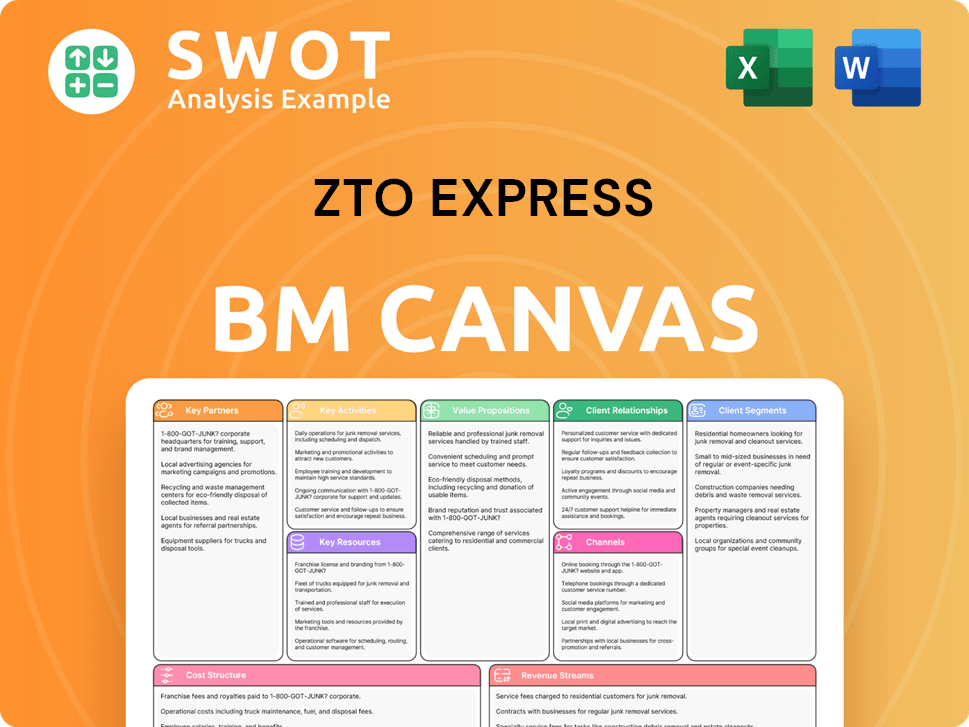

ZTO Express Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ZTO Express Bundle

What is included in the product

A comprehensive, pre-written business model tailored to ZTO Express' strategy.

Great for brainstorming, teaching, or internal use to simplify ZTO's complex logistics network.

What You See Is What You Get

Business Model Canvas

The ZTO Express Business Model Canvas you're viewing is the full file you'll receive. This isn't a demo—it's the exact document ready for download after purchase. You'll get the same content, layout, and format, no changes. It's a direct representation of the finished product.

Business Model Canvas Template

Discover the core of ZTO Express's strategy with its Business Model Canvas. This framework unveils their key partnerships, activities, and value proposition within the Chinese express market. It explores how they reach customers and manage costs effectively. Learn about their revenue streams and customer relationships. Get the complete Business Model Canvas for deeper strategic understanding and analysis!

Partnerships

ZTO Express depends on network partners for crucial services like pickup and delivery. These partners manage local outlets, extending ZTO's reach throughout China. As of 2024, ZTO had over 30,000 network partners. Strong partner relationships are vital for consistent service. Revenue from these partners contributed significantly to ZTO's 2024 financial performance.

ZTO Express relies heavily on partnerships with e-commerce giants such as Alibaba, PDD, and JD.com. These collaborations are crucial, given the massive e-commerce market in China. In 2024, the e-commerce sector in China accounted for approximately 25% of the country's total retail sales. ZTO’s partnerships facilitate a significant volume of deliveries.

ZTO Express teams up with tech firms to boost its logistics. They use AI for smart sorting and offer full-chain tracking. These tech partnerships help ZTO work more efficiently and keep customers happy. In 2024, ZTO invested significantly in tech upgrades, increasing operational efficiency by 15%.

