Woolworths Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Woolworths Bundle

What is included in the product

Tailored analysis for Woolworths' portfolio, examining Stars, Cash Cows, Question Marks, and Dogs.

Easily switch color palettes for brand alignment, ensuring consistent Woolworths branding.

What You’re Viewing Is Included

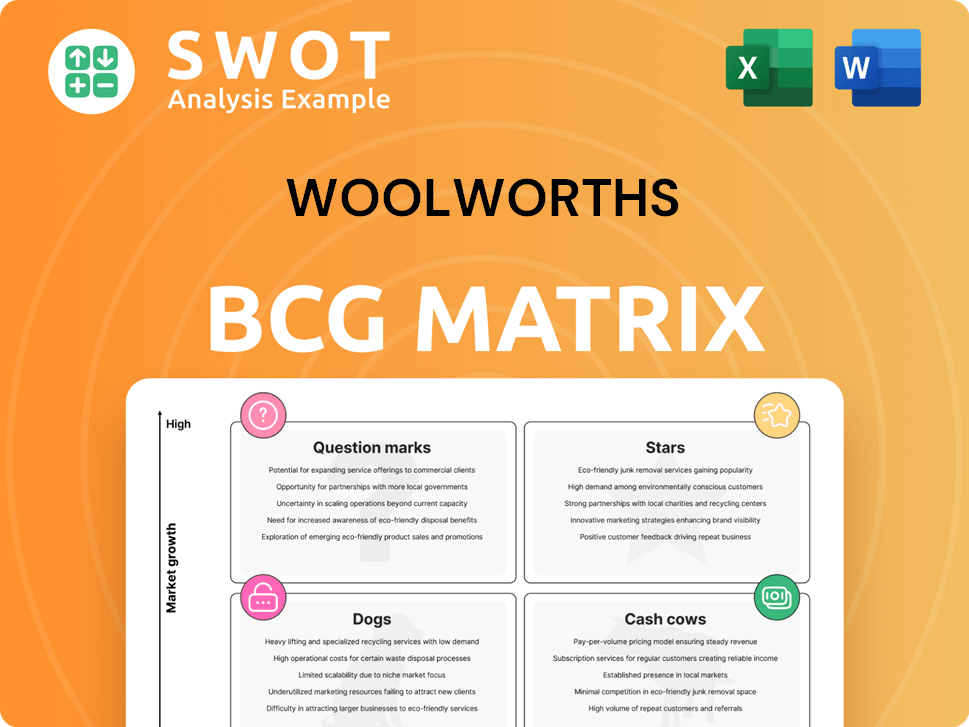

Woolworths BCG Matrix

The BCG Matrix preview mirrors the complete report you receive after purchase. This comprehensive document, ready for immediate use, includes a thorough analysis of Woolworths' portfolio. You'll have the full, unedited version to tailor it. It's optimized for clear strategic insights.

BCG Matrix Template

Woolworths navigates a competitive retail landscape with diverse product offerings. Its BCG Matrix categorizes these into Stars, Cash Cows, Dogs, and Question Marks. This provides insights into market share and growth potential. Understanding these classifications is crucial for strategic decisions. The Matrix highlights resource allocation opportunities and risks. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Woolworths is a Star in the BCG matrix with a dominant 37% of Australia's grocery market share. This strong position allows for economies of scale and enhanced brand recognition. Woolworths' revenue in 2024 was approximately $64.1 billion. Ongoing investments in efficiency and technology support its leading status.

Woolworths' e-commerce in Australian Food is growing strongly. This shows they're adapting well to online shopping trends. In 2024, online sales grew significantly, boosting overall earnings. E-commerce is crucial for Australian Food's growth. Woolworths' online food sales increased by 20% in the last year.

WooliesX, including e-commerce, Cartology, and digital services, is a star. It significantly boosts Australian Food's EBIT. DAP EBIT margins are rising, showing better efficiency. Scaling wiq and Cartology will boost sales and EBIT. In 2024, Cartology's revenue increased by 30%.

Everyday Rewards Program

Woolworths' Everyday Rewards program is a star in its BCG matrix, demonstrating strong growth and market share. The program fosters customer loyalty and provides crucial data insights, essential for strategic decision-making. In 2024, Everyday Rewards saw increased app engagement and scan rates, indicating its effectiveness. Strategic partnerships, like Everyday Extra, further enhance its value.

- Large and engaged membership base.

