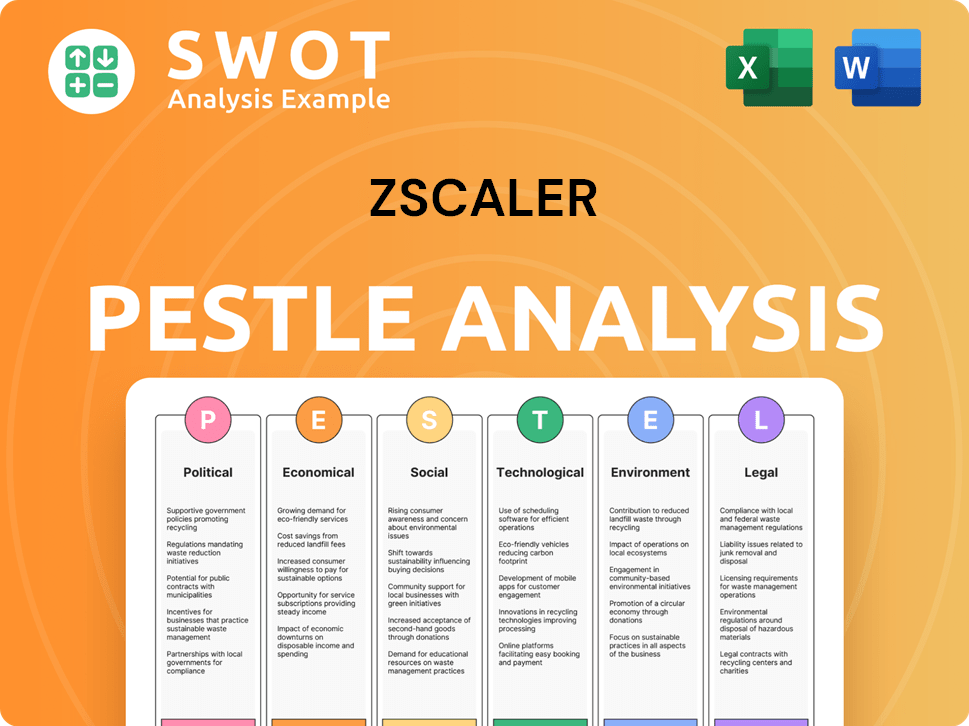

Zscaler PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zscaler Bundle

What is included in the product

Examines how external macro-factors influence Zscaler's business through six PESTLE dimensions.

Easily shareable for quick alignment across teams and departments.

Full Version Awaits

Zscaler PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Zscaler PESTLE analysis explores political, economic, social, technological, legal, and environmental factors. The structure is as it will be after purchase, ensuring a clear, comprehensive study.

PESTLE Analysis Template

Zscaler's future hinges on understanding external factors. Our PESTLE Analysis dives deep into political, economic, social, technological, legal, and environmental influences. We examine regulations, market trends, and emerging technologies impacting Zscaler's growth. Get expert insights, spot opportunities, and mitigate risks effectively. Purchase the full analysis for a strategic edge!

Political factors

Governments worldwide are intensifying their focus on cybersecurity. They are pushing for Zero Trust architectures. This is due to growing cyber threats. Zscaler benefits from these mandates. The US government's zero trust directive offers a major opportunity. In 2024, the global cybersecurity market is valued at approximately $200 billion.

Geopolitical instability affects cloud security. Export restrictions and scrutiny on vendors create barriers. Operating in tense regions poses challenges. Zscaler's Q1 FY24 revenue was $486.6M, a 32% increase. Sanctions and trade wars can disrupt operations.

The global emphasis on data protection, driven by regulations like GDPR and CCPA, is intensifying. Zscaler addresses these needs directly. The company's focus on secure access and data protection helps organizations comply. In Q1 2024, Zscaler reported a 34% year-over-year increase in revenue, reflecting strong demand for its solutions amid rising regulatory pressures.

Government Procurement Policies

Government procurement policies play a significant role in Zscaler's success. Stricter FedRAMP authorization levels in the US directly affect Zscaler's ability to serve the public sector. Compliance with these evolving standards is essential for securing government contracts, which is a substantial market. These policies can influence the pace of adoption and revenue streams.

- In 2024, the U.S. federal government spent over $100 billion on IT, with a growing emphasis on cloud security.

- FedRAMP certification typically takes 6-12 months, influencing Zscaler's time-to-market.

- Approximately 80% of federal agencies use cloud services, creating a large addressable market.

Connectivity Sovereignty

Connectivity sovereignty is a growing political factor, with nations seeking greater control over their internet and data. This could drive the adoption of distributed cloud systems and edge computing. Zscaler must adapt its global infrastructure to meet these evolving national demands.

