Wuxi Apptec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wuxi Apptec Bundle

What is included in the product

Tailored analysis for Wuxi AppTec's product portfolio.

Printable summary optimized for A4 and mobile PDFs for effortless sharing.

What You See Is What You Get

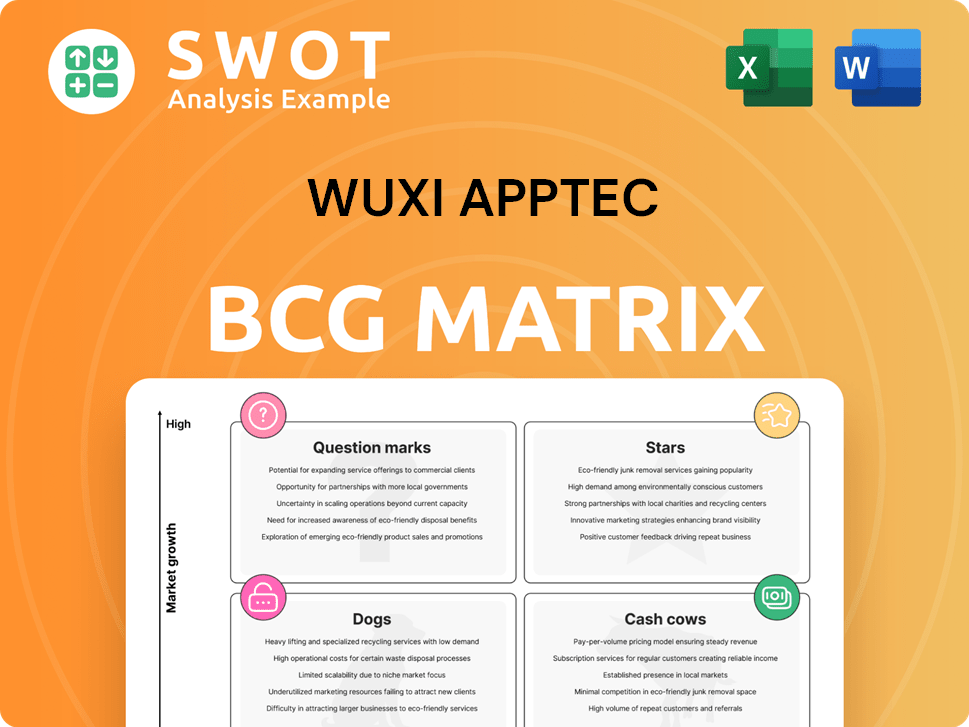

Wuxi Apptec BCG Matrix

The preview displays the complete Wuxi AppTec BCG Matrix report you receive upon purchase. It's the final, ready-to-use document, fully formatted and suitable for your strategic decisions. Download the exact same, watermark-free version after buying.

BCG Matrix Template

Explore the preliminary view of Wuxi Apptec’s product portfolio through our simplified BCG Matrix. We've identified potential Stars, promising Question Marks, and areas of focus. This glimpse into their strategic positioning highlights key growth opportunities. But, this overview is just the beginning.

Unlock the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

The TIDES business within Wuxi AppTec is a Star, excelling in both growth and market share. In 2024, it saw impressive revenue growth of 70.1% year-over-year, totaling RMB5.80 billion. This segment also boasts a substantial backlog increase of 103.9%, signaling strong future demand. Wuxi AppTec plans to expand reactor volume to over 100,000L by the close of 2025, strengthening its position in the market.

Wuxi AppTec's small molecule D&M services are a "Star" performer. In 2024, revenue hit RMB17.19 billion, a solid 11.2% increase year-over-year. This growth reflects strong demand and operational success. The pipeline expanded, adding 1,187 molecules, totaling 3,377.

WuXi AppTec's CRDMO platform is a "Star" in its BCG Matrix, fueling growth. This integrated platform provides top-tier services globally. A record backlog of RMB49.3B, up 47.0% YoY, highlights its success. The platform benefits patients globally with its efficiency.

Drug Discovery Services ('R')

Drug Discovery Services remain a Star for WuXi AppTec, despite some market slowdowns. This segment continues to drive downstream opportunities and new customer acquisition. In 2024, the company synthesized over 460,000 new compounds, achieving 10% year-over-year growth. This performance solidifies its crucial role.

- Strong revenue contribution

- Significant customer base expansion

- High growth potential in the market

- Successful compound synthesis output

New Modality Business

WuXi AppTec's new modality business, encompassing nucleic acids, conjugates, and mRNA, is experiencing rapid growth, positioning it firmly as a Star within its BCG matrix. The company actively supports its customers in obtaining global licensing, fostering international collaborations. This support is evident in its contribution to approximately 40% of China's biotech companies that have secured out-licensing deals in the last three years. This strategic approach fuels market share expansion and reinforces its leading position.

