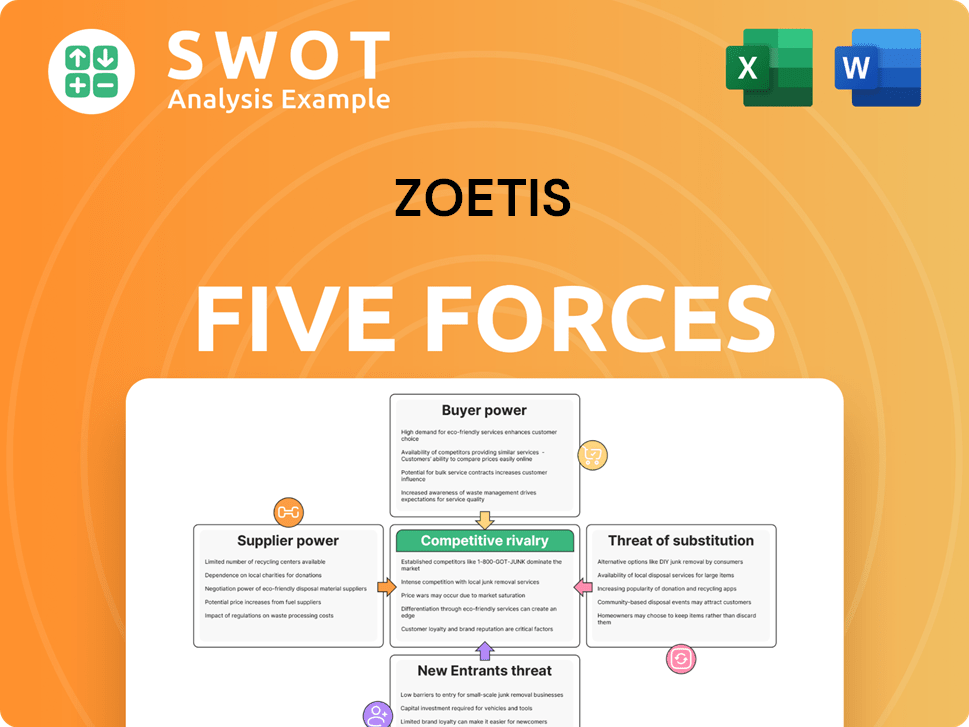

Zoetis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zoetis Bundle

What is included in the product

Tailored exclusively for Zoetis, analyzing its position within its competitive landscape.

Instantly view Zoetis' strategic environment with dynamic, color-coded visualizations.

Full Version Awaits

Zoetis Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Zoetis Porter's Five Forces analysis comprehensively examines the competitive landscape. It assesses the bargaining power of suppliers & buyers, threat of new entrants & substitutes, and industry rivalry.

Porter's Five Forces Analysis Template

Zoetis faces a complex competitive landscape shaped by the Five Forces. High buyer power from veterinarians and distributors impacts pricing. Supplier power is moderate, driven by the availability of raw materials. The threat of new entrants is low, due to regulatory hurdles. Competition is intense, especially from established animal health giants. The threat of substitutes, like alternative medicines, remains a factor. Ready to move beyond the basics? Get a full strategic breakdown of Zoetis’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Zoetis's bargaining power of suppliers is influenced by the limited number of key suppliers for essential raw materials. This concentration potentially gives suppliers increased leverage in pricing and terms negotiations. For instance, in 2024, the cost of key biological components rose by approximately 7%, impacting production costs. Assessing the availability of alternative suppliers helps Zoetis mitigate supply chain risks. This is crucial for maintaining profitability and operational efficiency.

Zoetis faces supplier power when inputs are specialized. If they need unique, patented materials, suppliers gain leverage. This reduces Zoetis' options. Consider the intellectual property landscape. For 2024, R&D spending at Zoetis was over $800 million, indicating ongoing reliance on specific inputs.

Zoetis faces high supplier power due to substantial switching costs. Reformulation, re-validation, and regulatory hurdles make changing suppliers expensive. These costs reduce Zoetis's negotiating leverage, especially with critical raw material providers. In 2024, the pharmaceutical industry saw these challenges. This is further complicated by complex manufacturing processes.