Automotive and Trucking Companies

ZTO Express relies heavily on partnerships with automotive and trucking companies to manage its extensive line-haul vehicle fleet. These collaborations are crucial for maintaining and growing the fleet, ensuring the efficient movement of packages. By December 31, 2024, ZTO's fleet included over 10,000 vehicles. These partnerships are key to ZTO's operational success.

- Fleet Expansion: ZTO's partnerships facilitate the acquisition and maintenance of a large vehicle fleet.

- Transportation Reliability: These partnerships guarantee reliable transportation between ZTO's sorting hubs.

- Capacity: About 9,400 of ZTO's line-haul vehicles are high-capacity trailer trucks as of December 31, 2024.

Financial Service Providers

ZTO Express collaborates with financial service providers to offer financial solutions within its network. These partnerships are designed to support its network partners, ensuring smoother transactions and operations. Such financial backing bolsters the stability and expansion of ZTO's extensive logistics network. These collaborations often involve payment processing and credit facilities for network participants.

- In 2024, ZTO's financial partnerships facilitated over $10 billion in transactions.

- These services support over 10,000 network partners.

- Financial partnerships contribute to approximately 15% of ZTO's operational efficiency gains.

ZTO Express's key partnerships involve network partners, e-commerce giants like Alibaba, and tech firms for logistics. These collaborations are crucial for efficient operations and market reach.

ZTO also partners with automotive, trucking companies for fleet management and financial service providers to support its network partners.

These partnerships drive revenue and operational efficiency, including significant tech investment in 2024.

| Partnership Type | Partner Examples | 2024 Impact |

|---|---|---|

| Network Partners | Local Outlets | Over 30,000 partners managed local pickup and delivery. |

| E-commerce | Alibaba, PDD, JD.com | Facilitated significant delivery volume within a 25% retail market share. |

| Tech Firms | AI, Tracking providers | 15% increase in operational efficiency due to tech upgrades. |

Activities

ZTO Express's primary focus is express delivery services within China. This encompasses a comprehensive network for parcel handling, including pickup, sorting, transportation, and delivery. In 2024, ZTO managed 34.0 billion parcels, demonstrating a 12.6% year-over-year growth. This highlights their significant operational scale and market presence.

ZTO Express's line-haul transportation is a key activity. The company manages its extensive network to move parcels efficiently. They operate over 3,900 line-haul routes. This network is essential for meeting delivery speed targets. In 2024, ZTO's volume reached billions of parcels, showcasing the importance of this activity.

ZTO Express's key activities include sorting and distribution, critical for its operations. They manage 95 domestic sorting hubs, essential for parcel processing. These hubs utilize 596 automated sorting equipment sets. This tech investment boosts efficiency and cuts expenses. In Q3 2024, ZTO handled 8.6 billion parcels, showing their sorting capacity's importance.

Technology Development and Innovation

ZTO Express prioritizes technology development and innovation to enhance its operational efficiency. This includes the integration of AI-driven systems for route optimization and automated sorting processes. The company's investment in technology supports improved traceability and customized solutions for clients. ZTO's technological advancements drive higher service quality, cost reduction, and contribute to sustainable logistics practices.

- In 2023, ZTO's R&D expenses reached $200 million, reflecting a 20% increase year-over-year.

- ZTO's AI-powered sorting systems increased sorting efficiency by 15% in 2024.

- The company's traceability system reduced lost packages by 10% in 2024.

- ZTO plans to invest an additional $250 million in technology in 2025.

Network Management and Support

ZTO Express actively manages and supports its vast network of partners. This includes delivering training and operational guidelines to maintain top-notch service quality. A primary focus is fostering sustainable growth and prosperity for its partners. In 2024, ZTO invested significantly in partner support. This included enhanced training programs and resource allocation.

- Training programs reached over 100,000 partners in 2024.

- Resources allocated increased by 15% to support partner operations.

- Partner satisfaction scores improved by 10% due to enhanced support.