- Increased member engagement and scan rates.

- Expansion and partnerships like Everyday Extra.

- Data-driven insights for strategic decisions.

PFD Food Services

PFD Food Services, a key player in Woolworths' portfolio, shines as a "Star" within the BCG Matrix, driving significant revenue. The B2B segment, where PFD operates, demonstrates strong sales growth, fueled by a diverse and expanding customer base. Woolworths' strategic move to fully acquire PFD, slated for late 2024, underscores its commitment to bolstering its B2B food sector presence. Utilizing cross-dock warehouses in Primary Connect enhances efficiency, contributing to EBIT growth.

- PFD Food Services is a "Star" in Woolworths' BCG Matrix.

- The B2B segment shows robust sales growth.

- Full acquisition of PFD is expected in late 2024.

- Improved warehouse use boosts EBIT.

Woolworths, with entities like e-commerce and PFD, shines as a "Star" in its BCG Matrix. These segments demonstrate robust growth and market share leadership. Strategic initiatives drive revenue and boost EBIT margins, showing strong performance in 2024. Woolworths' focus on digital and B2B markets enhances its competitive edge.

| Segment | Growth Rate (2024) | Key Feature |

|---|---|---|

| Australian Food E-commerce | 20% | Adaptation to online shopping trends |

| Cartology Revenue | 30% | Digital advertising and sales |

| PFD Food Services | Strong Sales | B2B market expansion |

Cash Cows

Woolworths' Australian supermarkets are cash cows, consistently generating substantial cash flow. In 2024, Woolworths reported a strong performance in its Australian Food segment. While store sales have faced challenges, e-commerce sales have remained robust. The focus on value and successful promotions continues to drive sales growth.

Woolworths' Own and Exclusive brands are cash cows, driving sales and margins. In 2024, these brands accounted for over 20% of total sales. They provide value and foster customer loyalty. Continuous innovation in this area supports ongoing growth.

Primary Connect, a cash cow for Woolworths, is boosted by the Moorebank DC hub, improving supply chain efficiency. This strategic move reduces costs, boosting profitability. Efficient networks are key for retail success; Woolworths' focus on this helps maintain its competitive edge. In 2024, Woolworths reported strong supply chain performance.

Sustainability Initiatives

Woolworths' sustainability efforts, such as emissions reduction and renewable energy use, boost its image and attract eco-minded shoppers. These actions can also cut costs through better energy and waste management. The company's green bonds signal its dedication to funding sustainable projects. In 2024, Woolworths increased its renewable energy sourcing by 15%.

- Focus on reducing carbon emissions.

- Invest in renewable energy.

- Issue green bonds.

- Improve waste management.

Woolworths Financial Services

Woolworths Financial Services (WFS), including Woolworths Insurance, is a cash cow, providing steady revenue and profit. The WFS book showed growth, and the impairment rate improved, showing efficient risk management. Focus on customer service and product innovation will sustain performance. In 2024, WFS contributed significantly to Woolworths' overall financial health.

- Steady Revenue: WFS consistently generates reliable income.

- Improved Impairment Rate: Indicates strong risk management practices.

- Focus on Innovation: Supports sustained performance.

- 2024 Contribution: WFS played a key role in Woolworths' financials.

Woolworths leverages several cash cows. Australian supermarkets generate substantial cash flow. Own and Exclusive brands drive sales and margins, with over 20% of 2024 sales. Primary Connect boosts efficiency, while WFS provides steady revenue.

| Cash Cow | Contribution | 2024 Data |

|---|---|---|

| Australian Supermarkets | Strong Cash Flow | E-commerce sales robust |

| Own & Exclusive Brands | Sales & Margins | Over 20% of sales |

| Primary Connect | Supply Chain Efficiency | Strong supply chain performance |

| WFS | Steady Revenue/Profit | Significant financial contribution |

Dogs

BIG W, a "Dog" in Woolworths' BCG matrix, struggles with declining sales. Cost-of-living pressures push customers to cheaper options. In FY23, BIG W's sales decreased, reflecting these challenges. Restructuring and efficiency improvements are crucial for recovery.

Woolworths New Zealand faces a tough market, with slow sales growth and a drop in EBIT. In 2024, EBIT decreased by 10%. Initiatives like store rebranding are in progress. Customer scores need improvement to boost growth. The company is working on transformation to combat rising costs.

