2025 planting season will see an expansion of varieties across different maturity groups. Independent research supports their high yield potential, making them a strong market performer. In 2024, the soybean market saw significant growth, with prices fluctuating.

Sustainable Pet Food Ingredients

Wilbur-Ellis Nutrition's collaboration with Bond Pet Foods, initiated in April 2024, represents a "Star" in the BCG matrix, focusing on sustainable pet food ingredients through precision fermentation. This partnership addresses the rising demand for eco-friendly pet food options, capitalizing on a market trend. The global pet food market is substantial, with projections estimating it to reach $119.2 billion by 2024. This venture offers innovative protein and flavor solutions.

- April 2024: Wilbur-Ellis and Bond Pet Foods partnership announced.

- 2024: Global pet food market estimated at $119.2 billion.

- Focus: Sustainable, precision-fermented ingredients.

- Meeting the rising demand for eco-friendly pet food options.

Precision Agriculture Technologies

Wilbur-Ellis's precision agriculture technologies, such as soil probes and Agvance software, are prime examples of a star in the BCG matrix. These tools allow for optimized water and nutrient use, boosting yields and efficiency. The precision agriculture market is rapidly expanding; it was valued at $8.7 billion in 2023 and is projected to reach $15.7 billion by 2028.

- Enhanced Crop Yields

- Resource Optimization

- Market Growth: $15.7B by 2028

- Agvance Software

Stars in Wilbur-Ellis's portfolio show strong growth potential and market share. NUTRIO N-TUNE, launched in early 2025, targets nitrogen deficiencies. BenVireo TerraLux, launched in February 2025, focuses on sustainable nitrogen. FORTUS brand soybeans, launched in July 2024, also show promise.

| Product | Launch Date | Market Focus |

|---|---|---|

| NUTRIO N-TUNE | Early 2025 | Crop Nitrogen |

| BenVireo TerraLux | Feb 2025 | Organic Nitrogen |

| FORTUS Soybeans | July 2024 | High Yield |

Cash Cows

Wilbur-Ellis's crop protection products are a cash cow, generating 48% of their 2024 revenue. Their herbicides, insecticides, and fungicides are vital for farmers. Innovation and distribution are key to maintaining profitability in this segment.

Fertilizers are a major revenue source for Wilbur-Ellis, making up 36% of input revenue in 2024. The company offers diverse liquid and dry fertilizer products to meet varied agricultural needs. Effective distribution and infrastructure investments are essential for maximizing cash flow from this key segment.

Wilbur-Ellis's specialty chemicals distribution, like its Connell Brothers Division, is a cash cow. It serves multiple industries with its established global network. This division provides specialty chemicals and ingredients, ensuring a steady cash flow. In 2024, the specialty chemicals market is valued at approximately $600 billion. Expanding into high-growth markets is key.

Animal Nutrition Products

Wilbur-Ellis Nutrition, a cash cow, delivers top-tier nutrients for livestock, pets, and aquaculture. This segment thrives on industry innovation, meeting the rising demand for animal feed. Strategic alliances and product advancements solidify its cash cow status. In 2024, the global animal feed market was valued at approximately $500 billion, showing consistent growth.

- Focus on premium animal nutrition products.

- Leverage established distribution networks.

- Invest in research and development for innovative feed solutions.

- Maintain strong relationships with key suppliers.

Water Management Solutions

Wilbur-Ellis's water management solutions are a strong "Cash Cow" in its BCG Matrix. They provide expertise in optimized timing, data interpretation, and regulatory guidance, boosting yields. With water scarcity rising, efficient agricultural water use is vital. This creates a stable revenue stream for Wilbur-Ellis.

- Water scarcity is a $70 billion market opportunity.

- Wilbur-Ellis's revenue in 2024 was $3.5 billion.

- Water management solutions can increase crop yields by 15-20%.

- The agricultural water management market is projected to grow 8% annually.

Wilbur-Ellis’s cash cows are key revenue drivers. These include crop protection, fertilizers, specialty chemicals, nutrition, and water management. They ensure consistent cash flow and market stability. Strategic investments are critical.

| Segment | 2024 Revenue Contribution | Market Growth |

|---|---|---|

| Crop Protection | 48% | Steady |

| Fertilizers | 36% | Moderate |

| Specialty Chemicals | Significant | High |

| Nutrition | Consistent | Growing |

| Water Management | Increasing | High |

Dogs

For Wilbur-Ellis, commodity chemical distribution might be a 'dog' in the BCG matrix. These chemicals often struggle with tough price competition and slim profit margins. In 2024, the chemical distribution market saw margins as low as 2-3% for some commodity products. To boost returns, Wilbur-Ellis might scale back here.

Outdated application technologies at Wilbur-Ellis, like older sprayers, are "dogs" in the BCG matrix. These may be less efficient than modern methods. Transitioning to advanced tech is vital to stay competitive. Consider that in 2024, precision agriculture adoption increased by 15% year-over-year. This includes updated application methods.

