AbbVie Bundle

How Did AbbVie Rise to Pharmaceutical Prominence?

Embark on a journey through the AbbVie SWOT Analysis, a pharmaceutical company that has rapidly become a global force. From its inception as a spin-off to its current status, AbbVie's story is one of strategic focus and significant growth. Discover the key milestones and pivotal decisions that shaped this biotechnology giant.

Understanding the AbbVie history provides critical context for evaluating its present and future. This brief AbbVie company overview highlights the company's evolution, from its roots in the history of medicine to its current position. Explore AbbVie's research and development efforts and how it has impacted healthcare.

What is the AbbVie Founding Story?

The story of AbbVie, a major player in the pharmaceutical industry, began on January 1, 2013. This marked its official founding as a spin-off from Abbott Laboratories, a well-established name in healthcare.

The decision to split was announced in October 2011. The goal was to create two distinct entities: one focused on a broad range of medical products (the new Abbott) and the other, AbbVie, dedicated to research-based pharmaceuticals. This strategic move was designed to allow each company to concentrate on its specific strengths and growth opportunities.

Richard A. Gonzalez, with a long tenure at Abbott, became AbbVie's first Chairman and CEO. The spin-off allowed AbbVie to focus on developing and selling innovative drugs, particularly those with high growth potential and requiring significant investment in research and development. The initial portfolio included Abbott's proprietary pharmaceutical products, most notably Humira. The separation aimed to unlock value for shareholders by allowing each company to pursue its own strategic priorities and investment opportunities.

AbbVie's creation was a strategic move to focus on pharmaceutical innovation, separating from Abbott Laboratories to pursue its own research and development goals.

- AbbVie was officially founded on January 1, 2013.

- The spin-off from Abbott Laboratories was announced in October 2011.

- Richard A. Gonzalez became AbbVie's first Chairman and CEO.

- The initial focus was on developing and commercializing innovative drugs, including Humira.

The separation from Abbott Laboratories allowed AbbVie to concentrate on its core business: Mission, Vision & Core Values of AbbVie. This focused approach enabled AbbVie to make significant strides in the pharmaceutical industry. As of 2024, AbbVie's commitment to research and development remains strong, with substantial investments aimed at discovering and developing new treatments across various therapeutic areas. The company continues to evolve, driven by its dedication to innovation and its impact on global healthcare.

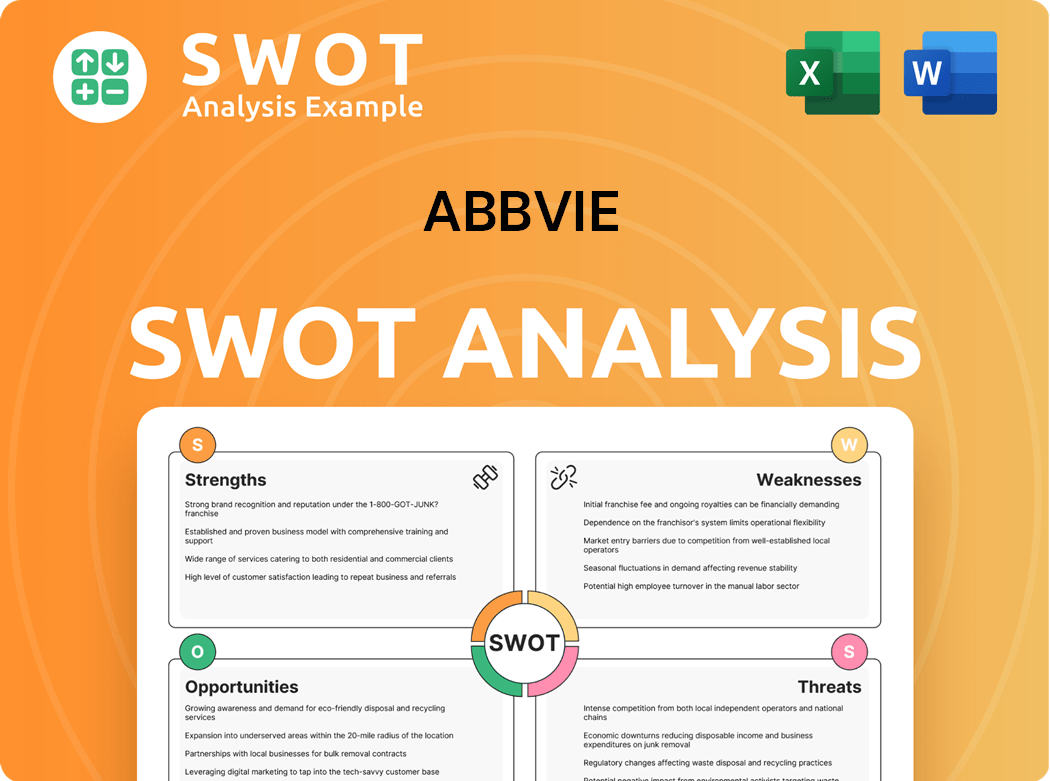

AbbVie SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AbbVie?