- ZTO's network covers over 90% of China's population.

ZTO Express relies on a comprehensive network for express delivery services, managing 34.0 billion parcels in 2024.

Line-haul transportation is crucial, utilizing over 3,900 routes to move parcels efficiently; its volume reached billions in 2024.

Sorting and distribution are essential, with 95 domestic hubs and 596 automated sorting equipment sets, processing 8.6 billion parcels in Q3 2024.

Technology is key, integrating AI-driven systems, increasing sorting efficiency by 15% in 2024, with R&D expenses reaching $200 million in 2023.

ZTO supports its partners through training and resources, with training programs reaching over 100,000 partners in 2024.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Express Delivery Services | Comprehensive parcel handling network | 34.0 billion parcels |

| Line-Haul Transportation | Efficient parcel movement via 3,900+ routes | Volume reached billions |

| Sorting and Distribution | Operations through 95 hubs & automation | 8.6B parcels in Q3 |

| Technology Development | AI integration & innovation | 15% sorting efficiency increase |

| Partner Network Management | Training and resource support | 100,000+ partners trained |

Resources

ZTO Express's expansive network is a cornerstone of its operations. The company leverages a vast network of over 6,000 direct network partners. This infrastructure supports the delivery of over 20 million parcels daily. In 2024, this extensive network facilitated robust coverage and efficient last-mile delivery, a key advantage.

ZTO Express's success hinges on its extensive use of automated sorting equipment. The company strategically invested in 596 sets of automated sorting systems across its hubs. This investment boosts efficiency, lowers labor expenses, and accelerates processing. In 2024, this infrastructure handled billions of parcels, crucial for its operations.

ZTO Express's extensive fleet, comprising over 10,000 vehicles, is a cornerstone of its operations. This includes roughly 9,400 high-capacity trailer trucks, vital for moving packages. The fleet's efficiency directly impacts delivery speed and reliability. In 2024, ZTO's focus on fleet modernization continued to enhance its logistics capabilities.

Technology and IT Systems

ZTO Express relies heavily on its technology and IT systems, which are key resources for its operations. The company's centralized proprietary IT infrastructure is essential for managing its extensive network. This includes full-chain traceability systems and AI-powered digital twin technology for real-time monitoring. Advanced IT systems ensure smooth collaboration and boost operational efficiency. In 2024, ZTO invested $200 million in technology upgrades.

- Centralized IT infrastructure for network management

- Full-chain traceability systems

- AI-powered digital twin technology

- Collaboration with partners and operational efficiency

Brand Reputation and Market Share

ZTO Express benefits from a robust brand reputation and dominant market share in China's express delivery sector. As of 2024, ZTO held the top spot in terms of business scale for nine years straight. This leadership position is a crucial resource, fostering customer loyalty and attracting new partnerships. The company's brand strength directly influences its financial performance and market competitiveness.

- Market Share: ZTO consistently leads, with a significant percentage of the domestic express delivery market.

- Brand Value: High brand recognition translates into customer trust and preference.

- Competitive Advantage: Strong brand reputation and market leadership provide a competitive edge.

- Financial Impact: Brand strength positively influences revenue and profitability.

ZTO's core strength lies in its extensive network of over 6,000 partners, crucial for daily parcel deliveries. The company's automated sorting systems, with 596 sets, ensure efficient processing and reduced costs. A large fleet exceeding 10,000 vehicles enhances delivery capabilities.

| Resource | Description | Impact |

|---|---|---|

| Extensive Network | 6,000+ partners | Facilitates efficient delivery. |

| Automated Sorting | 596 sets | Boosts efficiency and reduces costs. |

| Large Fleet | 10,000+ vehicles | Enhances delivery speed. |

Value Propositions

ZTO Express boasts an expansive and dependable nationwide network in China, providing comprehensive coverage. This extensive reach is crucial, enabling seamless parcel delivery and receipt nationwide. Such broad coverage is a significant draw for both e-commerce entities and individual clients. In 2024, ZTO's network handled billions of parcels, reflecting its vast reach and reliability.

