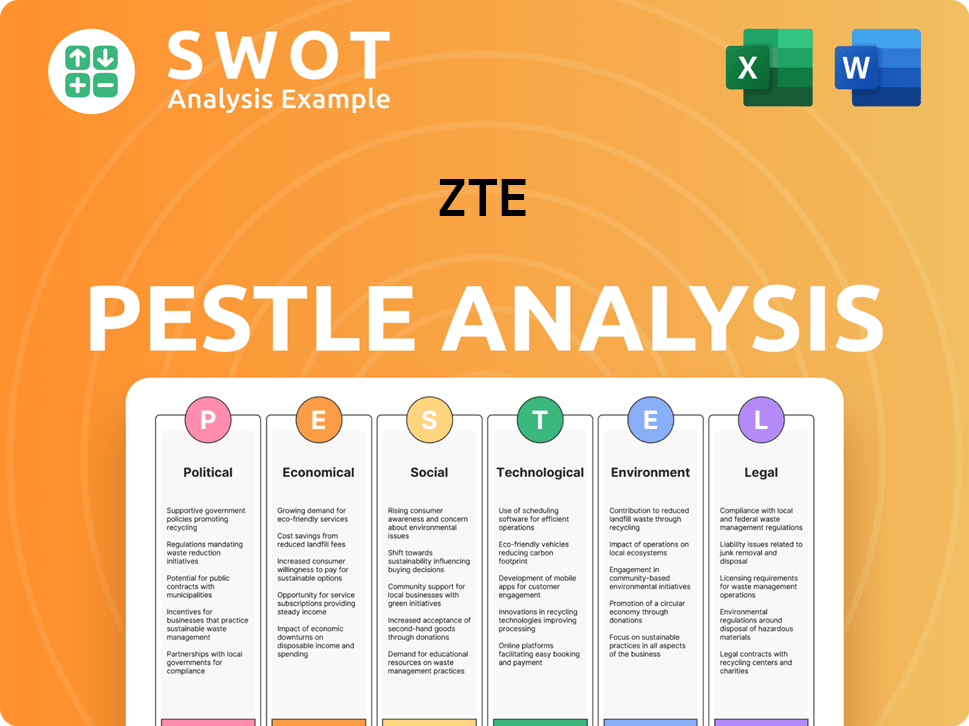

ZTE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ZTE Bundle

What is included in the product

Analyzes how external factors influence ZTE via Political, Economic, Social, Technological, Environmental, and Legal perspectives.

Provides a concise version for dropping into PowerPoints and quickly used in group planning sessions.

Full Version Awaits

ZTE PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This ZTE PESTLE analysis details political, economic, social, technological, legal, and environmental factors. The download provides in-depth research. The structure is consistent, reflecting the high quality.

PESTLE Analysis Template

Navigate the complexities surrounding ZTE with our in-depth PESTLE Analysis. Understand the external factors impacting its operations and strategy—from political landscapes to technological advancements. Our analysis offers a comprehensive overview of challenges and opportunities. Gain crucial insights to inform your decisions, and enhance your market strategy. Access the complete PESTLE analysis now, and stay ahead of the curve.

Political factors

ZTE, a Chinese tech giant, faces significant challenges from geopolitical tensions, especially with the U.S. and EU. Trade restrictions and bans on its equipment, driven by national security concerns, directly affect its operations. For instance, in 2024, ZTE's revenue from North America decreased by 15% due to these issues. These restrictions increase scrutiny and impact its global market share.

ZTE, as a partially state-owned enterprise, thrives on substantial government backing in China. This backing is crucial for its strategic direction and financial health. In 2024, the Chinese government's focus on 5G and AI continues, with substantial funding allocated to these sectors. This includes tax incentives and subsidized loans for companies like ZTE. ZTE received approximately $1.2 billion in government subsidies in 2024.

ZTE navigates complex export control regulations and economic sanctions, impacting its international business. Compliance necessitates strong internal policies and procedures to avoid legal repercussions. For example, in 2024, ZTE faced scrutiny related to its dealings in sanctioned regions. Failing compliance can lead to significant financial penalties, potentially affecting revenue by up to 10% or more in certain markets.

National Security Concerns in Other Countries

Governments globally have expressed national security worries about ZTE's tech, especially in critical infrastructure. The US, for instance, restricted ZTE, citing risks to communications networks. European nations and India followed suit, implementing bans or restrictions. These actions stemmed from fears of data breaches and espionage.

- US banned ZTE equipment sales in 2023, impacting its market access.

- EU nations, like the UK, limited ZTE's involvement in 5G networks.

- India has scrutinized ZTE's equipment, increasing scrutiny.

