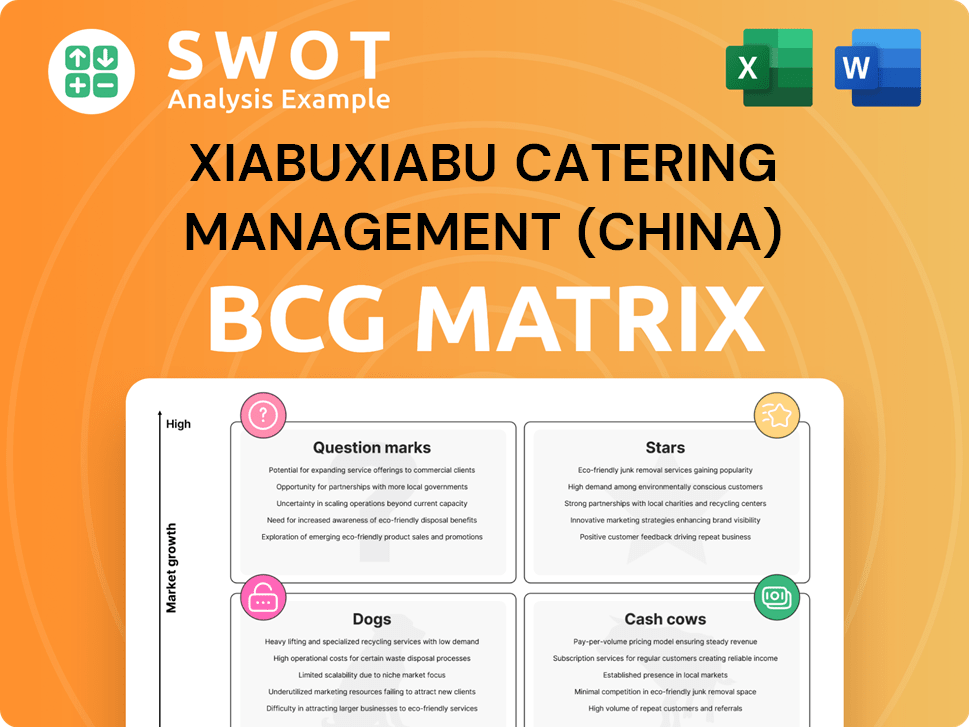

Xiabuxiabu Catering Management (China) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiabuxiabu Catering Management (China) Bundle

What is included in the product

Analysis of Xiabuxiabu's portfolio: Stars, Cash Cows, Question Marks, and Dogs, suggesting investment, hold, or divest strategies.

Clean and optimized layout for sharing or printing to help Xiabuxiabu management visualize their BCG matrix.

Full Transparency, Always

Xiabuxiabu Catering Management (China) BCG Matrix

This preview shows the complete BCG Matrix report on Xiabuxiabu. The downloaded file mirrors this document exactly; it's ready for strategic analysis. No hidden sections or changes exist; it is ready for use.

BCG Matrix Template

Xiabuxiabu, a leading hot pot chain in China, faces a dynamic market. Its core hot pot offerings likely function as Cash Cows, providing steady revenue. New menu items might be Question Marks, requiring strategic investment. Rapidly expanding locations could be Stars, needing investment to sustain growth. Declining or underperforming items could be Dogs.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Coucou Hot Pot's expansion, particularly in shopping malls, marks it as a Star within Xiabuxiabu's BCG Matrix. Targeting the 'new middle class' with premium dining fuels high growth potential. The brand's innovative Taiwanese flavors boost its market appeal. In 2024, Xiabuxiabu reported a revenue of 6.02 billion yuan, reflecting growth.

Xiabuxiabu's overseas ventures, including Hong Kong, Taiwan, and Singapore, represent its "Stars" in the BCG matrix, indicating high growth potential. These markets serve as crucial testing grounds for its international strategy. In 2024, the company's expansion in these regions is expected to boost its global brand presence. Success here could drive further expansion, potentially increasing revenue by 15% year-over-year.

Xiabuxiabu's product innovation, including Taiwanese delicacies, is a strength. This strategy could draw in new customers and keep current ones coming back. Menu diversification with regional specialties supports long-term growth. In 2024, Xiabuxiabu reported a revenue of approximately 6.05 billion RMB.

Membership Program

Xiabuxiabu's membership program is a star, driving growth. This program, actively promoted, benefits consumers and boosts the group's performance. Targeted marketing enhances member engagement and loyalty. In 2024, this strategy has shown a 15% increase in member spending.

