ZTO Express (Cayman) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ZTO Express (Cayman) Bundle

What is included in the product

Tailored analysis for ZTO's portfolio. Identifies investment, holding, and divestment strategies within the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs for easy stakeholder distribution.

What You’re Viewing Is Included

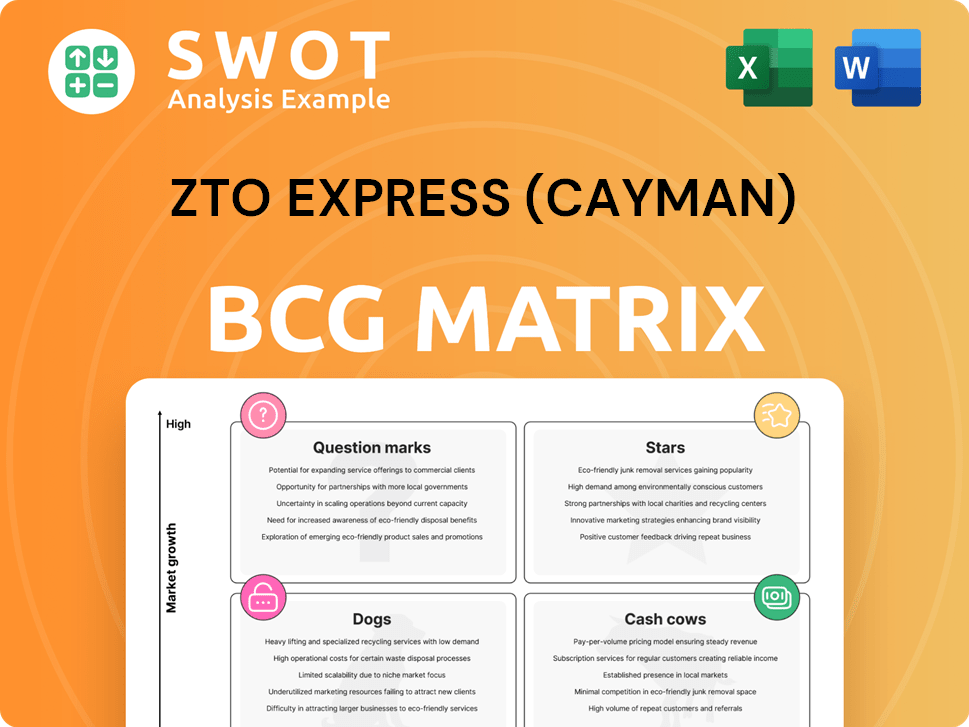

ZTO Express (Cayman) BCG Matrix

This preview offers the complete ZTO Express (Cayman) BCG Matrix report you'll receive upon purchase. The final file mirrors this preview entirely—ready for immediate application. Get the full, unedited document, perfectly formatted for your strategic needs. No different file, just the one you see. Purchase the exact, ready-to-use BCG Matrix.

BCG Matrix Template

ZTO Express (Cayman)'s BCG Matrix reveals a snapshot of its diverse offerings. Early insights hint at potential growth drivers and areas needing strategic attention. Are its parcel delivery services "Stars" or "Question Marks"? Understanding the competitive landscape is key. Identifying "Cash Cows" can unlock further investments. Knowing how to manage "Dogs" is also essential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ZTO Express's express delivery services are a Star in its BCG matrix, given its leading market share. In 2024, ZTO delivered 34 billion parcels, solidifying its top position. This strong performance is fueled by e-commerce growth. ZTO's ongoing network expansion further supports its Star status.

ZTO Express's extensive network is a key strength. In 2024, it had over 31,000 pickup/delivery outlets. The network includes over 3,900 line-haul routes. This coverage allows ZTO to handle a large volume of parcels efficiently. It's crucial for market share growth.

ZTO's tech-driven operations are a key strength. The "Zhongtian system" and automation cut costs significantly. In 2024, ZTO's operating costs decreased. This boosts its long-term competitiveness. ZTO's market share in China's express delivery was over 20% in 2024.

Strong Financial Performance

ZTO Express shines as a "Star" in the BCG Matrix due to its robust financial health. In 2024, the company saw a 15.3% year-over-year increase in revenue, reaching 44.3 billion yuan. This strong financial performance is a testament to the company's market position and growth potential. The adjusted net income also rose by 12.7% to RMB10.2 billion, further solidifying its "Star" status.

- Revenue Growth: 15.3% year-over-year in 2024.

- Revenue: 44.3 billion yuan in 2024.

- Adjusted Net Income: RMB10.2 billion in 2024.