ZTO Express offers rapid and effective delivery services. They use automated sorting and a vast vehicle fleet. This efficiency is key to the e-commerce sector. ZTO's focus on efficiency boosts customer happiness. In 2024, ZTO's delivery volume reached billions of parcels.

ZTO's scalable partner model is key. It fuels rapid expansion across China. This partner approach enables ZTO to adapt swiftly. It supports ZTO's leading market position. In 2024, ZTO handled billions of parcels.

Advanced Technology Integration

ZTO Express leverages advanced technology to optimize its logistics. AI-powered systems and traceability solutions boost efficiency and accuracy. This tech enhances transparency, giving them a competitive edge. In 2024, ZTO invested significantly in tech, improving service quality.

- AI-Driven Route Optimization: ZTO uses AI to optimize delivery routes.

- Real-Time Tracking: Customers can track packages in real-time.

- Automated Sorting: Automated sorting systems enhance speed.

- Data Analytics: Data analytics improves decision-making.

Reliable and Trusted Service

ZTO Express's value proposition includes being a reliable and trusted service provider in China's express delivery market. This trust stems from consistent service quality, a key factor in customer satisfaction, crucial for business growth. ZTO's commitment to reliability has helped it build strong, enduring customer relationships. In 2024, ZTO handled over 30 billion parcels, reflecting its market position.

- Consistent service quality is a cornerstone of ZTO's reputation.

- Customer satisfaction is directly linked to ZTO's reliability.

- Trust fosters long-term customer loyalty and retention.

- ZTO's massive parcel volume highlights its market dominance.

ZTO Express offers vast nationwide coverage, key for seamless deliveries. They provide rapid, efficient delivery with automated systems, essential for e-commerce. ZTO uses a scalable partner model, enabling rapid market expansion.

| Value Proposition Element | Description | 2024 Data Highlights |

|---|---|---|

| Network Coverage | Extensive network across China. | Handled billions of parcels. |

| Delivery Speed | Rapid and efficient delivery. | Delivery volume in billions of parcels. |

| Scalability | Partner model for rapid growth. | Significant market share maintained. |

Customer Relationships

ZTO Express provides substantial support to its partners through diverse programs. These include training initiatives, resource allocation, and operational guidance to enhance service quality. These programs are critical for maintaining strong partner relationships and ensuring network consistency. In 2024, ZTO's investment in partner support increased by 15%, reflecting its commitment to network stability and growth.

ZTO Express directly serves major enterprise clients such as e-commerce platforms and traditional merchants. They maintain direct sales teams dedicated to key account (KA) customers. This approach allows ZTO to offer tailored solutions and fosters strong client relationships. In 2024, ZTO's KA revenue likely saw a significant increase, reflecting the focus on direct engagement. This strategy enhances customer retention and service quality.

ZTO Express offers customer support through various channels, including a hotline (95311) and online platforms. These channels allow customers to quickly get help with questions and resolve problems. In 2024, ZTO aimed to improve customer satisfaction scores by 10%. Good customer service is key to keeping customers happy and loyal.

Digital Engagement Platforms

ZTO Express heavily relies on digital platforms to interact with customers. These platforms offer real-time tracking and delivery updates, enhancing the customer experience. This digital approach boosts transparency in the logistics process. These platforms are also designed to collect customer feedback and facilitate direct communication.

- In 2024, ZTO Express's digital platform handled over 30 billion parcels.

- Customer satisfaction scores improved by 15% due to enhanced digital engagement.

- Real-time tracking usage increased by 25% year-over-year.

- Feedback collected through the platform led to a 10% improvement in delivery efficiency.

ESG Initiatives and Community Engagement

ZTO Express prioritizes Environmental, Social, and Governance (ESG) initiatives, actively engaging with stakeholders. They foster community relationships through welfare programs and transparent ESG reporting. These efforts build trust and strengthen connections with communities and stakeholders. In 2024, ZTO Express invested significantly in green logistics, aiming for carbon neutrality.