- Focus on new modalities: Nucleic acids, conjugates, and mRNA.

- Rapid market share expansion.

- Committed to customer global licensing.

- Supported approximately 40% of China biotech out-licensing deals in the last three years.

Multiple segments of WuXi AppTec are categorized as Stars, indicating high market share and growth.

These include the TIDES business, small molecule D&M services, CRDMO platform, Drug Discovery Services, and the new modality business.

They show revenue growth, backlog increases, and significant contributions to the biotech sector.

| Segment | 2024 Revenue | YoY Growth |

|---|---|---|

| TIDES | RMB5.80B | 70.1% |

| Small Molecule D&M | RMB17.19B | 11.2% |

| CRDMO | RMB49.3B Backlog | 47.0% YoY Backlog |

| Drug Discovery | Over 460,000 compounds | 10% |

Cash Cows

WuXi AppTec's pharmaceutical manufacturing, focusing on biologics and small molecules, is a Cash Cow. This mature market segment generates significant revenue, reflecting its strong market share. In 2024, this segment contributed substantially to the company's overall financial performance. The cash generated supports other ventures and shareholder returns.

Drug safety evaluation services are a Cash Cow for Wuxi Apptec, particularly in the Asia-Pacific region. These services ensure regulatory compliance and generate consistent revenue streams. In 2024, facilities in Qidong and Chengdu received GLP qualifications from NMPA and OECD. This strengthens their market position and supports steady financial returns.

The Site Management Organization (SMO) in China, a key part of Wuxi AppTec's portfolio, remains a solid Cash Cow. SMO revenue saw a 15.4% year-over-year increase in 2024, solidifying its industry leadership. In 2024, SMO facilitated 73 new drug approvals for its clients. This reflects its strong and established market presence.

Chemistry Manufacturing

WuXi Chemistry's manufacturing operations are a key source of revenue, classifying it as a Cash Cow within the BCG Matrix. The company has seen continuous improvement in operational efficiency, which has increased its gross profit margin. The Taixing API manufacturing site became operational in 2024, expanding its production capacity. This strategic expansion is a testament to WuXi AppTec's commitment to growth.

- WuXi Chemistry's revenue contribution is substantial.

- Improved efficiency boosted gross profit margins.

- Taixing API site commenced operations in 2024.

- This expansion enhances manufacturing capabilities.

Global Pharmaceutical Partnerships

WuXi AppTec's collaborations with the world's top 20 pharmaceutical firms are a financial cornerstone, clearly marking these partnerships as a Cash Cow. The revenue from these key clients hit RMB16.64 billion in 2024, showing a strong 24.1% year-over-year growth, excluding specific COVID-19 related projects. This robust income stream provides a reliable and consistent financial foundation for the company. These partnerships are crucial for WuXi AppTec's financial health.

- Revenue from top 20 pharmaceutical companies: RMB16.64 billion (2024)

- Year-over-year growth (excluding COVID-19): 24.1%

- Stable income stream

WuXi Chemistry's revenue is a cornerstone, cementing its status as a Cash Cow. Operational efficiency gains elevated gross profit margins significantly. The Taixing API site, operational since 2024, boosts production.

| Metric | Details | Year |

|---|---|---|

| Revenue Impact | Substantial | 2024 |

| Gross Profit Margin | Improved due to efficiency | 2024 |

| Taixing API Site | Operational, expanding capacity | 2024 |

Dogs

Legacy services at Wuxi AppTec, especially in older drug development processes, are in a declining phase. Revenues from these services decreased, signaling a move towards advanced R&D. For instance, in 2024, a 15% drop was observed. These might need to be sold to prevent financial strain.

Wuxi AppTec's lab testing services, classified as a Dog in the BCG matrix, saw an 8.0% revenue decline year-over-year in 2024. This downturn is primarily due to market pricing adjustments affecting revenue and backlog conversion. The segment's performance needs strategic attention to improve or mitigate its negative effects. The company's 2024 financial results reflect this challenge, underscoring the need for a turnaround strategy.

Following the medical device unit's divestiture, it's categorized as a Dog in WuXi AppTec's BCG Matrix. In 2024, this segment generated RMB1.32 billion in revenue, marking a 20% year-over-year decline. The strategic shift indicates a focus on higher-growth sectors.