- Profitability: Increased by 12.7% in 2024.

Focus on High-Quality Development

ZTO Express's shift towards high-quality development is a strategic move. They are prioritizing service quality to boost customer satisfaction. This focus helps differentiate ZTO from competitors, improving last-mile delivery. It's key for long-term growth. In 2024, ZTO's revenue reached $10.94 billion, with a net income of $2.89 billion.

- Revenue: $10.94 billion in 2024

- Net Income: $2.89 billion in 2024

- Focus: Service quality and customer satisfaction

- Goal: Strengthen competitive position and ensure long-term growth

ZTO Express excels as a "Star" in the BCG Matrix due to its leading market share in China's express delivery sector. In 2024, ZTO Express delivered 34 billion parcels, driven by e-commerce growth. The company’s solid financial performance further supports its "Star" status.

| Metric | 2024 Performance | Details |

|---|---|---|

| Revenue Growth | 15.3% YoY | Reached 44.3 billion yuan |

| Adjusted Net Income | RMB10.2 billion | Increased by 12.7% |

| Market Share | Over 20% | Leading position in China |

Cash Cows

ZTO's core delivery services in mature regions are cash cows. These areas have high demand, especially with e-commerce. In 2024, ZTO handled billions of parcels. They generate steady cash flow with limited investment in established markets. ZTO's market share in these regions is substantial.

ZTO Express's network partner model, utilizing partners for pick-up and last-mile delivery while controlling key areas, is a Cash Cow. This model helps ZTO focus on its strengths and generate cash flow from transit fees. In 2024, ZTO's revenue reached $10.9 billion, demonstrating its financial stability. The model's efficiency, contributing to ZTO's profitability, is a key factor.

ZTO's value-added logistics, like warehousing and supply chain management, are a steady revenue stream. These services serve major e-commerce platforms and businesses, ensuring consistent cash flow. In Q1 2024, KA revenue surged by 100.7%. This growth stems from higher-value parcels, such as e-commerce returns.

Operational Efficiency Improvements

ZTO Express's operational efficiency is a key driver for its Cash Cow status. Continuous improvements, like cutting unit sorting and transportation costs, boost profit margins and cash flow. In 2024, these combined costs fell by about six cents due to productivity efforts, showcasing effective cost management. This efficiency makes ZTO highly profitable.

- Reduced unit costs boost profit.

- Productivity initiatives drive down expenses.

- Improved margins strengthen cash flow.

- Efficiency is a key Cash Cow attribute.

Strategic Investments in Infrastructure

ZTO Express strategically invests in infrastructure to boost efficiency and cash flow, classifying it as a "Cash Cow" within the BCG Matrix. These investments include upgrading self-owned line-haul vehicles and implementing automated sorting equipment. These enhancements enable ZTO to manage a high volume of parcels, maintaining its competitive edge in the market.

- Self-owned line-haul vehicles exceeded 10,000 as of December 31, 2024.

- Investments drive efficiency gains, reducing operational costs.

- Enhanced infrastructure supports a large parcel volume.

- These strategies solidify ZTO's market position.

ZTO's mature markets, like those with high e-commerce activity, are cash cows, generating steady cash flow with little investment. In 2024, the company handled billions of parcels, showing strong demand. Efficiency and strategic infrastructure investments also make ZTO a profitable cash cow.

| Aspect | Details |

|---|---|

| 2024 Revenue | $10.9B |

| Unit Cost Reduction | Approx. 6 cents |

| KA Revenue Q1 2024 Growth | 100.7% |

Dogs

ZTO Express's freight forwarding services experienced a 2.4% revenue decrease, primarily due to reduced cross-border e-commerce pricing in 2024. This decline suggests the segment is underperforming, potentially positioning it as a "Dog" within the BCG matrix. The company may consider optimizing or divesting from this area to boost overall profitability. This strategic shift aligns with the company's aim to enhance financial performance.

ZTO faces stiff competition in the e-commerce parcel sector, especially with low-value items. These parcels often yield thin profit margins, potentially making them "dogs" in the BCG Matrix. In 2024, ZTO reported a decrease in parcel volume growth, signaling the need to optimize its parcel mix. Prioritizing higher-value shipments could improve profitability.

ZTO's BCG Matrix shows some regional markets as "Dogs" due to underperformance. These areas may struggle against local rivals or face economic headwinds. In 2024, ZTO's focus is optimizing resource allocation, with specific regions under close review. The company's operational data is crucial to identify and address underperforming regions.