- Community welfare programs are a key aspect of ZTO's social responsibility efforts.

- Transparent reporting on ESG performance builds trust with stakeholders.

- ESG initiatives enhance ZTO's brand reputation and stakeholder relationships.

- ZTO's commitment to ESG includes environmental sustainability and social impact.

ZTO Express nurtures strong relationships through comprehensive partner support programs. Direct sales teams cater to enterprise clients, fostering tailored solutions and loyalty. Customer service is delivered through various channels, including digital platforms. ESG initiatives build trust and strengthen community ties.

| Aspect | Description | 2024 Data |

|---|---|---|

| Partner Support Investment | Programs for training and operational guidance. | Increased by 15% |

| KA Revenue Focus | Direct sales teams for key accounts. | Significant increase projected |

| Customer Satisfaction | Hotline and online platforms for support. | Targeted 10% improvement |

| Digital Platform Usage | Real-time tracking and updates. | Handled over 30B parcels |

Channels

ZTO Express relies on its network of partner outlets for efficient pickup and delivery. These partners offer local customer access and service. This decentralized approach boosts coverage and quick response times. In 2024, ZTO's network included over 30,000 partners, crucial for its operations.

ZTO Express relies on sorting and distribution centers to manage parcel processing and routing. These centers utilize cutting-edge technology for operational efficiency. Their strategic locations and effective operations are vital for punctual deliveries. In 2024, ZTO's daily parcel volume hit roughly 70 million, demonstrating the importance of these centers.

ZTO Express utilizes a self-operated fleet for line-haul transportation, moving parcels between its sorting hubs. This approach ensures dependable and prompt delivery services. A dedicated fleet offers ZTO control over its core transportation network, enhancing operational efficiency. In 2024, ZTO's parcel volume reached 30.3 billion, highlighting the fleet's importance.

Online Tracking Systems

ZTO Express's online tracking systems enable customers to monitor their parcels in real-time. These systems boost transparency and provide up-to-the-minute delivery statuses. Such easy access to information increases customer satisfaction significantly. ZTO's 2024 revenue reached $12.6 billion, showing the importance of customer-centric services.

- Real-time tracking enhances the customer experience.

- Transparency builds trust and loyalty.

- ZTO's tech investments support efficient operations.

- Customer satisfaction is a key performance indicator.

Mobile Applications

ZTO Express utilizes mobile applications to boost customer service and operational efficiency. These apps enable customers to track their parcels, manage deliveries, and get customer support directly. Mobile access enhances customer convenience, which is vital in today's fast-paced environment. ZTO's mobile technology streamlines operations, contributing to a more efficient logistics network.

- In 2024, ZTO's mobile app users increased by 18% year-over-year.

- Over 70% of ZTO's customer service interactions are now handled via mobile apps.

- The mobile app contributes to about 15% of ZTO's total operational cost savings annually.

- User satisfaction scores for mobile app services average 4.5 out of 5 stars.

ZTO Express utilizes various channels to reach customers and manage operations effectively. These include partner outlets, sorting centers, and a self-operated fleet, ensuring comprehensive coverage and efficient delivery. Mobile apps and online tracking systems enhance customer service and provide real-time updates. These channels contribute to ZTO's high delivery volume and customer satisfaction.

| Channel | Description | 2024 Data |

|---|---|---|

| Partner Outlets | Local access points for pickup/delivery. | 30,000+ partners. |

| Sorting Centers | Parcel processing and routing. | 70M parcels daily. |

| Self-Operated Fleet | Line-haul transportation. | 30.3B parcels handled. |

Customer Segments

E-commerce businesses form a crucial customer segment for ZTO Express. They depend on ZTO for dependable and quick delivery solutions. China's e-commerce expansion fuels the demand for ZTO's services. In 2024, e-commerce sales in China reached $2.1 trillion, boosting ZTO's volumes. ZTO handled 29.2 billion parcels in 2023.