The Home category at Woolworths, classified as a Dog in the BCG matrix, has struggled due to reduced consumer spending. Reflecting a shift towards essential items, sales in the Home category are under pressure. Inventory management and strategic promotions are vital. In 2024, this category faced challenges with sales figures.

Underperforming Fashion Segments

The Fashion, Beauty, and Home segment at Woolworths has seen subdued growth, while the Country Road Group faced sales declines. These issues stem from supply chain disruptions and ongoing transformation efforts. Addressing operational leverage and restructuring are critical for improvement, impacting profitability. In 2024, the Country Road Group's sales decreased by 3.4%, highlighting the urgency to refine strategies.

- Sales Decline: Country Road Group experienced a 3.4% sales decrease.

- Transformation Efforts: Ongoing changes within the business.

- Operational Leverage: Focus on improving cost management.

- Restructuring: Key priority to improve performance.

Exited B2B Businesses

Woolworths' exited B2B businesses have affected sales growth. While these exits improved EBIT, overall sales were impacted by cycling sales. The focus is now on core B2B operations and strategic partnerships. This strategic shift is vital for future growth, and Woolworths is adapting.

- Sales growth in the Australian B2B segment was impacted by the exit of B2B businesses.

- Exiting loss-making businesses improved EBIT.

- Focus is on core B2B operations and strategic partnerships.

- This is crucial for driving future growth.

BIG W, a Dog, battles declining sales due to cost pressures. In FY23, sales fell, reflecting customer shifts. Restructuring is key for recovery.

| Metric | FY23 Performance | Impact |

|---|---|---|

| BIG W Sales | Decreased | Reflects tough market |

| Country Road Group | Sales decreased 3.4% | Highlights transformation |

| B2B Sales | Impacted by exits | Focus shifts to core |

Question Marks

Woolworths' accelerator businesses, like MilkRun, saw quick revenue gains. However, long-term profitability is still unclear for these ventures. Scaling them up requires substantial investment in a competitive market. Therefore, potential and strategic alignment necessitate a thorough evaluation for future investment decisions. In 2024, the fast-delivery market faced challenges.

Woolworths MarketPlus, encompassing BIG W Market, MyDeal, and Everyday Market, is a "Question Mark" in the BCG Matrix. This segment faces high growth potential but intense competition. Woolworths needs to integrate these platforms to find synergies. The company must invest in marketing to increase market share. In 2024, Woolworths' e-commerce sales grew, indicating the potential of MarketPlus.

Healthylife, as part of Woolworths, is a question mark in the BCG matrix. It taps into the expanding health and wellness market, offering potential for growth. Success hinges on significant investment to stand out. In 2024, the wellness market grew to $7 trillion globally, showing promise.

Advanced Analytics Initiatives

Woolworths' focus on advanced analytics is a question mark, requiring careful evaluation. Investments in this area aim to boost decision-making and efficiency, yet the ROI is not guaranteed. The company must weigh the costs against potential benefits to ensure value creation. Data-driven personalization of offers is key for growth.

- Woolworths spent $200 million on digital and analytics capabilities in FY24.

- Customer loyalty program data analysis increased sales by 5% in 2024.

- Predictive analytics reduced supply chain costs by 3% in 2024.

- The success of these initiatives is still under review, with further details expected in the 2025 report.

Expansion into New Geographies/Formats

Venturing into new geographical areas or retail formats presents Woolworths with both opportunities and risks. Success hinges on comprehensive market research and strategic planning to understand local consumer preferences and competitive landscapes. In 2024, Woolworths' international expansion could focus on Southeast Asia, where the retail market is growing. Adaptation to local market conditions is vital, as seen in Woolworths' success in Australia, where it holds a substantial market share.

- Market research is crucial.

- Adapt to local conditions.

- Consider Southeast Asia.

- Leverage existing strengths.

Woolworths' expansion strategies, like venturing into new geographies, are classified as "Question Marks." These ventures face high growth potential but also come with high risks, such as the need for substantial investment. In 2024, market research and adaptation to local conditions were crucial for success. Woolworths' international expansion could focus on Southeast Asia.

| Aspect | Details |

|---|---|

| Focus | International expansion and new retail formats. |

| Challenges | High risks, intense competition, and substantial investment needed. |

| Strategic Considerations | Market research, adaptation to local conditions, and leverage existing strengths. |

BCG Matrix Data Sources

The Woolworths BCG Matrix leverages annual reports, sales data, and market share analyses to evaluate business units.