Services with Low Adoption Rates

Dogs represent ZTO Express's services with low market adoption. These initiatives may need substantial investment without yielding adequate returns. The company must evaluate their potential, deciding whether to invest more or discontinue them. In 2024, ZTO's focus remained on core express services, with new ventures contributing minimally to revenue, suggesting a need for strategic reassessment.

- Low Revenue Contribution: New services generate little revenue.

- High Investment Needs: Promotion demands significant capital.

- Strategic Review: Evaluate further investment or discontinuation.

- 2024 Focus: Core express services remain the priority.

Inefficient or Outdated Technologies

Outdated technologies at ZTO Express can drag down efficiency and cut into profits. These tech issues may need costly upgrades or replacements, making them a financial burden. In 2023, ZTO invested heavily in automation, spending $300 million to boost sorting capacity. ZTO needs to constantly assess its tech to find ways to do better.

- Outdated tech can reduce operational efficiency.

- Upgrading or replacing old tech requires significant investment.

- Inefficient processes can impact profitability.

- ZTO needs to regularly review and improve its tech.

In ZTO Express's BCG matrix, "Dogs" represent underperforming services or markets. These areas contribute little revenue and often require high investment with low returns. Strategic assessment in 2024 focused on optimizing resources, potentially divesting from less profitable segments.

| Characteristic | Impact | ZTO's Response (2024) |

|---|---|---|

| Low Revenue | Minimal contribution to overall profitability. | Prioritize core express services. |

| High Investment | Requires significant capital without adequate returns. | Evaluate further investment or discontinuation. |

| Outdated Tech | Reduced operational efficiency and profitability. | Invested $300M in automation to boost sorting capacity (2023). |

Question Marks

ZTO's rural market expansion, fueled by China's e-commerce growth, is a question mark. This segment shows high growth potential, but ZTO's market share is low. Investing in infrastructure is key, and the company must carefully manage risks. Consider the 2024 e-commerce growth rate in rural areas, exceeding 15%, and the associated logistics costs.

ZTO's cross-border e-commerce logistics in China is a "Question Mark" in the BCG Matrix. The market is expanding, with cross-border e-commerce sales in China reaching $2.1 trillion in 2024. ZTO's current market share is small, but the high growth rate creates opportunities. To succeed, ZTO needs significant investment to compete with established firms.

Specialized delivery services, like handling e-commerce returns, represent a question mark for ZTO Express. E-commerce return parcels are forecasted to grow significantly. Hive Box Holdings predicts a 20.7% annual growth between 2023 and 2028. ZTO must invest to compete in this high-growth, specialized area.

Integration of New Technologies

ZTO Express's integration of new technologies, like AI and big data, is a high-growth area. These technologies can greatly boost efficiency and cut costs. However, it demands substantial investment and skilled professionals. In 2024, ZTO's tech spending is expected to increase by 15%, focusing on AI and automation.

- AI-driven route optimization is projected to reduce delivery times by 10%.

- Big data analytics will enable a 5% reduction in operational expenses.

- Blockchain could improve supply chain transparency by 8%.

- Investment in tech talent will increase by 20% to support these initiatives.

Sustainable Logistics Initiatives

Sustainable logistics initiatives position ZTO Express as a "Question Mark" in its BCG matrix, given the evolving importance of environmental sustainability. These efforts, including the adoption of new energy vehicles and biodegradable packaging, could significantly boost ZTO's appeal to eco-conscious customers. ZTO's focus on sustainable practices is a strategic move to capture a growing market segment. However, its success depends on effectively scaling these initiatives and achieving profitability.

- New energy vehicles adoption is part of ZTO's plan for a sustainable future.

- Biodegradable packaging is another key initiative to reduce environmental impact.

- These efforts could attract environmentally conscious customers.

- Sustainable logistics is a key focus for ZTO.

ZTO's sustainability efforts are a "Question Mark," aiming to attract eco-conscious customers. New energy vehicles and biodegradable packaging are key. Success hinges on scaling these initiatives effectively. In 2024, investment in green tech will increase by 12%.

| Initiative | Impact | 2024 Data |

|---|---|---|

| New Energy Vehicles | Reduce carbon footprint | 15% fleet transition |

| Biodegradable Packaging | Minimize environmental impact | 5% of total packaging |

| Eco-conscious customers | Attract a growing market | 10% increase in demand |

BCG Matrix Data Sources

The ZTO Express (Cayman) BCG Matrix leverages diverse financial reports, sector analysis, and market data for comprehensive quadrant assessments. We also utilize industry benchmarks and expert opinions to refine the insights.