Air Lease Bundle

How Did Air Lease Company Take Flight?

In the wake of the 2008 financial crisis, a new player emerged in the world of Air Lease SWOT Analysis, aiming to revolutionize how airlines acquire aircraft. Founded in 2010 by aviation industry veteran Steven Udvar-Házy, Air Lease Company (ALC) quickly established itself as a major force in the aircraft leasing market. This brief history explores the company's strategic beginnings and rapid growth within the competitive landscape of commercial aviation.

ALC's journey began with a clear vision: to provide airlines with flexible access to modern, fuel-efficient jets. Udvar-Házy's extensive experience in aircraft finance, particularly his leadership at ILFC, proved invaluable. Today, Air Lease Company's impact on the aviation industry is undeniable, holding a substantial market capitalization and a significant order book, solidifying its position as a global leader in aircraft leasing.

What is the Air Lease Founding Story?

The story of Air Lease Corporation (ALC) began in February 2010. It was founded by Steven F. Udvar-Házy, along with John Plueger and other former executives from International Lease Finance Corporation (ILFC).

Udvar-Házy, a prominent figure in the aircraft leasing sector, established ILFC as a major player before its sale to AIG. His departure in 2010, following a disagreement, set the stage for ALC's creation. The founding of ALC was driven by the opportunity to create a new aircraft leasing platform focused on acquiring new technology, fuel-efficient aircraft directly from manufacturers.

The founders recognized a growing trend of airlines using operating leases to manage their fleets. This, coupled with the need for modern, fuel-efficient aircraft, presented a clear opportunity. Their business model involved purchasing new aircraft directly from manufacturers like Boeing and Airbus, and then leasing them to airlines globally under long-term contracts. This approach offered airlines flexibility and reduced the capital expenditure associated with direct purchases. Read more about the ALC history.

ALC launched with significant financial backing, securing over $1.3 billion in initial equity commitments.

- Steven Udvar-Házy, a well-known figure in the aircraft leasing industry, was the founder.

- The company focused on acquiring new, fuel-efficient aircraft directly from manufacturers.

- The business model centered on leasing aircraft to airlines under long-term contracts.

- ALC's strategy has consistently focused on building a fleet of young, in-demand aircraft.

Air Lease SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Air Lease?

The early years of Air Lease Corporation (ALC) were characterized by swift expansion and securing significant capital for growth. Founded in February 2010, the company quickly moved to its Initial Public Offering (IPO) on the New York Stock Exchange (NYSE: AL) on April 19, 2011. This IPO was a pivotal moment, raising approximately $965 million, which fueled its ambitious fleet expansion plans. This initial capital injection was crucial for establishing ALC's presence in the aircraft leasing market.

A core element of ALC's early strategy involved placing substantial orders with aircraft manufacturers like Boeing and Airbus. These orders, often multi-billion dollar deals, were for new-technology, fuel-efficient aircraft. This approach not only established ALC's modern fleet strategy but also secured favorable pricing and delivery slots, crucial for competitive advantage in the aircraft leasing sector. This strategy was a direct result of the vision of Steven Udvar-Házy, the company's founder.

ALC quickly built its fleet and customer base, demonstrating rapid growth. By the end of 2017, the company owned 244 aircraft. These aircraft were leased to over 91 airlines across 55 countries. This rapid expansion highlights the company's effective strategy and its ability to establish a global presence early in its history. The company's success in aircraft finance and commercial aviation is evident through its growth.

ALC's operational framework centered around a continuous cycle of aircraft acquisition, leasing, management, and sales. A key aspect of its business model involved long-term lease agreements, typically spanning 8 to 12 years. This approach generated stable cash flows, providing a solid foundation for the company's financial performance. To learn more about the company's approach, read about the Marketing Strategy of Air Lease.

The early success of ALC significantly impacted the aviation industry by providing airlines with flexible aircraft financing solutions. The company's ability to secure large aircraft orders and establish long-term lease agreements has been a key factor in its financial performance history. ALC's business model has allowed it to become a major player in the aircraft leasing market, competing with other industry giants.

