Air Lease Bundle

Who Flies with Air Lease Company?

Air Lease Corporation (ALC), a leader in the aviation industry, strategically navigates the complex world of aircraft leasing. Understanding its customer demographics and target market is crucial for its continued success. This exploration delves into ALC's core business model and the factors driving its growth in the dynamic aircraft leasing sector.

The aircraft leasing market, projected to reach $210.4 billion in 2025, highlights the importance of Air Lease SWOT Analysis. ALC's success hinges on identifying and catering to the specific needs of its customer demographics within the aviation industry. This market analysis will uncover the target market for Air Lease Company, including their geographical distribution and evolving demands, offering insights into ALC's strategic adaptation.

Who Are Air Lease’s Main Customers?

The primary customer segments for Air Lease Corporation (ALC) are airlines worldwide, operating under a Business-to-Business (B2B) model. As of March 31, 2025, ALC had relationships with 112 airlines across 57 countries, demonstrating a global reach. This customer base is diversified to mitigate risks, ensuring no single customer accounts for more than 10% of its fleet by net book value or rental revenue.

The company's target market includes both established full-service carriers and rapidly expanding low-cost carriers (LCCs) and emerging airlines, particularly in high-growth markets. This strategy allows ALC to capitalize on the diverse needs of the aviation industry. Leasing is an attractive option for start-ups and LCCs, enabling them to preserve capital and gain flexibility in fleet planning.

ALC focuses on providing modern, fuel-efficient aircraft, which are highly sought after by airlines globally due to their operational efficiency and sustainability benefits. This focus on modern aircraft is a key element of their customer value proposition. For a deeper understanding of ALC's financial operations, you can explore the Revenue Streams & Business Model of Air Lease.

ALC's customer base is strategically diversified across various airline types and geographic regions. This approach helps to reduce financial risks and ensures a broad market presence. The company's strategy is designed to adapt to changing customer needs and market dynamics.

- Full-Service Carriers: Established airlines with extensive route networks.

- Low-Cost Carriers (LCCs): Rapidly growing airlines focused on cost efficiency.

- Emerging Airlines: Airlines in high-growth markets, offering significant potential.

- Geographic Diversity: Customers located in over 57 countries as of March 31, 2025, including a focus on Asia-Pacific and other growth regions.

- Fleet Modernization: ALC's focus on young, fuel-efficient aircraft aligns with the industry's shift towards sustainability. As of March 31, 2025, the weighted average age of its owned fleet was 4.7 years.

Air Lease SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Air Lease’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any company, and for Air Lease Corporation (ALC), this involves a deep dive into the dynamics of its airline clients. The company's success hinges on its ability to meet the evolving demands of the aviation industry. This includes providing flexible leasing solutions and modern, fuel-efficient aircraft.

ALC's target market, primarily consisting of airlines worldwide, values fleet flexibility and efficient capital management. Airlines are increasingly choosing operating leases to avoid large capital outlays. This strategy enables them to adapt to market changes and optimize their operations. This approach is particularly attractive in an industry where agility and cost-effectiveness are paramount.

The preferences of ALC's customers are significantly shaped by the need for modern and fuel-efficient aircraft. Airlines are actively seeking new-generation aircraft that offer substantial fuel savings. This preference is driven by rising fuel costs and environmental concerns, which are critical factors in the aviation industry's sustainability efforts.

Airlines prioritize fleet flexibility to manage capital efficiently. Operating leases allow them to avoid significant capital investments, preserving funds for other operational needs.

Demand for modern, fuel-efficient aircraft is high. Airlines seek new-generation aircraft to reduce fuel costs and meet environmental standards. Aircraft like the Airbus A320neo/A321neo, Boeing 737 MAX, Airbus A220, A330neo, A350, and Boeing 787 are preferred.

Airlines value comprehensive fleet management solutions. ALC aims to be a preferred partner by providing exceptional service and building lasting relationships, offering fleet planning and customization services.

Airlines seek strategic partnerships for long-term support. ALC builds trust and offers ongoing support throughout the leasing process, tailoring lease structures to meet specific airline needs.

Strong demand for air travel and supply constraints support higher lease rates. ALC's high fleet utilization rate, which was 100% for the year ended December 31, 2024, reflects strong demand.

Airlines are focused on sustainability. Fuel-efficient aircraft and fleet modernization are key to meeting environmental goals. ALC supports this through its aircraft leasing strategy.

ALC's focus on customer needs is evident in its approach to fleet management and strategic partnerships. The company aims to be a preferred leasing partner by establishing trust and delivering exceptional service. This includes providing fleet planning services and assisting airlines in modernizing their fleets. The strong demand for air travel globally, coupled with supply constraints, supports higher lease rates and extension activity, which highlights airlines' preference for securing capacity. For a deeper insight into ALC's growth strategy, you can read more in this article: Growth Strategy of Air Lease.

