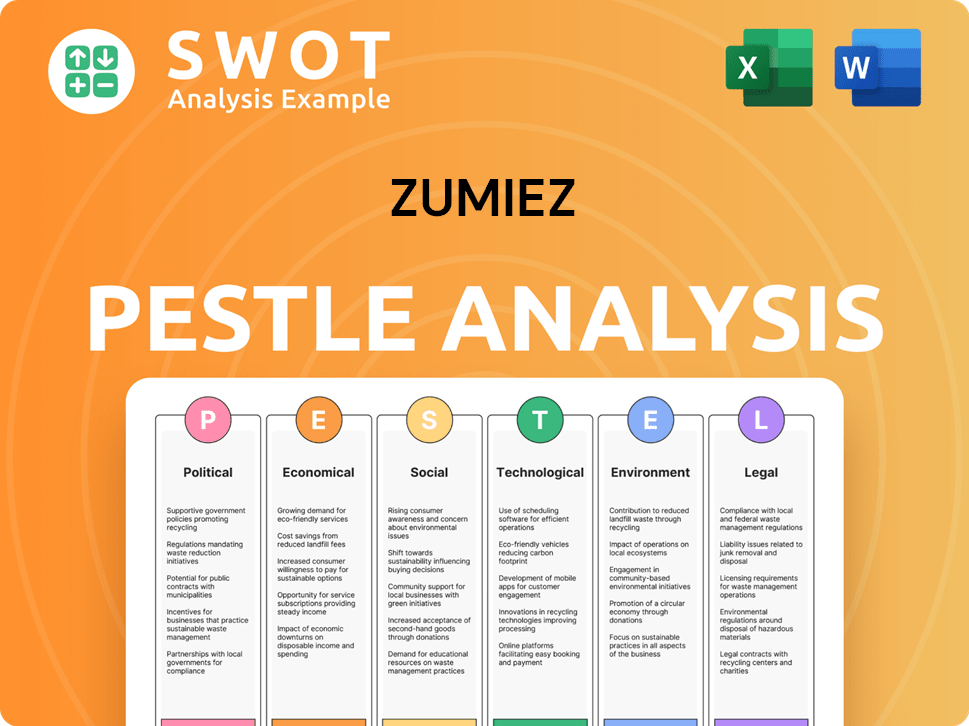

Zumiez PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zumiez Bundle

What is included in the product

This Zumiez PESTLE analysis identifies macro-environmental impacts across six categories.

It aids proactive strategy design by providing forward-looking insights.

Provides a concise version for quick assessments, streamlining Zumiez strategy for informed decisions.

What You See Is What You Get

Zumiez PESTLE Analysis

No need to guess! This is the complete Zumiez PESTLE analysis.

The preview shows the full report, fully ready to download and use.

It includes everything—same layout, same detailed content.

This document is identical to what you get post-purchase.

What you’re seeing is what you’ll receive!

PESTLE Analysis Template

Explore how Zumiez navigates the external environment with our PESTLE analysis. Uncover political, economic, social, and technological impacts on their strategy. Understand the legal and environmental factors shaping their business. Gain valuable insights to refine your own strategies. Download the full version now and see Zumiez's future.

Political factors

Zumiez faces trade policy risks due to global sourcing. U.S.-China tariffs impact import costs and supply chains. In 2023, U.S. imports from China totaled $427 billion. Increased costs reduce Zumiez's profitability. Changes in trade agreements demand strategic agility.

Zumiez, operating globally, navigates diverse government regulations affecting retail and e-commerce. Data privacy laws, such as GDPR and CCPA, mandate compliance, necessitating investments in protective measures. Non-compliance risks significant fines, impacting financial performance. For instance, in 2024, companies faced an average GDPR fine of $100,000.

Zumiez relies on stable political environments in sourcing countries. Political instability, like coups or civil unrest, disrupts supply chains. This can lead to delays and increased costs. For example, disruptions in key manufacturing hubs could significantly impact Zumiez's Q4 sales, which accounted for 31.5% of total revenue in 2023.