The early growth of the pharmaceutical company, after its 2013 spin-off, was heavily influenced by Humira (adalimumab), which quickly became a top-selling drug globally. This period focused on expanding Humira's applications and market reach. Simultaneously, the company invested in its research and development capabilities and built its pipeline through internal initiatives and partnerships. This was a critical time for the Growth Strategy of AbbVie.

Humira was a major revenue driver for AbbVie in its early years. By 2014, Humira's sales reached approximately $11.05 billion globally. The drug's success was due to its effectiveness in treating various autoimmune diseases.

AbbVie actively pursued new indications for Humira. By 2015, Humira was approved for use in treating conditions such as rheumatoid arthritis, Crohn's disease, and psoriasis, among others. This expansion increased the drug's market potential significantly.

The company invested heavily in research and development to diversify its pipeline. In 2016, AbbVie's R&D spending was approximately $4.3 billion, showing a commitment to innovation. This investment was crucial for long-term growth.

AbbVie formed strategic collaborations to enhance its pipeline and expand its therapeutic areas. Partnerships with companies like Roche and others helped broaden AbbVie's research capabilities. These collaborations supported the development of new drugs.

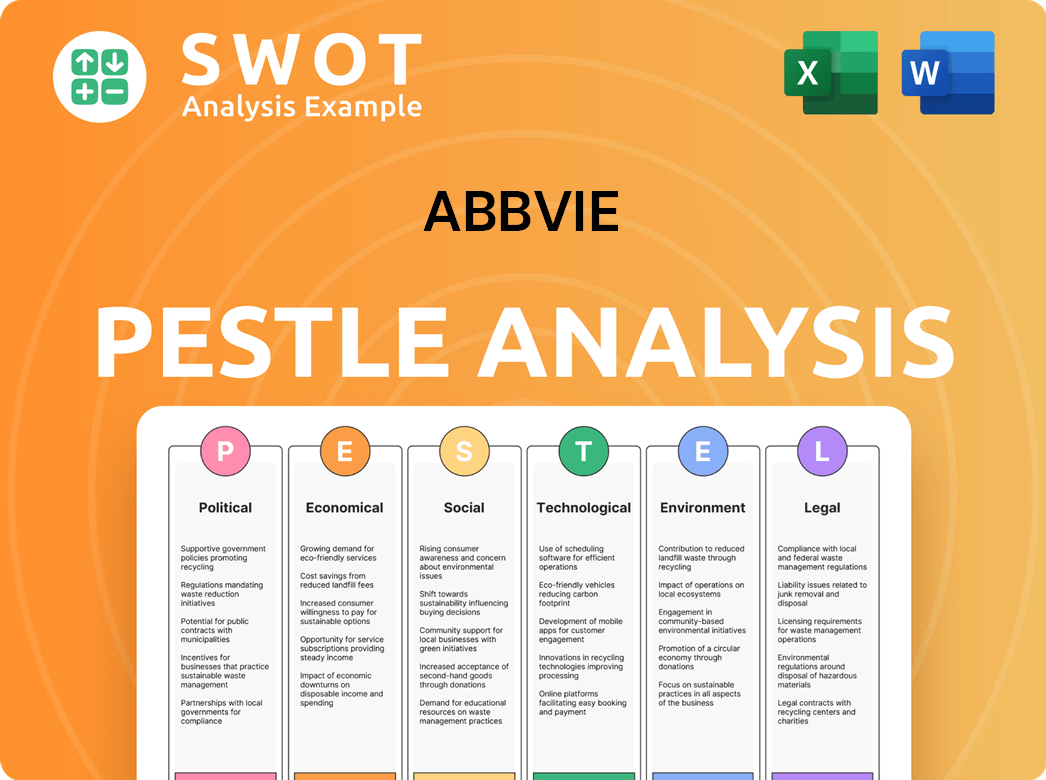

AbbVie PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AbbVie history?

