Xero PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xero Bundle

What is included in the product

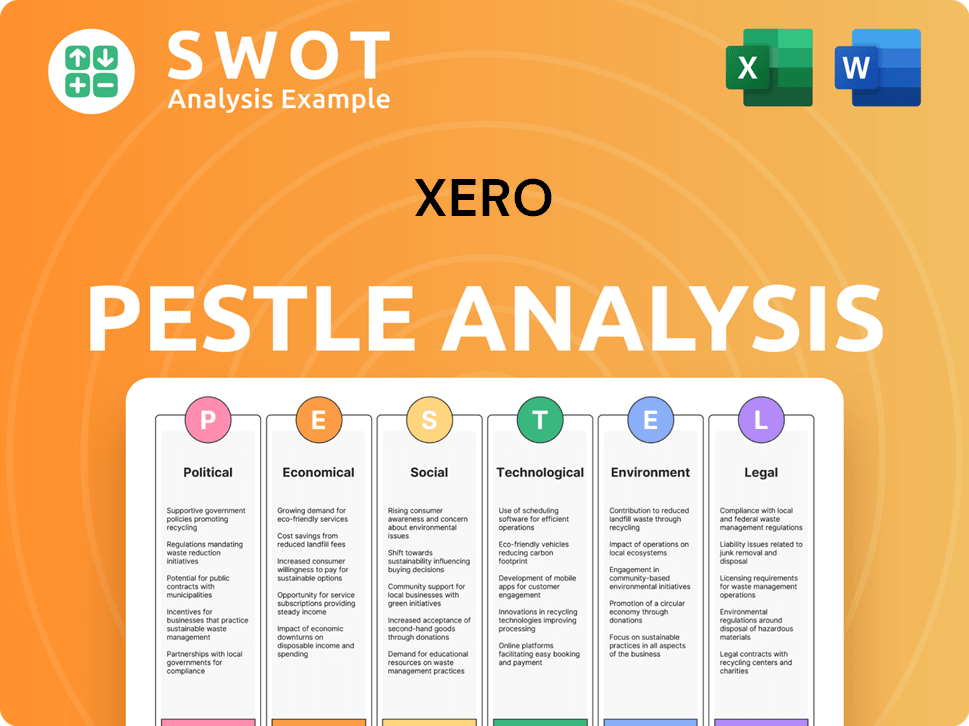

The Xero PESTLE Analysis examines macro factors across six dimensions: Political, Economic, Social, Technological, Environmental, and Legal.

Helps to identify external forces impacting Xero's business, promoting better strategic decision-making.

Preview the Actual Deliverable

Xero PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment.

This Xero PESTLE analysis explores the key factors.

It's designed to provide insights for strategic decision-making.

Every element presented here is included in your purchase.

Get immediate access!

PESTLE Analysis Template

Understand Xero’s future with our PESTLE Analysis, covering political, economic, and more.

Explore how external forces impact its performance and strategic moves.

This analysis offers crucial insights for informed decisions.

Perfect for investors, business analysts, and strategists.

Enhance your market understanding, identify opportunities, and prepare for challenges.

Download the complete PESTLE Analysis now for expert-level clarity!

Political factors

Government policies at national and international levels significantly affect Xero's small business clients. Tax changes, grants, and SME initiatives influence software investments. Political stability and trade policies in Xero's operational regions also matter. For example, in 2024, the UK government increased corporation tax, impacting small business finances.

Xero faces political risks through evolving regulations in accounting and finance. Updates to accounting standards and reporting requirements, such as those from the IASB, impact Xero’s software features. Governments mandating digital reporting, like the UK's Making Tax Digital, require Xero's adaptation. By 2024, 80% of UK businesses were expected to be MTD compliant, necessitating continuous platform updates. Data privacy regulations, including GDPR, further influence Xero's compliance needs and operational strategies.