Biologics Business

WuXi AppTec's biologics business is classified as a Dog in its BCG matrix. In 2024, this segment saw a minor revenue decrease of 0.3% compared to 2023. Although still substantial, its growth lags behind other areas, signaling a need for strategic review. This suggests potential challenges and the need for a turnaround plan.

- 2024 Biologics Revenue: Slightly decreased by 0.3%

- Strategic Implications: Requires attention and potential adjustments.

- Comparison: Underperforms relative to other business segments.

- BCG Matrix: Dogs require evaluation and strategic decisions.

Other Regions Revenue

Wuxi AppTec's "Other Regions Revenue" is categorized as a Dog in the BCG Matrix. This segment saw a 17.4% decrease in revenue from regions outside the U.S., Europe, and China. This suggests a challenging market position. The decline indicates potential issues with the company’s strategy in these areas.

- Revenue decrease in "Other Regions" by 17.4%.

- Market position challenges.

- Strategic reassessment needed.

Several Wuxi AppTec segments, labeled as Dogs in the BCG matrix, faced revenue declines in 2024.

These segments include lab testing services, medical devices, and biologics businesses. The declines ranged from 0.3% to 20%, necessitating strategic evaluations. This classification points towards potential divestiture or restructuring.

| Segment | 2024 Revenue Change | Strategic Implication |

|---|---|---|

| Lab Testing | -8.0% | Needs improvement |

| Medical Devices | -20% | Focus on growth |

| Biologics | -0.3% | Strategic review |

Question Marks

Investments in personalized medicine and genomics represent a strategic move for Wuxi Apptec. These areas, with high growth potential but low current market share, demand substantial investment to expand. The global market, valued at around $148 billion in 2021, is predicted to hit $485 billion by 2028, with an 18.6% CAGR. This positions them as potential Stars.

Cell and gene therapy services are positioned in the Question Marks quadrant, indicating high growth potential with significant investment needs. This area is experiencing rapid market evolution, demanding strategic capital allocation to foster growth. Wuxi AppTec is preparing for BLA filing to manufacture the LVV used in a commercial CAR-T product. The global cell and gene therapy market is projected to reach $30-40 billion by 2028.

New vaccine capabilities represent a question mark for Wuxi AppTec, indicating high growth potential with low current market share. The company is investing in nucleic acids, conjugates, and mRNA technologies to enhance these capabilities. Wuxi AppTec's revenue grew by 14.5% in 2024, reflecting its efforts to expand market share. Further investment and strategic expansion are crucial for success.

R&D and Manufacturing Site in Singapore

Wuxi AppTec's Singapore R&D and manufacturing site, a Question Mark in its BCG Matrix, is slated to start operations in early 2027. This project requires substantial upfront investment and strategic planning for successful market entry. The site's performance hinges on efficient execution and strong market acceptance. A significant portion of the company's future capital expenditure is likely allocated for this venture.

- Investment: The initial investment is expected to be substantial, potentially impacting short-term profitability.

- Market Entry: Success is tied to effective market penetration strategies and securing contracts.

- Operational Efficiency: Efficient management of resources and operations will be critical for success.

- Timeline: Phase I commencement by 2027 is a key milestone to watch.

Middletown U.S. Site

The Middletown U.S. site, classified as a Question Mark in Wuxi AppTec's BCG Matrix, is slated to begin operations by the end of 2026. Its future hinges on successful execution and market acceptance within the competitive U.S. landscape. Strategic investments and collaborations are vital for its growth and profitability. Wuxi AppTec's ability to navigate challenges and capitalize on opportunities will determine its transition to a Star or its decline.

- Expected operational start: End of 2026.

- Key success factors: Execution, market adoption, and strategic partnerships.

- BCG Matrix designation: Question Mark.

- Strategic importance: Growth potential in the U.S. market.

Question Marks in Wuxi AppTec's BCG matrix represent high-growth potential but require significant investment. These ventures, including cell and gene therapy services and new vaccine capabilities, are crucial for future growth. Success depends on strategic capital allocation, effective market entry, and operational efficiency.

| Category | Description | Financials |

|---|---|---|

| Investment | Significant upfront costs and ongoing investments. | Capex: $2.2B in 2024 |

| Market Entry | Strategies crucial for securing contracts & market share. | Revenue growth of 14.5% in 2024 |

| Operational Efficiency | Efficient operations vital for profitability. | Projected Cell and Gene Therapy market $30-40B by 2028 |

BCG Matrix Data Sources

The Wuxi AppTec BCG Matrix utilizes financial statements, market analysis, industry reports, and expert evaluations to build insightful strategy.