The AbbVie history is marked by significant achievements since its inception as a separate entity. The pharmaceutical company has evolved, focusing on innovation and strategic expansion to address unmet medical needs. Its journey reflects a commitment to research and development, leading to breakthroughs in various therapeutic areas. The company's story is a testament to its resilience and adaptability in the dynamic healthcare landscape.

| Year | Milestone |

|---|---|

| 2013 | AbbVie was established as a separate, publicly traded biotechnology company, spun off from Abbott Laboratories. |

| 2013-2022 | Humira, a blockbuster drug, generated significant revenue, contributing substantially to the company's financial performance. |

| 2015 | Acquisition of Pharmacyclics, gaining access to Imbruvica, a key oncology product. |

| 2019 | Acquisition of Allergan, expanding the portfolio to include aesthetics and eye care products. |

| 2023 | Continued expansion of its product portfolio and global presence, with a focus on innovative therapies. |

AbbVie's innovations have significantly impacted the history of medicine. The company has consistently invested in research and development, leading to the creation of novel therapies. Through strategic acquisitions and internal innovation, AbbVie has broadened its portfolio, addressing a wide range of diseases and conditions.

Development of Humira, a leading treatment for autoimmune diseases, marked a significant advancement in immunology. This innovation has improved the lives of millions globally.

The introduction of Imbruvica and Venclexta has revolutionized the treatment of certain cancers. These therapies have improved survival rates and quality of life for patients.

AbbVie has made strides in neuroscience, developing treatments for conditions like Parkinson's disease and migraine. These innovations address significant unmet needs in neurological care.

The acquisition of Allergan expanded AbbVie's portfolio to include aesthetics and eye care products. This diversification has broadened the company's market presence and revenue streams.

AbbVie's sustained investment in research and development has fueled its pipeline of innovative therapies. This commitment ensures a continuous flow of new products.

Strategic acquisitions, such as Pharmacyclics and Allergan, have enabled AbbVie to acquire new technologies and expand its portfolio. These moves have strengthened its market position.

The AbbVie company has faced several challenges, including the loss of exclusivity for Humira, which significantly impacted revenue. The company has needed to adapt to biosimilar competition and regulatory hurdles. Facing these challenges has driven AbbVie to focus on new product development and strategic acquisitions.

The expiration of Humira's patents and the entry of biosimilars have posed a significant challenge. This has led to a decline in revenue in key markets.

The increasing competition from biosimilars has pressured Humira's market share and profitability. AbbVie has had to develop strategies to mitigate these effects.

Clinical trial outcomes and regulatory hurdles can impact the development and launch of new products. This necessitates robust R&D and strategic planning.

Navigating regulatory approvals for new drugs can be complex and time-consuming. AbbVie must address these challenges to bring its products to market.

The success of AbbVie depends on the continuous development of its product pipeline. This requires substantial investment and strategic focus.

Changes in market dynamics and healthcare policies can affect AbbVie's performance. The company must adapt to these shifts to remain competitive.

For a deeper understanding of AbbVie's target market, you can explore Target Market of AbbVie.