Supplier forward integration

Supplier forward integration is a significant threat to Zoetis's bargaining power. If suppliers, like those providing raw materials, decide to produce their own animal health products, they become direct competitors. This move can squeeze Zoetis's profitability and market position. Assessing suppliers' strategic plans and abilities is crucial. For example, in 2024, the cost of active pharmaceutical ingredients (APIs), a key supplier input, increased by about 7%, affecting Zoetis's production costs.

- Increased supplier power can erode Zoetis's profit margins.

- Forward integration by suppliers creates direct competition.

- Zoetis must monitor supplier strategies closely.

- Raw material cost fluctuations, like API prices, impact Zoetis.

Impact of supplier consolidation

Zoetis faces potential challenges from the bargaining power of suppliers, especially due to consolidation within their industries. This consolidation might create fewer, larger suppliers, enhancing their ability to dictate terms. Consequently, Zoetis could experience rising input costs and less favorable contract conditions, impacting profitability. Therefore, closely monitoring industry consolidation trends is crucial for mitigating these supply chain risks.

- In 2024, the global animal health market, where Zoetis operates, was valued at approximately $55 billion, with consolidation continuing among key suppliers.

- Zoetis's cost of goods sold (COGS) in 2023 was around $3.7 billion, making it sensitive to supplier pricing changes.

- Monitoring mergers and acquisitions within the pharmaceutical ingredient and packaging sectors is essential for Zoetis.

- Zoetis's ability to diversify its supplier base is a key strategy to manage supplier power.

Zoetis deals with supplier power due to concentrated suppliers. Their pricing and terms can greatly influence Zoetis. Specialized inputs like patented materials give suppliers leverage. Switching costs and potential forward integration further challenge Zoetis.

| Factor | Impact on Zoetis | 2024 Data |

|---|---|---|

| Supplier Concentration | Increased input costs | API prices rose 7% |

| Specialized Inputs | Reduced negotiating power | R&D spending over $800M |

| Switching Costs | Higher operational costs | Industry saw similar issues |

Customers Bargaining Power

Zoetis might face concentrated customer power. A few large veterinary chains or distributors could represent a significant portion of its sales. This concentration allows these customers to negotiate better prices and terms. In 2024, major distributors like AmerisourceBergen and Patterson Veterinary Supply likely influenced Zoetis's pricing.

The price sensitivity of Zoetis's customers, such as veterinarians and livestock producers, significantly shapes their bargaining power. If these customers are highly price-sensitive, especially with alternative treatments available, they can push for lower prices. The availability of generic or cheaper alternatives directly influences this sensitivity. In 2024, the animal health market saw increased competition, which heightened price sensitivity among customers.

Customers gain bargaining power with more information on prices and product performance. Transparency allows informed decisions and better negotiations. Online resources and veterinary networks are key for accessing this information. For example, in 2024, the rise of e-commerce platforms like Chewy increased price comparisons. This shift has changed customer behavior.

Customer switching costs

Zoetis faces high customer bargaining power due to low switching costs in the animal health market. Customers can readily switch between veterinary suppliers or treatment protocols, increasing their leverage. This forces Zoetis to compete aggressively on price and offer superior value to retain customers. Understanding customer loyalty drivers is crucial for Zoetis's success.

- The global animal health market was valued at $55.4 billion in 2023.

- Zoetis held a leading market share, but faces competition from several other companies.

- Switching costs are often low due to readily available alternative products.

- Zoetis invests heavily in R&D to differentiate its offerings.

Customer backward integration

Large customers, like major livestock producers, possess the option to create their own animal health products, which is called backward integration. This move allows them to compete directly with Zoetis, potentially squeezing profit margins and market share. Keeping a close eye on these key customers' plans and abilities is crucial for Zoetis. In 2024, the global animal health market was valued at approximately $58.2 billion, highlighting the stakes involved.

- Backward integration by large customers poses a threat.

- This can lead to decreased margins and market share for Zoetis.

- Monitoring key customer strategies is essential.

- The animal health market was worth around $58.2B in 2024.