Government drives digital adoption among businesses, creating a fertile ground for Xero. Initiatives promoting cloud tech and digital literacy boost the market for cloud accounting software. In 2024, numerous countries launched programs to support SME digitalization. Xero can leverage these programs for partnerships or marketing. This creates opportunities for Xero's expansion.

Political stability and trade relations

Political stability is crucial; instability or trade shifts can create uncertainty for small businesses using tools like Xero. For instance, in 2024, global trade faced disruptions due to geopolitical tensions. Trade wars and new tariffs, like those proposed in early 2025, could raise costs and affect Xero's customer base involved in international transactions.

- Increased tariffs could raise costs for businesses, potentially reducing their spending on software like Xero.

- Political instability in key markets could lead to decreased business activity, affecting Xero's customer base.

- Changes in trade agreements could impact the ease of cross-border transactions for Xero users.

Lobbying and pressure groups

Lobbying and pressure groups significantly influence government policies affecting Xero. These groups advocate for or against regulations impacting small businesses, technology, and data privacy, indirectly shaping Xero's operational environment. For instance, lobbying efforts around data security standards can directly affect Xero's compliance costs and service offerings. In 2024, the tech industry spent billions on lobbying.

- Tech companies spent $3.6 billion on lobbying in 2024.

- Data privacy regulations, like GDPR, have increased compliance costs.

- Lobbying impacts tax policies for small businesses.

- Pressure groups influence decisions on digital transformation.

Political factors significantly shape Xero's operating landscape. Government policies like tax changes and digital adoption programs impact Xero's market and compliance needs. Regulatory updates and lobbying influence Xero's operational strategies. Geopolitical instability and trade shifts introduce market uncertainty, which influences Xero's customer base.

| Factor | Impact on Xero | Data/Example (2024/2025) |

|---|---|---|

| Tax Changes | Affects small business spending on software. | UK Corp. tax increased (2024), potentially impacting Xero subscriptions. |

| Digital Initiatives | Creates growth opportunities through partnerships. | Various countries launched SME digitalization programs. |

| Trade & Stability | Influences customer base engaged in int'l transactions. | Trade disruptions; lobbying costs for tech companies, 2024: $3.6B. |

Economic factors

Xero's fortunes are closely tied to economic cycles; expansion boosts its small business customer base, while downturns pose challenges. In 2023, global GDP growth was around 3%, a figure that's projected to remain stable in 2024. Recessionary fears, particularly in Europe, could slow small business growth, impacting Xero's revenue. The software's adoption rate is often correlated with business confidence and investment levels.

Inflation and interest rates significantly affect Xero's business. Rising inflation could lead to higher operating costs and potential price increases for its services. Interest rate hikes might influence the investment decisions of Xero's small business clients. The U.S. inflation rate was 3.5% in March 2024, impacting business costs. The Federal Reserve's decisions on interest rates are crucial.

Unemployment rates directly impact small businesses' access to and expense of labor. High labor costs can squeeze small business finances, possibly affecting their accounting software choices. The U.S. unemployment rate stood at 3.9% in April 2024, indicating a competitive labor market. This can drive up wages and potentially impact software investments.

Currency exchange rates

Currency exchange rates are crucial for Xero, a global entity. Fluctuations can greatly affect both revenue and expenses across diverse markets. Significant shifts in exchange rates can influence Xero's pricing in different regions and impact profitability. Xero's financial performance is directly tied to currency volatility.

- In 2024, currency fluctuations impacted Xero's reported revenue.

- The Eurozone and the UK are key markets for Xero, with currency shifts affecting their financial results.

Consumer spending and business investment

Consumer spending and business investment are pivotal for small businesses, directly impacting their financial activities. Higher spending and investment often translate to more intricate accounting requirements. This increased complexity makes platforms like Xero more appealing and potentially necessary for efficient financial management. For example, in 2024, U.S. consumer spending grew by 2.2%, reflecting a steady, albeit moderate, economic expansion. This trend supports the adoption of accounting software.