Potential Minimum Wage Increases

Zumiez faces political risks from minimum wage changes. Increases in minimum wage laws in operating regions directly affect labor costs. The federal minimum wage could lead to considerable increases in annual labor expenses. These changes can squeeze profit margins. For instance, in 2024, several states and cities increased minimum wages.

- Federal minimum wage is $7.25, unchanged since 2009.

- California's minimum wage is $16 per hour, as of January 1, 2024.

- New York's minimum wage varies by region, up to $16 per hour.

- These increases impact Zumiez's operating expenses.

Geopolitical Events and Trade Restrictions

Geopolitical events and trade restrictions significantly influence Zumiez. These factors introduce uncertainty, affecting consumer confidence and spending habits, which are crucial for retail. Disruptions in the supply chain can increase merchandise costs and limit product availability. Recent data shows a 10% decrease in consumer confidence in regions affected by geopolitical instability.

- Trade tariffs on textiles and apparel could raise Zumiez's costs.

- Geopolitical events might disrupt supply chains, impacting product availability.

- Consumer confidence fluctuations could reduce discretionary spending.

- Political instability could affect international expansion plans.

Zumiez navigates trade policy uncertainties due to global sourcing and tariffs. Government regulations, like data privacy laws (GDPR, CCPA), require compliance. Political instability and minimum wage hikes affect supply chains and operational costs. As of March 2024, US imports from China totaled $35.2 billion. These shifts necessitate adaptable strategies to manage risks.

| Risk Factor | Impact | Example/Data |

|---|---|---|

| Trade Policies | Increased Costs | U.S. imports from China totaled $427B in 2023. |

| Government Regulations | Compliance Costs | Average GDPR fine $100,000 (2024). |

| Political Instability | Supply Chain Disruptions | Q4 revenue accounted for 31.5% (2023). |

Economic factors

Zumiez's focus on young adults makes its sales very sensitive to consumer discretionary spending. Economic downturns, inflation, and lower savings impact spending on clothing. In Q1 2024, consumer spending softened, impacting retailers. Consumer confidence dipped in early 2024, affecting discretionary purchases. Zumiez's performance closely mirrors these economic trends.

High inflation rates, notably in developed economies, diminish consumer spending power. This can cause consumers to focus on necessities. Consequently, this leads to a decrease in discretionary spending. For example, the U.S. inflation rate was 3.5% in March 2024, impacting consumer behavior. Zumiez, as a retailer of non-essential goods, could experience reduced sales.

Economic growth significantly influences Zumiez's performance; robust growth boosts consumer spending. The U.S. GDP grew by 3.3% in Q4 2023, indicating a strong economy. Recession risks, however, could curb discretionary spending. A downturn could lead to reduced sales and profit margins for Zumiez.

Exchange Rate Fluctuations

Zumiez, with its global presence, faces exchange rate risks. Currency fluctuations affect the prices of imported merchandise. These changes can influence profit margins and competitiveness. For example, a stronger U.S. dollar makes imports cheaper. Conversely, a weaker dollar increases import costs.

- In 2023, the U.S. dollar's strength fluctuated significantly against other currencies.

- Zumiez's financial reports detail these impacts on cost of goods sold (COGS).

- Hedging strategies help mitigate these risks.

Market Saturation and Competition

The retail landscape is intensely competitive, with market saturation posing a significant challenge to consumer traffic and sales. Zumiez contends with rivals for vendors, customers, store locations, and online presence. In 2024, the specialty retail sector saw a 2.5% decline in foot traffic, indicating heightened competition. Zumiez's same-store sales decreased by 4.2% in Q4 2024, reflecting these pressures.

- Foot traffic in the specialty retail sector declined by 2.5% in 2024.

- Zumiez's same-store sales decreased by 4.2% in Q4 2024.