Zoetis encounters strong customer bargaining power, especially from large distributors and price-sensitive buyers. The availability of alternatives and low switching costs amplify this pressure, forcing Zoetis to compete on price. Backward integration by major customers also poses a threat, impacting margins.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | Higher bargaining power | Large vet chains & distributors |

| Price Sensitivity | Increased negotiation power | Enhanced by market competition |

| Switching Costs | Low switching costs | Numerous alternative products |

Rivalry Among Competitors

The animal health sector faces fierce competition, with major firms like Merck Animal Health and Elanco vying for market share. This rivalry, based on 2024 data, pressures Zoetis to innovate and adjust pricing. Competitive intensity is evident in product launches and marketing campaigns. In 2024, Elanco had a revenue of approximately $3.06 billion.

Zoetis faces product differentiation challenges in the competitive animal health market. While offering diverse products, setting them apart from rivals is tough. This can spark price wars, squeezing profits. Analyzing Zoetis' product uniqueness versus competitors is crucial. In 2023, Zoetis' revenue was $8.5 billion, highlighting market competition.

The animal health market is highly concentrated, with major companies like Zoetis, Elanco, and Boehringer Ingelheim significantly influencing the competitive landscape. This concentration leads to fierce rivalry as these firms compete for market share and customer loyalty. In 2023, Zoetis held approximately 28% of the global animal health market. Observing the strategic actions of these key players is critical for understanding market dynamics.

Slow industry growth

Slow industry growth significantly intensifies competition. Companies battle for market share in a stagnant market. This can trigger price wars and decrease profitability across the board. For example, the global animal health market was valued at $54.6 billion in 2023. Analyzing market growth is crucial for strategic decisions.

- Market growth directly impacts competitive intensity.

- Slow growth can lead to price wars.

- Profitability is often reduced in slow-growth markets.

- Strategic decisions depend on market analysis.

High exit barriers

High exit barriers significantly intensify competitive rivalry. Companies like Zoetis, with its specialized animal health products, face hurdles in exiting the market. These barriers, including regulatory requirements and long-term contracts, force firms to compete aggressively. This can lead to price wars and reduced profitability for all players. Assessing these exit barriers is crucial for understanding market dynamics.

- Specialized assets and regulatory hurdles are significant barriers.

- Long-term contracts can lock companies into the market.

- Aggressive pricing is a common strategy to retain market share.

- Understanding competitor exit strategies is key.

Competitive rivalry is intense in the animal health market, with companies like Zoetis, Merck, and Elanco battling for market share. This rivalry is fueled by product differentiation challenges and the slow growth of the market. High exit barriers further intensify competition, leading to strategies like aggressive pricing.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Concentration | Top firms dominate | Zoetis: ~28% market share |

| Revenue Example | Elanco | ~$3.06B |

| Market Value (2023) | Global Animal Health | $54.6B |

SSubstitutes Threaten

The emergence of generic drugs and biosimilars presents a notable threat to Zoetis due to their lower prices and comparable efficacy. As patents on Zoetis's products expire, the company encounters heightened competition from these alternatives. In 2024, the global generic animal drug market was valued at around $10 billion, growing at a CAGR of 6%.

Alternative treatments, like supplements and holistic therapies, pose a threat to Zoetis. These alternatives, though varied in effectiveness, could lure customers away from traditional pharmaceuticals and vaccines. For instance, the global pet supplements market was valued at $7.03 billion in 2024. Monitoring the adoption of these alternatives is crucial for Zoetis.

Improved preventative care, like enhanced hygiene and biosecurity, can act as a substitute for Zoetis's products. These practices reduce the need for medications and treatments. For instance, the implementation of strict biosecurity protocols in poultry farms decreased disease incidence by 20% in 2024. Analyzing trends in animal management is crucial.

Changes in pet ownership trends

Changes in pet ownership trends pose a threat to Zoetis. A decline in pet ownership, or a shift towards pets with fewer healthcare needs, could shrink demand for animal health products. This requires Zoetis to actively monitor these market dynamics. For example, in 2024, pet ownership rates showed slight fluctuations.

- In 2024, the American Pet Products Association (APPA) reported that pet ownership remained relatively stable, with approximately 66% of U.S. households owning a pet.

- Smaller pets, like cats and certain dog breeds, may require less specialized and expensive healthcare, potentially impacting revenue streams.

- Zoetis must adapt its product offerings and marketing strategies to cater to evolving pet owner preferences to mitigate this threat.

