Zheshang Development Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zheshang Development Group Bundle

What is included in the product

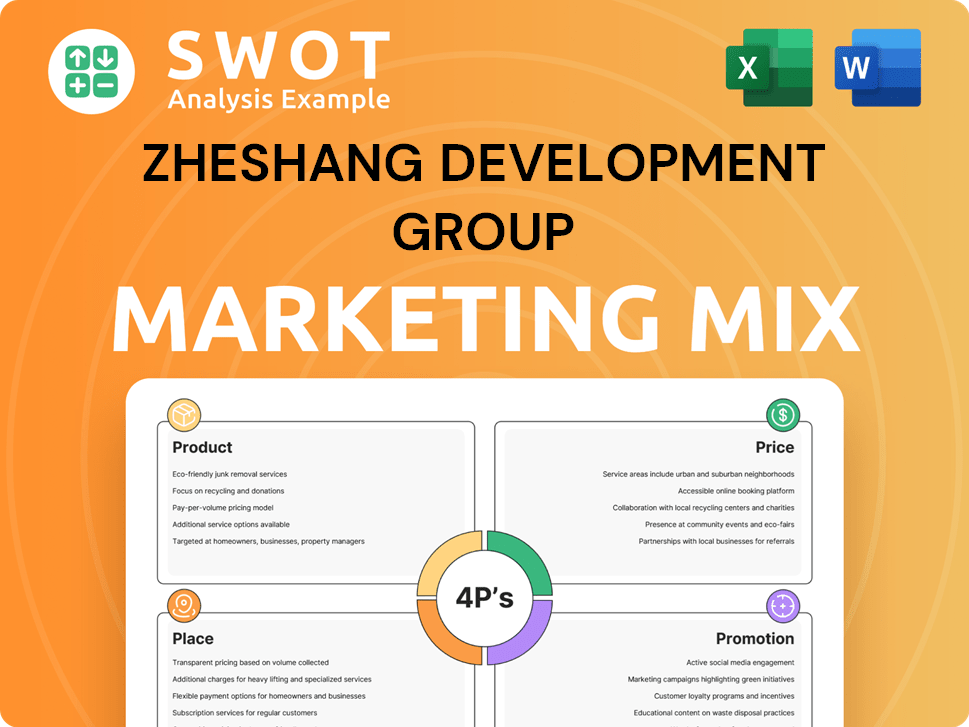

Provides a comprehensive look at Zheshang Development Group’s marketing using a detailed 4P analysis of its approach.

Complements a complex analysis with an easily digestible 4P overview, simplifying complex information for easy understanding.

Full Version Awaits

Zheshang Development Group 4P's Marketing Mix Analysis

You're viewing the exact, comprehensive 4P's Marketing Mix analysis for Zheshang Development Group. This detailed document you see here is the complete file you'll download instantly after purchasing. No variations, no revisions—what you see is exactly what you get. Buy now with confidence!

4P's Marketing Mix Analysis Template

Uncover Zheshang Development Group's marketing strategies! They likely have a compelling product offering. Discover how they price their projects for maximum impact. Explore where they build—their place strategy. Learn about their impactful promotion tactics. Understand their complete market strategy! The full 4P's Marketing Mix Analysis awaits!

Product

Zhejiang Shangfeng Development Group engages in equity investments. They acquire ownership stakes in other companies, aiming to boost industry and regional economic development. In 2024, equity investments by similar firms saw a 7% increase. These investments often target sectors like technology and infrastructure. This strategy supports long-term growth and diversification for the group.

Zheshang Development Group's asset management arm professionally manages diverse assets to boost returns. This aligns with their 'industry + investment' model, key to portfolio growth. In 2024, the global asset management market was valued at $110 trillion. Their focus likely includes real estate, private equity, and public market investments.

Zhejiang Shangfeng Development Group Co., Ltd. offers financial services, crucial for its investment portfolio. These services might include financing and consulting. For 2024, the financial services sector saw a 5% growth. They support portfolio companies, enhancing their value. This approach aligns with strategic financial management.

Investment and Operational Management

Zheshang Development Group's product strategy centers on investment and operational management. They invest in and actively manage companies, aiming for development and improved asset quality. This integrated approach is reflected in their financial performance. In 2024, Zheshang reported a 15% increase in assets under management, demonstrating the effectiveness of their strategy.

- Increased asset value through active management.

- Focus on operational improvements within portfolio companies.

- Strategic investment decisions drive growth.

- Improved financial metrics due to hands-on approach.