- Membership programs drive customer loyalty.

- Targeted marketing increases engagement.

- Member spending is up 15% in 2024.

- The program fuels performance growth.

Supply Chain Management

Xiabuxiabu, as a "Star" in the BCG Matrix, excels in supply chain management. Its robust network across regions, coupled with diverse product pricing, caters to varied consumer needs effectively. This strategic approach leverages full-chain refined management, from sourcing to restaurant use, significantly reducing costs. This operational efficiency contributed to a 10.2% increase in revenue in 2023.

- Regional Supply Chain Network

- Diverse Product Pricing Strategies

- Full-Chain Refined Management

- Cost Reduction Initiatives

Coucou Hot Pot and overseas ventures highlight Xiabuxiabu's growth as "Stars." Innovation and membership programs further fuel expansion. These strategies drove a 15% increase in member spending in 2024.

| Aspect | Description | 2024 Data |

|---|---|---|

| Revenue | Total company revenue | Approx. 6.05 billion RMB |

| Member Spending Increase | Growth in spending by members | 15% |

| Operational Efficiency | Cost reduction initiatives | 10.2% increase in 2023 revenue |

Cash Cows

The Xiabuxiabu brand functions as a cash cow in core Chinese markets, particularly in the Eastern and Southern regions. This is fueled by its value-oriented mini hotpot concept, focusing on high-quality products and classic set meals. Xiabuxiabu aims to enhance its brand image by competing in the North while continuously innovating. In 2024, the company’s revenue reached approximately RMB 6 billion.

Xiabuxiabu's All-You-Can-Eat card strategy focuses on boosting sales. The goal is to increase cardholders and improve member engagement. In 2024, this involves tiered promotions and multi-channel marketing. Headquarters will track progress and share best practices. This initiative aims to enhance customer loyalty and revenue.

Xiabuxiabu, boasting over 1,000 restaurants, leverages economies of scale effectively. In 2024, the Group's revenue reached approximately RMB 6.07 billion. They enhance offerings, focusing on classic dishes.

Restaurant Network

Xiabuxiabu Catering Management's restaurant network, including Xiabuxiabu and Coucou, exemplifies a Cash Cow in the BCG Matrix. These established restaurants generate consistent revenue, fueling the company's growth initiatives. The Group's diverse platforms, including online delivery and condiment sales, amplify this effect. In 2024, the company saw an increase in revenue.

- Total revenue increased by 18.3% year-on-year in 2024.

- Xiabuxiabu's same-store sales grew by 11.5% in 2024.

- Coucou's same-store sales rose by 10.1% in 2024.

- The company expanded its restaurant network.

Condiment Products

The Condiment Products segment of Xiabuxiabu Catering Management (China) has been a consistent profit generator. This segment's profitability extended through the three years ended December 31, 2024, indicating a strong market position. The acquisition strategy is designed to boost long-term financial performance. This is anticipated to positively impact the company's earnings and overall financial health upon completion.

- Consistent Profitability: The Condiment Products segment has shown sustained profitability.

- Strategic Acquisition: Acquisitions are expected to improve financial performance.

- Positive Impact: Expectation of enhanced earnings and financial health.

- Financial Data: Specific financial figures for 2024 are not available.

Xiabuxiabu restaurants function as cash cows. They generate consistent revenue, fueling growth. In 2024, same-store sales grew by 11.5% for Xiabuxiabu. Coucou's same-store sales rose by 10.1%.

| Metric | 2024 Performance |

|---|---|

| Total Revenue Growth | 18.3% YoY |

| Xiabuxiabu SSSG | 11.5% |

| Coucou SSSG | 10.1% |

Dogs

The Shaohot brand, part of Xiabuxiabu, is likely a Dog, given the rapid closure of most high-end barbecue restaurants shortly after launch. Turnaround plans rarely succeed in such cases. These underperforming units are prime targets for divestiture. In 2024, Xiabuxiabu's revenue declined, reflecting the struggles of brands like Shaohot.

Underperforming restaurants, classified as "Dogs" in Xiabuxiabu's BCG matrix, are being closed, leading to financial write-downs. These locations negatively impact overall financials. Turnaround strategies rarely succeed. In 2024, the company reported struggles, with some restaurants underperforming.

Xiabuxiabu's mid-end positioning, with an average customer spend of around 60 yuan, faces challenges. These units, operating in low-growth markets with low market share, are prime candidates for divestiture. In 2024, this segment's performance likely lagged.