Some low-margin forage products in Wilbur-Ellis's animal feed segment could be "dogs." These products likely have little growth and low profitability. In 2023, the animal feed industry saw a 3% profit margin. Wilbur-Ellis might need to focus on higher-margin products. The company's overall revenue in 2024 was $3.3 billion.

Regions with Declining Agricultural Activity

Regions facing declining agricultural activity, like parts of the U.S. Corn Belt, could be considered dogs in Wilbur-Ellis's BCG Matrix. These areas may struggle due to economic shifts or competition. Reevaluating Wilbur-Ellis's investments is crucial for strategic allocation. Consider data from 2024, showing a 5% decrease in agricultural land value in certain regions.

- Economic downturns in specific agricultural sectors.

- Shift in land use to non-agricultural purposes.

- Increased competition from other regions.

- Potential for reduced market share and profitability.

Products Facing Regulatory Challenges

Products under regulatory pressure, like certain crop protection chemicals or feed additives, can end up as "dogs" in the Wilbur-Ellis BCG matrix. These items face potential bans and growing scrutiny due to environmental or health concerns. For example, in 2024, the EPA continued to review and restrict specific pesticides, impacting agricultural product lifecycles. Addressing regulatory challenges and innovating with alternatives is vital.

- Regulatory changes directly affect product viability and profitability.

- Proactive measures are crucial for long-term market presence.

- Developing alternatives is key to mitigating risks.

- Failure to adapt leads to reduced market value.

Wilbur-Ellis's "dogs" include low-margin commodity chemicals due to price competition, which saw margins of 2-3% in 2024. Outdated technologies like older sprayers also fall into this category, emphasizing the need for modern methods. Some forage products and regions with declining agriculture, with a 5% decrease in land value in 2024, also fit as "dogs."

| Category | Issue | 2024 Data |

|---|---|---|

| Chemicals | Low Margins | 2-3% margin |

| Technology | Outdated Sprayers | Need for modern tech |

| Forage | Low Growth | 3% feed industry margin |

| Regions | Declining Ag | 5% land value drop |

Question Marks

Wilbur-Ellis's NUTRIO N-TUNE launch signifies a step into biologicals and biostimulants, a question mark in their BCG matrix. These products show promise but demand substantial R&D, which in 2024, could be expensive. Market adoption is key to success, potentially transforming these into stars. Consider the $27 billion biostimulants market by 2027.

Wilbur-Ellis's venture with Bond Pet Foods in precision fermentation is a question mark. This area, with its potential for sustainable pet food ingredients, is still nascent. Market validation and adoption are critical, particularly as the global pet food market was valued at $116.9 billion in 2023. Strategic investment and partnerships are key to gaining ground.

Sustainable agriculture tech is a question mark for Wilbur-Ellis. Investing in carbon sequestration or low-emission fertilizers is key. These technologies address environmental issues. However, they need significant investment. For example, the market for sustainable agriculture is expected to reach $22.4 billion by 2024.

Digital Agriculture Platforms

Digital agriculture platforms are a question mark for Wilbur-Ellis. These platforms need more investment and user adoption. Success hinges on improving capabilities and showing customer value. The global smart agriculture market was valued at $15.3 billion in 2023. It's projected to reach $28.4 billion by 2028.

- Investment in platform development is crucial.

- User adoption rates must increase to justify costs.

- Platform capabilities need to be continuously enhanced.

- Demonstrating clear value to growers is essential.

Specialty Products for Emerging Crops

Developing specialty products for emerging crops or niche markets fits the question mark quadrant of the BCG matrix. These ventures offer high growth potential but also carry considerable risk and uncertainty. Successful navigation requires meticulous market analysis and focused product development strategies.

This approach can lead to significant returns if the market takes off. Conversely, failure is a real possibility if the market doesn't materialize as anticipated. Careful consideration of market dynamics is crucial for these products.

- Market analysis is key to understanding the viability of emerging crops.

- Focused product development can help to meet specific market needs.

- Risk mitigation is essential given the inherent uncertainties.

- Success hinges on a deep understanding of consumer demand.

Wilbur-Ellis's question marks in the BCG matrix indicate high-growth, high-risk ventures. These include new products and technologies in markets like biostimulants, which could hit $27B by 2027. Success requires strategic investments, adaptation, and a keen understanding of market needs. Careful risk management is vital for these investments.

| Initiative | Market Potential | Risk Level |

|---|---|---|

| NUTRIO N-TUNE | Biostimulants: $27B by 2027 | High due to R&D costs |

| Bond Pet Foods | Pet Food: $116.9B (2023) | Medium due to adoption |

| Sustainable Ag Tech | Sustainable Ag: $22.4B (2024) | Medium, needs investment |

BCG Matrix Data Sources

The Wilbur-Ellis BCG Matrix is built using company financial data, agricultural market analyses, and expert interviews for a well-rounded perspective.