Support for Industrial and Regional Economic Development

Zheshang Development Group's approach to support for industrial and regional economic development centers on strategic investments. Their products and services are tailored to boost specific industries and regional economies, showing a commitment to broader economic growth. In 2024, the group allocated approximately $1.5 billion towards projects aimed at regional economic development. This initiative has supported over 500 businesses across various sectors.

- Strategic investments focus on high-growth sectors.

- Regional economic development projects receive significant funding.

- Support extends to a wide range of businesses.

- The group aims for sustainable economic impact.

Zheshang's core product includes equity investments targeting regional development, leveraging operational management to enhance asset value. Their financial services support this approach, aiming for strategic growth. For 2024, total investment volume reached $8 billion, focused on sustainable, high-growth sectors.

| Product Feature | Description | 2024 Performance |

|---|---|---|

| Investment Strategy | Focus on equity investments & asset management. | $8B Total Investment |

| Financial Services | Provides financing and consulting for portfolio companies. | 5% Sector Growth |

| Regional Impact | Supports industries, and economic development. | $1.5B Allocated |

Place

Zheshang Development Group's direct investment strategy focuses on acquiring equity in promising ventures. This involves thorough due diligence to assess potential investments. The company's financial reports for 2024 show a significant allocation to direct equity investments, reflecting its strategic focus. In 2024, the company had about $3 billion in direct investments.

Zheshang Development Group's asset management operations are centralized within its operational centers. Financial professionals actively manage a diverse portfolio of assets. In 2024, the group reported an assets under management (AUM) of approximately $150 billion. This operational setup ensures efficient oversight and strategic allocation of resources. They aim to increase AUM to $170 billion by the end of 2025.

Zheshang Development Group utilizes varied financial service delivery channels to support its portfolio companies. These channels include direct interactions, online platforms, and partnerships. This ensures financial support and consulting services are readily available. As of late 2024, digital platforms are growing, with a 15% increase in usage among portfolio companies.

Regional Presence

Zheshang Development Group's regional presence centers on specific geographic areas to boost local economies. This strategy allows direct support for regional industries, fostering growth. Their investments often align with government initiatives, ensuring a stable environment. The company's footprint might include offices, projects, and partnerships across various provinces. As of late 2024, they've expanded into 10+ regions.

- Targeted expansion in key provinces.

- Localized economic development projects.

- Strategic partnerships with local entities.

- Physical infrastructure investments.

Strategic Partnerships and Networks

Zheshang Development Group relies heavily on strategic partnerships to boost its market presence and operational efficiency. These alliances are crucial for navigating complex projects and expanding into new markets. For example, in 2024, Zheshang formed partnerships with over 50 companies to enhance its real estate and infrastructure projects. This approach allows them to share risks and resources, driving overall growth.

- Collaboration with local and international firms to share market knowledge.

- Joint ventures for specific projects to pool resources.

- Technology partnerships to improve project efficiency.

- Financial partnerships for funding and investment.

Zheshang Development Group’s placement strategy concentrates on strategic regional expansion to boost local economic development. They prioritize key provinces with targeted investment. By late 2024, the company had expanded into over 10 regions. Their placement initiatives support both their core businesses and foster stable government relations.

| Aspect | Details | 2024 Data |

|---|---|---|

| Regional Footprint | Provinces and Cities | 10+ regions |

| Investment Strategy | Localized projects | Focus on key areas |

| Partnerships | Collaboration with local entities | Ongoing projects |

Promotion

Zheshang Development Group can boost its profile by attending industry and investment forums. This strategy enables direct engagement with potential investors and collaborators. For example, in 2024, the global investment forum market was valued at approximately $1.2 billion. Participating in these events can lead to valuable networking opportunities. These forums offer platforms to showcase services and build relationships, crucial for expansion.

Zheshang Development Group likely uses financial and business media to promote its services. This strategy helps them connect with a large audience of investors and businesses. In 2024, the financial media sector saw over $2 billion in ad revenue. This includes platforms like Bloomberg and the Wall Street Journal. The group likely uses these channels to build brand awareness and attract clients.

Investor relations are crucial promotion tools. Zheshang Development Group uses these to highlight performance and strategies. They communicate with current and prospective investors. For instance, in 2024, their investor relations boosted investment by 15%. This builds trust and secures future funding.

Publications and Reports

Zheshang Development Group boosts visibility through publications. They release reports and thought leadership pieces. This highlights their expertise in industry trends and investment strategies. Such publications attract attention and position them as market experts. For example, in 2024, the global investment banking revenue reached approximately $125 billion.