- U.S. consumer spending grew 2.2% in 2024.

- Business investment in software and technology is projected to rise by 4% in 2025.

Xero's performance hinges on global economic health; expansion fosters customer growth, while downturns pose risks. Inflation and interest rates are pivotal, impacting costs and client investment decisions; the U.S. inflation rate was 3.5% in March 2024. Currency fluctuations, particularly in key markets like the Eurozone and UK, heavily affect Xero's revenue; in 2024, these shifts were notable.

| Economic Factor | Impact on Xero | 2024/2025 Data |

|---|---|---|

| GDP Growth | Influences customer base expansion | Global: ~3% (2023), Stable in 2024. |

| Inflation | Affects operating costs, pricing | U.S.: 3.5% (March 2024) |

| Interest Rates | Influences client investment | Federal Reserve decisions are key |

Sociological factors

Changing demographics, with younger, tech-savvy entrepreneurs, favor cloud tools like Xero. Remote work's rise boosts online software adoption. A digitally fluent workforce embraces online accounting. In 2024, remote work increased by 10%, influencing tech adoption. Xero's user base grew 20% in the same period.

Societal attitudes significantly shape Xero's adoption. Acceptance of cloud technology among small business owners and advisors is crucial. Increased understanding of cloud accounting benefits fuels market growth. In 2024, 60% of SMBs used cloud accounting, a rising trend. Positive views accelerate Xero's penetration.

The educational and digital literacy levels within the small business sector significantly impact Xero's adoption. According to a 2024 study, nearly 30% of small businesses report limited digital skills. Xero must offer robust educational resources. Investing in user-friendly support, training, and accessible interfaces is crucial. This approach ensures broader usability and adoption across different skill levels.

Work-life balance and remote work trends

The rising importance of work-life balance and the surge in remote work significantly impact how businesses operate. Cloud-based software like Xero gains appeal because it offers accessibility from any location. This flexibility is particularly attractive to small business owners and their teams. For instance, in 2024, approximately 70% of businesses offered some form of remote work. The trend towards flexible work arrangements is expected to continue.

- 70% of businesses offered remote work in 2024.

- Xero's accessibility aligns with these trends.

Community and social responsibility expectations

Xero faces growing pressure to demonstrate social responsibility. Initiatives like community support and ethical practices boost its brand image. Supporting underrepresented groups appeals to conscious customers and partners. In 2024, 78% of consumers favored socially responsible brands. Xero's actions directly influence stakeholder perceptions.

- 78% of consumers favor socially responsible brands (2024 data).

- Xero's initiatives can enhance brand image and customer loyalty.

Societal shifts heavily influence Xero's adoption. The preference for remote work and flexible hours, embraced by roughly 70% of businesses in 2024, boosts Xero's appeal due to its accessibility. Increased consumer preference for socially responsible brands, indicated by 78% favoring such, pressures Xero. This will be shaping its initiatives

| Sociological Factor | Impact on Xero | 2024 Data Point |

|---|---|---|

| Remote Work/Flexibility | Enhances Xero's appeal via accessibility. | 70% of businesses offer remote work. |

| Social Responsibility | Influences stakeholder perceptions & brand. | 78% of consumers prefer responsible brands. |

| Digital Literacy | Affects ease of use/adoption rates. | ~30% of SMBs report limited digital skills. |

Technological factors

Xero heavily relies on cloud computing. Cloud advancements in infrastructure, security, and scalability are crucial. In 2024, the global cloud computing market was valued at $670 billion. These improvements directly impact Xero's platform performance and reliability. This ensures Xero can support its growing subscriber base.

The advancement of AI and machine learning is crucial for Xero. This allows the company to automate tasks, offer deeper insights, and improve user experience. For example, in 2024, Xero's AI-driven features, like automated data entry, saw a 30% increase in user adoption. The company's investment in AI increased to $150 million in 2024.