- The company's ability to innovate and offer diverse products will be key to maintaining market share.

Diet and lifestyle changes

Dietary and lifestyle shifts pose a threat to Zoetis. Changes in animal diets, like the rise of grain-free options, can alter health needs. This could reduce demand for specific medications. Analyzing these trends is crucial for Zoetis's product planning.

- The global pet food market was valued at $107.07 billion in 2023.

- The market is projected to reach $150.85 billion by 2030.

- Premium and specialized pet food segments are growing.

- These shifts impact the types of health products needed.

Zoetis faces substitution threats from generics and biosimilars, which have lower prices and growing market shares. Alternative treatments like supplements and holistic therapies also pose competition. Preventative care and shifts in pet ownership trends present further challenges.

| Threat | Impact | 2024 Data |

|---|---|---|

| Generics/Biosimilars | Price Competition | Generic animal drug market: ~$10B, CAGR 6% |

| Alternatives | Customer Shift | Pet supplements market: ~$7.03B |

| Preventative Care | Reduced Product Need | Biosecurity reduced disease by 20% |

Entrants Threaten

The animal health sector faces high capital requirements, a significant barrier. New entrants need substantial funds for R&D, manufacturing, and regulatory compliance. In 2024, Zoetis spent billions on R&D alone, hindering smaller firms. Assessing investment needs is crucial to compete. High costs deter many potential entrants.

Stringent regulatory hurdles significantly impact new entrants in the animal health industry. Agencies like the FDA and EMA mandate rigorous testing and approval processes, which can take years. These lengthy processes and associated costs, including approximately $100 million for new drug approvals, act as a substantial barrier. Navigating these complex regulatory landscapes requires specialized expertise and substantial capital, deterring potential competitors. Regulatory compliance is a critical factor for market entry.

Zoetis and other established companies benefit from strong brand reputations and customer loyalty, which are significant barriers for new entrants. In 2024, Zoetis's marketing expenses were substantial, reflecting the investment needed to maintain brand presence. The challenge for new entrants is to build brand awareness and trust, requiring considerable time and financial commitment. Analyzing the strength of existing brands is crucial for evaluating their impact on customer loyalty, as seen in Zoetis's continued market dominance.

Access to distribution channels

New animal health companies, like Zoetis, face significant hurdles in accessing established distribution networks. Veterinary clinics, livestock producers, and existing distributors often have long-standing partnerships, creating a barrier. New entrants need to build relationships or offer compelling incentives. Analyzing the distribution landscape is crucial for understanding the threat. In 2024, the global animal health market was approximately $57 billion, with distribution costs a significant portion.

- Exclusive Agreements: Existing players might have exclusive distribution deals.

- Relationship Barriers: Strong ties between incumbents and channels can hinder access.

- Cost of Entry: Establishing a new distribution network is expensive.

- Market Dynamics: Understanding the channel structure is key.

Economies of scale

Zoetis leverages economies of scale across its operations, including manufacturing, marketing, and distribution, which creates a significant barrier for new entrants. This cost advantage helps Zoetis maintain competitive pricing in the animal health market. New companies face the challenge of matching Zoetis's scale to compete effectively. Understanding the cost structure of existing players and the potential to achieve economies of scale is therefore crucial for evaluating the threat of new entrants.

- Zoetis's market capitalization was approximately $178.4 billion as of May 2024.

- In 2023, Zoetis reported revenue of $8.5 billion.

- The company's global presence and established supply chains contribute to its economies of scale.

- New entrants would need substantial investment to match Zoetis's operational efficiency.

The threat of new entrants in the animal health sector is moderate to low due to substantial barriers. High capital requirements, including R&D and regulatory compliance, deter smaller firms. Established brands and distribution networks further limit new competitors.

| Barrier | Description | Impact |

|---|---|---|

| Capital Needs | High R&D, manufacturing, regulatory costs. | Deters new entrants. |

| Regulations | FDA/EMA approval processes are lengthy and costly. | Adds barriers to entry. |

| Brand/Loyalty | Established brands like Zoetis have strong presence. | Makes it hard to build trust. |

Porter's Five Forces Analysis Data Sources

The analysis is informed by Zoetis' annual reports, industry surveys, financial databases, and competitor analysis. Regulatory filings provide additional depth.