- China's cybersecurity regulations require data localization.

- The EU's Digital Services Act impacts content moderation.

- These trends influence Zscaler's infrastructure strategy.

Political factors significantly impact Zscaler. Governments globally mandate cybersecurity. The U.S. federal government spent over $100 billion on IT in 2024. Connectivity sovereignty drives infrastructure adaptations.

| Political Factor | Impact on Zscaler | 2024 Data/Example |

|---|---|---|

| Cybersecurity Mandates | Boosts demand for Zero Trust | Global cybersecurity market: ~$200B. |

| Data Protection Regulations | Drives compliance solutions | Q1 2024 revenue up 34% YOY. |

| Government Procurement | Influences market access | FedRAMP certification timeline: 6-12 months. |

Economic factors

Broader macroeconomic conditions significantly influence Zscaler. Inflation and rising interest rates can squeeze enterprise IT budgets, affecting cybersecurity spending. Economic instability, as seen in 2023 with fluctuating markets, poses a risk. Cybersecurity spending growth slowed to 11.3% in 2023, according to Gartner, but is expected to reach $215 billion in 2024.

Enterprise IT spending significantly impacts Zscaler's revenue. Increased IT budgets, especially from large firms, boost demand for cloud security solutions. Gartner projects global IT spending to reach $5.06 trillion in 2024, a 6.8% rise. This trend supports Zscaler's growth.

The cybersecurity market is fiercely competitive. Zscaler faces rivals like Fortinet, Palo Alto Networks, and Cisco. These competitors drive pricing pressures. In Q1 2024, Zscaler's gross margin was 79%, impacted by competition.

Currency Exchange Rate Fluctuations

As a global entity, Zscaler faces currency exchange rate risks. These fluctuations directly affect reported revenues and operational costs across various geographic segments. For instance, a strong US dollar can diminish the value of international sales when converted. In Q1 2024, Zscaler's revenue was $525.5 million, impacted by currency shifts.

- Currency volatility can alter profitability in different regions.

- Hedging strategies are crucial to mitigate these risks.

- Exchange rate movements necessitate careful financial planning.

- Zscaler’s financial reports provide details on currency impacts.

Investment in Digital Transformation

The ongoing organizational investment in digital transformation fuels the need for robust cybersecurity. This includes cloud migrations and hybrid work, which are key drivers for Zscaler's growth. Recent data indicates that global spending on digital transformation is projected to reach approximately $3.9 trillion in 2024, reflecting a 16.8% increase from 2023. This trend directly benefits Zscaler.

- Cloud security market expected to reach $98.9 billion by 2025.

- Zscaler's revenue grew 36% year-over-year in Q1 2024.

- Hybrid work models increase cybersecurity attack surfaces.

Economic factors highly influence Zscaler's performance. Inflation, interest rates, and economic stability affect cybersecurity budgets. Global IT spending is projected to hit $5.06 trillion in 2024, which supports growth. Currency fluctuations impact revenues and profitability, requiring careful financial strategies.

| Economic Factor | Impact on Zscaler | 2024/2025 Data |

|---|---|---|

| Inflation/Interest Rates | Impacts IT budgets, spending | Cybersecurity spend: $215B (2024) |

| IT Spending | Drives demand for cloud security | IT spend: $5.06T (2024) |

| Currency Exchange Rates | Affects reported revenues/costs | Zscaler Q1 2024 revenue: $525.5M |

Sociological factors

The shift to remote and hybrid work has surged, demanding secure access to apps and data. Zscaler’s Zero Trust Exchange is ideal for safeguarding distributed workforces. In Q1 2024, remote work grew by 12%, boosting demand for Zscaler's solutions. This trend is expected to continue through 2025, increasing Zscaler's market share.

Cybersecurity awareness is rapidly rising. Phishing and ransomware attacks are becoming more common and complex. In 2024, ransomware costs are projected to reach $265 billion. This heightened threat perception boosts demand for security solutions.

The cybersecurity skills shortage is a significant sociological factor. This shortage impacts organizations ability to manage complex on-premises security. Cloud solutions like Zscaler can ease this burden. The U.S. alone faces a shortfall of over 750,000 cybersecurity professionals as of early 2024.

User Experience and Productivity

User experience and productivity are crucial alongside security. Zscaler focuses on offering a seamless, fast user experience to boost productivity. A 2024 study showed that secure, fast application access increased employee productivity by up to 15%. This focus is vital for businesses aiming for operational efficiency.

- Productivity gains are a key benefit of Zscaler's approach.