Zumiez thrives or struggles with economic shifts that influence young consumers' spending habits. Inflation, like the U.S.'s 3.5% in March 2024, shrinks purchasing power, potentially reducing sales. U.S. GDP growth of 3.3% in Q4 2023 can boost spending, but recession risks remain a concern. Currency fluctuations affect import costs, impacting Zumiez's profits.

| Economic Factor | Impact on Zumiez | 2024/2025 Data |

|---|---|---|

| Consumer Spending | Directly affects sales | Softened in Q1 2024, influenced by inflation |

| Inflation | Reduces spending power | 3.5% in March 2024 (U.S.) |

| GDP Growth | Boosts spending | 3.3% in Q4 2023 (U.S.) |

Sociological factors

Zumiez thrives on youth culture, fashion, and action sports. Its success hinges on staying ahead of trends. In 2024, youth spending on apparel hit $250 billion. Fast fashion and social media heavily influence these trends. Zumiez must adapt quickly to maintain relevance and sales.

Online shopping is surging, especially with younger consumers, which is key for Zumiez. In 2024, e-commerce sales grew by 7.6% globally. Zumiez must boost its online presence. This includes a strong e-commerce platform. Integration with physical stores is also vital. This helps meet customer expectations.

Consumers, particularly younger demographics, are increasingly focused on sustainability and social responsibility in their buying choices. This shift is evident in market trends; for instance, the global sustainable fashion market was valued at $8.6 billion in 2024 and is projected to reach $15.1 billion by 2028. Zumiez could experience increased demand for eco-friendly products and needs to showcase ethical practices.

Demographic Changes in Target Age Groups

Shifting demographics, particularly within Generation Z and Millennials, significantly influence Zumiez's customer base and revenue. These groups' population sizes and spending habits are vital. For example, Gen Z's spending power is projected to reach $360 billion by 2025. This demographic shift necessitates Zumiez to adapt its product offerings and marketing strategies.

- Gen Z's spending power is projected to reach $360 billion by 2025.

- Millennials represent a large portion of the target demographic.

- Changes in population size affect market size.

Customer Engagement and In-Store Experience

Zumiez cultivates customer loyalty via unique in-store experiences and active engagement on social media and events. This strategy is crucial for driving sales and building a strong brand identity. The company's success is significantly tied to customer interaction. In Q3 2024, Zumiez reported a slight decrease in sales, emphasizing the importance of customer engagement for sales.

- Social media is key for Zumiez, with over 2 million followers on Instagram as of early 2024.

- Zumiez reported net sales of $221.1 million for the three months ended November 4, 2023.

- The brand hosts in-store events like skate demos and music performances.

Youth culture, encompassing trends in fashion and action sports, is pivotal to Zumiez's success. E-commerce growth impacts how Zumiez reaches its audience, reflecting the rising dominance of online retail, as global e-commerce grew by 7.6% in 2024. A significant focus on sustainability, with a $8.6 billion market value in 2024 and projected $15.1 billion by 2028, pressures companies to be socially responsible.

| Factor | Details | Impact |

|---|---|---|

| Youth Culture | Fast fashion, social media trends | Needs quick adaptation |

| Online Shopping | E-commerce sales grew 7.6% in 2024 | Must boost online presence |

| Sustainability | $8.6B market in 2024 | Demand for eco-friendly goods |

Technological factors

Zumiez's e-commerce platform must be robust to handle online sales and provide customer service. Omnichannel strategies, blending online and physical stores, are key. In 2024, e-commerce represented a significant portion of retail sales. A seamless experience improves customer loyalty and sales.

Zumiez faces data security and privacy challenges due to online operations and customer data collection. In 2024, data breaches cost companies an average of $4.45 million. Zumiez must invest in cybersecurity to protect against threats. Compliance with data privacy regulations, like GDPR and CCPA, is crucial. Failure to comply can result in significant financial penalties.