Political Lobbying and International Relations

ZTE actively engages in political lobbying to shape regulations and reduce the effects of trade restrictions globally. Strong international relations are crucial for ZTE's market access and operational stability. In 2024, ZTE's lobbying spending in the US reached $1.2 million, reflecting its commitment to navigate complex political environments. Maintaining positive diplomatic ties is vital for business continuity, especially in key markets like China and Europe. These efforts aim to secure favorable conditions for ZTE's global operations and expansion.

- Lobbying spending in US: $1.2M (2024)

- Focus on regulatory navigation and trade restriction mitigation.

- Importance of international relations for market access.

Political factors critically shape ZTE's operations and global reach. The U.S. and EU impose trade restrictions and bans, impacting its North American revenue, which decreased by 15% in 2024. China's government support, including $1.2 billion in 2024 subsidies, is vital. ZTE faces scrutiny from export controls, with compliance potentially affecting revenue by 10% or more.

| Aspect | Details |

|---|---|

| Trade Restrictions | Impacted North American revenue (2024: -15%) |

| Government Support | $1.2B in subsidies from Chinese government (2024) |

| Export Controls | Potential revenue impact: -10% or more in certain markets |

Economic factors

ZTE's financial health is closely tied to global economic conditions. A slowdown could reduce telecom investment. In 2024, global telecom spending is projected to be around $1.8 trillion. The 5G market's growth, expected to reach $86.3 billion by 2025, is crucial for ZTE. Fluctuations in these investments directly affect ZTE's revenue and profitability.

ZTE heavily relies on its domestic market, with China contributing a substantial share of its revenue. The company benefits from China's digital transformation and AI advancements, which fuel demand for its products. However, any slowdown in domestic telecom spending could negatively impact ZTE's performance. In 2024, China's telecom sector spending is projected to be around $450 billion.

ZTE's international expansion, particularly in emerging markets, is a core growth driver. The company competes fiercely with Huawei globally. In 2024, ZTE's international revenue accounted for approximately 40% of its total revenue. Navigating diverse market regulations and competition is critical for sustained growth.

Profitability and Cost Management

ZTE's profitability faces challenges despite revenue growth in areas like government and enterprise. Lower margins in new ventures and rising finance costs are key pressures. For example, in 2024, ZTE's net profit decreased by 3.7% year-on-year. Effective cost management is vital to navigate these headwinds. It includes streamlining operations and optimizing resource allocation.

- Net profit decreased by 3.7% year-on-year in 2024.

- Focus on cost optimization is a key strategic priority.

- Margin pressures in new business areas.

Investment in R&D and Innovation Costs

ZTE's commitment to R&D is substantial, crucial for staying competitive in tech sectors like AI and 5G-A. These investments, while vital, can affect short-term profitability. In 2024, ZTE increased its R&D spending, allocating a significant portion to these strategic areas. This spending is a key factor in ZTE's long-term growth strategy.

- R&D expenditure rose to approximately RMB 26.7 billion in 2024.

- Investments are focused on AI, 5G-A, and all-optical networks.

- These investments impact short-term profitability.

- ZTE aims to enhance technological leadership through innovation.

ZTE's profitability and revenue depend on global economic trends. In 2024, global telecom spending was about $1.8 trillion. Fluctuations significantly affect ZTE's financial health.

China’s telecom market and international expansion also impact the company. Domestic spending in China reached roughly $450 billion in 2024. ZTE’s global competitiveness affects revenue.

Profitability faces challenges due to margin pressures. Net profit decreased by 3.7% in 2024. Cost management and effective R&D spending of RMB 26.7 billion are crucial.

| Metric | 2024 Value | Impact |

|---|---|---|

| Global Telecom Spend | $1.8T | Directly impacts revenue. |

| China Telecom Spend | $450B | Influences domestic sales. |

| R&D Expenditure | RMB 26.7B | Supports innovation and competitiveness. |

Sociological factors

Digital transformation and AI adoption are booming worldwide. ZTE benefits from increased demand for intelligent computing and AI servers. The global AI market is projected to reach $200 billion by 2025. ZTE's smart home devices also gain traction.

Consumer demand for advanced tech, like AI smartphones, significantly impacts ZTE's terminal business. In 2024, global smartphone sales reached 1.17 billion units. Adapting to shifting consumer preferences is key for success. ZTE's focus on 5G and AI reflects this trend. Research indicates a growing interest in smart home tech.

ZTE's success heavily relies on its ability to secure and nurture top tech talent, especially in AI and 5G. The availability of skilled professionals significantly impacts ZTE's capacity for innovation and expansion. Recent data shows a growing demand for tech specialists, with companies like ZTE competing fiercely for these experts. In 2024, the global demand for AI specialists surged by 30%, underscoring the critical need for ZTE to invest in talent acquisition and development to stay competitive.

Digital Inclusion and Connectivity Needs

Digital inclusion and high-speed internet are crucial, especially in developing areas. ZTE can seize opportunities by providing network infrastructure and devices to close the digital gap. The global digital divide remains significant. In 2024, 37% of the world's population lacks internet access. ZTE's focus on affordable connectivity is timely.