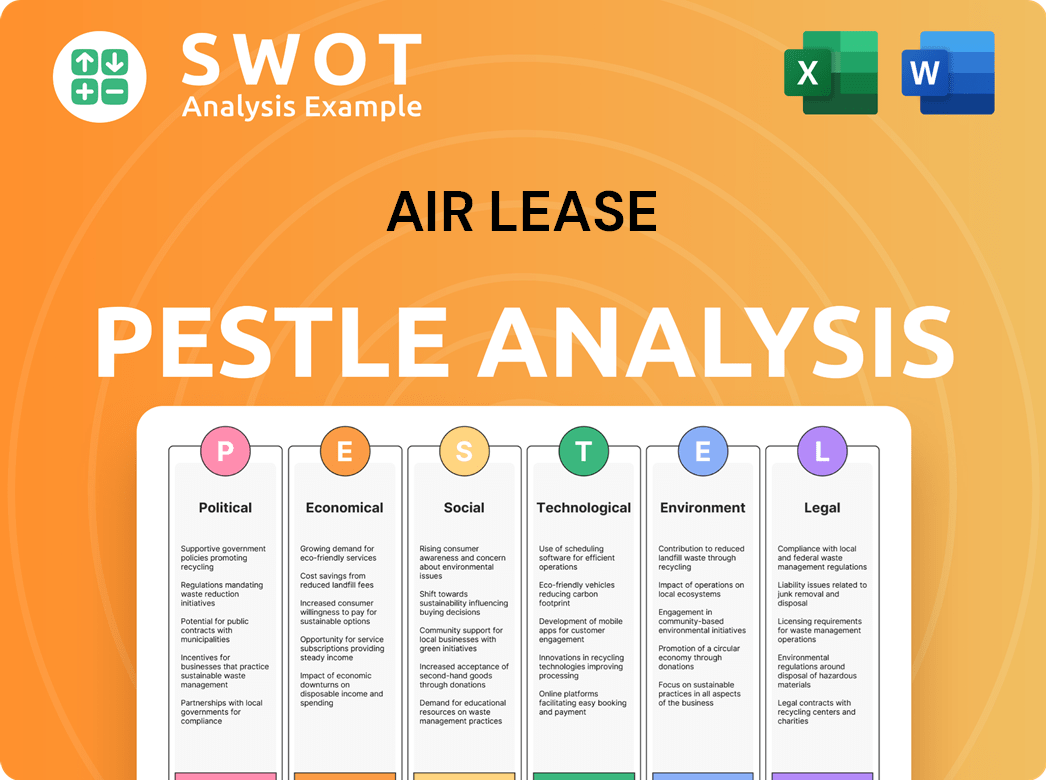

Air Lease PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Air Lease history?

Throughout its history, Air Lease Company has achieved significant milestones, notably in fleet expansion and financial performance. By the end of 2024, the company had grown its owned fleet to 489 aircraft and managed an additional 60, demonstrating substantial growth in the aircraft leasing market.

| Year | Milestone |

|---|---|

| 2010 | Founded by Steven Udvar-Házy, marking the beginning of the company's journey in aircraft leasing. |

| 2011 | The company went public, raising capital to fuel its aircraft acquisition strategy and expand its presence in commercial aviation. |

| 2014 | ALC's fleet size increased significantly, reflecting its rapid growth and strategic aircraft acquisitions. |

| 2024 | ALC owned 489 aircraft and managed 60, with a total asset value exceeding $32 billion, showcasing its substantial market presence in aircraft finance. |

A key innovation for Air Lease Company is its business model, which focuses on acquiring new, fuel-efficient aircraft and leasing them to airlines. This approach has provided airlines with modern fleet options, contributing to the company's success in the aircraft leasing industry.

ALC strategically manages its aircraft portfolio, including the sale of aircraft to optimize its fleet composition and financial performance.

ALC prioritizes acquiring fuel-efficient aircraft, which helps airlines reduce operating costs and aligns with environmental sustainability goals.

ALC consistently maintains a high fleet utilization rate, often above 99%, maximizing revenue generation from its aircraft assets.