Zumiez leverages technology, especially social media and online channels, to connect with its core demographic. Managing customer interactions and fulfillment demands sophisticated digital execution across various platforms. In 2024, e-commerce sales accounted for approximately 30% of Zumiez's total revenue, showcasing its digital focus. The company's tech investments aim to improve online shopping experiences.

Supply Chain Technology

Zumiez's operational success hinges on supply chain technology for efficient distribution. This includes robust systems for product inspection, allocation, and delivery to both physical stores and online customers. Efficient supply chains are crucial for managing inventory and meeting customer demand promptly. In 2024, companies that embraced supply chain tech saw a 15% reduction in logistics costs.

- Inventory management systems.

- Real-time tracking.

- Demand forecasting.

- Automation.

Utilizing Data Analytics

Zumiez leverages technology to gather and analyze sales data, operational figures, and customer behavior. This data-driven approach supports strategic decisions and planning across the company. It enables Zumiez to understand market trends and customer preferences better. Data analytics also helps optimize supply chains and improve inventory management. In 2024, Zumiez reported that online sales accounted for about 30% of total revenue, a key area where data analytics is crucial for understanding consumer behavior and targeting online marketing.

- Online sales contribute a significant portion of Zumiez's revenue.

- Data analytics informs strategic decisions.

- Supply chain and inventory management are optimized using data.

- Zumiez uses data to understand market trends.

Zumiez utilizes technology to boost online sales via a robust e-commerce platform, representing a key part of the company’s revenue stream. Data security, crucial for online operations, demands substantial cybersecurity investment to protect customer data and ensure regulatory compliance. Data analytics also enables them to optimize operations and understand consumer behavior and market trends.

| Tech Aspect | Description | Impact |

|---|---|---|

| E-commerce | Robust online platform for sales | Approximately 30% of revenue from online sales (2024) |

| Data Security | Investments in cybersecurity; GDPR/CCPA compliance | Avoidance of an average data breach cost of $4.45M (2024) |

| Data Analytics | Analysis of sales, ops, and customer behavior | Enhanced strategic decisions, optimized supply chain and inventory |

Legal factors

Zumiez faces consumer protection regulations, like those from the FTC, ensuring product safety and fair advertising. In 2024, FTC actions led to $2.5 billion in refunds for consumers due to deceptive practices. Compliance is vital to avoid penalties and maintain consumer trust. Failure to comply can result in significant fines, impacting profitability.

Zumiez must comply with labor laws, affecting wages, hours, and worker classifications. Non-compliance risks legal issues and penalties. For example, minimum wage changes impact operational costs. The federal minimum wage has remained at $7.25 since 2009. States and localities often set higher rates, affecting Zumiez locations.

Zumiez's global operations are significantly shaped by international trade laws and agreements. These regulations influence the company's import and export activities. For example, tariffs and quotas, as dictated by agreements like the USMCA (United States-Mexico-Canada Agreement), directly affect the cost of goods. In 2024, Zumiez's international sales represented approximately 8% of its total revenue, highlighting the importance of managing trade-related risks. Compliance with international trade laws is crucial for avoiding penalties and ensuring smooth supply chain operations.

Data Privacy Laws (GDPR, CCPA)

Zumiez must adhere to stringent data privacy regulations, including GDPR and CCPA, to safeguard customer information. Non-compliance with these laws can lead to hefty fines, potentially impacting the company's financial performance. Zumiez needs to invest in robust data protection measures and compliance protocols to ensure consumer data is handled responsibly. The data breach fines can reach millions, as seen in recent cases.

- GDPR fines can go up to 4% of annual global turnover.

- CCPA violations can result in fines of up to $7,500 per record.

Compliance with Securities Regulations

Zumiez, as a public entity, faces stringent legal obligations. These include adherence to SEC and Nasdaq rules, which dictate financial reporting and governance. For instance, in fiscal year 2024, Zumiez reported a total revenue of $1.02 billion, reflecting its operational scale under regulatory oversight. Compliance costs are significant, affecting operational budgets.

- SEC filings: Annual reports (10-K) and quarterly reports (10-Q) are mandatory.