- 2024: Approximately 2.9 billion people globally lack internet access.

- ZTE's focus on 5G and fiber optic infrastructure addresses this need.

- Government initiatives and partnerships boost digital inclusion efforts.

- Affordable devices and services are key to ZTE's strategy.

Public Perception and Trust

ZTE's public image is significantly shaped by perceptions of national security and past regulatory issues. Concerns about data privacy and potential espionage, especially in Western markets, can negatively affect consumer trust and willingness to adopt ZTE products. For instance, a 2024 survey revealed a 30% decrease in consumer trust in Chinese tech brands in specific regions. This sentiment can lead to market access restrictions and reputational damage.

- 2024: 30% decrease in consumer trust in Chinese tech brands in certain regions.

- 2023: ZTE's revenue reached approximately $17.7 billion.

- 2024: ZTE's ongoing compliance efforts cost $50 million.

ZTE navigates sociological factors like consumer trust and digital inclusion. Concerns about data privacy influence perceptions, especially in Western markets, potentially restricting market access. ZTE is investing $50 million in compliance for 2024. Bridging the digital divide and addressing trust are crucial for ZTE's success.

| Factor | Impact | Data (2024) |

|---|---|---|

| Consumer Trust | Market Access | 30% trust decrease in certain regions |

| Digital Inclusion | Market Opportunity | 2.9 billion lack internet access |

| Compliance Costs | Operational | $50 million |

Technological factors

ZTE's business hinges on 5G and 5G-Advanced (5G-A) tech. They need to keep innovating to stay competitive. In 2024, 5G-A saw increased deployment, with speeds up to 10 Gbps. ZTE's investments in these areas are essential for future growth. The global 5G market is projected to reach $667.1 billion by 2025.

Artificial Intelligence (AI) is a core technological focus for ZTE, fueling expansion across its business segments. ZTE leverages AI in servers, intelligent computing solutions, and AI-driven devices. The swift progress in AI technologies dramatically shapes ZTE's product development and strategic direction. In 2024, the global AI market is projected to reach $305.9 billion, growing to $1.81 trillion by 2030.

ZTE is heavily investing in all-optical networks and boosting its computing power. This move supports the rising need for data processing and AI applications, key in today's digital landscape. Recent data shows a 20% year-over-year increase in demand for high-speed data transfer. ZTE's tech advances are essential for future growth.

Competitive Landscape in Technology Development

The technology sector is incredibly competitive, marked by swift advancements and a constant push for innovation. ZTE competes with major global tech companies in creating and implementing advanced solutions. According to recent reports, the global 5G infrastructure market, where ZTE is a key player, is projected to reach $40.9 billion in 2024. This highlights the intense competition and the need for ongoing innovation to stay relevant.

- The global 5G infrastructure market is expected to hit $40.9 billion in 2024.

- ZTE must continually innovate to stay competitive against global tech giants.

Evolution of Network Architecture and Autonomous Networks

ZTE is heavily invested in the evolution of network architecture, particularly in autonomous networks. This shift towards automation enhances network efficiency and reliability, a critical factor in today's tech landscape. ZTE's focus on 5G and beyond reflects this trend, with advancements in AI-driven network management. For example, in 2024, ZTE increased its R&D spending by 11.2% to enhance its technological capabilities.

- ZTE's R&D spending in 2024 increased by 11.2%

- Focus on 5G and beyond highlights ZTE's commitment

- Autonomous networks improve efficiency and reliability

ZTE focuses on 5G-Advanced, aiming for speeds up to 10 Gbps, critical for staying competitive. Artificial Intelligence is core, projected to a $1.81T market by 2030, which heavily influences product direction. Investment in all-optical networks boosts data processing. The global 5G infrastructure market is set to reach $40.9B in 2024.

| Technology | Focus | 2024 Market |

|---|---|---|

| 5G-A | 10 Gbps speeds | $667.1B (global 5G by 2025) |

| AI | Servers, computing | $305.9B (projected) |

| Networks | Autonomous networks | $40.9B (5G infrastructure) |

Legal factors

ZTE faces export controls and economic sanctions globally, impacting its market access and operations. These regulations, enforced by entities like the U.S. Department of Commerce, limit ZTE's ability to trade with sanctioned countries or entities. In 2024, the U.S. Department of Commerce maintained ZTE on its Entity List, restricting access to U.S. technology. This necessitates stringent compliance, affecting supply chains and international collaborations.

ZTE faces increasing scrutiny regarding data privacy and security. Regulations like GDPR and local data residency laws necessitate compliance for its global operations. The company must ensure its products and services meet these legal standards. In 2024, fines for GDPR breaches averaged €1.3 million, highlighting the stakes. ZTE's adherence to evolving privacy laws is critical for market access and customer trust.