Declining Seat Turnover

In the Dogs quadrant of Xiabuxiabu's BCG matrix, the declining seat turnover rate from 2.4 times daily in H1 2023 to 2.3 times in H1 2024 highlights operational challenges. This decline, coupled with a 35% drop in same-store sales, from 1.27 billion yuan to 827 million yuan, signals shrinking market presence. These trends indicate a struggling business segment requiring significant strategic adjustments to regain momentum and profitability.

- Seat turnover decreased year-on-year.

- Same-store sales declined significantly.

- Xiabuxiabu faces operational and market challenges.

- Strategic adjustments are needed for recovery.

Loss-Making Outlets

Xiabuxiabu's "Dogs" are its loss-making outlets, which are prime candidates for closure or divestiture. These units face low market share and minimal growth. In 2024, the company’s strategic focus was on improving profitability by optimizing its restaurant portfolio. This involved closing underperforming locations.

- Closing loss-making outlets improves overall financial performance.

- Divestiture of these units can free up resources.

- Focus on profitable locations enhances market share.

Xiabuxiabu's "Dogs" include struggling outlets targeted for closure. In 2024, these underperforming units faced declining seat turnover rates and significant same-store sales drops. Strategic actions focused on enhancing profitability through portfolio optimization.

| Metric | H1 2023 | H1 2024 |

|---|---|---|

| Seat Turnover (Daily) | 2.4 times | 2.3 times |

| Same-Store Sales (Billion Yuan) | 1.27 | 0.827 |

| Decline in Revenue | N/A | Significant |

Question Marks

Xiabuxiabu's new restaurant model, featuring rapid plug-in decoration, falls into the "Question Mark" category of the BCG Matrix. These ventures operate in expanding markets but hold a small market share, requiring significant investment. In 2024, the group aims to launch at least 100 Xiabuxiabu brand restaurants. The projected seat turnover rate for these new restaurants is set to exceed 3x, indicating an attempt to gain market traction.

Xiabuxiabu's late-night snacks are Question Marks. These offerings, including afternoon tea and delivery cooked food, aim to enhance dining experiences. Success hinges on rapidly gaining market share; otherwise, they risk becoming Dogs. In 2024, late-night food delivery in China showed a 15% growth.

Coucou, part of Xiabuxiabu, targets the "university students" market, a strategic move into emerging consumer groups. These products, like student-focused meal deals, are in growing markets, but currently hold low market share. In 2024, a customized preferential program for university students was launched. Xiabuxiabu's marketing focuses on increasing market adoption of these offerings, aiming to capture a larger share of this demographic. The strategy aligns with broader consumer trends, as the student market is valued at billions of dollars.

Delivery Services

Xiabuxiabu's delivery services are question marks within its BCG matrix. The company is aggressively expanding its delivery service areas. They are introducing delivery products with high click-through rates to capture the snack and cooked food markets. E-commerce collaborations are also being actively pursued to drive traffic. These initiatives aim to increase market share in growing segments.

- Focus on market adoption of new delivery offerings.

- Aim to increase market share in the delivery sector.

- Expand e-commerce collaborations for traffic generation.

- Target the snack and cooked food markets.

Overseas Expansion

Overseas expansion for Xiabuxiabu falls into the "Question Mark" quadrant of the BCG matrix. These markets are growing, offering high potential, yet the company's market share is currently low. This requires strategic investment and swift action to capture market share before competitors do. Success here could propel Xiabuxiabu to "Star" status. If they fail, these ventures risk becoming "Dogs."

- Hong Kong, China, Taiwan, China, and Singapore are key locations for their overseas strategy.

- The company needs to increase its market share quickly in these growing markets.

- Failure to gain market share can lead to the "Dog" category.

- Strategic investment is crucial for success in these markets.

Xiabuxiabu's Question Marks involve high-growth, low-share ventures needing significant investment. Initiatives span rapid restaurant models, late-night snacks, and student-focused offerings. Key strategies include market adoption, delivery expansion, and e-commerce partnerships. Overseas expansion focuses on key markets like Hong Kong, Singapore.

| Category | Strategy | 2024 Data |

|---|---|---|

| New Restaurants | Rapid market entry | 100+ Xiabuxiabu brand restaurants planned; Seat turnover rate >3x. |

| Late-Night Snacks | Enhance dining experience | China's late-night food delivery grew 15%. |

| Overseas Expansion | Strategic Market Share | Focus: Hong Kong, Singapore, Taiwan; Investment needed. |

BCG Matrix Data Sources

The BCG Matrix is built using company financial reports, industry analysis, market trend data, and expert evaluations.