- Governance: Must adhere to Nasdaq listing rules for board structure and shareholder rights.

- Audits: Regular financial audits are required to ensure accuracy and transparency.

- Insider Trading: Strict policies to prevent insider trading.

Zumiez faces consumer protection and labor laws, impacting operations. International trade laws, like those under USMCA, influence costs. Data privacy, like GDPR and CCPA, requires robust protection to avoid steep fines, and as a public company Zumiez has to adhere SEC and Nasdaq rules.

| Aspect | Regulatory Bodies | Impact on Zumiez |

|---|---|---|

| Consumer Protection | FTC | Product safety, fair advertising, consumer trust |

| Labor Laws | Federal, State, Local | Wages, hours, classification, and operating costs |

| International Trade | USMCA, WTO | Import/Export activities, tariffs, and supply chain. In 2024 int'l sales ≈ 8% |

| Data Privacy | GDPR, CCPA | Data protection, compliance, and financial impacts |

| Public Entity | SEC, Nasdaq | Financial reporting, governance, and listing standards. FY2024 Revenue: $1.02B |

Environmental factors

Consumers increasingly favor sustainable products, pushing Zumiez to evaluate its supply chain's environmental impact, encompassing raw material sourcing, manufacturing, and transport. Zumiez's 2024 Sustainability Report highlighted a 15% reduction in carbon emissions from its logistics operations. A 2025 study indicated that 60% of consumers prefer brands with eco-friendly practices, influencing Zumiez's sourcing decisions. Implementing sustainable practices can enhance brand reputation and appeal to environmentally conscious consumers.

Zumiez's retail operations produce waste from packaging, unsold inventory, and store materials. Effective waste management and recycling programs are vital for environmental responsibility. According to the EPA, the retail sector's waste generation in 2023 was approximately 82.2 million tons. In 2024, Zumiez is expected to enhance its recycling initiatives.

Zumiez's physical stores and distribution centers consume energy. This energy use can lead to environmental impact. In 2024, the retail sector faced increased scrutiny regarding its carbon footprint. Zumiez may need to adopt sustainable energy practices. This is due to rising consumer and regulatory pressure.

Environmental Regulations

Zumiez faces environmental regulations impacting operations, including emissions, waste, and material use. These regulations can lead to increased costs for compliance and potential penalties for non-compliance. For instance, the EPA's recent initiatives targeting textile industry waste could affect Zumiez. Increased focus on sustainability means Zumiez needs to adapt.

- Compliance costs: Regulations could increase operational expenses.

- Reputational risk: Non-compliance can damage brand image.

- Sustainability: Growing consumer demand for eco-friendly products.

Climate Change Impacts

Climate change presents indirect risks to Zumiez, primarily affecting its supply chain. Extreme weather events, such as floods or droughts, could disrupt the availability of raw materials or hinder the transportation of goods. Resource scarcity, driven by climate change, might also increase the costs of sourcing materials. These factors could lead to higher operational expenses and potentially impact profitability.

- Supply chain disruptions can increase costs.

- Extreme weather events may cause transportation delays.

- Resource scarcity can inflate material prices.

Zumiez's environmental strategies in 2024 involve waste management and energy efficiency. They aim to cut carbon emissions, reflecting a consumer shift towards sustainability, with 60% preferring eco-friendly brands. However, regulations and supply chain risks, exacerbated by climate change, pose operational challenges.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Sustainability Demand | Enhances brand image, appeals to conscious consumers | 60% consumers prefer eco-friendly brands (2025 study) |

| Waste Management | Vital for environmental responsibility | Retail sector waste 82.2 million tons (EPA, 2023) |

| Energy Consumption | Impacts environmental footprint | Increased focus on retailers' carbon footprint in 2024 |

PESTLE Analysis Data Sources

Zumiez's PESTLE uses financial reports, retail market studies, consumer behavior analyses, and governmental regulatory updates to analyze all factors.