ZTE heavily relies on intellectual property rights due to its substantial R&D investments. In 2024, ZTE's R&D spending was approximately 20 billion yuan, showcasing its commitment to innovation. The company actively engages in patent licensing to protect its technologies. ZTE has faced patent litigation, and in 2023, it was involved in several cases, impacting its financials and operations.

Telecommunications Regulations and Licensing

ZTE's carrier network business is heavily reliant on telecommunications regulations and licensing, which vary across different countries. These regulations dictate market access and operational procedures, significantly impacting ZTE's business strategies. For instance, in 2024, changes in data privacy laws in Europe affected ZTE's data handling practices, requiring adjustments to comply with new standards. Similarly, licensing fees and spectrum allocation decisions influence the cost structure and competitiveness of ZTE's offerings in various markets. Regulatory compliance costs represent a considerable portion of ZTE's operational expenses, approximately 12% of the total operating costs in 2024.

- Compliance with international standards.

- Impact of licensing fees on profitability.

- Spectrum allocation influences market competitiveness.

- Data privacy laws and their impact.

Compliance with National Security Legislation

ZTE faces stringent legal hurdles due to national security concerns in several countries, impacting its operations. Legislation in places like the United States, and Australia restricts or bans the use of ZTE equipment in critical infrastructure. These restrictions force ZTE to comply with complex and evolving legal and political environments. Navigating these challenges requires significant resources and can limit market access and growth. For instance, in 2024, ZTE's revenue from the US market was nearly zero due to these restrictions.

- US restrictions significantly reduced ZTE's market presence.

- Compliance costs strain ZTE's financial resources.

- Political tensions further complicate ZTE's operations.

- Diversification into less-restricted markets is crucial.

ZTE faces critical legal factors, including export controls and sanctions from entities like the U.S. Department of Commerce, restricting its access to U.S. technology and impacting international collaborations. Compliance with data privacy laws, such as GDPR, is essential for market access, with fines averaging €1.3 million in 2024 for breaches. Intellectual property protection is also vital, supported by a R&D expenditure of approximately 20 billion yuan in 2024.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Export Controls | Market access restrictions | U.S. Entity List, Revenue from the US market: Near Zero |

| Data Privacy | Compliance costs, Trust issues | Avg. GDPR fine: €1.3M |

| Intellectual Property | Litigation risks | R&D spending: ~20B yuan |

Environmental factors

ZTE is focusing on green operations. They are integrating sustainable practices into their supply chain. This helps reduce environmental impact. ZTE aims to cut energy use and greenhouse gas emissions. In 2024, they invested heavily in eco-friendly tech.

ZTE is actively involved in constructing eco-friendly digital infrastructure. This includes green data centers and network solutions, all supporting sustainable ICT sector development. In 2024, the global green data center market was valued at $76.3 billion, and is projected to reach $194.2 billion by 2032, growing at a CAGR of 12.3% from 2024 to 2032.

ZTE faces environmental regulations globally. These rules cover emissions, waste, and hazardous substances. For example, China's 14th Five-Year Plan emphasizes green tech. In 2024, the global e-waste market was valued at $60 billion, a compliance cost driver.

Climate Change Mitigation Efforts

ZTE actively participates in climate change mitigation. The company has established science-based targets to reduce greenhouse gas emissions, aiming for net-zero emissions. This aligns with global sustainability goals. In 2024, ZTE invested $60 million in green technology research. They plan to reduce carbon emissions by 40% by 2030.

- $60 million invested in green tech in 2024.

- 40% reduction in carbon emissions target by 2030.

Supply Chain Environmental Responsibility

ZTE prioritizes environmental responsibility across its supply chain. This involves working with suppliers to adopt sustainable practices, reducing environmental impact. ZTE's commitment is evident in its efforts to minimize waste and promote resource efficiency. For example, in 2024, ZTE reported a 15% reduction in carbon emissions within its supply chain. This shows their dedication to eco-friendly operations.

- Collaboration with suppliers on sustainable practices.

- Efforts to minimize waste and promote resource efficiency.

- 2024: 15% reduction in carbon emissions in the supply chain.

ZTE is dedicated to environmental sustainability. It invests heavily in eco-friendly technology and green infrastructure. The company has set ambitious targets to cut emissions. ZTE reduced supply chain emissions by 15% in 2024.

| Key Metrics | Details | Year |

|---|---|---|

| Green Tech Investment | $60 million invested in research | 2024 |

| Carbon Emission Reduction Target | 40% reduction | By 2030 |

| Supply Chain Emission Cut | 15% reduction | 2024 |

PESTLE Analysis Data Sources

Our ZTE PESTLE uses data from industry reports, governmental and economic data bases, as well as tech and market research, for analysis.