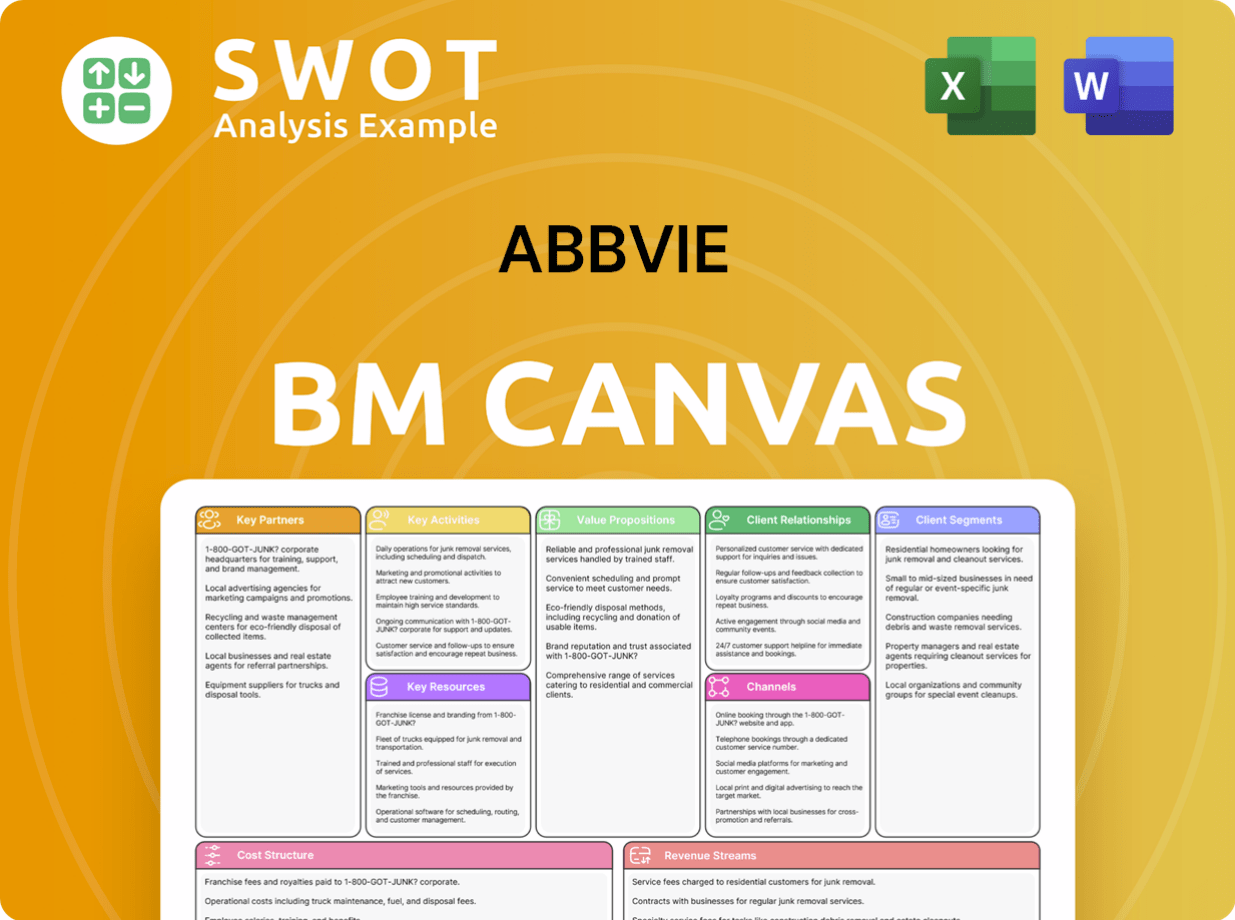

AbbVie Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AbbVie?

The AbbVie company has a rich history, starting as an independent entity spun off from Abbott Laboratories. It has achieved significant milestones, including the continued success of Humira and strategic acquisitions that have broadened its portfolio and market presence. The company's journey reflects its commitment to innovation and its ability to adapt to the evolving pharmaceutical landscape.

| Year | Key Event |

|---|---|

| 2013 | Established as an independent public company. |

| 2013 | Humira remains a major revenue driver. |

| 2015 | Acquired Pharmacyclics, adding Imbruvica to its portfolio. |

| 2016 | Launched Venclexta in partnership with Genentech. |

| 2019 | Announced acquisition of Allergan. |

| 2020 | Completed acquisition of Allergan, diversifying its portfolio. |

| 2021 | Skyrizi and Rinvoq show strong growth. |

| 2023 | Faced increased biosimilar competition for Humira in the U.S. market. |

The future of AbbVie depends heavily on the continued success of Skyrizi and Rinvoq, which are expected to offset the impact of Humira's biosimilar competition. The company is also focused on the integration of Allergan assets, capitalizing on the expanded portfolio. Analysts predict sustained growth through strategic pipeline advancements and market expansion.

Strategic initiatives include exploring new indications for existing products, investing in novel drug platforms, and pursuing targeted business development opportunities. The company aims to continue its mission of delivering innovative therapies to address unmet medical needs. AbbVie's focus remains on its pipeline, particularly in oncology, neuroscience, and immunology.

AbbVie's financial outlook for 2024-2025 is centered on the continued growth of Skyrizi and Rinvoq, along with the successful integration of Allergan. The company anticipates navigating the competitive landscape, especially with the impact of Humira biosimilars. Revenue projections and market analysis indicate a focus on sustainable growth through strategic product launches and market penetration.

Key market dynamics include the increasing competition in the immunology market and the importance of successful pipeline execution. AbbVie's ability to advance its pipeline, particularly in areas such as oncology, neuroscience, and immunology, will be crucial. The company's global presence and its ability to adapt to changing market conditions will also play a significant role.

AbbVie Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AbbVie Company?

- What is Growth Strategy and Future Prospects of AbbVie Company?

- How Does AbbVie Company Work?

- What is Sales and Marketing Strategy of AbbVie Company?

- What is Brief History of AbbVie Company?

- Who Owns AbbVie Company?

- What is Customer Demographics and Target Market of AbbVie Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.