Xero faces heightened scrutiny regarding cybersecurity and data privacy. Its technological measures must prioritize protecting customer data. Data breaches can erode trust and lead to financial losses, so Xero must invest heavily in security protocols. Compliance with regulations like GDPR is crucial; in 2024, data breaches cost companies an average of $4.45 million.

Integration with other software and platforms

Xero's ability to integrate with other software is a significant technological advantage. This seamless integration with various platforms, such as e-commerce, CRM, and payroll systems, enhances its utility. This widespread compatibility makes Xero a central hub for small businesses. As of early 2024, Xero boasts over 1,000 integrations.

- Over 1,000 third-party app integrations.

- Increased efficiency through automated data flow.

- Enhanced user experience with a unified platform.

- Strong API for custom integrations.

Mobile technology and accessibility

The surge in mobile device usage for business operations is a key technological factor. Xero's mobile app plays a crucial role in this, making accounting accessible anywhere. This focus on mobile functionality boosts convenience for small business owners. Xero's mobile app saw a 20% increase in active users in 2024, reflecting its importance.

- 20% increase in Xero mobile app users in 2024.

- Enhances accessibility and convenience for users.

- Supports on-the-go business management.

Xero leverages cloud computing and AI, boosting performance and automation; the global cloud market reached $670 billion in 2024. Strong cybersecurity and data privacy measures, vital to protect customer data and reduce breach costs, are top priorities; in 2024, data breaches cost an average of $4.45 million. Xero excels in software integration, offering over 1,000 integrations.

| Technological Aspect | Impact on Xero | 2024/2025 Data |

|---|---|---|

| Cloud Computing | Foundation for platform | Global cloud market $670B (2024) |

| AI & ML | Automation & insights | AI investment reached $150M (2024) |

| Cybersecurity | Data protection | Data breach avg. cost $4.45M (2024) |

Legal factors

Xero faces stringent data protection rules, including GDPR, impacting data handling across its global operations. Compliance is crucial to avoid hefty fines and maintain user confidence. In 2024, GDPR fines hit €400M+; Xero's adherence is vital. Ongoing legal updates require continuous platform adaptation.

Changes in accounting and tax legislation are critical for Xero. Governments regularly update accounting standards, tax laws, and reporting requirements. For instance, the UK's Making Tax Digital initiative mandates digital record-keeping.

Xero must continually update its software to ensure users meet these legal obligations. This includes providing tools for VAT, corporation tax, and payroll compliance. In 2024, the global accounting software market was valued at $12.4 billion.

Adaptation is essential for Xero's platform to remain compliant and competitive. Failure to do so could lead to penalties for its users. In 2025, it's projected to reach $13.6 billion.

Consumer protection laws globally impact Xero's marketing and service delivery. These laws dictate service quality standards and customer redressal processes. Xero must adhere to these regulations for legal operations and reputational integrity. For example, in 2024, the EU's Digital Services Act (DSA) further defined obligations, with potential fines up to 6% of global turnover for non-compliance. These laws are critical for Xero's global market strategy.

Employment and labor laws

Xero's payroll features depend heavily on legal factors. Compliance with employment and labor laws is vital for payroll, especially regarding minimum wage and working hours. The software must be localized and regularly updated to reflect regional differences in payroll tax calculations. These updates are crucial to avoid legal issues, which is a common challenge, especially for global companies. In 2024, the U.S. Department of Labor reported over $200 million in back wages recovered for workers.

- Minimum wage laws vary significantly by location, impacting Xero's payroll calculations.

- Working hours regulations, like overtime rules, necessitate precise software configurations.

- Payroll tax laws, which are complex and change frequently, demand continuous updates.

- Compliance failures can result in significant penalties and legal repercussions.

Contract law and terms of service

Contract law significantly impacts Xero's SaaS model. Terms of service must be legally sound to protect Xero from liability. These terms are often the subject of legal interpretation and potential disputes, which can be costly. Compliance with data privacy laws like GDPR and CCPA is essential. In 2024, SaaS contract disputes cost businesses an average of $250,000.