ZTO Express provides delivery services to online merchants on platforms like Alibaba and JD.com. These merchants need affordable and scalable logistics. In 2024, e-commerce sales in China reached approximately $2.3 trillion. Supporting these merchants is vital for ZTO's growth.

Individual consumers, especially those engaged in e-commerce, form a significant customer segment for ZTO Express. ZTO offers dependable delivery services, crucial for online shoppers. In 2024, e-commerce sales in China reached approximately $2.3 trillion. Satisfying individual consumer needs is vital for ZTO's competitive edge, helping it retain and grow its customer base.

Key Account (KA) Customers

ZTO Express strategically targets Key Account (KA) customers through dedicated direct sales teams, fostering strong relationships. These KA customers, which include major e-commerce platforms and large retailers, often need tailored delivery options and specialized support. This approach drives revenue growth and strengthens long-term partnerships. Focusing on these key accounts allows ZTO to optimize service offerings and maintain a competitive edge in the market. In 2024, KA customers contributed significantly to ZTO's revenue, accounting for approximately 65% of its total income.

- Direct Sales Focus: Dedicated teams for KA customers.

- Customized Solutions: Tailored delivery and support.

- Revenue Driver: KA customers contribute to significant revenue.

- Partnership Building: Fosters long-term relationships.

Cross-Border E-commerce

ZTO Express is actively growing its cross-border e-commerce logistics services, a key customer segment. This expansion targets both businesses and individual consumers participating in international trade, reflecting a strategic move to capitalize on global market trends. The increasing volume of cross-border e-commerce presents a substantial growth opportunity for ZTO. This segment is crucial for revenue diversification and market expansion.

- In 2024, cross-border e-commerce is estimated to reach $3.2 trillion globally, with projections to increase.

- ZTO's international revenue grew by 20% in Q3 2024, indicating strong demand.

- Key markets include Southeast Asia and North America, with ongoing expansion.

ZTO Express serves e-commerce businesses needing reliable delivery. Online merchants on platforms like Alibaba and JD.com are also key, requiring scalable logistics. Individual consumers are another vital segment, depending on dependable services. In 2024, ZTO Express handled approximately 31 billion parcels.

| Customer Segment | Description | 2024 Impact |

|---|---|---|

| E-commerce Businesses | Need for fast, reliable delivery. | $2.3T in China's e-commerce sales |

| Online Merchants | Require affordable and scalable logistics. | Significant volume growth |

| Individual Consumers | Depend on reliable delivery for online purchases. | Increasing e-commerce participation |

Cost Structure

Transportation costs, encompassing fuel and vehicle upkeep, form a substantial part of ZTO's expenses. In 2024, ZTO managed over 10,000 line-haul vehicles, emphasizing the importance of efficient management. Effective fleet management and route optimization are essential for controlling these costs. ZTO aims to maintain tight control over these costs to boost profitability.

Operating and maintaining sorting hubs represents a significant cost for ZTO Express, encompassing equipment, labor, and utility expenses. As of 2024, ZTO manages 95 domestic sorting hubs across China. These hubs are crucial for processing a high volume of parcels, with over 60 million parcels processed daily. ZTO invests in automation and technology to optimize operations and reduce costs; in 2023, ZTO's operating costs were around $3.8 billion.

ZTO's cost structure heavily relies on payments to its network partners. These partners handle crucial services like pickups and deliveries. A substantial portion of ZTO's expenses goes towards these payments. In 2024, ZTO's network partner costs were approximately 60% of total operating costs. Fair and sustainable payments are essential for keeping partners.

Technology and IT Infrastructure

ZTO Express allocates significant resources to technology and IT infrastructure. This involves continuous spending on software, hardware, and IT staff. Investments in advanced technology are crucial for boosting operational efficiency and ensuring high service quality. ZTO's commitment to technological advancements is evident in its financial reports, showing a consistent allocation of funds to these areas. These investments contribute to ZTO's competitive advantage and operational excellence.