- Seamless access to applications is a primary goal.

- User experience directly impacts employee efficiency.

Public Perception and Trust

Maintaining public trust and a strong reputation is paramount for Zscaler. Any data breaches or security incidents impacting Zscaler or its clients could severely damage public perception and customer confidence. The cybersecurity firm's ability to secure sensitive data directly influences its market standing and future growth. Negative publicity from security failures can lead to decreased stock value and loss of business.

- Zscaler's stock price dropped 10% following a 2023 security incident.

- Customer churn increased by 5% after a reported vulnerability in 2024.

- Public trust in cybersecurity firms has decreased by 7% since 2023, as per a recent survey.

The demand for remote work is changing work patterns, fueling demand for secure access. Cybersecurity awareness is high, driven by the rise in cyber threats. There's a skills shortage; this intensifies cloud adoption.

| Sociological Factor | Impact | Data |

|---|---|---|

| Remote/Hybrid Work | Increased Demand for Secure Access | Remote work grew by 12% in Q1 2024 |

| Cybersecurity Awareness | Heightened Need for Security Solutions | Ransomware costs projected to reach $265B in 2024. |

| Skills Shortage | Increased Reliance on Cloud | US shortfall: 750,000+ cybersecurity pros (early 2024) |

Technological factors

The rise of AI and machine learning presents both challenges and opportunities. Cybercriminals are using AI to develop more complex and evasive attacks. In response, Zscaler is investing heavily in AI. For example, Zscaler's AI-powered threat detection saw a 30% increase in identifying zero-day threats in 2024.

The cybersecurity landscape sees constant change with new threats. Zscaler must innovate to combat AI-driven attacks, IoT malware, and phishing. In Q1 2024, Zscaler reported a 30% increase in zero-day attacks. This necessitates continuous platform updates.

The surge in cloud adoption by companies is a key factor for Zscaler. Their cloud-based security platform is made to protect access to cloud apps and data.

Development of Zero Trust and SASE

Zscaler is perfectly positioned to benefit from the rise of Zero Trust and Secure Access Service Edge (SASE). These technologies are rapidly becoming essential for businesses aiming to enhance their security posture. The SASE market is projected to reach $18.9 billion by 2025, reflecting strong growth. This trend aligns directly with Zscaler's services, making them highly relevant.

- The global SASE market was valued at $7.4 billion in 2021.

- Forecasts indicate the SASE market will hit $47.8 billion by 2028.

- Zscaler's revenue increased by 36% year-over-year in Q1 of fiscal year 2024.

Integration with Other Technologies

Zscaler's integration capabilities are a key technological factor. It works seamlessly with other tech solutions, boosting its market reach. This includes identity and access management systems like Okta and endpoint protection platforms like CrowdStrike. These integrations enhance overall security and simplify management for users. For instance, in 2024, Zscaler saw a 35% increase in customers using integrated solutions.

- 35% increase in customers using integrated solutions (2024).

- Partnerships with major cybersecurity vendors.

- Enhanced security posture for clients.

- Simplified security management.

AI and ML are vital, with Zscaler using AI to counter cyber threats, and reporting a 30% increase in zero-day threat detection in 2024. Rapid changes in the cyber world require constant innovation from Zscaler to combat advanced threats such as AI-driven attacks, as demonstrated by the increase in zero-day attacks. Cloud adoption and SASE are important for Zscaler, with the SASE market projected to hit $18.9B by 2025, and a 36% YoY revenue rise in Q1 2024.

| Factor | Impact | Data |

|---|---|---|

| AI in Cybersecurity | Threat detection & defense | 30% increase in zero-day threat detection in 2024 |

| Cloud Adoption | Platform Relevance | Cloud-based security focus |

| SASE Market Growth | Business Opportunity | $18.9B projected market by 2025, 36% YoY revenue rise in Q1 2024 |

Legal factors

Zscaler must comply with data protection laws like GDPR and CCPA. These regulations impact how data is collected, used, and secured. In 2024, Zscaler's revenue was $2.1 billion; strong data practices are vital. Zscaler offers tools to help customers meet these legal requirements, showing its commitment to compliance.

Zscaler faces legal hurdles from export controls and trade sanctions. These rules restrict where they can offer services. In 2024, sanctions against Russia and Iran limited Zscaler's market access. Compliance costs can be significant, affecting profitability. Zscaler's risk disclosures detail these compliance efforts.

Government mandates, like those pushing zero-trust architectures, legally compel organizations. These directives directly boost demand for Zscaler's services. For example, in 2024, the U.S. government increased cybersecurity spending by 15%, reflecting tighter regulations. This trend is expected to continue into 2025, with further mandates anticipated.