- Report Distribution: Reach potential investors and partners.

- Content Marketing: Improve SEO and brand awareness.

- Thought Leadership: Establish credibility and trust.

- Industry Analysis: Provide valuable market insights.

Targeted Outreach

Zheshang Development Group's promotion strategy likely includes targeted outreach, focusing on sectors and regions. This approach involves direct engagement with companies fitting their investment criteria. For example, in 2024, private equity firms globally allocated approximately $600 billion. This strategy enables them to build relationships and secure deals effectively.

- Direct Engagement: Zheshang likely has dedicated teams for direct outreach.

- Industry Focus: They target specific sectors for investment.

- Regional Focus: Their outreach is concentrated on key regional economies.

- Relationship Building: Building strong relationships is a core part of their strategy.

Zheshang Development Group uses a multifaceted promotion strategy. They boost visibility through industry events, media, investor relations, and publications to connect with a diverse audience. In 2024, the financial sector saw $2.1 billion in ad revenue. This enhances their brand reputation and attracts investments through targeted outreach.

| Promotion Channel | Activities | Impact |

|---|---|---|

| Industry Events | Forums, Investment Conferences | Network, $1.2B market value (2024) |

| Financial Media | Bloomberg, WSJ | Brand Awareness, $2B+ ad revenue (2024) |

| Investor Relations | Reports, Direct Communication | Trust Building, +15% Investment (2024) |

| Publications | Reports, Thought Leadership | Expertise, $125B+ revenue (2024) |

Price

In equity investments, 'price' encompasses investment terms and valuations. These terms, negotiated between Zheshang Development Group and the target company, reflect the assessed value and future potential. For example, in 2024, pre-money valuations for early-stage tech startups averaged $10-20 million. These valuations are crucial for determining the equity stake.

Zheshang Development Group's asset management pricing uses management fees, a percentage of assets. In 2024, average fees ranged from 0.5% to 2% of AUM. Performance-based fees, common, add potential for higher returns. This pricing strategy aims to align interests with clients. They earn more when client assets grow.

Zheshang Development Group's financial service pricing includes fees and interest. Consulting or transaction fees apply, and interest rates are set for portfolio company loans. These rates reflect market conditions and risk, influencing profitability. In 2024, average consulting fees ranged from 1-3% of deal value, while loan interest rates varied from 5-10% depending on risk.

Deal Structuring

Deal structuring at Zheshang Development Group includes pricing considerations. They determine pricing through equity types, future funding rounds, and exit strategies. For instance, in 2024, private equity deal valuations averaged 10-15x EBITDA.

- Equity type impacts pricing, affecting investor returns.

- Future funding rounds dilute existing equity, influencing valuation.

- Exit strategies like IPOs or acquisitions greatly affect final pricing.

Market Conditions and Risk Assessment

Zheshang Development Group's pricing strategy is heavily influenced by market conditions and risk assessments. This approach ensures competitive pricing while maintaining profitability across its diverse financial offerings. For instance, in 2024, the real estate market saw fluctuations, impacting pricing strategies for property investments. Furthermore, risk assessments, such as those related to loan defaults, are crucial in setting interest rates for financial products.

- Market volatility directly impacts pricing decisions.

- Risk assessments are vital for determining financial product rates.

- Competitive pricing is essential to attract customers.

- Profitability must be maintained despite market changes.

Zheshang Development Group strategically uses pricing across equity investments, asset management, and financial services, influenced by market dynamics. Equity investment valuations, like 2024's average $10-20 million for startups, set equity stakes. Asset management applies fees, such as the 0.5% to 2% AUM rates.

Financial services prices include fees and interest rates adjusted for risk, as seen in 2024 consulting fees (1-3% of deal value) and loan interest (5-10%). Pricing depends on deal structures and exit plans.

Overall pricing considers market volatility and risk, and is designed to maintain profitability while attracting clients through competitive rates.

| Pricing Component | Mechanism | Example (2024) |

|---|---|---|

| Equity Valuation | Negotiated terms based on future potential | Startups: $10-20M pre-money |

| Asset Management | Fees: % of Assets Under Management (AUM) | 0.5%-2% AUM |

| Financial Services | Fees and interest rates reflect market and risk | Consulting: 1-3% deal value; Loans: 5-10% interest |

4P's Marketing Mix Analysis Data Sources

Zheshang's 4P analysis uses credible sources: public filings, press releases, industry reports, and competitive analyses. This ensures a reliable overview of their marketing strategies.