- In 2024, ZTO's R&D expenses were approximately $130 million, focusing on technology upgrades.

- ZTO's IT infrastructure investments include substantial spending on sorting automation, with over $400 million allocated in 2024.

- Approximately 3% of ZTO's total revenue in 2024 was dedicated to IT and technology costs.

- ZTO's technology investments have helped reduce per-parcel costs by about 5% in 2024.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses at ZTO Express include administrative salaries, marketing, and overhead. Managing these costs efficiently is crucial for profitability. In 2024, ZTO's SG&A expenses were approximately RMB 3.5 billion. The company focuses on maintaining a stable and efficient SG&A cost structure.

- SG&A covers salaries, marketing, and overhead.

- Efficient management is key to profitability.

- ZTO's 2024 SG&A expenses were around RMB 3.5B.

- ZTO aims for a stable and efficient structure.

ZTO Express's cost structure includes transportation, hub operations, network partner payments, and technology. Transportation costs involved managing over 10,000 vehicles in 2024. Network partner costs were about 60% of total operating expenses in 2024. IT and technology investments used around 3% of revenue, with R&D at approximately $130 million in 2024.

| Cost Category | 2024 Expense | Notes |

|---|---|---|

| Transportation | Significant | Fuel, vehicle upkeep; efficient fleet management |

| Hub Operations | Significant | 95 domestic sorting hubs; automation investments |

| Network Partners | ~60% of Op. Costs | Payments for pickups and deliveries |

Revenue Streams

ZTO Express's main income comes from its core express delivery services. This covers charges for picking up, moving, and delivering packages. In Q4 2024, ZTO's revenue from these services went up by 22.4%. This growth shows the importance of these services to ZTO's financial success.

ZTO's key account delivery fees are a significant revenue stream. The company charges fees to key account customers based on service agreements. This includes higher-value parcels from e-commerce platforms. In 2024, KA revenue saw substantial growth. This growth was driven by increased parcel volume and higher-value deliveries.

ZTO Express boosts revenue through value-added logistics, including warehousing and supply chain solutions. These services enhance its core express delivery business. This diversification is key, especially as total revenue reached ~$10.8 billion in 2024. Value-added services can increase margins.

Sales of Accessories

ZTO Express supplements its revenue through the sale of accessories, mainly thermal paper essential for digital waybill printing. This revenue stream, though secondary, still bolsters overall financial performance. Accessory sales offer additional income, supporting ZTO's core logistics operations and enhancing its service offerings. This strategy contributes to the company's diversified revenue model.

- In 2024, accessory sales likely contributed a small but consistent percentage to ZTO's total revenue.

- This stream helps cover operational costs.

- It supports ZTO's primary logistics services.

Freight Forwarding Services

ZTO Express generates revenue through its freight forwarding services, handling both domestic and international logistics. This supports the company's comprehensive logistics offerings, utilizing its existing infrastructure to streamline operations. Expanding freight forwarding helps ZTO to increase its market share in the competitive logistics sector.

- Freight forwarding services contribute to ZTO's revenue.

- Supports both domestic and international logistics needs.

- Leverages ZTO's existing infrastructure.

- Enhances ZTO's overall logistics offerings.

ZTO Express has multiple revenue streams. Core express delivery services are a primary source of income, with a 22.4% revenue increase in Q4 2024. Key account delivery fees and value-added logistics also contribute, boosting overall financial performance. The company also sells accessories and provides freight forwarding services.

| Revenue Stream | Description | 2024 Performance |

|---|---|---|

| Express Delivery | Core services for package pickup and delivery. | 22.4% revenue increase in Q4 |

| Key Account Fees | Charges for deliveries to key customers. | Significant Growth |

| Value-Added Logistics | Warehousing, supply chain solutions. | Enhanced Core Business |

Business Model Canvas Data Sources

The ZTO Express Business Model Canvas utilizes market reports, financial data, and operational analysis for its foundation. These data points are critical for an informed and viable business structure.