ALC has secured investment-grade ratings from major credit rating agencies, which reduces borrowing costs and facilitates access to capital markets.

ALC has established strong relationships with major airlines worldwide, securing long-term lease agreements and fostering repeat business.

ALC collaborates with aircraft manufacturers like Boeing and Airbus, ensuring access to the latest aircraft models and technologies.

Air Lease Company faces challenges common to the aviation and leasing industries, including economic downturns and geopolitical risks. Fluctuations in interest rates and potential supply chain disruptions from aircraft manufacturers also pose challenges to the company's operations and profitability.

Economic downturns can reduce demand for air travel, impacting airline profitability and potentially leading to lease defaults or renegotiations.

Geopolitical events, such as conflicts or trade disputes, can disrupt air travel and affect the value of aircraft assets.

Changes in interest rates can affect borrowing costs, potentially impacting lease profitability and overall financial performance.

Supply chain disruptions can lead to delays in aircraft deliveries, impacting ALC's ability to meet lease commitments and generate revenue.

The financial health of the airline industry directly impacts ALC, as airline bankruptcies or financial difficulties can lead to lease defaults.

The anticipated decrease in end-of-lease revenues through 2025 presents a challenge to profitability.

Air Lease Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Air Lease?

The ALC history is marked by strategic growth and adaptation to market dynamics. Founded in February 2010 by Steven F. Udvar-Házy and John Plueger, Air Lease Corporation quickly established itself in the aircraft leasing sector. The company's Initial Public Offering (IPO) in April 2011 on the NYSE marked a significant milestone. Over the years, ALC placed substantial aircraft orders with Boeing and Airbus, expanding its fleet. Despite challenges like the COVID-19 pandemic in 2020, the company achieved investment-grade credit ratings in 2019 and continued to grow its assets. Steven Udvar-Házy's retirement as Executive Chairman, effective May 2, 2025, signals a transition while the company maintains a strong position in commercial aviation.

| Year | Key Event |

|---|---|

| February 2010 | Air Lease Corporation is founded by Steven F. Udvar-Házy and John Plueger. |

| April 19, 2011 | ALC has its Initial Public Offering (IPO) on the NYSE. |

| 2010s | ALC places multi-billion dollar aircraft orders with Boeing and Airbus. |

| End of 2017 | ALC owns 244 aircraft. |

| 2019 | ALC achieves investment grade credit ratings. |

| 2020 | The aviation industry faces significant challenges due to the COVID-19 pandemic. |

| December 31, 2024 | ALC's owned fleet comprises 489 aircraft with over $32 billion in total assets. |

| February 2025 | ALC reports record revenues for the full year 2024. |

| March 2025 | Steven Udvar-Házy announces his retirement as Executive Chairman, effective May 2, 2025, but will remain on the board until 2026. |

| March 31, 2025 | ALC's owned fleet is 487 aircraft. |

ALC anticipates significant aircraft deliveries in 2025, with expected deliveries valued at $3 to $3.5 billion. The company expects lease rates and aircraft valuations to rise due to ongoing aircraft shortages. These factors are expected to support the value of its business and financial performance.

As of March 31, 2025, ALC has placed a significant portion of its order book on long-term leases. 100% of expected deliveries through the end of 2026 and 89% through 2027 have been placed. This demonstrates strong confidence in long-term demand for aircraft.

Growing demand for air travel and the need for more fuel-efficient aircraft are expected to positively impact ALC. The company focuses on acquiring and leasing modern, fuel-efficient aircraft. These strategic moves are designed to capitalize on market trends.

ALC is exploring various capital allocation strategies, including potential share repurchases and growth opportunities. The long-term outlook remains positive, driven by the fundamental growth of the global commercial aircraft fleet. The company is well-positioned for future growth.

Air Lease Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Air Lease Company?

- What is Growth Strategy and Future Prospects of Air Lease Company?

- How Does Air Lease Company Work?

- What is Sales and Marketing Strategy of Air Lease Company?

- What is Brief History of Air Lease Company?

- Who Owns Air Lease Company?

- What is Customer Demographics and Target Market of Air Lease Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.