ALC's success is tied to understanding and meeting the needs of its airline customers. These needs include financial flexibility, operational efficiency, and strategic support.

- Fleet Flexibility: Airlines prefer operating leases to manage capital and adapt to market changes.

- Fuel Efficiency: Demand for new-generation aircraft with significant fuel savings is high.

- Comprehensive Solutions: Airlines seek fleet management and strategic partnerships.

- Strategic Partnerships: Airlines value support and tailored lease structures.

- Market Demand: High demand and supply constraints support higher lease rates.

- Sustainability: Focus on fuel-efficient aircraft to meet environmental goals.

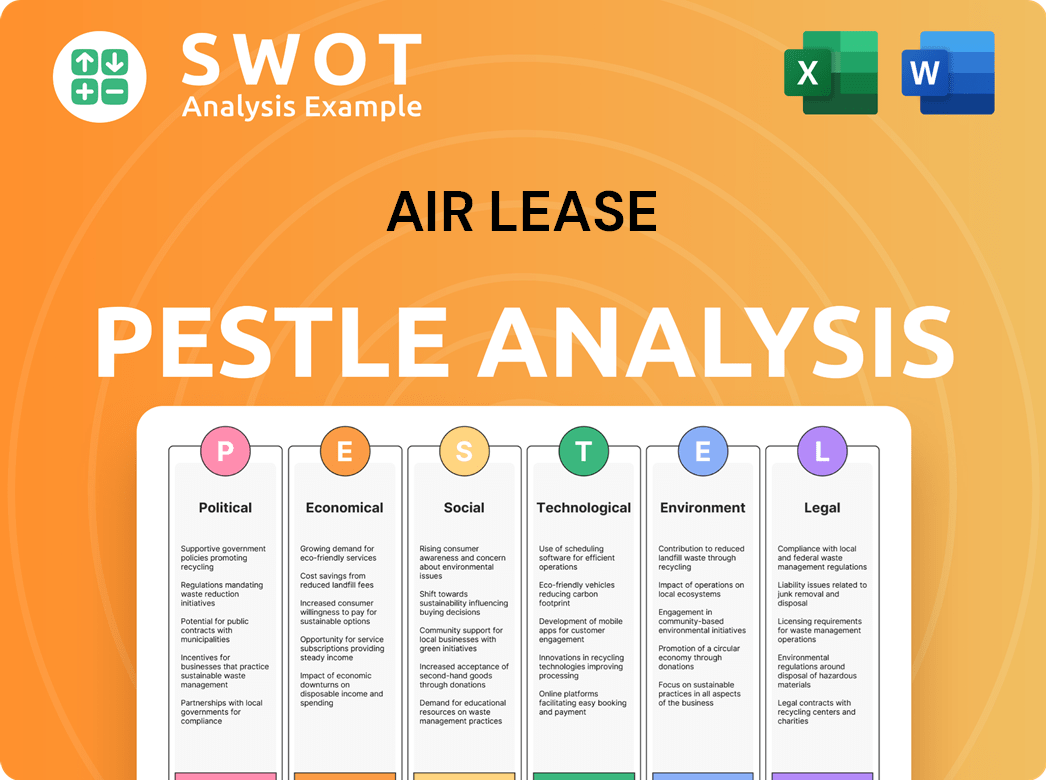

Air Lease PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Air Lease operate?

The geographical market presence of Air Lease Corporation (ALC) is a cornerstone of its business strategy. ALC provides aircraft to airlines globally, ensuring a diversified customer base across major regions. This approach minimizes reliance on any single market or airline, mitigating risks associated with economic fluctuations and geopolitical events.

As of March 31, 2025, ALC's customer base included 112 airlines spread across 57 countries. This widespread presence underscores the company's commitment to serving the global aviation industry. The company's strategy focuses on maintaining a balanced portfolio to reduce financial risks.

ALC strategically targets high-growth international airline markets, particularly in the Asia-Pacific region. The company actively expands its banking relationships in this area to support its operations. This targeted approach allows ALC to adapt to regional differences in customer preferences and buying power.

ALC's flight equipment subject to operating leases is spread across several regions. Europe accounts for 40.8%, while the Asia-Pacific region represents 36.4%. Other key regions include Central America, South America, and Mexico (9.7%), the Middle East and Africa (6.9%), and the U.S. and Canada (6.2%).

ALC concentrates on the Asia-Pacific market, capitalizing on the expansion of emerging carriers. The company has added credit facilities from banks in Singapore, Japan, and Australia. This strategic move supports ALC's operations in these key markets.