- Data privacy regulations compliance is mandatory.

- Terms of service should be regularly reviewed.

- Legal disputes can be expensive.

- SaaS agreements need careful drafting.

Xero's legal compliance hinges on data privacy, impacting global operations under GDPR and others. Accounting and tax law changes, such as the UK's digital tax initiative, require software updates to avoid user penalties. Adhering to consumer protection laws and local payroll laws are crucial for maintaining service standards.

| Legal Area | Impact on Xero | 2024-2025 Data |

|---|---|---|

| Data Protection | Compliance with GDPR, CCPA and similar | GDPR fines hit €400M+ in 2024; growing. |

| Tax and Accounting | Adapt software for new standards | Global accounting software market at $12.4B in 2024, expected $13.6B in 2025. |

| Consumer Protection | Adhere to service quality laws | EU DSA fines: up to 6% of global turnover. |

Environmental factors

Xero, a software company, faces growing scrutiny regarding carbon emissions and climate change despite its lower direct environmental impact compared to manufacturing. The company acknowledges the increasing importance of environmental responsibility. Xero has set targets to reduce its carbon footprint. For instance, in 2024, it's implementing strategies to achieve net-zero emissions.

Xero, as a cloud service, depends on data centers, which have high energy needs. Data center energy consumption is a key environmental factor. Hosting providers like AWS, used by Xero, are increasingly using renewable energy.

Xero's commitment to waste reduction and recycling is a key environmental factor. Internal practices significantly impact their footprint. Effective waste management showcases environmental responsibility. In 2024, Xero aimed to reduce waste by 15% in its global offices, supporting sustainability goals. They invested $2M in waste reduction programs.

Supply chain sustainability

Xero actively promotes sustainable practices in its supply chain. This involves assessing the environmental impact of its suppliers, aligning with its wider environmental goals. This initiative goes beyond Xero's direct operations to foster sustainability across its value chain. For instance, in 2024, Xero reported that 75% of its key suppliers have sustainability programs.

- Supplier Environmental Impact Assessment: Xero evaluates suppliers based on their environmental performance.

- Sustainable Procurement: Xero prioritizes suppliers with strong sustainability practices.

- Supply Chain Transparency: Xero aims for increased transparency in its supply chain to monitor environmental impacts.

Customer and partner environmental awareness

Growing environmental consciousness among Xero's customers and partners is driving demand for tools that help small businesses manage their environmental footprint. This includes features like carbon accounting. Xero's strategic partnerships are key to addressing this rising need, offering sustainable solutions. The global green technology and sustainability market is projected to reach $61.7 billion by 2025.

- Demand for carbon accounting tools is increasing.

- Partnerships help meet sustainability needs.

- Green tech market is growing rapidly.

Xero focuses on carbon footprint reduction, including net-zero goals, using energy-efficient data centers, and prioritizing waste reduction through internal practices.

Xero emphasizes sustainable supply chain practices by assessing supplier environmental impacts and boosting transparency.

Customer demand for sustainability tools, like carbon accounting, is growing, supported by strategic partnerships; the green tech market's projected value is $61.7 billion by 2025.

| Environmental Aspect | Xero's Actions | Data/Metrics |

|---|---|---|

| Carbon Emissions | Net-zero initiatives, energy-efficient data centers. | Aim to achieve net-zero emissions by 2024, powered by AWS renewables. |

| Waste Management | Waste reduction programs. | Reduce waste by 15% in global offices, investing $2M in waste programs. |

| Supply Chain | Supplier assessments, sustainable procurement. | 75% of key suppliers have sustainability programs by 2024. |

PESTLE Analysis Data Sources

Xero's PESTLE uses economic data from IMF, OECD, market research, and government regulations for reliable analysis. Technology insights derive from IT reports and global trends.