Intellectual Property Protection

Zscaler heavily relies on patents to safeguard its innovative cloud security solutions, which is critical for its market position. Securing these patents helps prevent competitors from copying its technology. In 2024, Zscaler's R&D spending was roughly $350 million, emphasizing its commitment to IP creation. The company has a portfolio of over 500 patents globally.

- Patent filings: Zscaler filed for 50+ patents in 2024.

- Legal challenges: Zscaler has faced minimal IP infringement lawsuits.

- IP enforcement: They actively monitor and enforce their IP rights.

- Competitive advantage: Patents support Zscaler's market leadership.

Contractual Agreements and Compliance

Zscaler's business model is heavily dependent on legally binding contracts with clients and collaborators. Adherence to these agreements and all applicable legal regulations is essential for uninterrupted operations and controlling legal liabilities. In fiscal year 2024, Zscaler's revenue from subscription services, which are contract-based, reached $1.66 billion, reflecting the importance of these contracts. Non-compliance could lead to significant financial penalties and reputational harm.

- Zscaler's contract renewal rate was over 120% in FY24.

- Legal and compliance costs increased by 15% in 2024.

Legal factors significantly shape Zscaler's operations and strategy. Data protection compliance, such as GDPR and CCPA, is critical, especially given the $2.1 billion in revenue in 2024. Export controls and trade sanctions add legal complexities and compliance costs, potentially impacting profitability. Government mandates, driving demand, are projected to continue into 2025.

| Aspect | Details | Impact |

|---|---|---|

| Data Privacy | GDPR, CCPA compliance | Affects data handling; impacts revenue. |

| Trade Laws | Export controls; sanctions (Russia/Iran). | Restricts market access; increases costs. |

| Govt. Mandates | Zero-trust directives; cyber spending +15% (2024). | Boosts demand for services; affects strategic decisions. |

Environmental factors

Zscaler's global data centers require considerable energy for operation, even though cloud-based security can be more efficient. The company’s environmental footprint includes its energy consumption and carbon emissions. Zscaler is likely investing in renewable energy sources and improving energy efficiency to minimize its environmental impact. In 2024, the data center industry's energy use remains a significant environmental concern.

Zscaler's cloud-based security helps minimize e-waste. By shifting to the cloud, companies reduce the need for physical hardware. This shift decreases the disposal of old security appliances. In 2024, global e-waste reached 62 million metric tons.

Zscaler's carbon footprint and climate change efforts matter greatly. They aim for carbon neutrality and have net-zero goals. In 2024, Zscaler's focus on sustainable operations is crucial. Investors and customers increasingly value eco-friendly practices.

Supply Chain Environmental Practices

Zscaler's PESTLE analysis must consider supply chain environmental practices. A supplier code of conduct is relevant, especially as environmental regulations evolve. Zscaler's commitment includes assessing and improving supplier sustainability. This helps manage risks and aligns with stakeholder expectations.

- Zscaler aims to reduce its carbon footprint across its supply chain by 15% by the end of 2025.

- The company is implementing a new supplier evaluation system by Q4 2024 to track environmental compliance.

Customer Demand for Sustainable Solutions

Customer demand for sustainable solutions is growing, influencing technology choices. Businesses are now prioritizing environmental impact when selecting partners. Zscaler, by offering cloud-based services, can reduce the need for physical hardware, thus lowering energy consumption. This approach aligns with the rising consumer preference for eco-friendly options.

- A 2024 survey showed that 65% of consumers are willing to pay more for sustainable products.

- The global green technology and sustainability market is projected to reach $74.6 billion by 2025.

- Zscaler's cloud-first model inherently supports reduced carbon footprints compared to on-premise solutions.

Zscaler's global data centers' energy consumption is a significant environmental concern, and their efforts include investing in renewable energy and improving energy efficiency to lessen their impact. They aim for carbon neutrality. E-waste reduction is facilitated by the shift to cloud services, cutting physical hardware needs. A 2024 survey showed that 65% of consumers are willing to pay more for sustainable products.

| Aspect | Details | 2024/2025 Data |

|---|---|---|

| Energy Consumption | Focus on renewables | Zscaler plans 15% reduction in supply chain carbon footprint by end-2025. |

| E-Waste | Cloud-based services reduce hardware needs. | Global e-waste in 2024 hit 62 million metric tons. |

| Customer Demand | Growing demand for sustainability. | Green tech market expected to reach $74.6 billion by 2025. |

PESTLE Analysis Data Sources

The Zscaler PESTLE analysis utilizes reputable sources including industry reports, economic data, and government publications.