ALC adapts its leasing solutions to fit regional differences. In emerging markets with limited financing options, ALC can command higher lease rates. This approach allows the company to maximize returns while meeting diverse customer needs.

ALC continuously monitors its customer concentration as part of its risk management strategy. This ensures diversification by region and country, reducing the impact of any single lessee default. ALC’s strategy is designed to mitigate risks effectively.

ALC's commitment to global expansion is evident in its recent activities. For instance, in Q1 2025, the company delivered 14 aircraft from its order book, representing over $800 million in aircraft investments. The company's outlook for 2025 includes $3.0–$3.5 billion in new aircraft deliveries. The company's success in the aircraft leasing market is further detailed in this article about Air Lease by placing ONLY ONE natual link with anchor text (Air Lease Company's Market Position) into the content.

Air Lease Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Air Lease Win & Keep Customers?

Air Lease Corporation's (ALC) customer acquisition and retention strategies are centered on building long-term relationships and providing tailored solutions within the aviation industry. The company focuses on acquiring modern, fuel-efficient aircraft directly from manufacturers like Boeing and Airbus. This approach allows ALC to offer airlines access to advanced fleets, addressing their operational efficiency and sustainability needs, which is a key part of their target market strategy.

ALC's strategy involves a deep understanding of the aviation sector and leveraging its established relationships to identify and engage potential lessees. The company works closely with airlines to develop customized lease structures that meet their specific fleet planning and financial requirements. This personalized approach is critical for securing long-term lease agreements, which provide stable revenue streams. Understanding the customer demographics is essential for this process.

For retention, ALC prioritizes exceptional service and continuous communication with its lessees. The company monitors the operating and financial performance of its airline customers throughout the lease term. This proactive engagement helps in mitigating risks and fostering lasting relationships. ALC's approach to the aviation industry is detailed in Owners & Shareholders of Air Lease.

ALC acquires new, technologically advanced aircraft directly from manufacturers. As of March 31, 2025, ALC had 255 new aircraft on order from Airbus and Boeing, scheduled for delivery through 2029. This strategy ensures that ALC can offer airlines access to the latest, most fuel-efficient aircraft.

ALC focuses on building strong relationships within the aviation industry. The management team identifies potential lessees and works closely with them. This collaborative approach helps in understanding and addressing the unique needs of each airline, which is critical for customer acquisition.

ALC develops innovative lease structures tailored to the specific needs of each airline. These customized solutions address fleet planning and financial requirements. This approach ensures that each customer receives a solution that aligns with their operational and financial goals.

ALC emphasizes delivering exceptional service and maintaining strong communication with its lessees. The company monitors the operating and financial performance of its airline customers. This proactive engagement helps mitigate risks and fosters lasting relationships, which is crucial for customer retention.

ALC maintains a diversified customer base across different regions and market segments. This strategy reduces dependency on any single customer. This approach helps in mitigating financial risks and ensures a stable revenue stream.

ALC engages in aircraft sales from its portfolio to generate revenue and optimize its fleet. In the fourth quarter of 2024, ALC sold 14 aircraft, generating approximately $540 million in sales proceeds. For the full year 2024, aircraft sales and trading revenues increased by 18% to $246 million, with gains from aircraft sales reaching $170 million from 39 aircraft sold. ALC expects to sell approximately $1.5 billion in aircraft for 2025.

ALC's strong financial position enables it to offer competitive lease rates. The company's debt financing strategy focuses on raising unsecured debt, with 97.3% of its $19.9 billion total debt outstanding as of March 31, 2025, being unsecured. This financial strength enhances ALC's attractiveness to airlines.

ALC maintains high fleet utilization rates, which were 100% in 2024. This high utilization rate demonstrates the efficiency of ALC's fleet management and its ability to provide reliable aircraft to its customers. This contributes to customer satisfaction and retention.

ALC's financial stability allows it to secure favorable financing terms, which translates into competitive lease rates for airlines. This financial strength is a critical factor in attracting and retaining customers. The company’s focus on unsecured debt provides financial flexibility.

ALC continuously monitors market conditions and proactively addresses potential difficulties faced by its airline customers. This adaptability helps in retaining customers and fostering long-term relationships. The company's proactive approach ensures it can respond to changing customer needs.

Air Lease Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Air Lease Company?

- What is Competitive Landscape of Air Lease Company?

- What is Growth Strategy and Future Prospects of Air Lease Company?

- How Does Air Lease Company Work?

- What is Sales and Marketing Strategy of Air Lease Company?

- What is Brief History of Air Lease Company?

- Who Owns Air Lease Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.